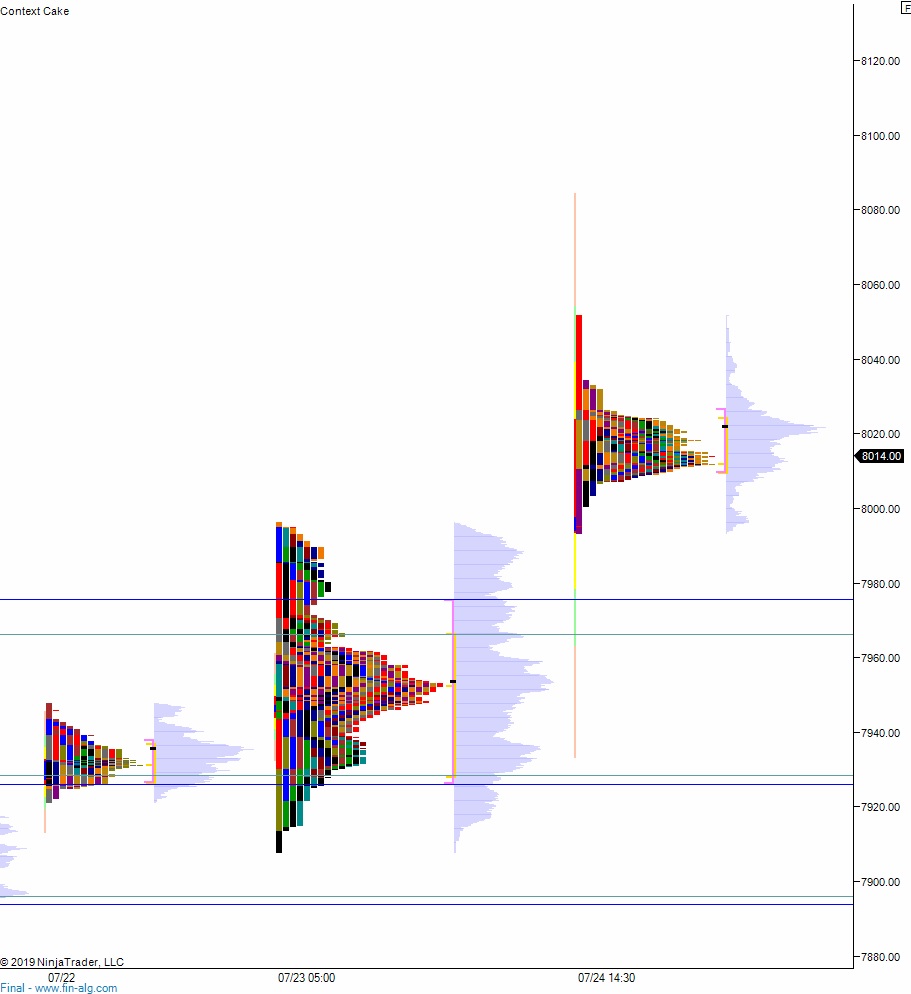

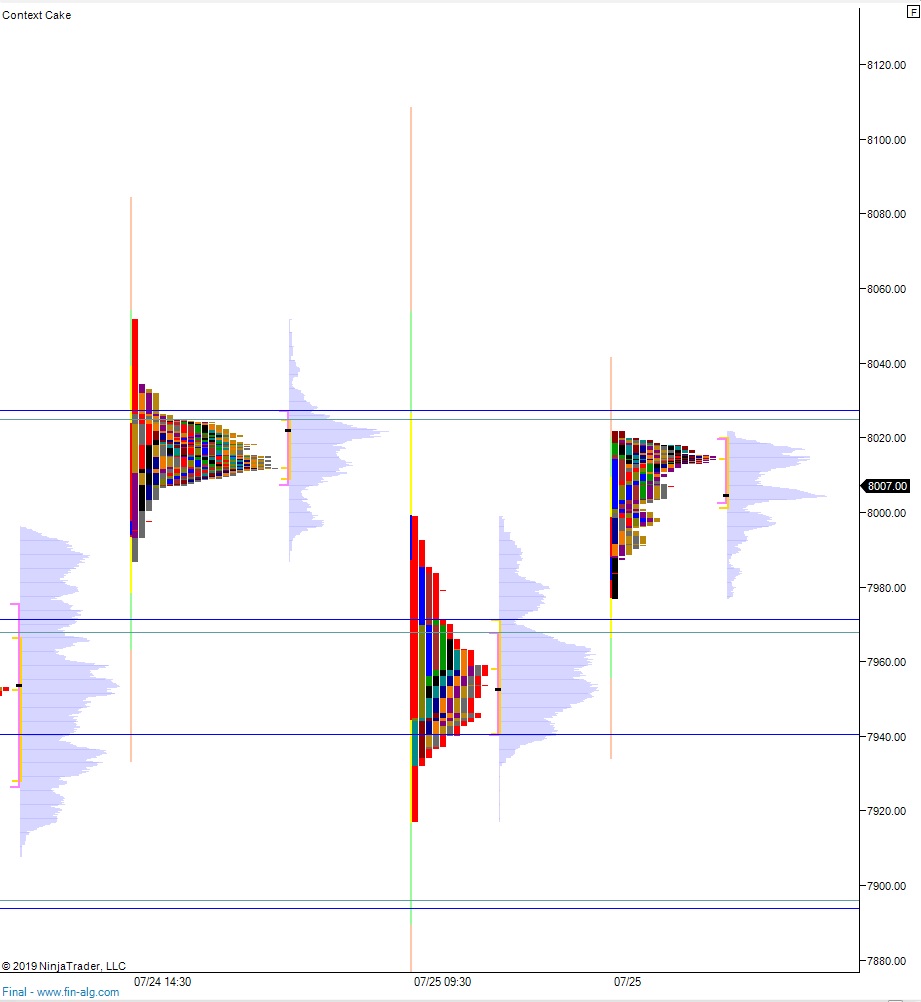

NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme volume on elevated range. Price worked higher overnight, trading up through the Thursday range before coming into balance. At 8:30am GDP data came out much stronger than expected, quarter-over-quarter, Q2 annualized, the