Late last week, I started seeing several charts setting up in a manner I prefer, and with the docile behavior of the S&P I began buying up shares in names like ZIP, F, ATML, FB, and DDD. These stocks were added to my other wiry positions: VHC, PPC, and TSLA. Having a portfolio of these types of names can be more fun than a barrel of monkeys. But anyone who’s ever kept a pet monkey will attest to the fact that at some point the monkey will challenge you. You’ll come home, and that cuddly pet will have grown into a fucking gorilla, perched on your china cabinet with a fucked up look in its eyes.

Last week’s buys took my cash levels down to 25% and I intend to rebuild that cash level at the slightest sign of weakness. Top of my list to sell include: DDD, TSLA, FB, and ZIP. If their behavior demonstrates weakness they will be cut.

Should the ground the market stands on (profile) begin to look shaky, I want to be back to my core holdings (GS and AWK) with a much smaller portion of degeneracy. However, should said degenerate stocks continue to hold their respective nine day exponential moving averages I’ll ride.

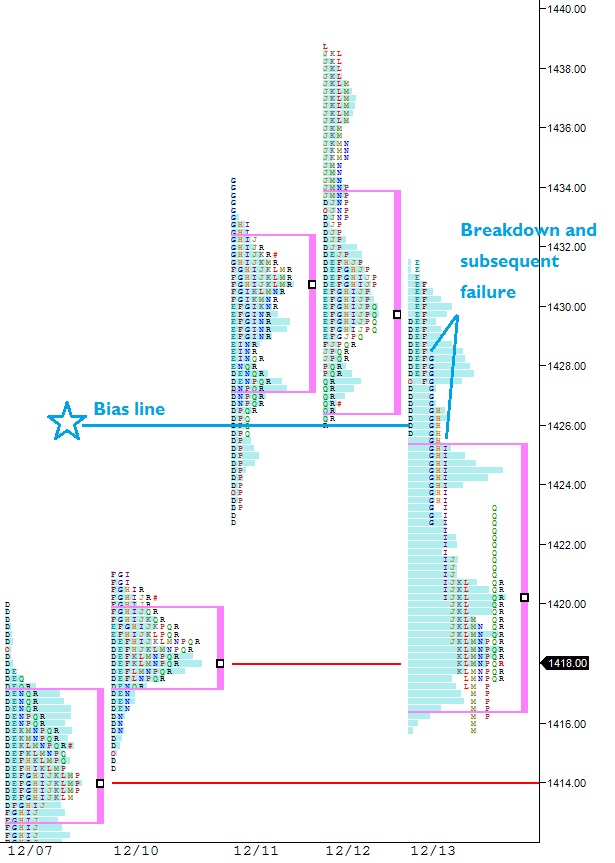

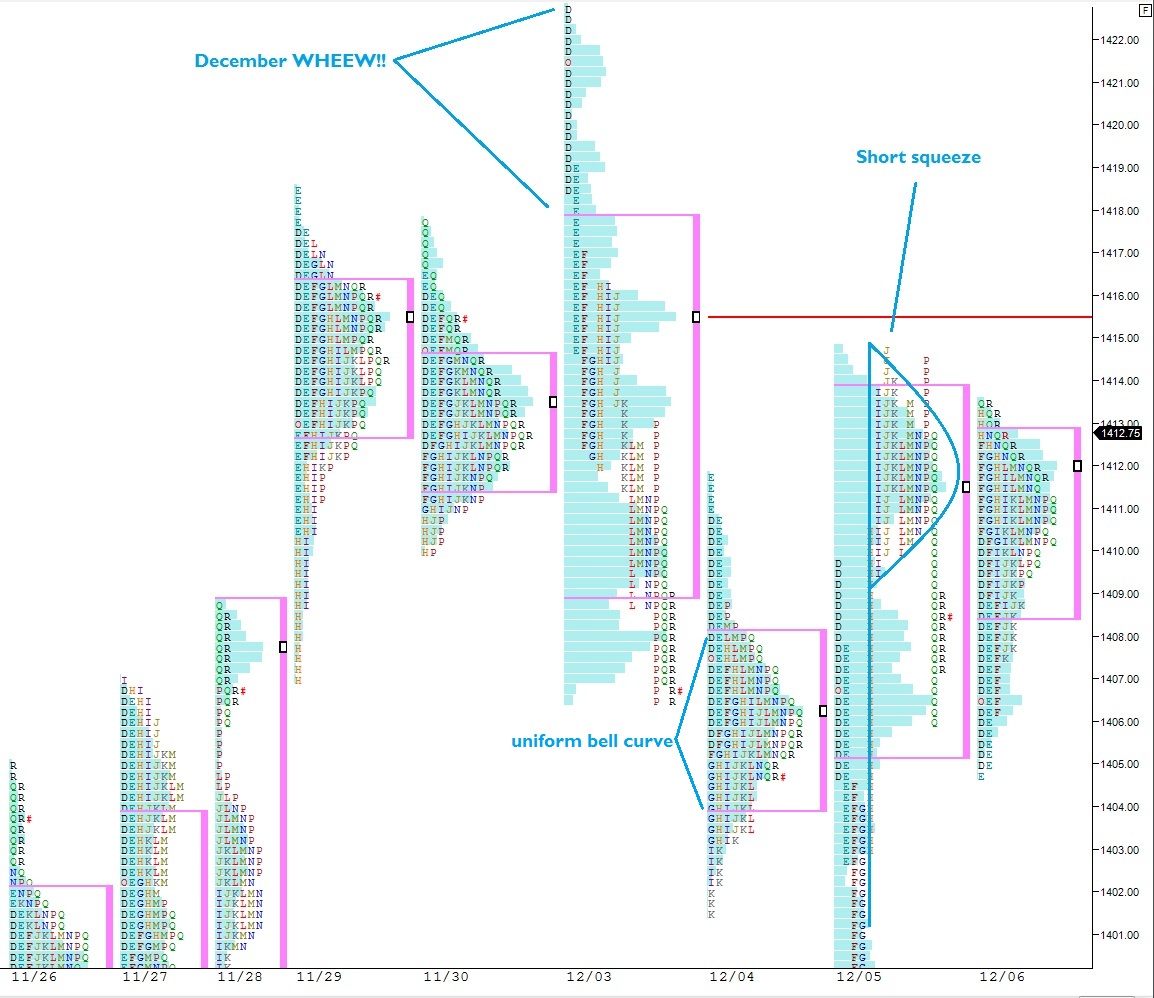

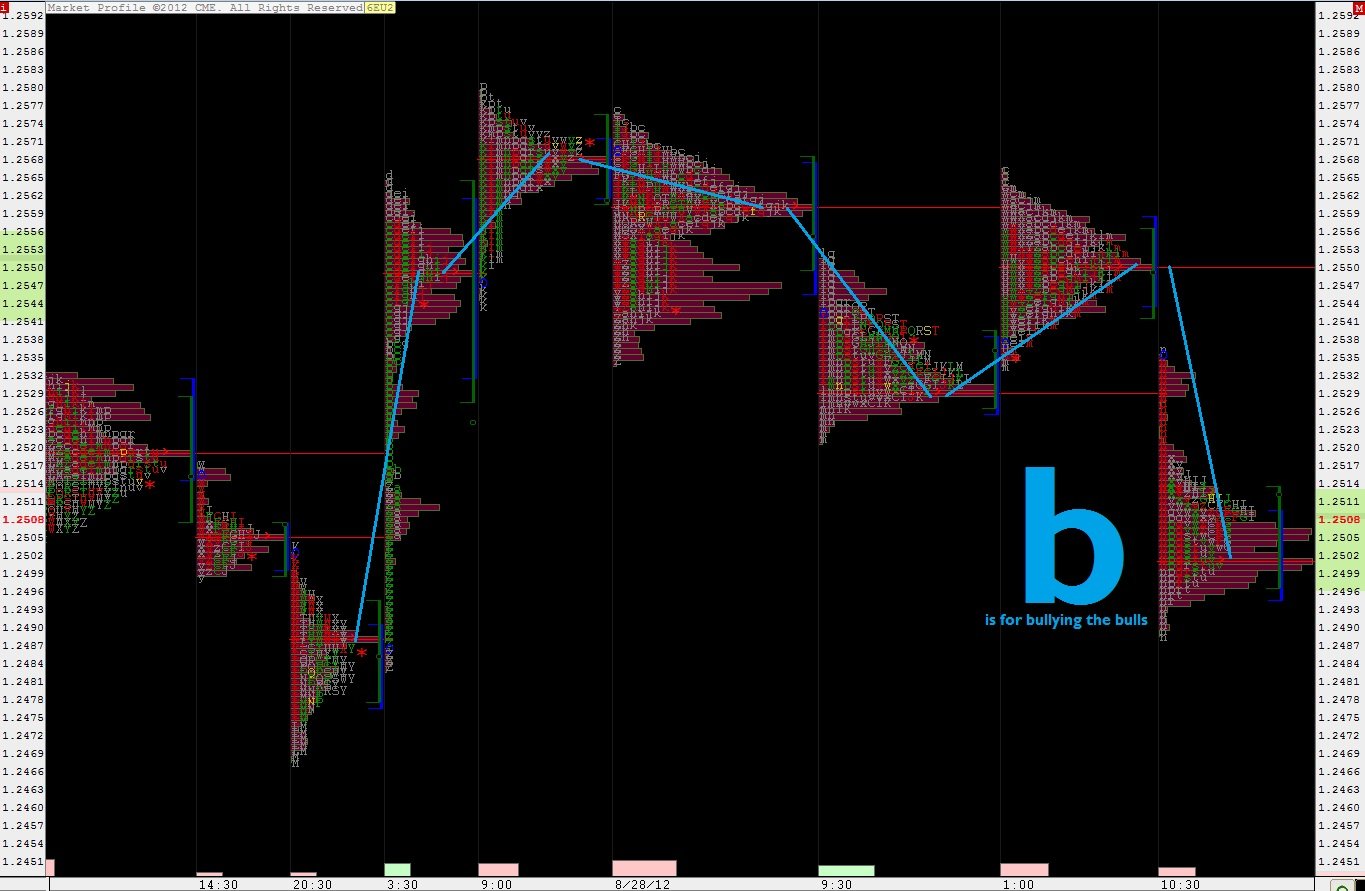

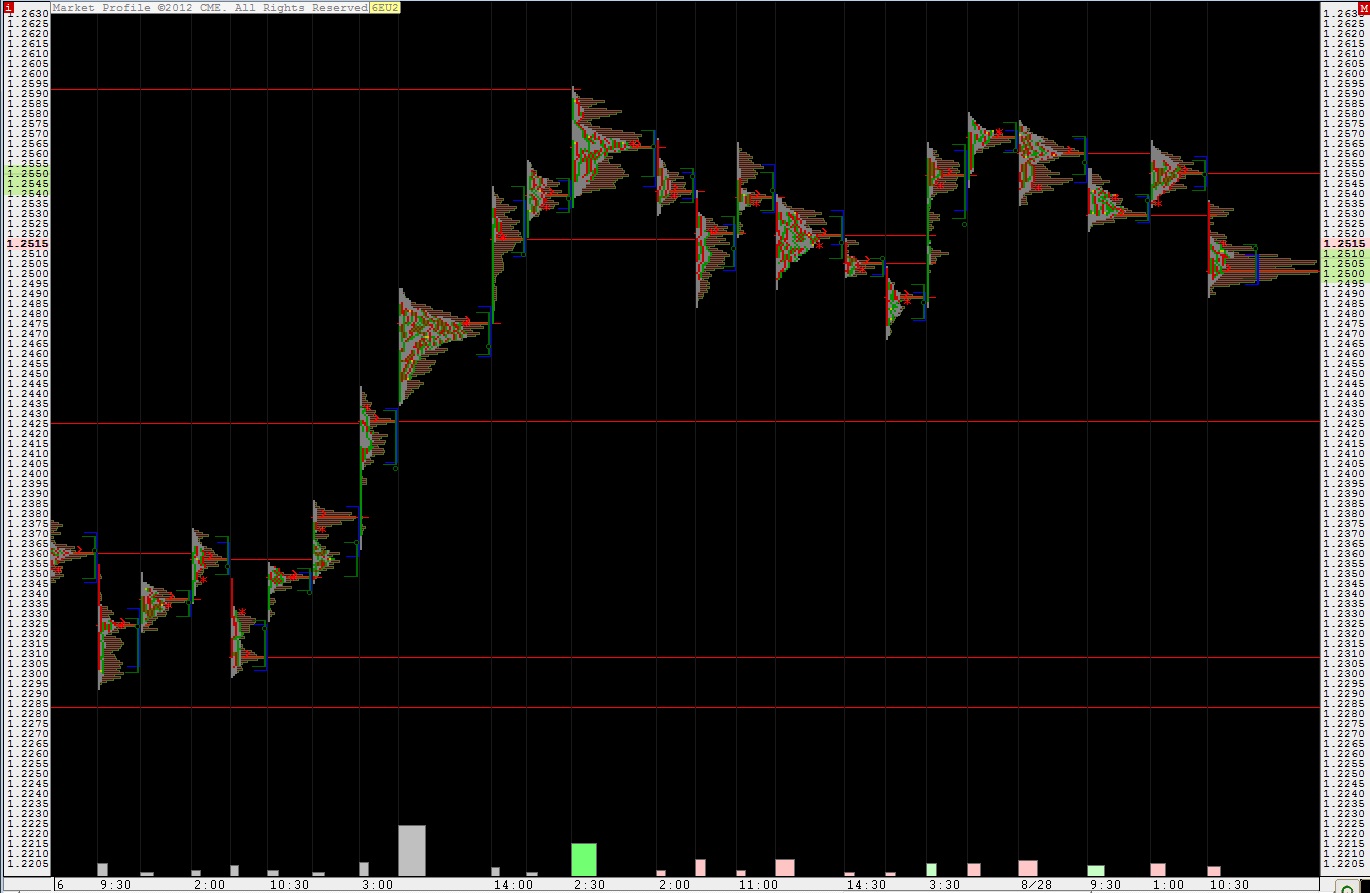

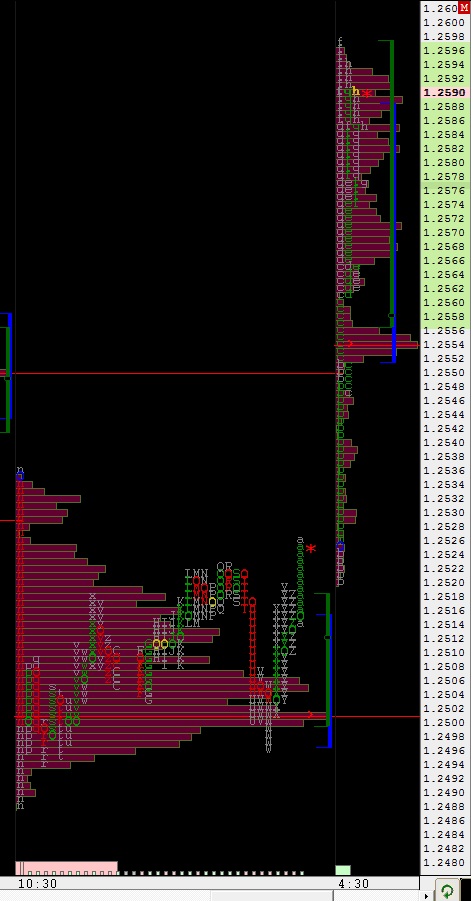

Looking back at the profile from last Friday, we can see the early NFP numbers had us opening above all respective value areas for the week. Again the sellers stepped in and smacked the penis lower, recapturing much of Thursday’s value area before we found buyers and spent the rest of the day methodically auctioning higher; a slow grind if you will. The resulting auction succeeded in pushing value higher for a third day, but failed to place value above the important 1415.50 level (142.15 SPY).

We’re set to open right on this key level again this morning. Bulls want to see 1414 hold, otherwise 1412.75 value area low.

Upside targets include Friday’s high, 1420, then last Monday’s above 1422.

Comments »