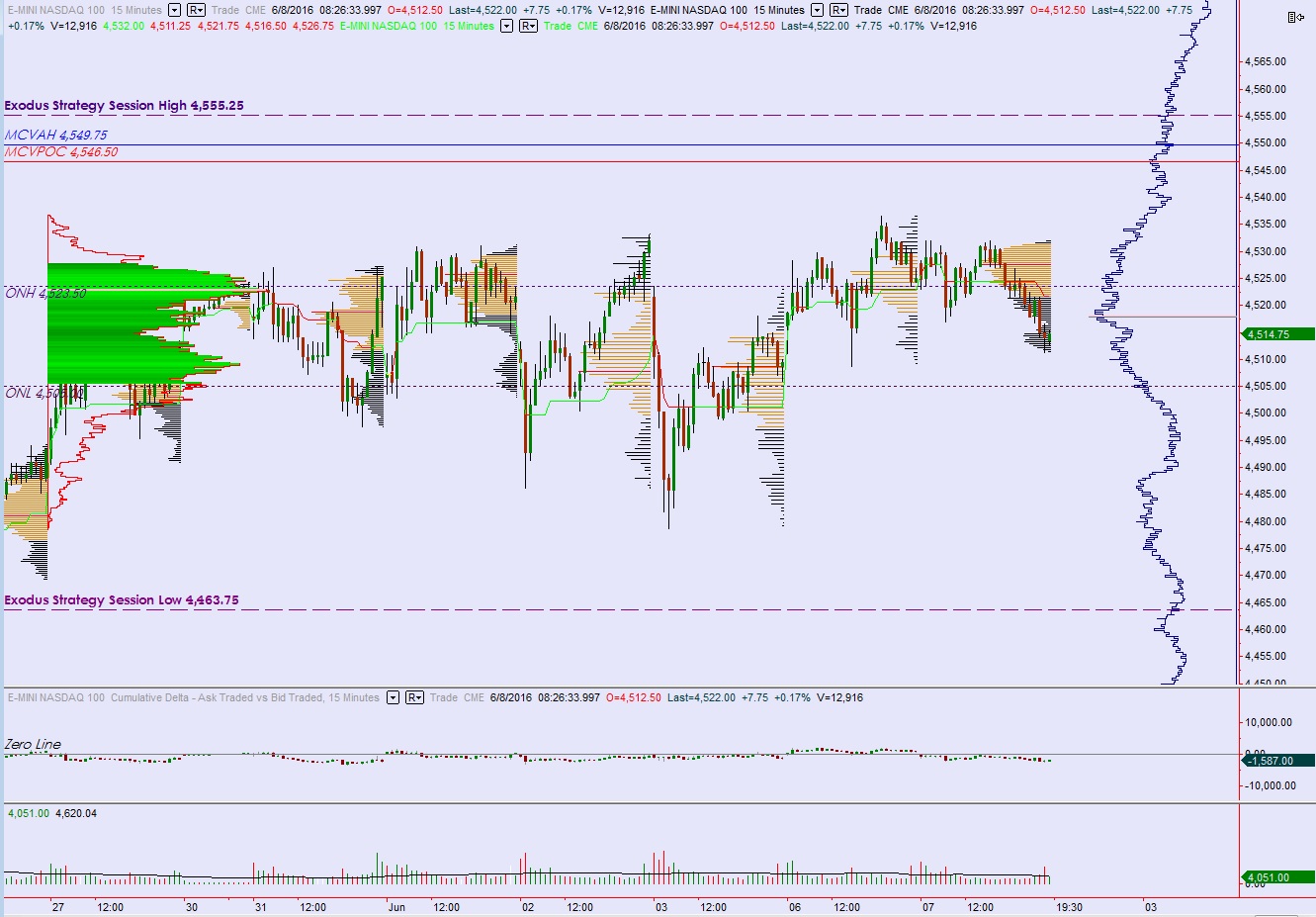

NASDAQ futures are coming into Monday gap down after an overnight session featuring normal range on elevated volume. The Globex session started with a gap down and price continued lower until just after midnight. Price then rallied back up through overnight range but was unable to fill the gap. Sellers then reemerged and pressed down through the entire range. Around 8:30am share of Microsoft halted and they announced a cash deal to buy LinkedIn. Heading into the open the market is on session low.

See Also: Microsoft to Aquire LinkedIn for $26.2 Billion, All Cash

The only events on the economic docket today are the 3- and 6-month T-bill auctions at 11:30am.

