Prices moved lower in the Nasdaq overnight and as we approach US trade the market is hovering inside the lower quadrant of yesterday’s range. At 8:30am traders learned about the CPI and Jobs situation in the United States, and all numbers but one were better than expected. Initial Jobless Claims came in a bit higher than expected. After the open we have Markit PMI at 9:45am and both Existing Home Sales and Philadelphia Fed at 10am.

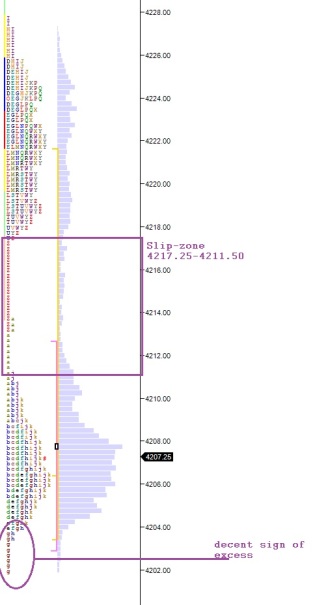

The futures broke loose to the downside just after 3am and since then the overnight profile has taken on a b-shape suggesting the initial wave might have been of the long liquidation variety. It also exposes a slip-zone up to 4217.50. You can see the overnight profile below:

At our current prices, the weak low at 4207 is now in range. This is a piece of context that formed on Monday when the market printed a double bottom on this tick. That is a poor low and carries an expectation of resolution. The swing high also looks weak but is nearly out of range statistically. The net result is a neutral stance which leads me to expect choppy trade. This is unless we see a strong driver off the open like we saw the past two days. I have highlighted the key price levels I will be observing as well as the weak high/low observations on the following volume profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter