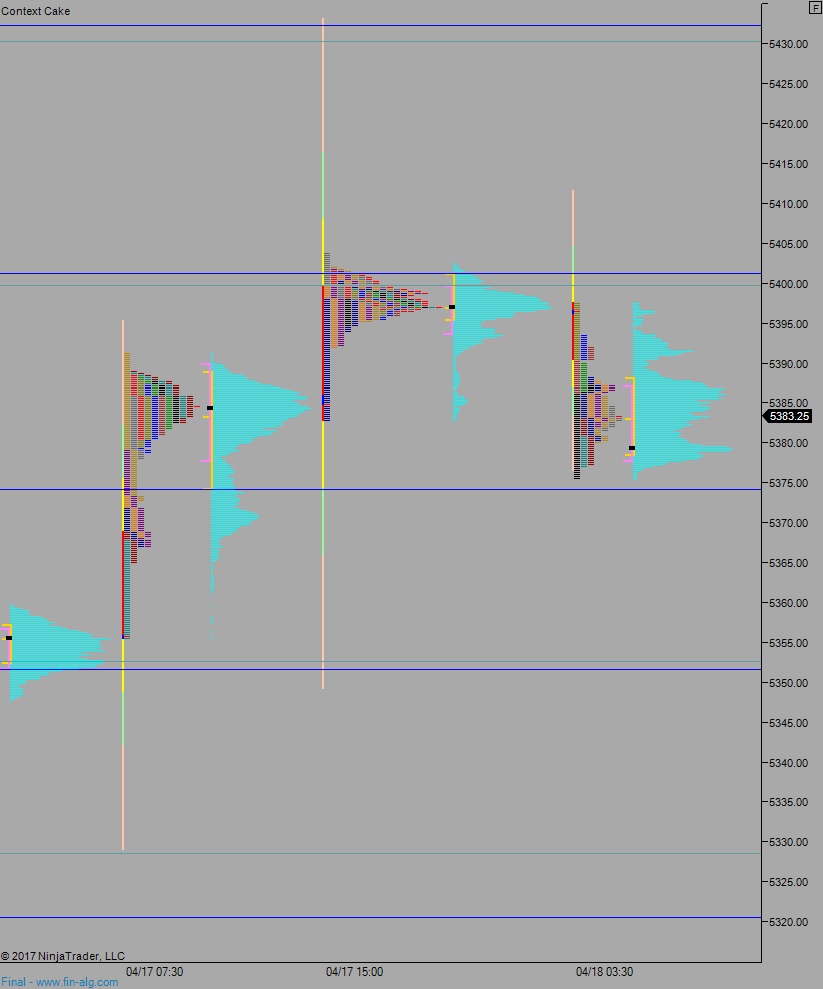

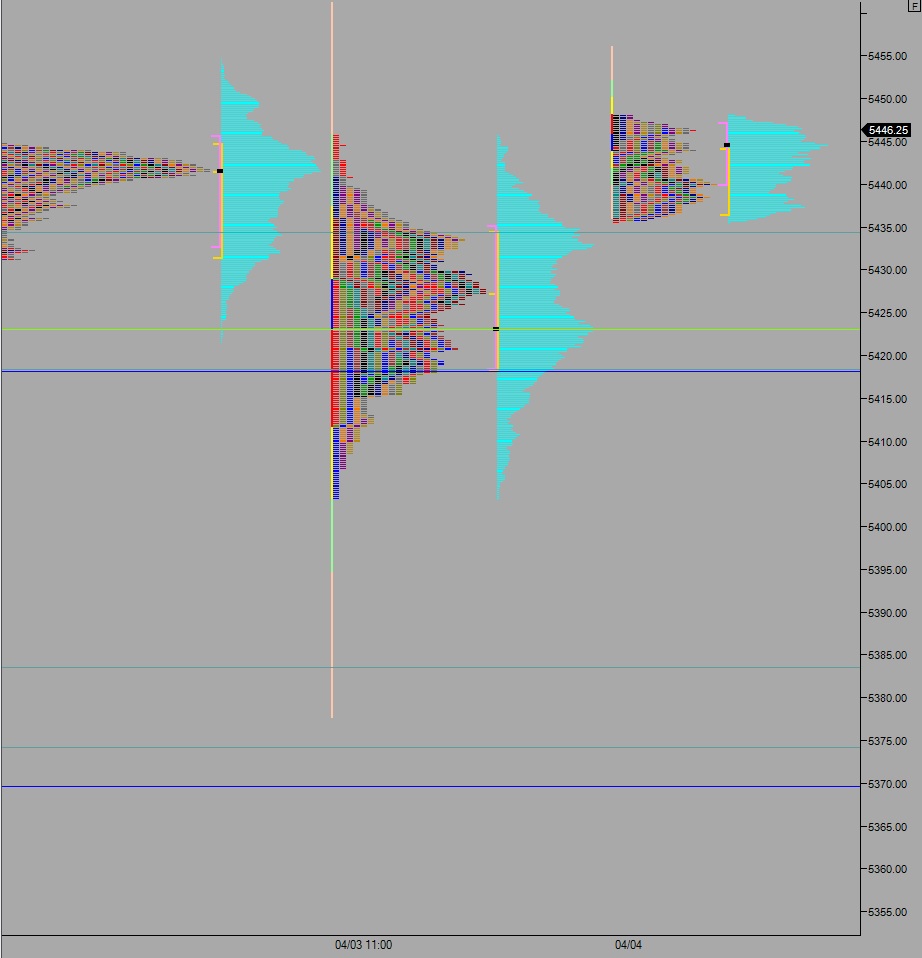

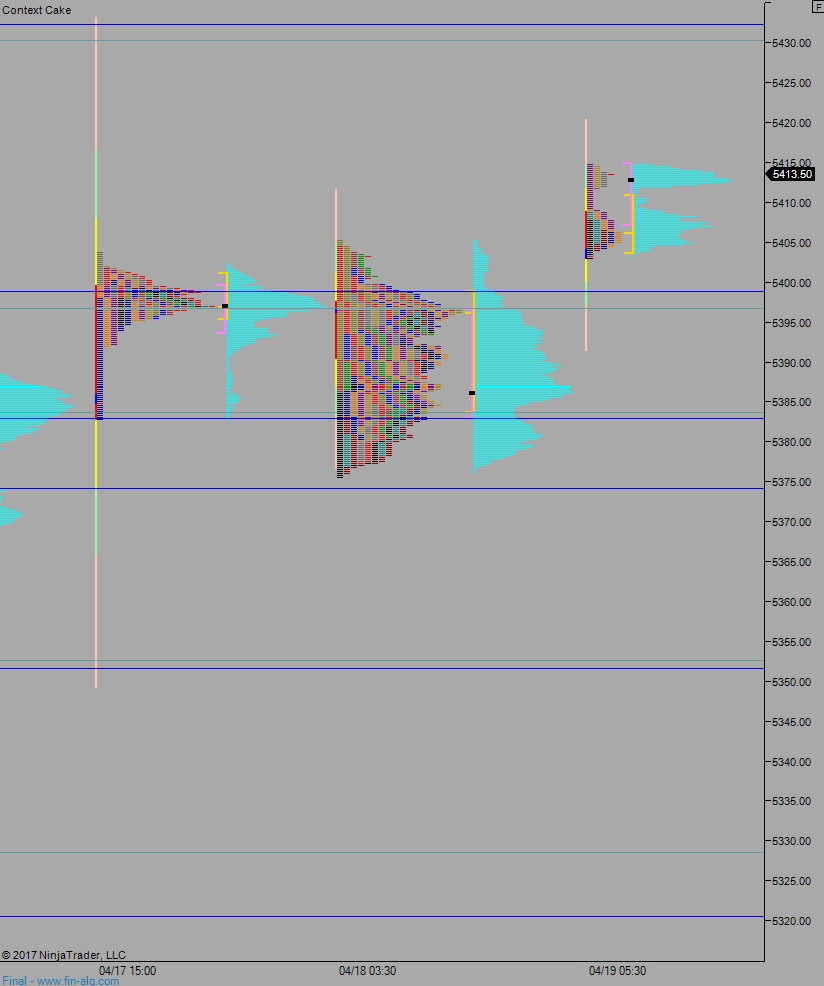

NASDAQ futures are heading into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher during the entire session, pressing up into the hard selling from last Tuesday and nearly erasing the losses. At 7am MBA Mortgage applications data came out worse than last week.

