Nasdaq futures are flat-to-lower as we come into US trade. Volume and range are coming in a bit light for the globex session suggesting the holiday week might reduce participation a bit. As we come into the open the overnight low shows signs of being weak.

The economic calendar is not too busy this week. Today we have Existing Home Sales at 10am. The announcement shortly after the open may be reason to chop about early on before the market finds direction.

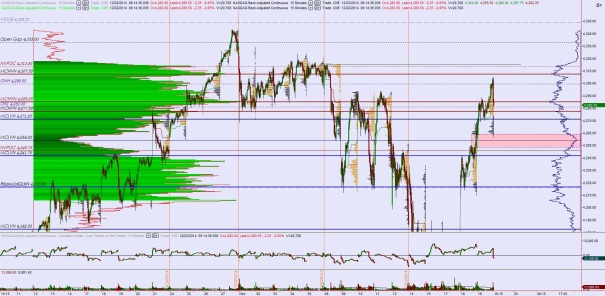

We are set to open right at Friday’s VPOC suggesting the market accepted these prices over the weekend. There was a bit of liquidation into Friday’s close, this can be seen as a large red candle on the volume profile chart.

The microcomposite we are trading inside has two distinct value areas with a thin pocket separating the two. If sellers manage to press below 4271.25 this pocket may come into play.

My primary expectation this morning is for an open auction inside of Friday’s range with sellers pushing down to test the MCHVN at 4277.50 then the LVN at 4271.25. I will be looking for responsive buyers around here who work toward the 4285.25.

Hypo 2 is buyers pushing off the open to go after the overnight high and test Friday’s high 4304.50 and target the MCHVN at 4307.50.

Hypo 3 is a drive lower below 4271.25 and push through the volume pocket to test its mid 4254.25 and if breached then continue through to the other end and target 4245.75.

I have highlighted these levels on the following volume profile chart:

Comments »