We all slip up sometimes, which is fine.

I like helping people I care about, and people I care about have needed me to be a bit more hands on these last several months. At some point, about when the heat dialed up into the mid-80s, I stopped putting my best effort into the Sunday Strategy sessions, skipped a bunch of morning trading reports, and also broke away from several other wellness routines (exercise, diet, etc). Again, this is fine.

All of these mechanisms, or routines if we’re humanizing it, were established over the years to check me before I do something selfish like emotionally trade.

I have lost so many US Federal Reserve notes to emotional trading, mostly during my hot-headed 20s, when I was more than a little obsessed with making money. Wanting something so bad and forcing it usually doesn’t go well, ask me how I know.

Anyways, it doesn’t feel good to break routine. Its like when you’re full of pizza, but you enjoy the taste of it some much that you ram another piece down and then you’re sick for the next 18 hours. I feel the same sick kind of way when I break routine, and that tells me to be cautious on all fronts—with relationships, with business decisions—everything.

I don’t trade when my research doesn’t feel good or when I plum skip it, I can’t afford to waste my resources anymore. Truthfully, I couldn’t back in my 20s either but that lesson took some pain to really take root.

So hopefully this week I can dial back in. I’m not sure yet, but temperatures are on track to drift down to more comfortable levels, and the people I care about are getting back on their feet. But who knows what sort of fuckery lies ahead. So, as always, TBD, and we’ll be taking it one day at a time here on the old RAUL blog.

Raul Santos, July 22nd, 2019

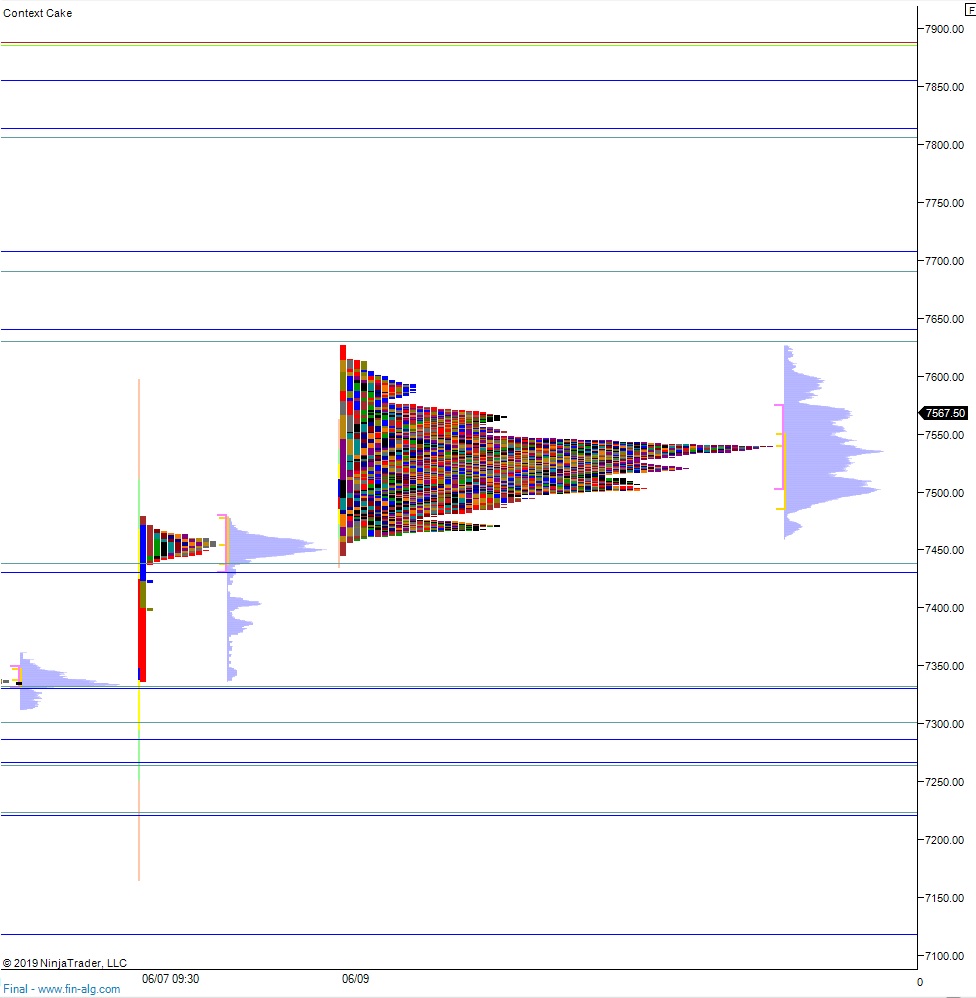

Exodus members, the 244th edition of Strategy Session is live. I think the NASDAQ Transportation index paints an interesting picture, plus there is little else to go on, algorithmic or trading model-wise, so it’s about all we’ve got in terms of observable bias.

Comments »