Also on the economic calendar today we have crude oil inventories at 10:30am and the Fed’s Beige Book at 2pm.

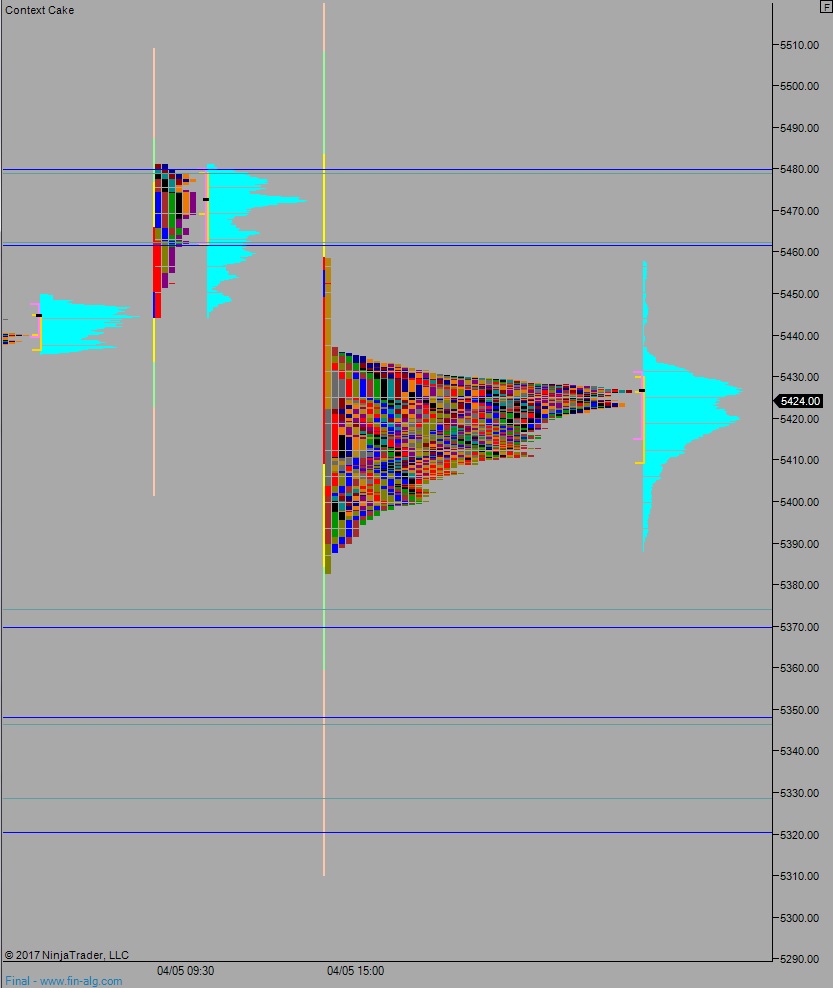

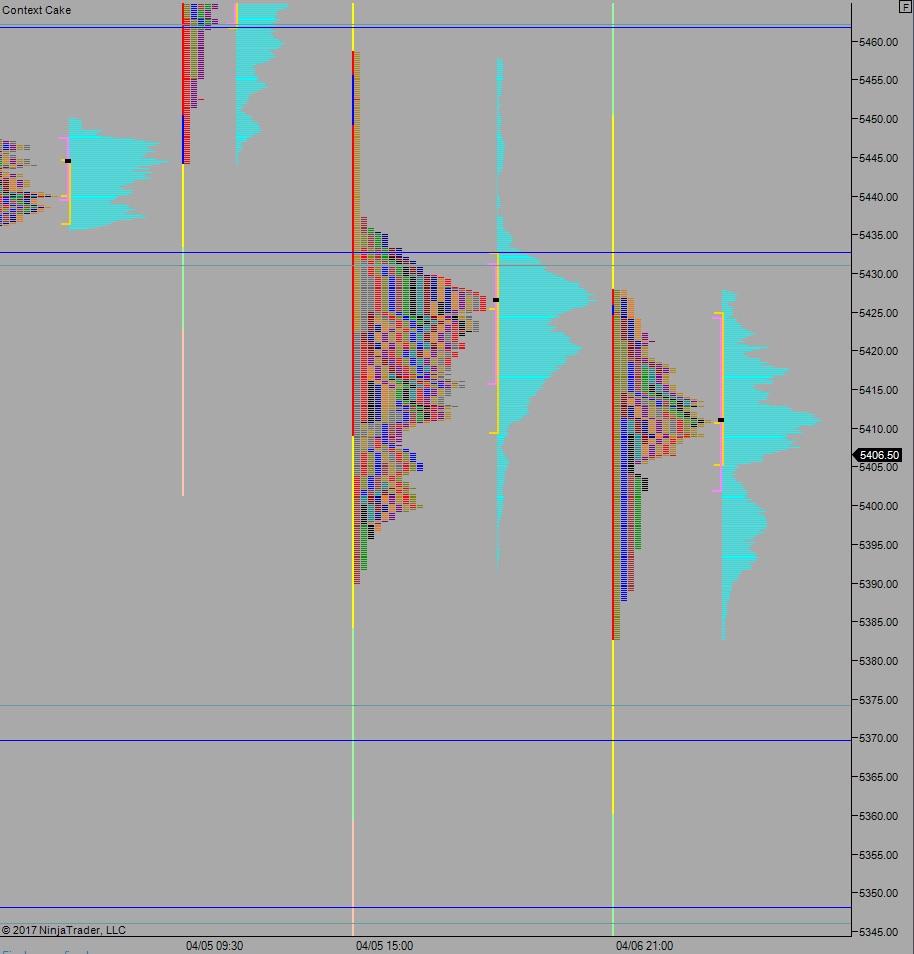

Yesterday we printed a normal variation down. The gap down was quickly bought up and buyers continued pushing higher, to a new weekly high before sellers came in and reversed the entire move, briefly pushing the market range extension down before two-way trade ensued.

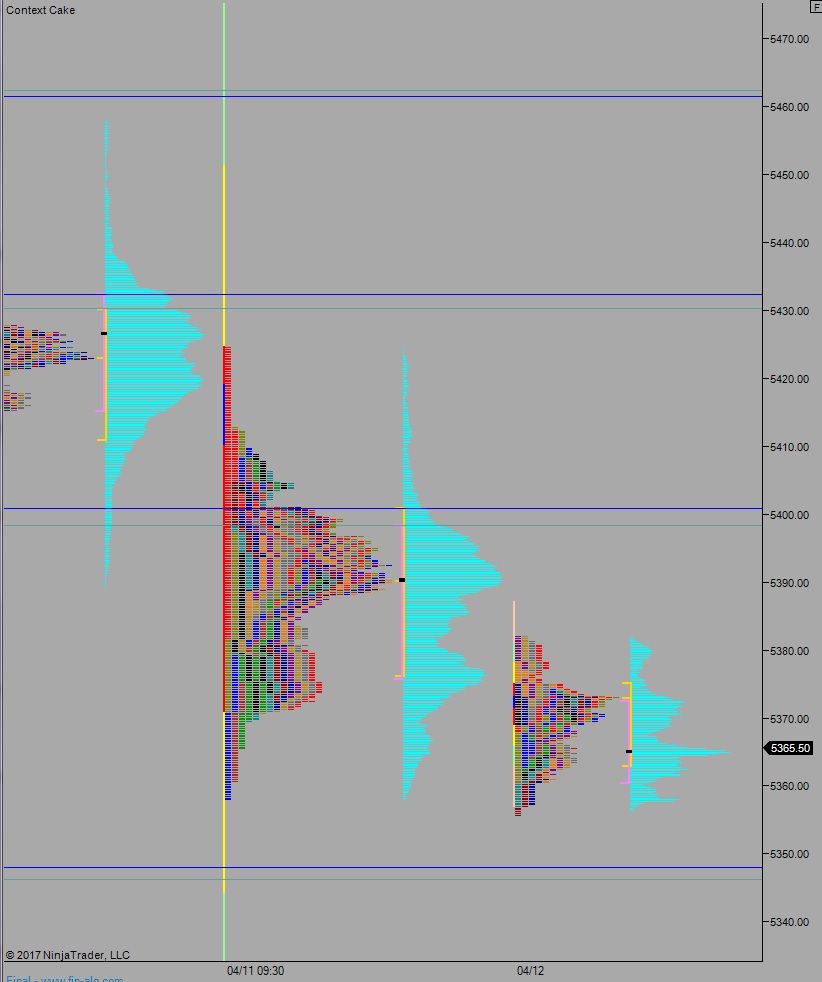

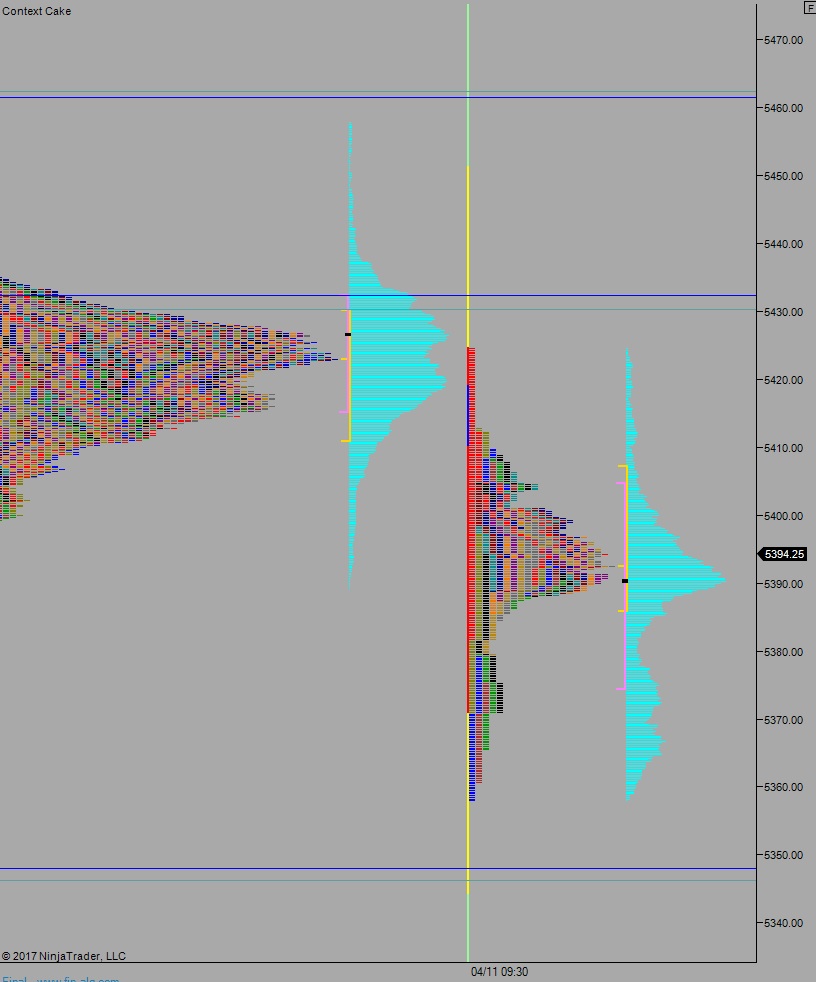

Heading into today my primary expectation is for buyers to gap-and-go higher, working up to the naked VPOC at 5432.25 before two way trade ensues.

Hypo 2 seller work into the overnight inventory and attempt to regain the Tuesday range at 5405.25 but fail, ultimately leading to a move up to 5432.25 before two way trade ensues.

Hypo 3 sellers work a full gap fill down to 5389.50 then take out overnight low 5388. Look for sellers down at 5383.75 and two way trade to ensue.

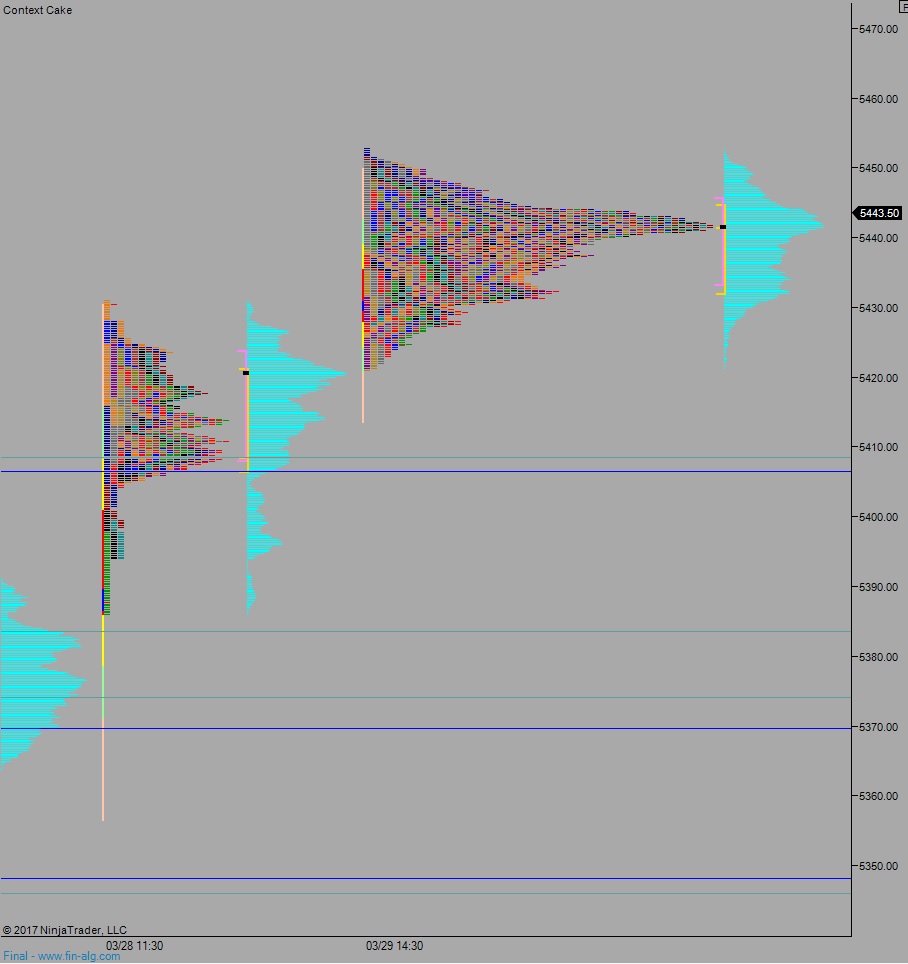

Levels:

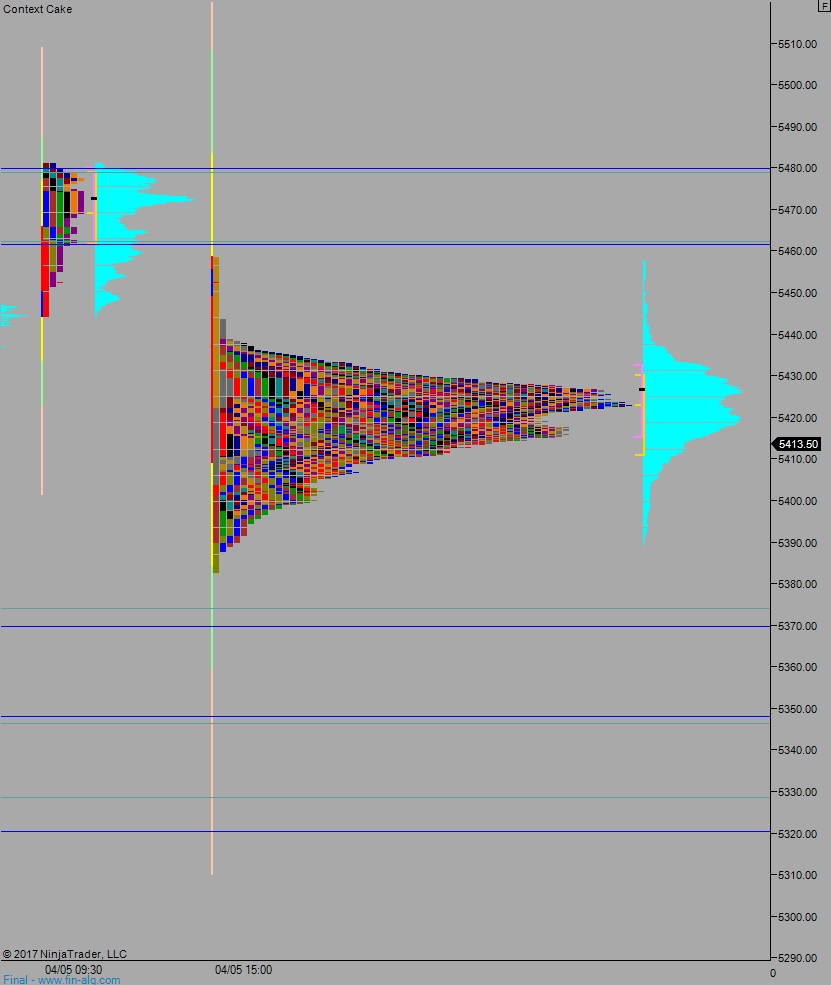

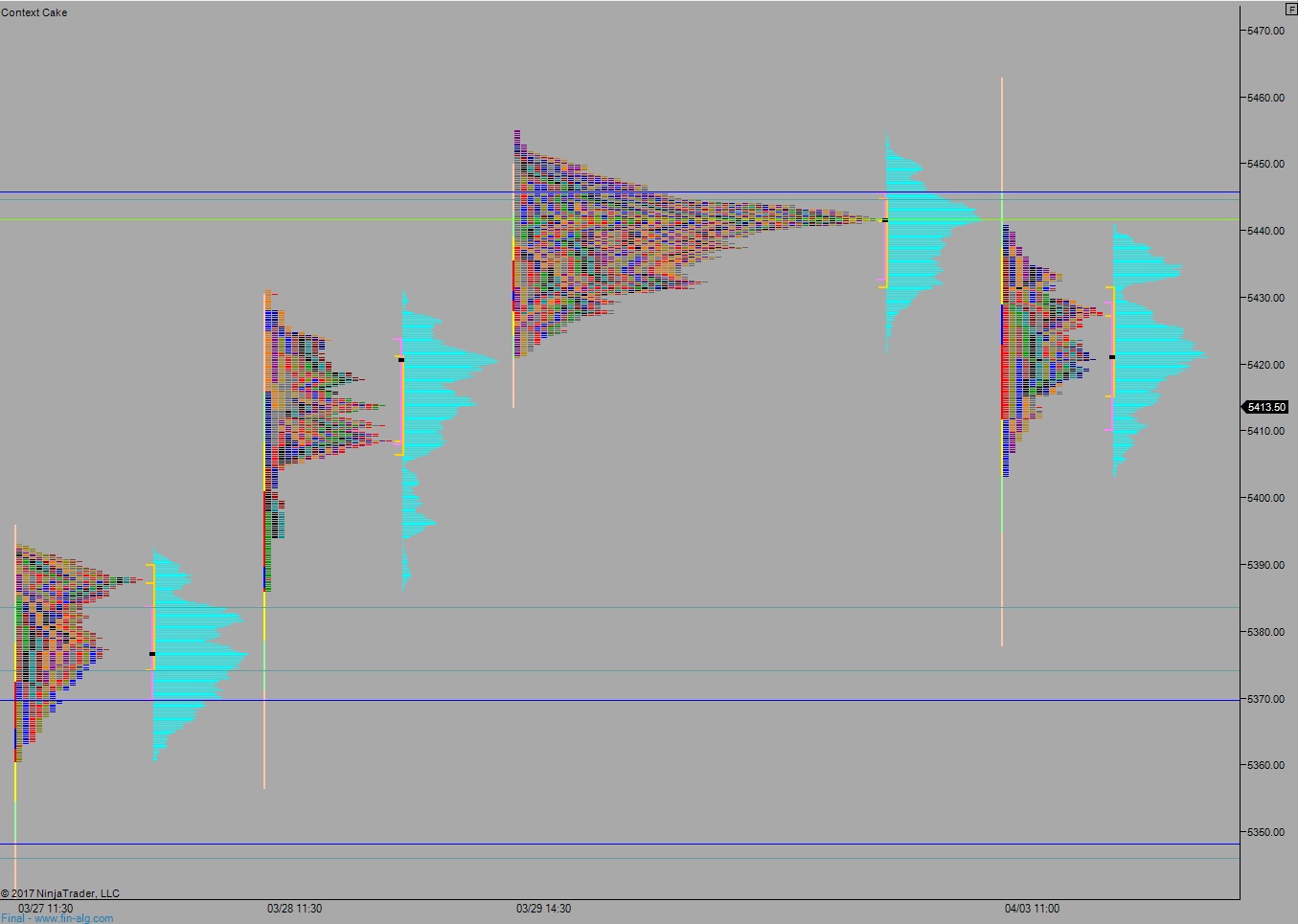

Volume profiles, gaps, and measured moves: