Greetings lads,

Floods coming.

And until then our job as humans is to establish a controlled grip on our facilities. Not too firm a grip but steady and prepared for chaos. One of our favorite tools for ensuring a prepared mind is objective observation of the financial markets. A power shift is happening now. Decentralization. Less power to the government. More to private enterprise. The stone cold bankers at JP Morgan have formed a triumvirate with Amazon and America’s favorite privateer Warren Buffet to fix healthcare—one of societies biggest sore spots. Whether they succeed, as always, is TBD.

But we need to act now. Not when we know if capitalism has fixed what politicians cannot. We need to act, or not act, to extract wealth from the financial markets. Said wealth will then be converted into real assets like land. Northern land in mountainous territories. High ground is insulated from the malaise of human propagation.

Because it is hard to live in those unforgiving regions. But with the right gear they become happy oases of pure nature.

Therefore our job is to collect our thoughts and prepare for battle inside the financal complex. We know who we are up against—the Chanoses and the burrito eaters. The sheiks, the Chinese, and those crypto-loving Koreans.

The competition is institutionalized at a young age and trained to mathematically outperform your average football-loving American.

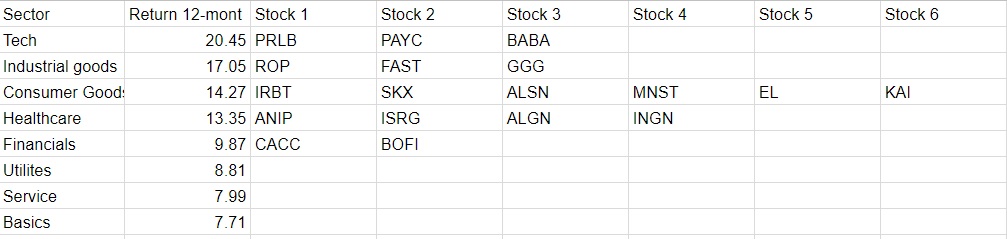

Oddly enough, rabidly successful teams like the Patriots have all enacted some form of moneyball analysis. It has become abundantly clear that competing at the highest level in any game, from skis to /6e’s to chess or kung fu requires a statistical foundation.

Data does not lie.

