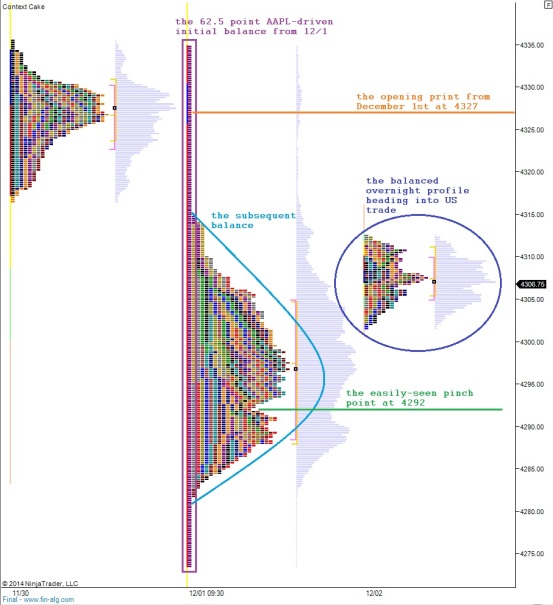

Every detail matters. It is the little details that add up to something big. If anything ever seems cryptic or overly granular bear in mind it all adds up to the big picture. Never lose sight of either.

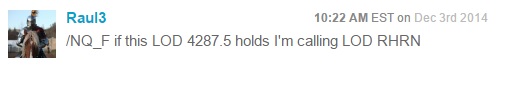

I can’t always clearly see the low of the day at 10:30am, but when I do the Pelicans are the first to know about it:

And I don’t throw these types of calls around often. They’re special. Sometimes there is a clean stride to the auction; a near perfect grace to the proceedings of the price mechanism and it whispers sweet nothings in my ear.

“Go long, Raul”

As many of you know, I am a product of the bull market having become active around 2013. Therefore, confidence with my long trade is a bit stronger than the short trade. But I am developing those tools as well. Trade ideas are symmetrical, ideally, meaning they work both ways. The thing is if you study market behavior you will learn that the behavior of the market hardly symmetrical most of the time.

That’s what makes the symmetry so special.

So while my stocks exchange punches with each other, there are a few clams to scrape out of this market as a scalper. One needs both skills, IMO, to truly benefit from the ebb-and-flow nature of the stock market.

Comments »