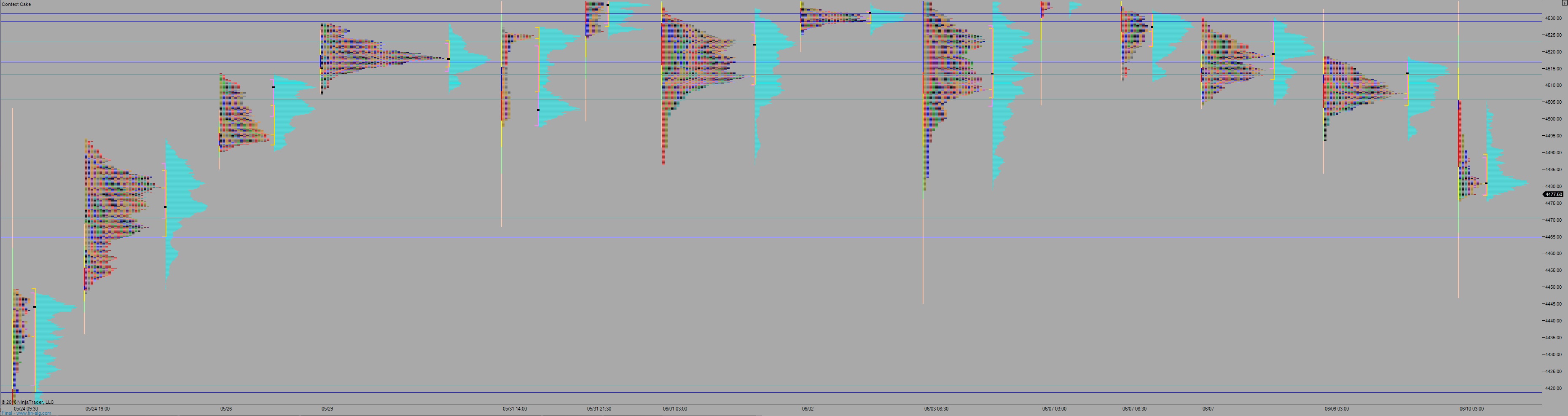

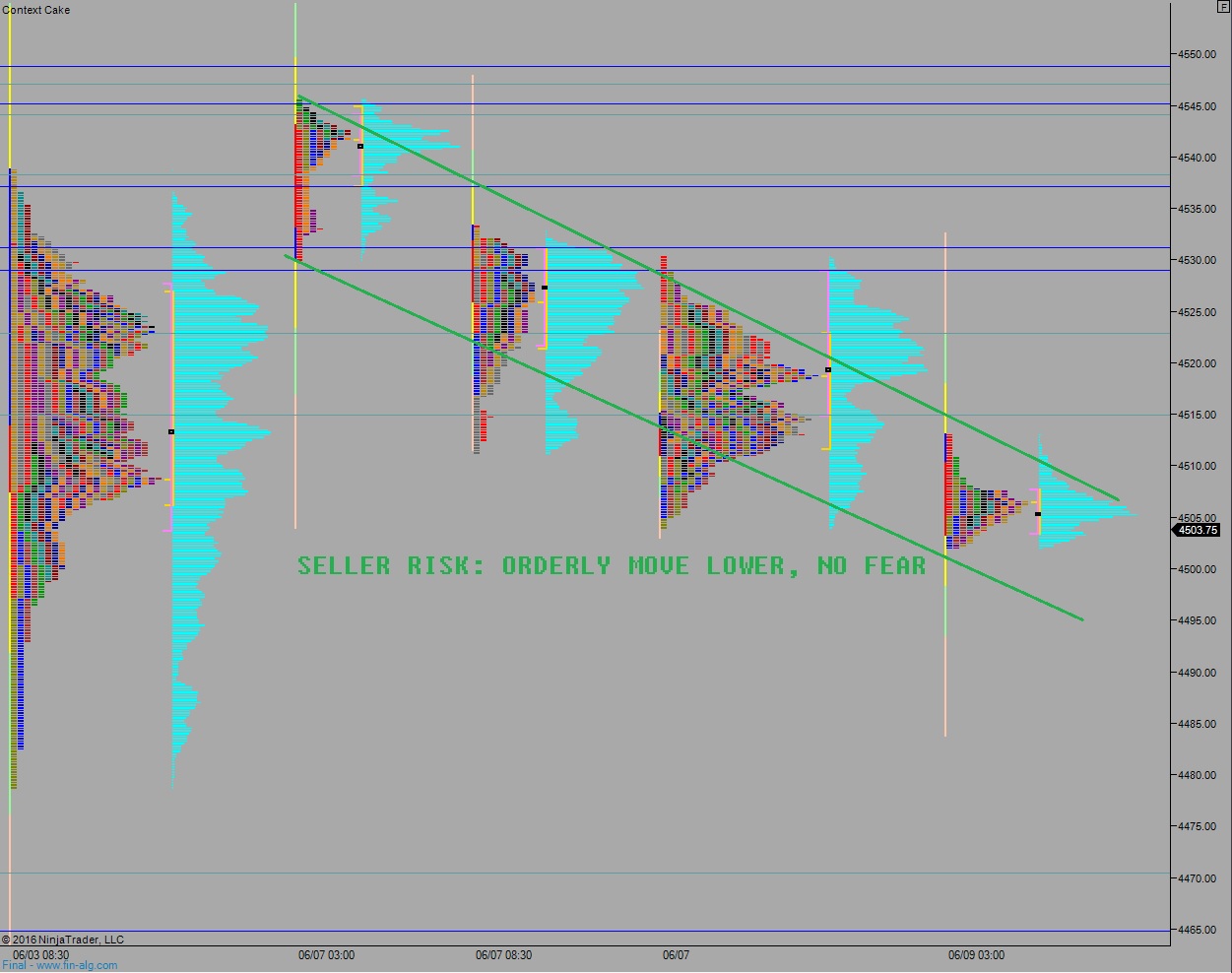

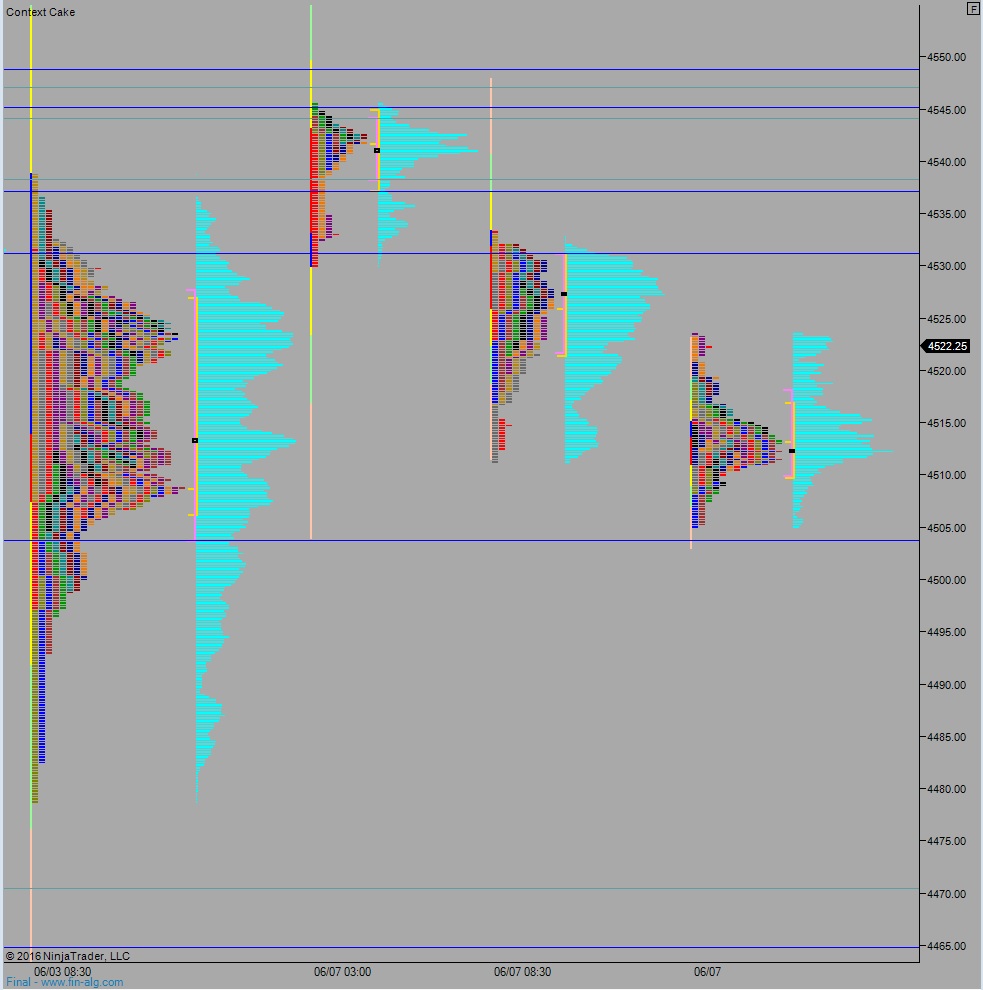

Last week the NASDAQ worked higher than churned sideways through Wednesday, despite the other major indices working higher. Both Thursday and Friday the market opened gap down. Friday was balanced until the end of the session when a sharp attempt lower was rejected by responsive buyers.