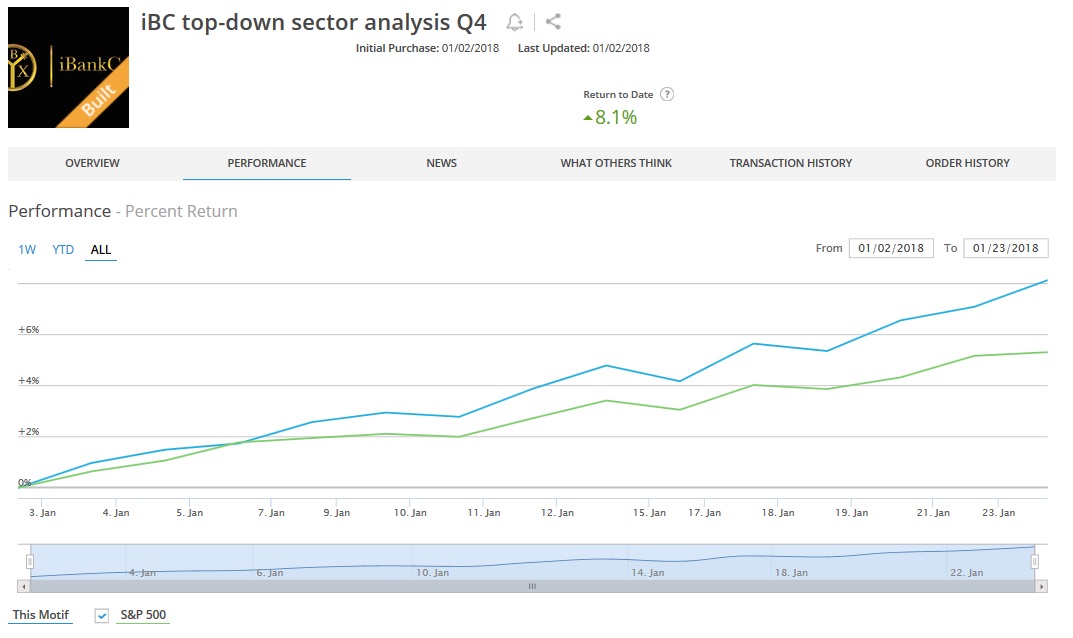

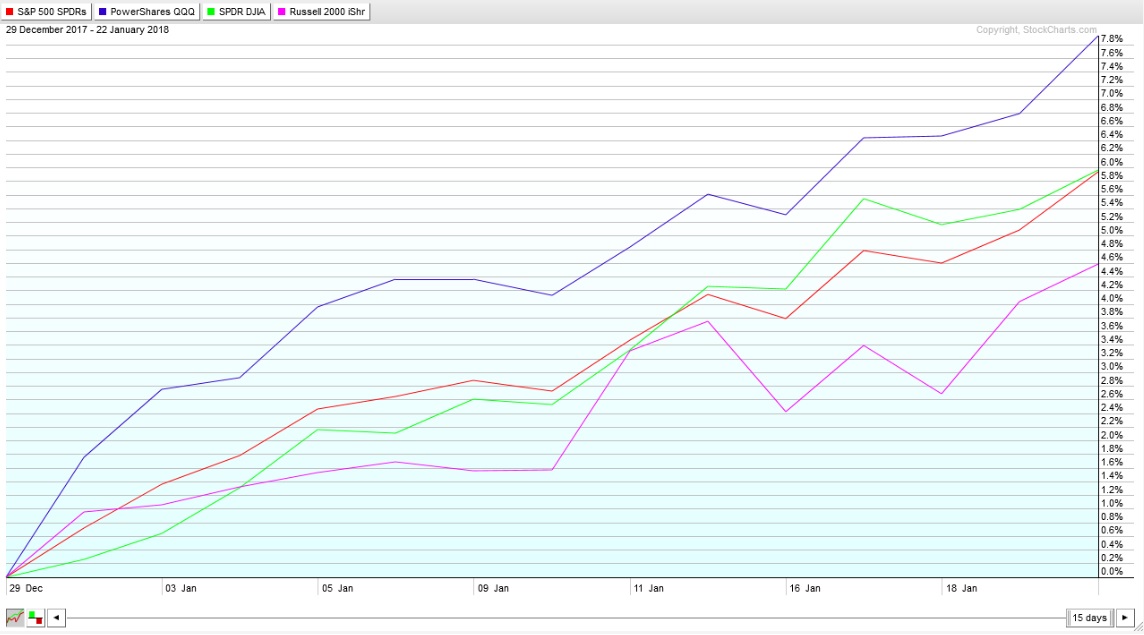

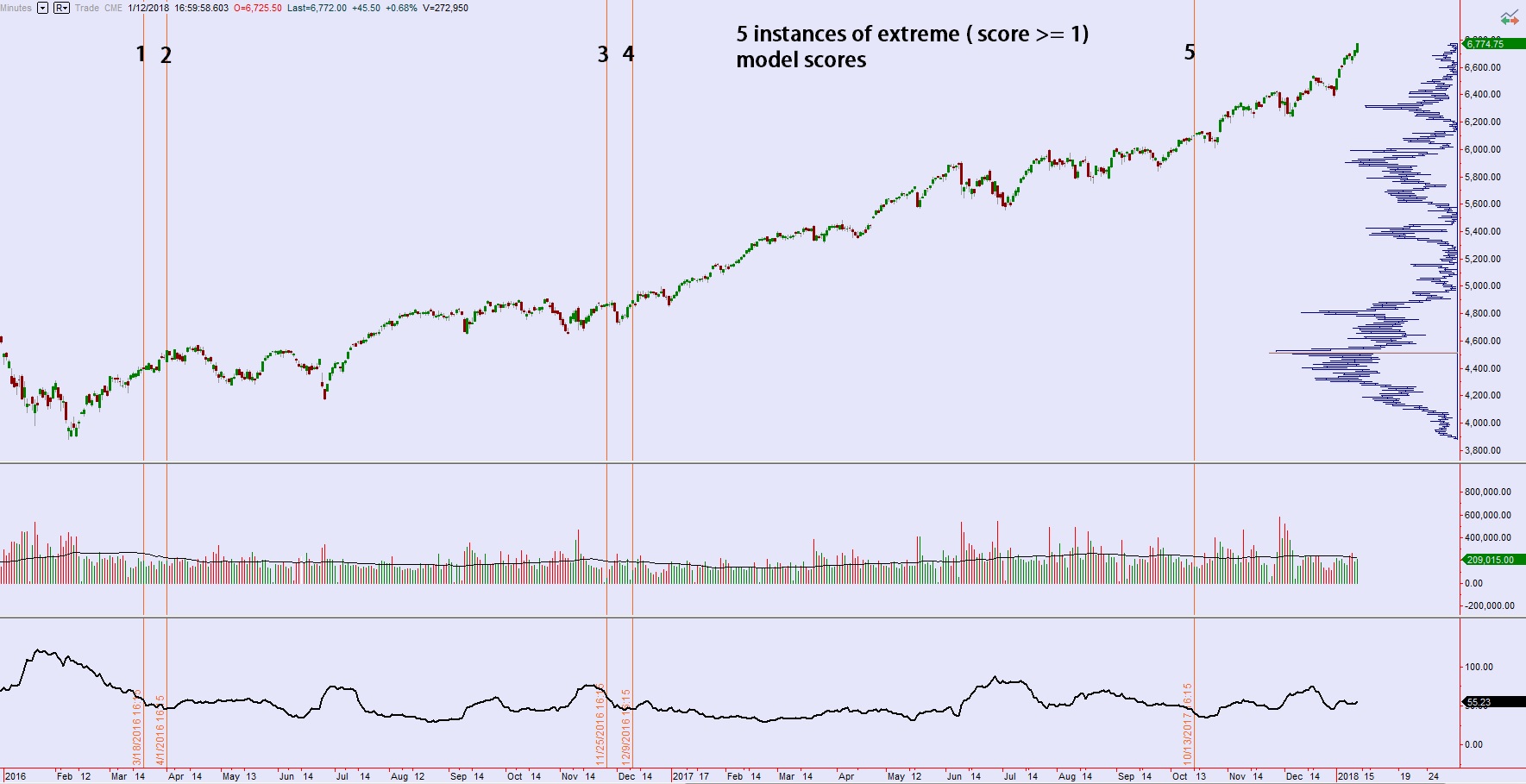

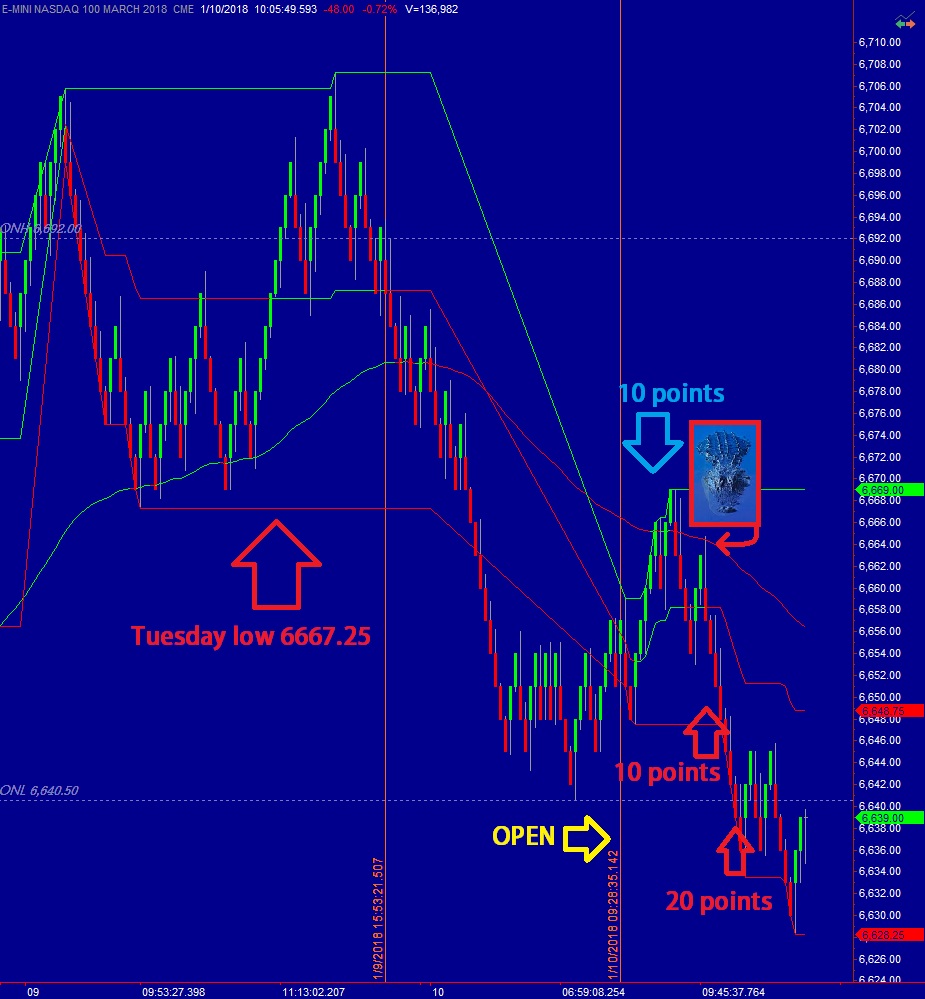

Which is why we set out every Sunday to collect and parse out the best data available and use it to prepare for any chaos to come. And the models lads, they are calling for conditions many perceive as chaotic. The model is calling for a correction.

We are at a pivotal moment in history. AI is on the Moores’s parabolic arc and climbing. The good folks at Microsoft and Google are doing incredible work in quantum that will only serve to accelerate this truth. Our Obama-era Fed chair is out. Our sweet grandma from Brooklyn is being replaced by Jarome Powell, an old white man from Washington DC with an estimated net worth that ranges from $19-$112 million.

God bless America.

Chinese New Year is right around the corner and the gambling halls in Vegas favor the steady Patriots by 4.5 points. An unexpected victory from the birds might be enough for society to finally snap and take to the streets with aluminum bats and ski masks, hellbent on altering the course of American history.

Their biggest enemy is the cold. For 1000s of years cold weather has successfully thwarted attempts at revolution, from the fires of Byzantium to the French gallows. Which is why it is our job to avoid all these chaotic times from the comforts of the north, letting nature insulate us from the recurrences of fanaticism.

All that being said, it is with great pleasure to announce I am headed to the mountains. February is without question the worst month down on the Michigan flats. It is time I seek steeper lands and deeper snow packs to hurl myself down. I am returning to the fringe life. We have rented an RV and will be chasing powder until further notice.

During this time stock market communications will be limited. The way I see it, we are due for a correction and the models are calling for a correction, and if we are correcting, then what purpose does it serve me to ring my hat over a violent market? My time is better spent becoming one with winter nature.

If you would like to follow my adventure, be sure to follow me on Instagram, username vincalim. I will be posting all sorts of content from the highlands.

Models are bearish lads. We could establish a trading low at some point next week. But a longer view suggests a correction is in the cards for the next several weeks.

