Today is option expiration day for many stock options, and although we live in the age of weekly expiration dated options, the original third Friday expiration carries a bit more weight. Just before 6am we received unexpected news from the East where the Chinese Central Bank cut deposit rates by 40 basis points. This news fueled a rally in the Nasdaq globex session which is currently printing a range in excess of the 1st standard deviation of normal on volume to the same degree. In short, this is an outlier overnight session verse 68.8% of overnight sessions over the last five years.

The price action has us set to gap to new swing highs on the index suggesting the market will be out of balance come opening bell. This can lead to big moves. Leading into today was yesterday’s session which had the look of a short trap. Prices went gap lower and took out Wednesday’s low only to sharply reverse early on and squeeze shorts. The overall look of the profile suggests a short-squeeze event occurred leading into today.

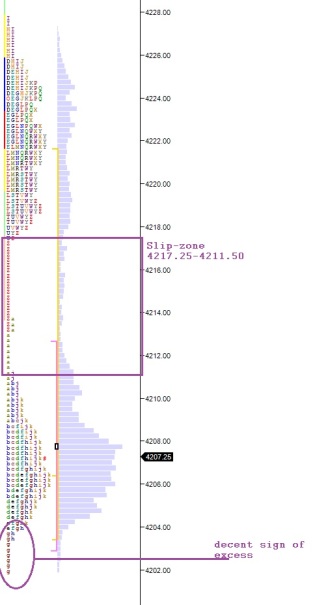

Auction theory is not quite as effective at new highs, however I have listed the support levels I will be observing on the following volume profile chart:

Comments »