Nasdaq futures drifted higher while stocks were closed for trade Sunday and Monday, and as we approach USA open prices are around 15 point above our Friday closing price of 3675. Durable Goods Orders came in better than expected at 8:30am but was received by the market with a muted response. This may suggest buyers have already priced in best case scenarios on the short term. Or perhaps participants are moving slow after the holiday weekend.

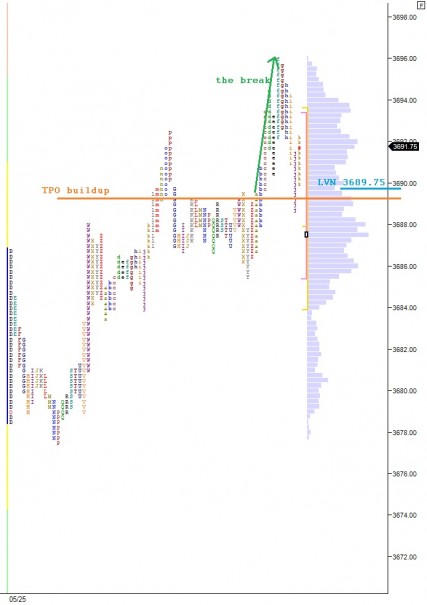

The short term pivot level early on appears to be 3689.75. Taking a look at our 24-hour profile which includes all of the globex trade during the holiday, we can see a buildup occurring just below this level before finally bursting through. The resulting profile has a low volume node at this action point. See below:

Buyers are in control the intermediate term swing. Price has been trending higher since setting swing low on 5/20. The action indicates other timeframe (OTF) activity. These longer term participants became evident last Wednesday and now they are coming into the week in control. There is a possibility we see some profit taking by the OTF early this week, and an early tell about the profit taking and the overall health of the market will be the depth of the next pullback. It seems bulls will want to hold 3645.25 which is Friday’s low print and a low volume node on our composite. Otherwise the door swings wide open for a fast mean revision trade to take hold:

It is important to keep the long term market structure in your mind even while you trade the very short term. Looking a monthly candle chart you can see the sideways churn or bracketed trading action. Markets spend around 70% of the time in balance. Hanging out up near the dot come bubble peaks for this long is rather interesting. What is it telling us about the overall health of the marketplace? What is it telling us about investor risk tolerance? See below:

If you enjoy the content at iBankCoin, please follow us on Twitter