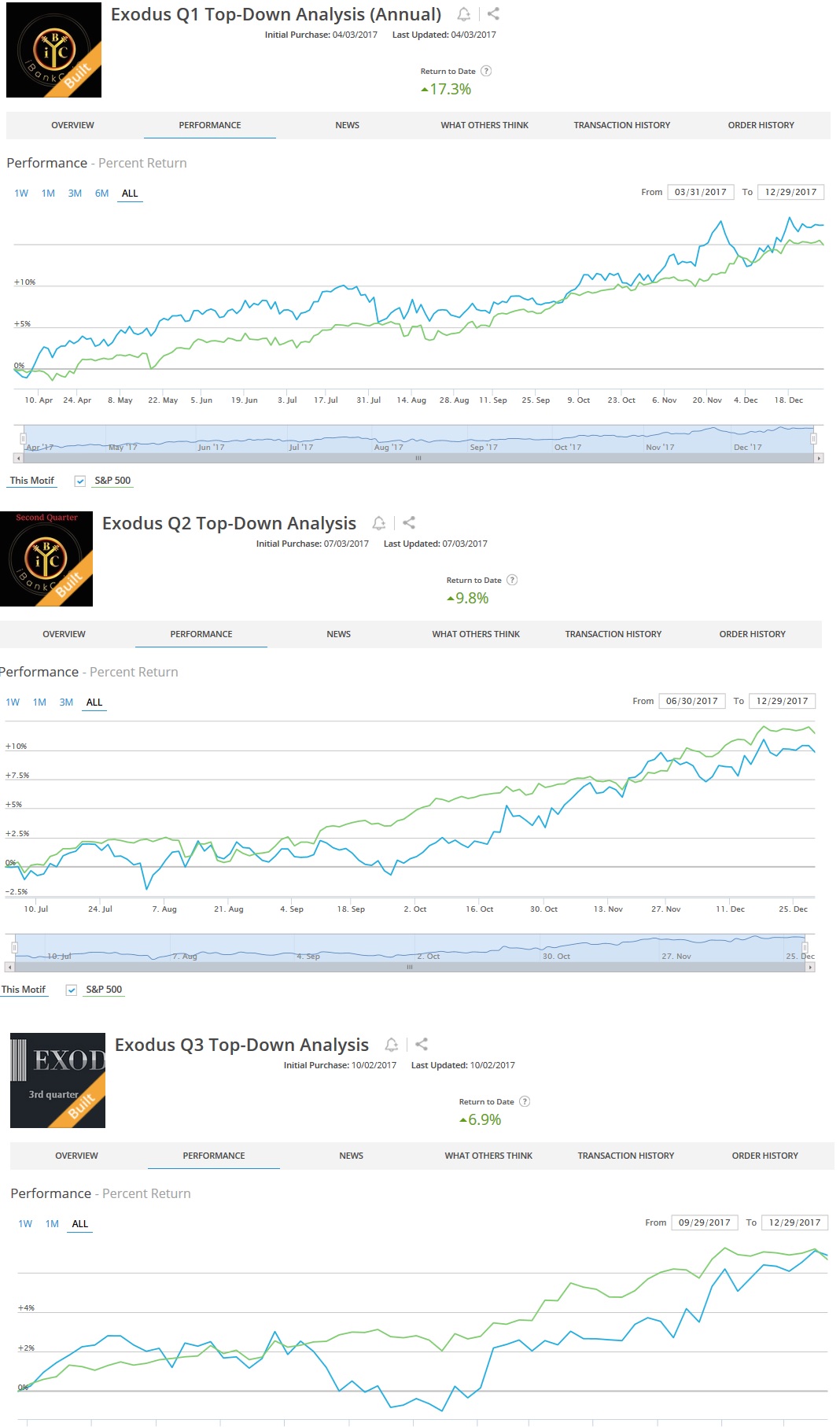

Exodus members, the 168th edition of Strategy Session is live. Go read more specifically what the model is calling for and see in much less colorful words what we are specifically looking for before we initiate new long.

Comments »