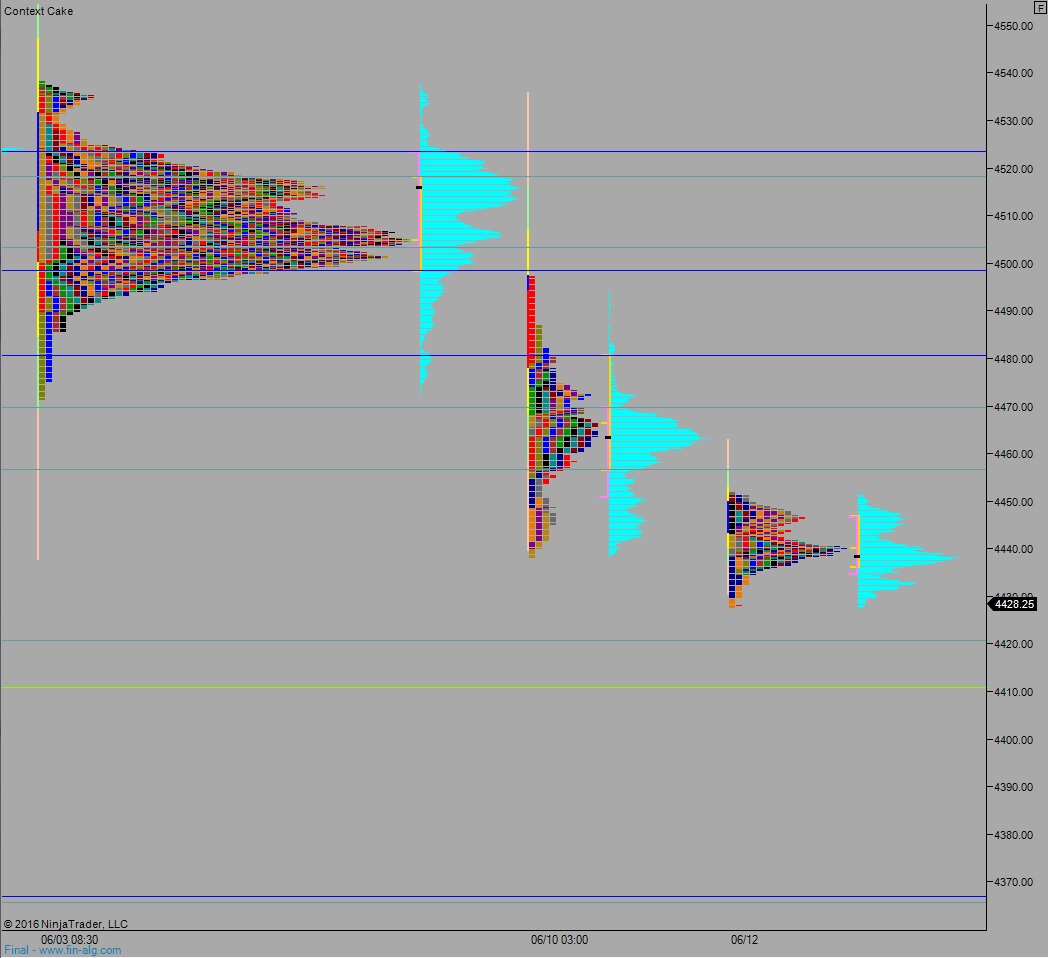

Heading into today my primary expectation is for a shake-out push lower off the open, down to 4421.25 followed by a strong responsive bid higher. Buyers work up to test last Friday’s low 4438.25. Look for sellers to reject a move back into Friday’s range and the market to continue to probe lower, down to 4411.

Hypo 2 buyers push into the overnight inventory and regain 4438.25 early on setting up a move to target overnight high 4452. Buyers then push a full gap fill up to 4458.50 before two way trade ensues.

Hypo 3 strong buyers close overnight gap up to 4458.50 early on and sustain trade above 4450, setting up a move to target 4470.

Hypo 4 full-on liquidation, sellers push down through 411 and sustain trade below it setting up a move to the 4400 century mark. If the century mark does not hold, then we could see a fast move down to 4367.

Levels:

Volume profiles, gaps, and measured moves:

Comments »