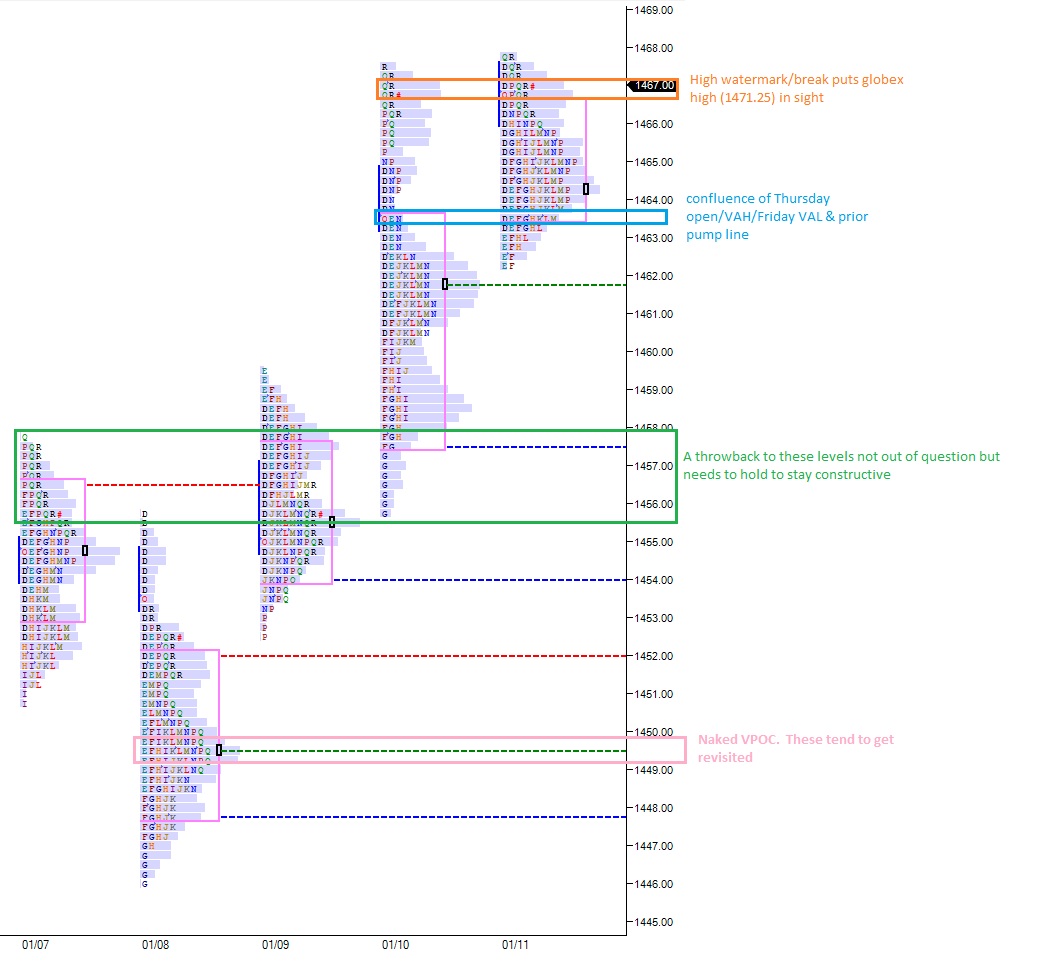

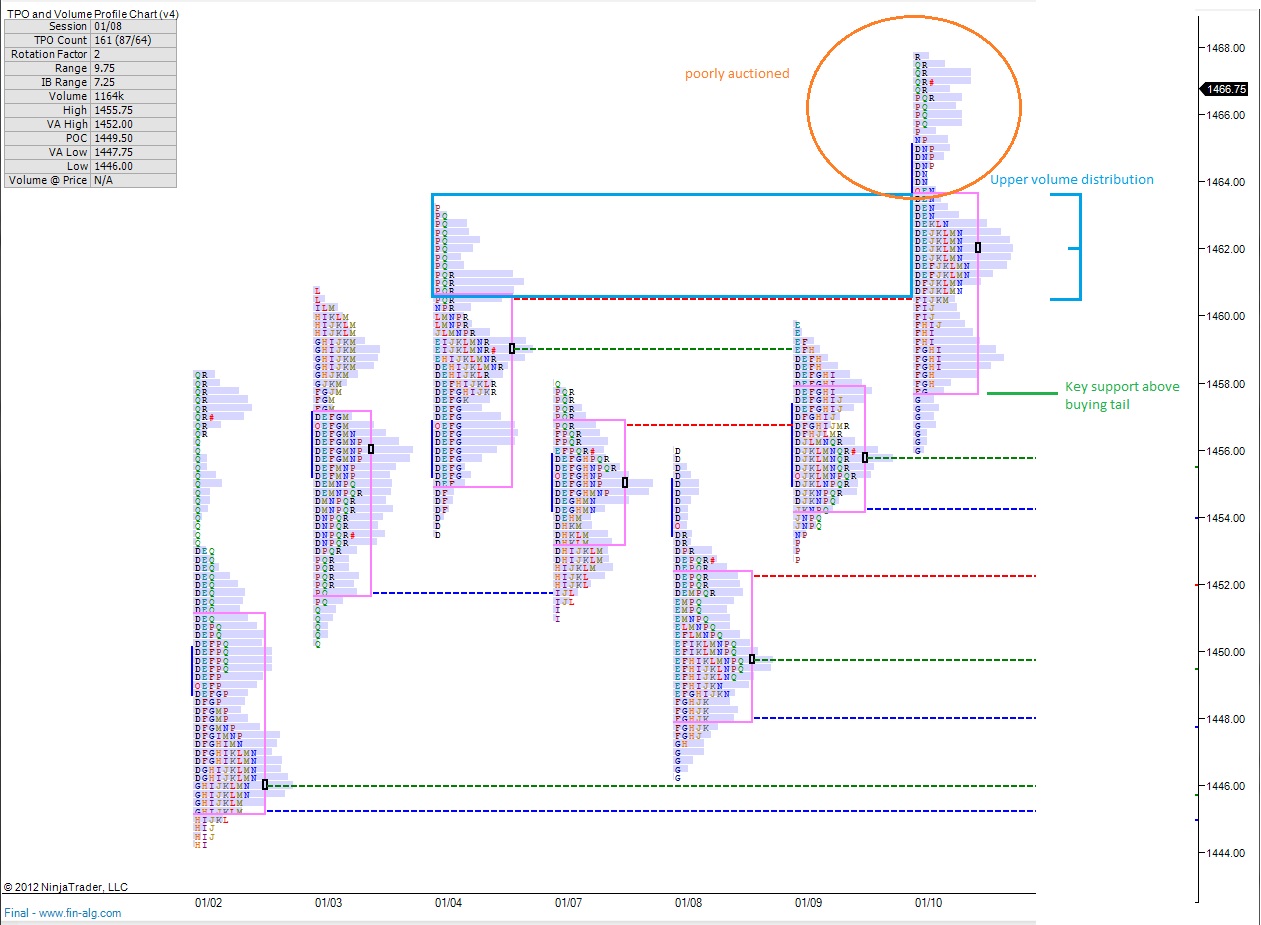

We saw an interesting session yesterday. After gapping out of a multiday range and opening higher we immediately saw selling on the open. The sellers drove price lower for the first half hour of trade and we had ourselves a weak morning gap being faded. The buyers seemed to watch the morning activity play out and after letting the sellers bring price in they went back to work bidding up price. They stayed active throughout the rest of the session. It would only be ten handles higher when sellers were able to react and overpower the upward momentum. We closed the session higher than the open and above the day’s midpoint. Bulls won.

At this point the sellers have much work to do before regaining any semblance of control. Given the progress higher, there is much room below for buyers to put in a higher low and remain in control.

For today’s session, I’m sticking with the bull and will be hesitant to cut names unless we lose yesterday’s value area low at 1474. Keep in mind only my weakest would be cut below here. Any new long trades would be trades only and mostly of the short squeeze variety. I don’t intend to initiate any intermediate-term swings at these levels.

Top two picks going into today: PPC & DNKN (chicken & donuts)

Comments »