NASDAQ futures are heading into the first day of the second quarter with a slight gap up after an overnight session featuring normal range and volume. Price held inside the range of last Friday overnight in a balanced session.

The economic calendar starts out slow this week, picking up steam as the week matures. For Monday, we have ISM Manufacturing data at 10am, then at 11:30am the US Treasury is auctioning off 3- and 6-month T-bills, $39b and $33billion respectively.

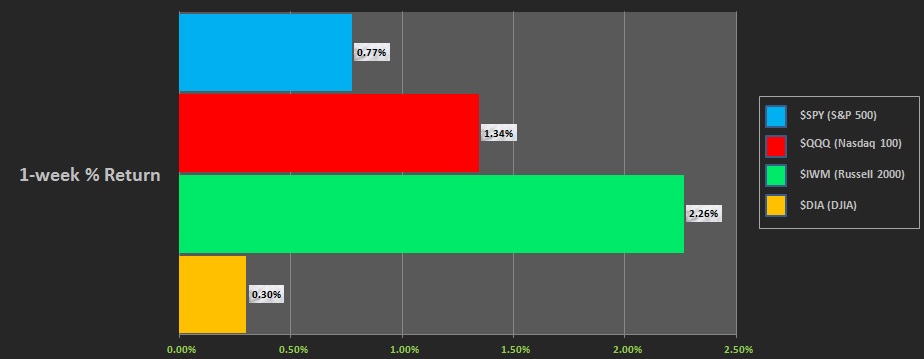

Last week the major indices worked higher. But first the week began with a major gap down. On the open last Monday, the Dow was down nearly -200. However, after two trend day ups, the stock markets spent the rest of the week drifting, with a slight upward bias. Here are the performances of each major index last week:

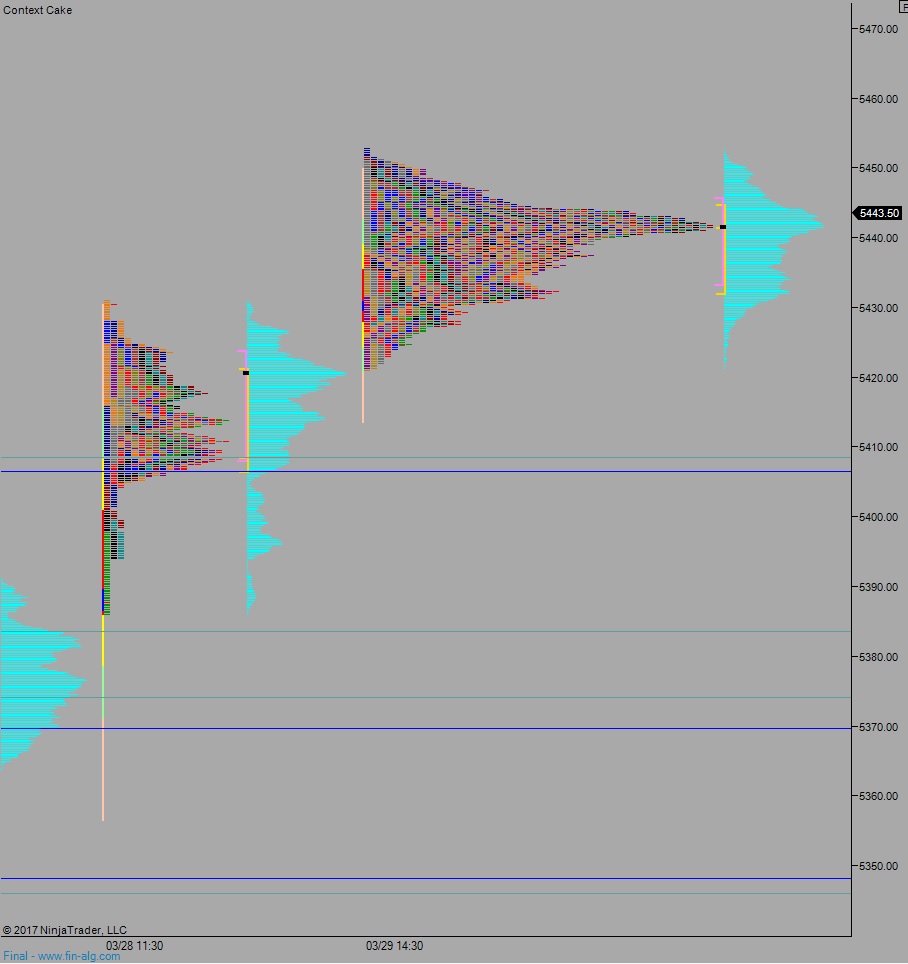

Last Friday the NASDAQ printed a normal variation up. Price opened gap down but still inside the Thursday range. Sellers made an attempt down through Thursday’s low but stalled ahead of it before buyers came in and worked the market to a new high on the week. The new high was quickly met with selling, twice, ultimately settling price out just below the Friday midpoint.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5438.75. From here they continue lower, down through overnight low 5432.75. Look for a move down to Wednesday’ naked VPOC at 5421.25 before two way trade ensues.

Hypo 2 stronger sellers work down to 5406.75 before two way trade ensues.

Hypo 3 buyers press up through overnight high 5450.75 setting up a run at new highs. Look for sellers up at the Fibonacci zone starting at 5462.50.

Levels:

Volume profiles, gaps, and measured moves:

Why are two of your 14 Exodus picks red? Are they shorts??

They are Chinese burritos