U.S. economy grew at 2.1% vs. 1.8% expectations. As we approach cash open, price is hovering along the Thursday high.

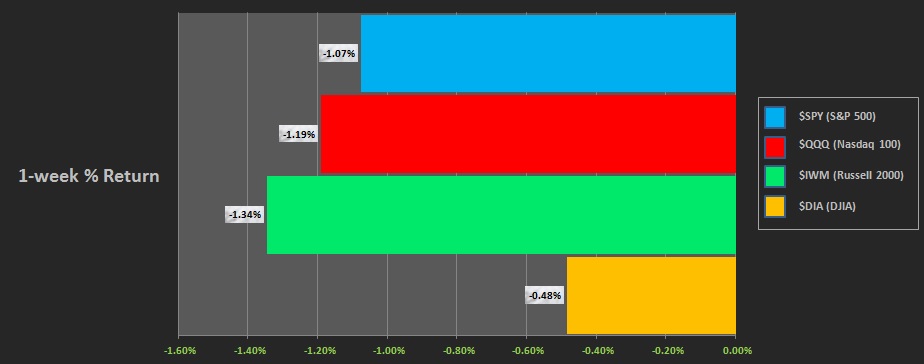

Google and Amazon reported earnings after the bell Thursday. Between the two we have a net-positive movement—Google is +8.5% in pre-market and Amazon is -1.5%.

There are no other economic events today.

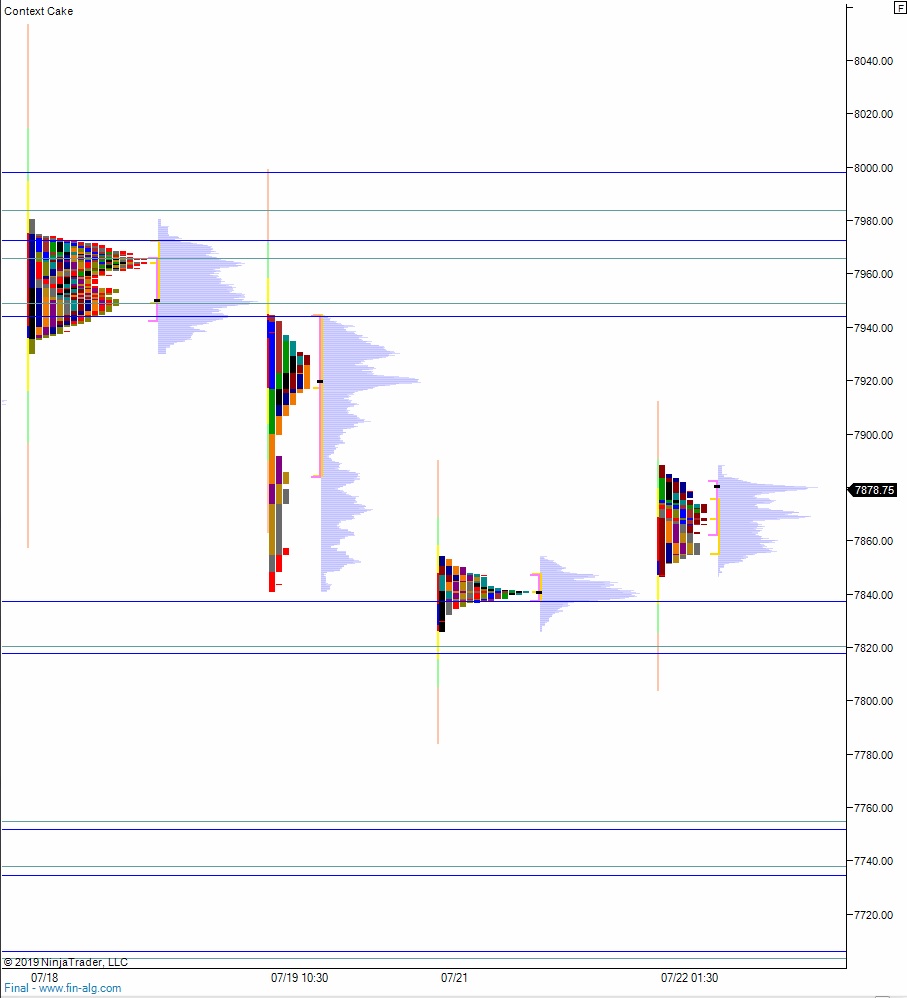

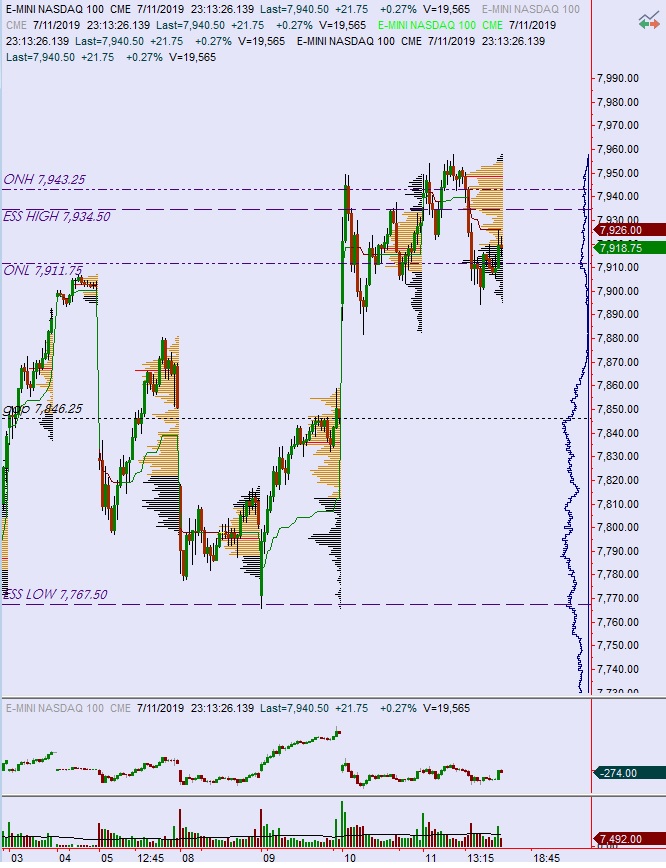

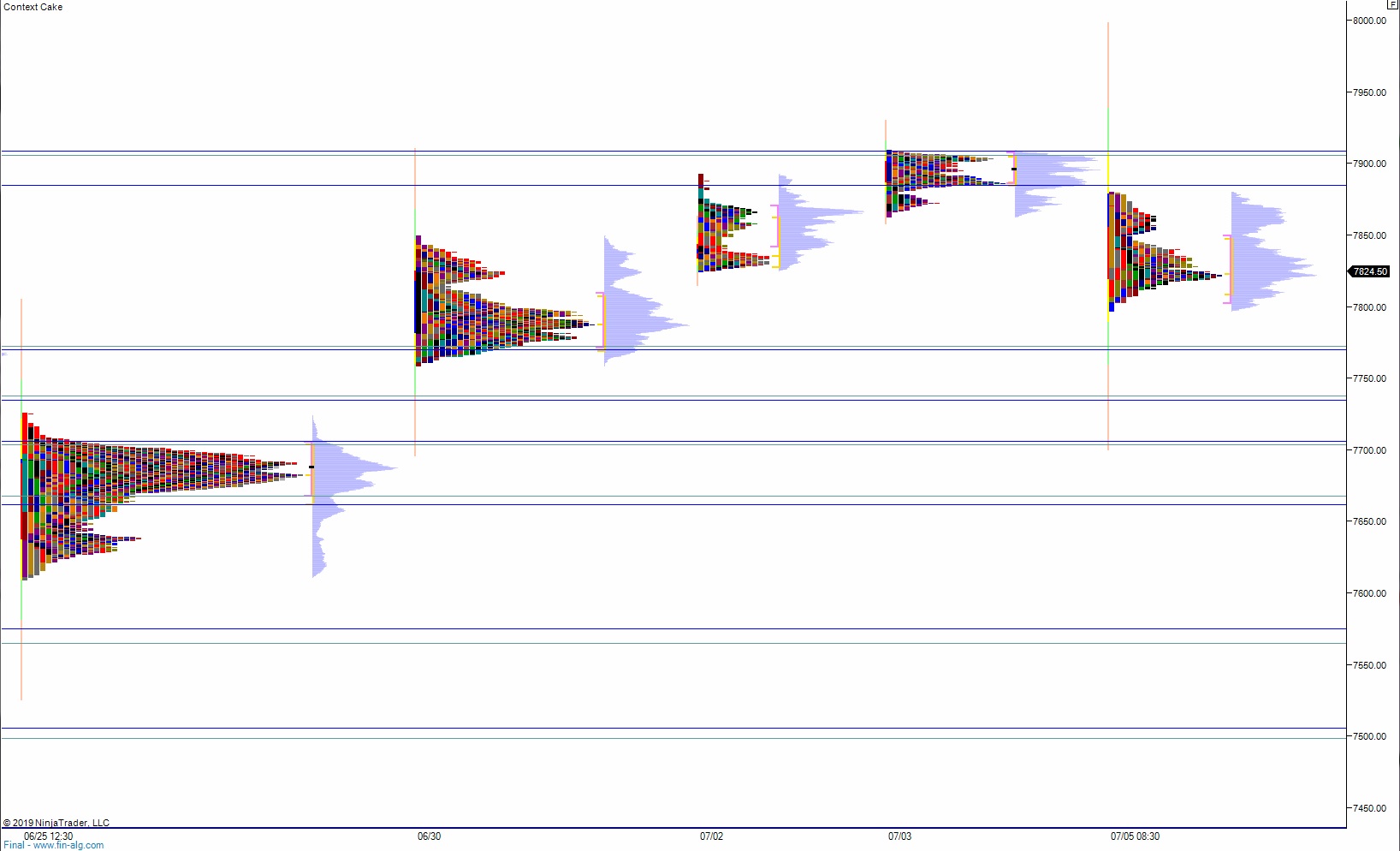

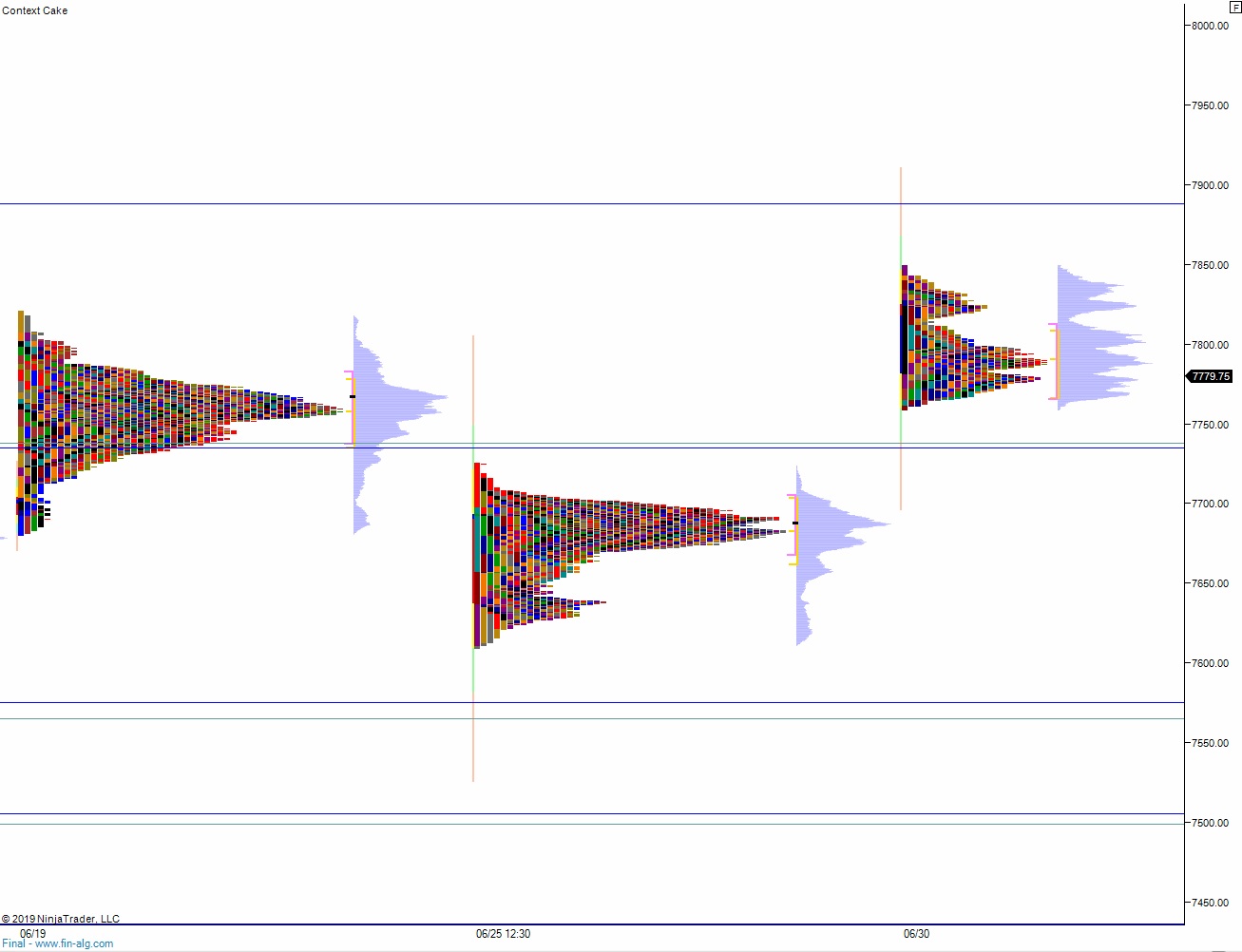

Yesterday we printed a normal variation down. The day began with a gap down and drive lower. Responsive buyers were seen ahead of the Wednesday low. Price moved back up to the daily midpoint where sellers were seen defending before pressing the market range extension down. Price bounced along the lows before the earnings spike at settlement which spiked lower, then ultimately higher to close the day near session high but not neutral.

Heading into today my primary expectation is for buyers to press up through overnight high 8021.75. Look for sellers up at 8027 and two way trade to ensue.

Hypo 2 sellers press into the overnight inventory and close the gap down to 7979.25 then continue down through overnight low 7977. Look for buyers down at 7971.25 and two way trade to ensue.

Hypo 3 stronger buyers sustain trade above 8027.50 setting up a move to close the open gap up at 8037 before two way trade ensues.

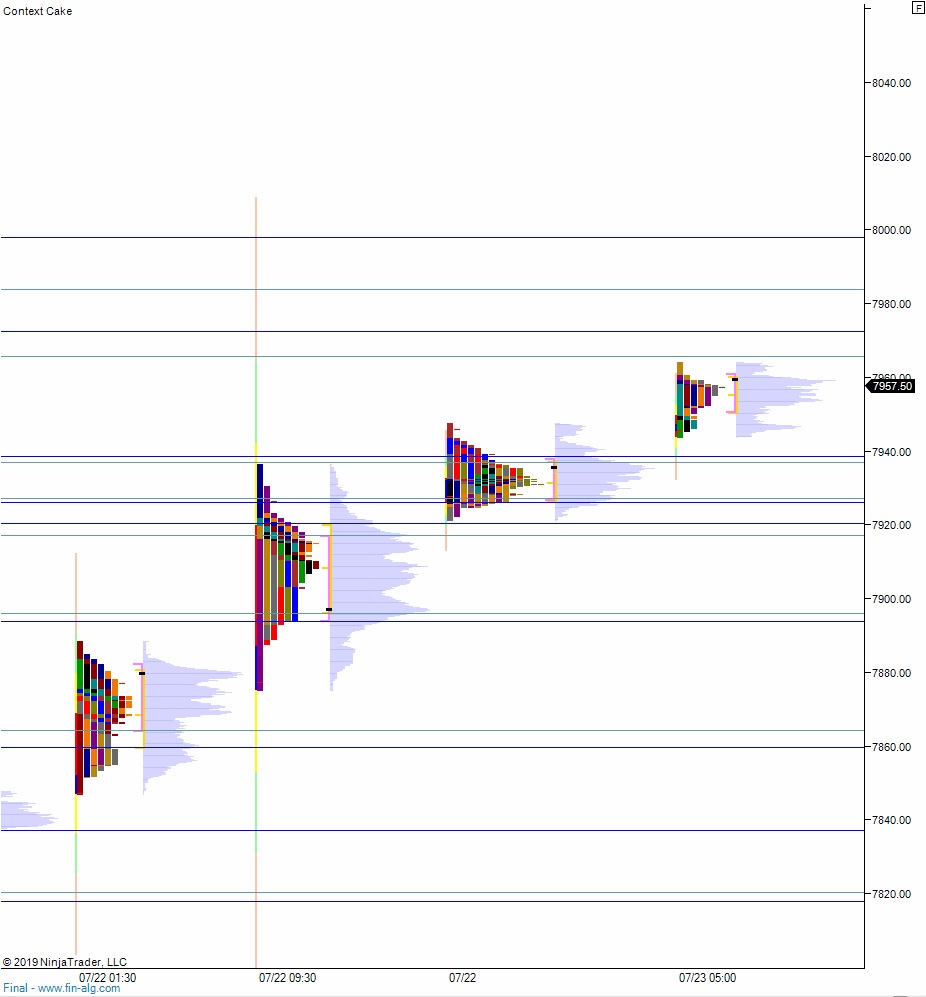

Levels:

