When the market works upward in the grinding manner we have seen over the course of the past 10 days, it makes sense to consider rotating into lower quality stocks that have not yet appreciated alongside the market. Such is the case with my long in FCEL. I have already locked in 2/3 of my long and I now have a runner piece as earnings approach. Stocks behave very odd into earnings because humans begin questioning the very fabric of their thesis as the micro news approaches. It is my intent to profit from the uncertainty, and I have secured my risk well.

Considering the success I had dabbling in the dumpsters, I initiated and intermediate long in Waste Management. The truth is I have been watching this name behave well for many weeks and I was waiting for signs of initiating buyers. This stock pairs with TWTR and LO as long term holds that will not overly distract me while I trade futures.

Speaking of Twitter, she is off to the races today. You would think this would distract me, but I am a long term investor in Twitter who is convinced of its media prowess and certain the stock will trade at upsetting valuations within my lifetime. These valuations, mind you, will not upset me whatsoever. I am currently down about 34% on my position. This is committed capital whether I like it or not. Fortunately, I like it.

I took a new long in WB in anticipation of the Chinese waking up, reading of the crazy Americans and how they rushed into Twitter like a pack of fresh zombies, and immediately using their iPhones to buy their native twitter Weibo. This should bode well for not only my WB June calls, but also my SINA shares.

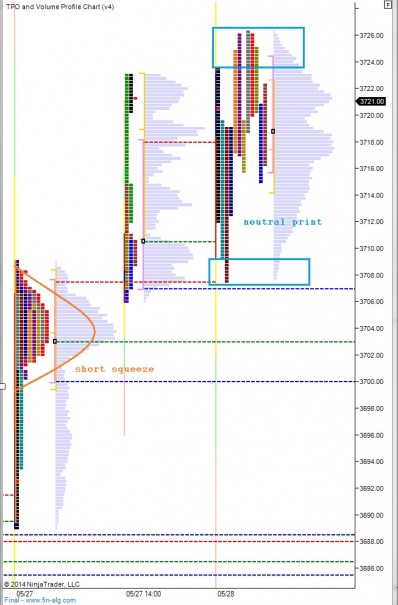

We printed a neutral day today, suggesting we are again at an area of intense indecision in the Nasdaq. Be prepared for violence:

NOTE: The neutral print suggests very little directional conviction if we close near the middle. HOWEVER, the neutral print with an extreme closing, like HOD or LOD suggests strong directional conviction by the dominant party. So this close is very telling…pay attention!

http://youtu.be/Z3yBzgem2V4

If you enjoy the content at iBankCoin, please follow us on Twitter

What are your thoughts on light emitting diodes?

The hard working people of China began worrying me last month with their foaming at the mouth desire to sell me LED bulbs.

They were holding too much supply, and being they are intermediate term holders of inventory, not long term participants like the manufacturers (long term sellers) and users.

Whenever too much supply is held by intermediate term market participants, you can bet incentives and other discounts will begin.

This puts a burn on the tight-margined operations of folks like LEDS, RVLT, and CREE.

With all that said, I still am with CREE for a snapback to at least 50 after being completely decimated. LFI is coming up next week which may shed insight into the industry, too.

POWI chart looks good and tight also, after taking a swift kick to end April. It will be interesting to see how it breaks from here and if it carries over to other LEDS.

RVLT looked good to bounce for a second, but is pretty weak out of the consolidation gate. Again, the pop finds responsive selling.

LEDS looks like death