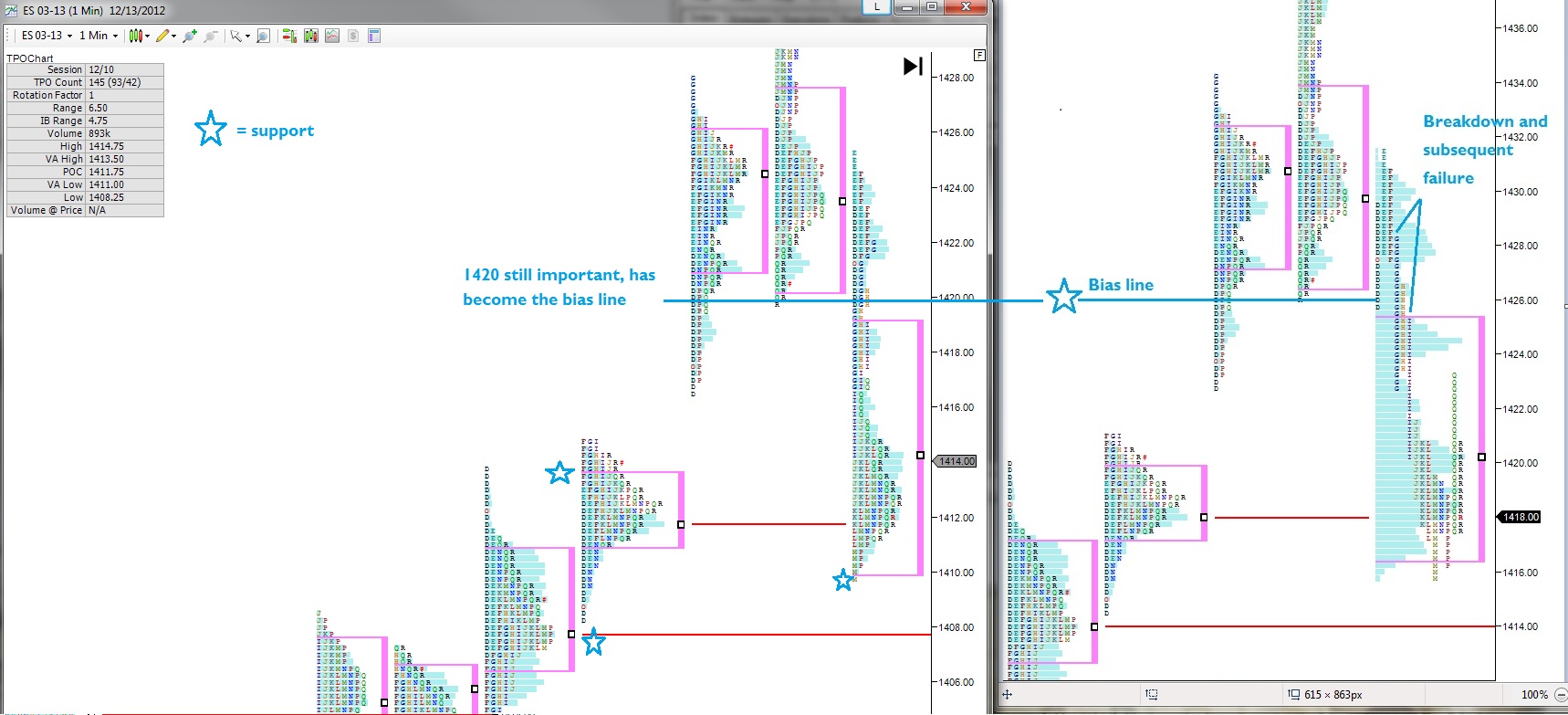

What first catches my eye when viewing yesterday’s profile is its shape. It nearly resembles a lowercase letter b. The shape of the profile indicates sellers overwhelming the tape early in the session only to find interested buyers down below. It’s often referred to as long liquidation which is the opposite of a short squeeze. Once the temporary excess of supply from top tickers and chasers ends the market stabilizes. Often times the occurrence of a long liquidation can mark the low of a trough. However, I’ve noted a bias line where I want to see trade sustained above to be constructive on long positions. The level also acted as resistance during the overnight session on three occurrences also before we blasted through it around 7am. Watch trade in and around 1415:

Comments »Merge For a Clearer Picture

Sometimes when a session like Monday occurs with very little movement in price and trade entirely contained within the prior session’s range, I will merge the profiles into one, to get a better sense of the overall trading range and relevant guideposts it can present.

By merging Friday and Monday sessions together, we get the below profile. Interesting note, the volume price of control at 1423 (also Monday high) has been tested three times overnight. Going into the open we’re priced to open right on the level. For all these reasons, I consider the range from 1422 to 1423 my pivot line.

Above resistance is the confluence of the profiles value area high and last Tuesday’s session low at 1425. The next interesting area above is last Friday’s high. Trading above 1428.50 would demonstrate buyer strength.

Very important support below is the confluence of last Monday’s VPOC and the profiles value area low from 1418.50 to 1419.

Comments »Lets See Who Shows Up For Work Today

The early AM has seen prices in the S&P gently levitate after gapping down Sunday evening. After finding support near Friday’s low near 1418 the market has lifted over five handles and as of 9:15 AM is pricing an open within yesterday’s value area.

Key levels from Friday’s balance are the volume price of control at 1422.75 and the value area high and low at 1426.75 and 1416.25 respectively. Below Friday’s low the next key area is last Monday’s value area low at 1415.75 and below there we want to see bulls holding last Monday’s low, otherwise they risk a quick blow to their confidence on this shortened trading day. Taking out Monday’s lows, the lows of last week could set the tone for the week.

Keep an eye on the key levels from Friday for a cue on who make their way to market this Christmas eve:

Comments »Down But Never Out

Strong bounce thus far this morning in the S&P, pumping hard off of a key support level. Financials continue to behave very bullish although the session is still early. We’re into the back-and-fill range I highlighted this morning after getting a telegraphed bounce off of Monday’s value area high:

Although I’m down over 1.5% today and counting, I used this morning’s pop to clean out all the degenerate positions from my portfolio. All except one, BGMD. I can’t let this position go unless it gets seriously weak. It flagged hybrid oversold yesterday with an impressive dataset and look at this chart:

Comments »

Finally Some Snow

I woke up this morning to the first sight of snow on the ground. It’s just a light dusting, mind you, but even the slightest glimpse has me in a better mood than last night. Let it snow, let it snow, let it snow.

I got all bulled up yesterday afternoon after seeing the S&P thoroughly auction the EXACT price range I had laid out in the morning yesterday and then break higher. Typically, this is a very bullish event. It says to me, the buyers and the sellers came to the town square, exchanged their paper while wearing top hats, the sellers were quite pleased with the amount they had sold and went home for the day, but more buyers were left around in the afternoon, possibly drunk on eggnog, and they were still interested in buying. Only the sellers were gone so their teased them back into the square by throwing snow balls at their windows.

Little did they know the world was ending today, and they would wake a giant laser beam armed algo who would melt all the snow and leave only a bottomless pit where the buyers once stood.

And here we are today, still alive after the attack. Take a look at where we’re set to open, around 1422, not as bad as it looks on the freaky overnight tape:

We’re set to open right around Monday’s value area high, an area we snapped through and never looked back. Well here we are, throwing back to the scene of the crime where this week’s breakout started. Chess mentioned in his special fiscal cliff video last night that even though it appears we could see extreme volatility today given the overnight action, the busy news headlines, and option expiration it’s quite possible to be a quiet day given the light holiday trading action.

A mild session favors the bulls going into next week, and if they can hold the key levels of support I’ve outlined in the above profile, I we can stay constructive on the market. Keep your head on the open.

Update: Futures took another cliff jump down to 1418 as soon as I published. Be prepared for anyting, including a flush. Key off of the support levels highlighted.

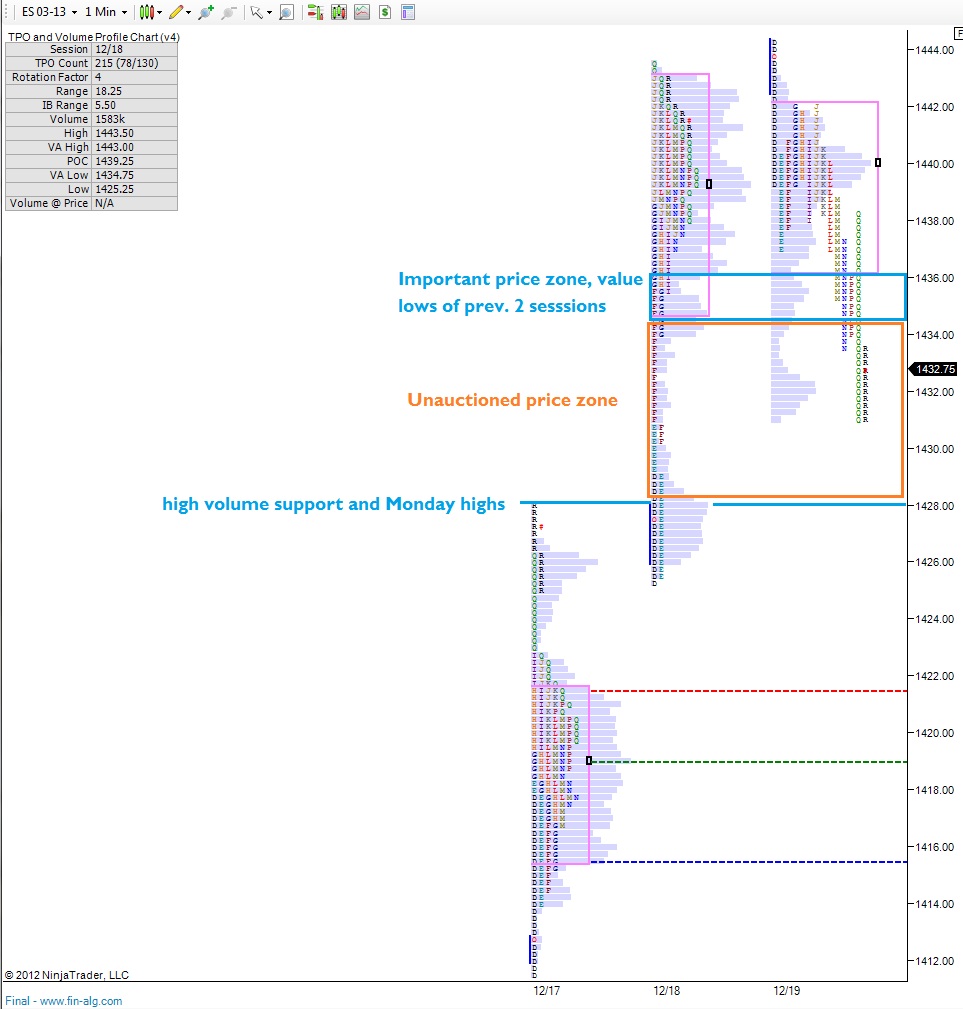

Comments »Settling Unfinished Business

Tuesday’s trend day higher left some interesting price levels behind as we moon shot higher. Often times, when a price level is not thoroughly auctioned, the market will return to those levels. It’s quite possible that is how we will spend today’s trading session.

Although yesterday was an inside day, where price consolidated within the range of Tuesday, we did see price fall lower toward the closing bell, pushing price down below both yesterday’s and Tuesday’s value area. As of 8am the globex session seems to have bumped its head on the value area low zone I’ve highlighted below:

Trading today in the non-auctioned price zone I’ve highlighted would be constructive and we can expect high quality charts to still provide high probability trades. Globex lows coincide with the low of the orange box above. Should we sustain trade below 1428 that’s our cue to cut laggards and consider scaling profits in winners.

Above 1434-1436 we can consider getting more aggressive into the close of the week.

Comments »Markets in Rip Mode

Going into 8:30 the S&P futures were above recent swing highs. We set a Globex high at 1434.25 and we are pricing an open right near yesterday’s close. I noted early yesterday that a Santa rally may be short lived and I wanted early involvement. Yesterday was the spark that lit a massive pile of paper aflame, whether we get the soaked logs ignited is another story.

I expect to see some early back-and-fill action. Key price areas include last Wednesday’s Fed reaction around 1430 then possible support at yesterday’s high/close which coincides with last Wednesday’s value area high at 1428. The next level of key support is yesterday’s value area high at 1422. Should we sustain trade below that level I would expect a quick trade down to the value area low of yesterday down to 1416:

My plan is to cut any early weakness out of my portfolio if necessary, to make room for better charts. Stocks of interest going into today are CERN, HEK, FTK, REGN, SHLD, and SKS.

For the sake of redundancy of an important concept, should we sustain trade below 1422, we could get a quick flush. I may cut some longs and see how things pan out.

Update: S&P making a new overnight low into the open. Looks like participants want to re-auction the thin rip from yesterday’s close to ensure buyers are still present from 1422-1425. Not quite rip mode!

Update II: We are in fact IN RIP MODE!

http://youtu.be/ofoIMg76Sng

Comments »In The Dip Zone

We’re starting the week in my favorite area to do business, the dip zone. More specifically, we’re above my favorite EMAs after making a new swing high.

I’m looking to buy strength today, should the market remain constructive. As of 8am, the S&P futures are priced to open slightly higher, near Friday’s value area high. Critical support for a constructive session is the confluence of interesting profile action at Friday’s lows. We don’t want to see trade sustained below these levels as longs because it’s likely to preclude another flush lower.

Overhead resistance at Thursday’s volume price of control at 1414.25 and above there it could be a quick ride to last Wednesday’s lows which share confluence with Thursday’s value area high. I expect we could see sellers at that level too. E-mini S&P profile below:

Also, the light sweet contract continues to be on slippery footing, after gapping higher on its Sunday evening open it has been smacked lower. The session has stabilized since the USA started coming online, but be on the watch for continued weakness which could bode well for Rhino’s refinery thesis and the airliners:

Comments »TPO Verses P&F Charts

After casting his vote for me, one of my favorite all time reads and radio/television sensation Scott Bleier told me to cut out the point and figure crap. This was in reference to the TPO and volume profile charts I have been posting for the S&P futures. Seeing as Scott is arguably one of the most seasoned pros on this site, it’s easy to assume a few others are unfamiliar with TPO charts and how they can be interpreted to glean understanding of a contract’s price action.

First let me very quickly cover the P&F chart. If you desire more background on the charting method, I’ve linked to two detailed sources at the end of this post.

P&F differentiates from most chart styles by not plotting price against time. Instead it uses Xs and Os to delineate upward and downward movement respectively. One goal is spotting breakouts and breakdowns. Below I’ve marked up the SPY chart. Notice all of 2012 is contained within five strands of Xs and Os. Writing about this chart every morning would be grounds for banishment, no doubt:

TPO charts, and more importantly the volume profile, give us much more actionable data. TPO stand for time price opportunity and each letter (usually) represents 30 minutes of trading. As the session progresses, the TPOs build up and take shape. Remember bell curves? They show up all the time in a balanced market. My write ups cover the e-mini S&P future contract. It’s the most traded financial instrument in the world and is derived from the price of the S&P 500 index.

The more time we spend trading at a specific level, the more TPOs build up, and it tells us the market has “accepted” a price as reasonable and buyers and sellers both find the price as reasonable, balanced. Balance is good, but imbalance and price discovery are where the opportunity to bank coin reside. Last Thursday was an example of price discovery which led to the gap fill. You can see the before and after in my posts here and here.

As volume data became more raw, more pure, we began plotting the volume at price to build similar imagery as the TPOs had in the past. Most current users of this type of charting consider tracking the volume to be more relevant and actionable. I agree. If we know where the most volume has traded, we can watch that level and see how the market reacts when we reach it. If we blow through the level, something has changed and the participants no longer agree the price is fair.

I could continue on, but let’s instead look at Friday’s auction and what it tells us. First, I very clearly see from the tight range that there wasn’t much action on Friday and the market found balance. The purple box I plot is the range where 70% of the transactions occurred for the day, using volume at price. It’s called the value area and people make a living trading around these levels alone. We closed right near the middle of the value area, but not before the bears attempted an afternoon push lower. Buyers showed up and price quickly returned to the midpoint. Overall Friday was a balanced day of market stabilization:

In my next post I’ll cover price areas of interest going into Monday’s trade. Levels where we could expect the market to pause or explore.

PnF Links:

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:pnf_charts

http://en.wikipedia.org/wiki/Point_and_figure_chart

Comments »Rolling On

How apropos my dear readers that the day of my interim trial blogger status we roll into the March contract. The contract will exist as long as my trial-by-fire period. Let us hope both appreciate in value, although the contract’s road is much more rocky and unsure.

Going forward all price levels quoted will be from the March contract. First and foremost the infamous 1420 level—its 1414 now. That’s an important level to keep in mind today as trade sustained below that level could result in a short trip to 1407.75 the untested (or naked) volume price of control from last Friday. I’ve placed the two contracts side-by-side below to give your eye an understanding of the levels. March-13 is on your left:

Comments »