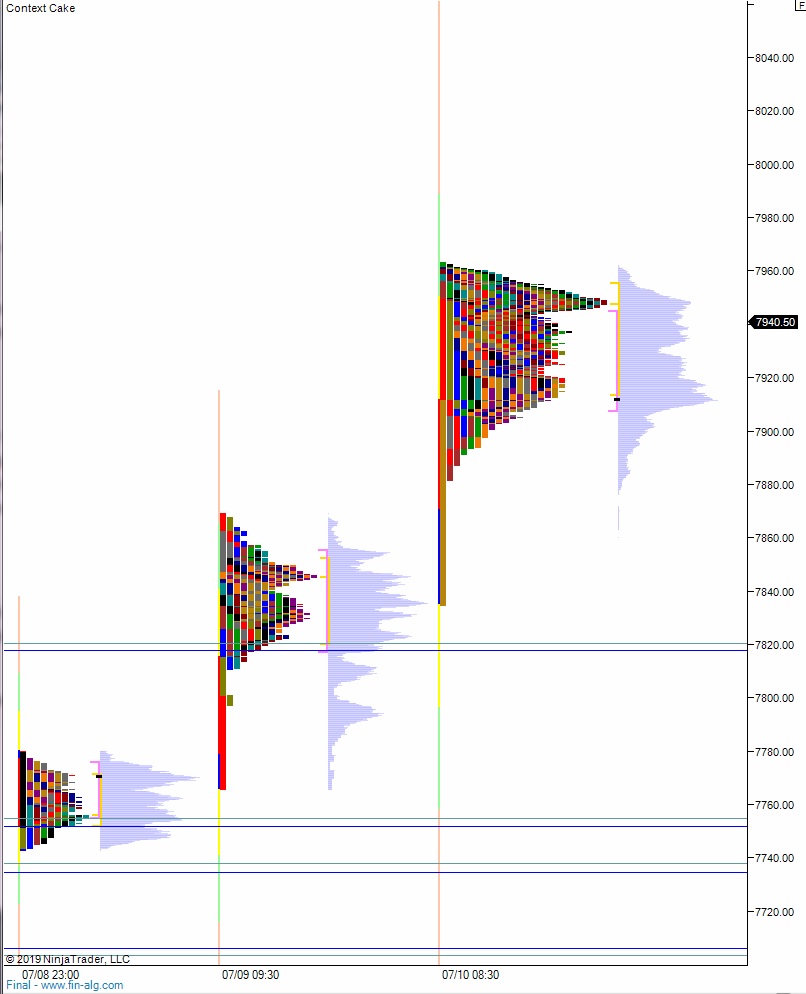

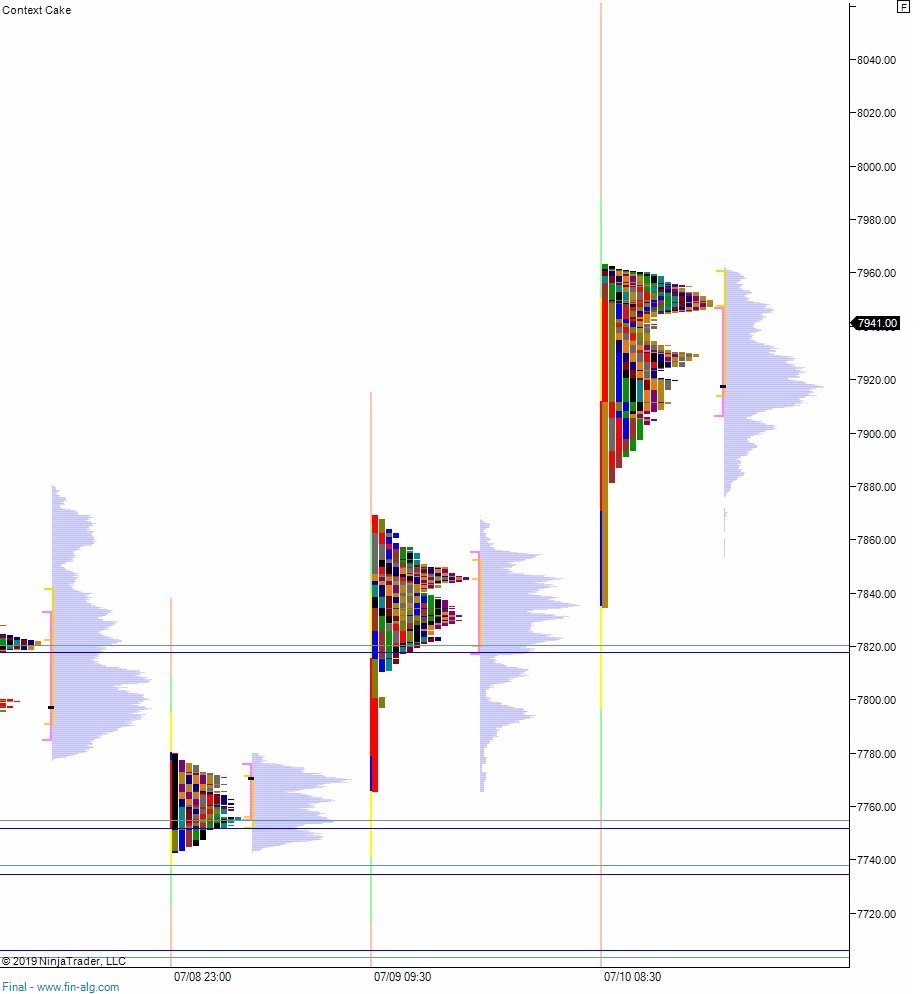

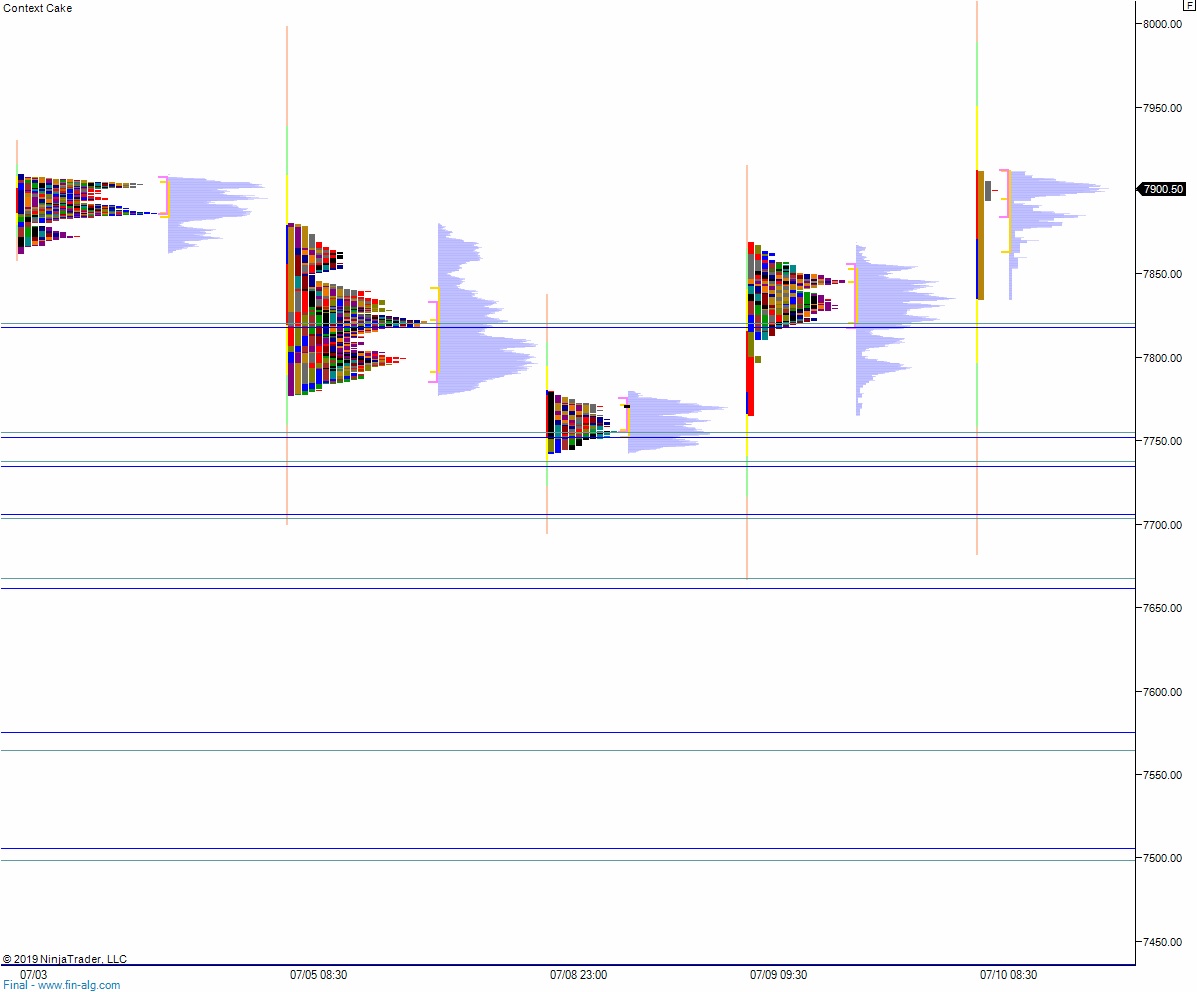

Volume profiles, gaps, and measured moves: