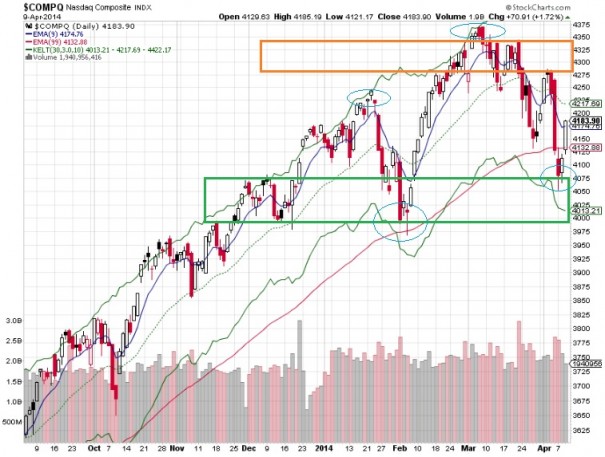

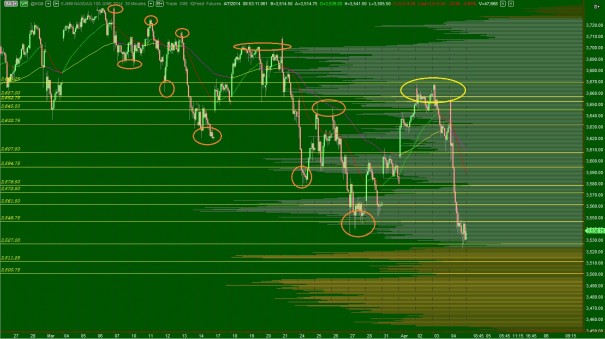

The NASDAQ and equities in general treated my tattered tech portfolio to a bit of respite while I toiled away at various campaigns of industry and trading methodology. My trading plan and its autonomous counterparts continue being built and optimized into a plan I intend to take live. There is no amount of planning I consider excessive by this point in my trading experience because I have seen what this market can do to a person, intraday, without the rights set of tools and planning. One must exude a high amount of discipline and execution to have even a chance at success in the futures markets. The same rules apply to stock trading too.

The blood moon crests over our heads at night and its presence brings the parts of our life that we may be reluctant to address to the forefront. The big white moon acts like a giant mirror and shows us where our shortcomings exist and then paints them blood red. It can be a very unpleasant experience but it can also end well if we take the time to digest the introspective and use our stronger abilities to foster and settle our weaknesses.

My weakness is an excess of hope and opportunism. I will run 100 miles per hour into a wall by over committing to all the opportunities I see. This is how I end up with 20-25 positions. This is also why the long term sellers of equity introducing MORE opportunity into the marketplace via IPOs troubles me. If I don’t get a wrangle on my desire to peruse all the business opportunities out there I will end up in a sanatorium.

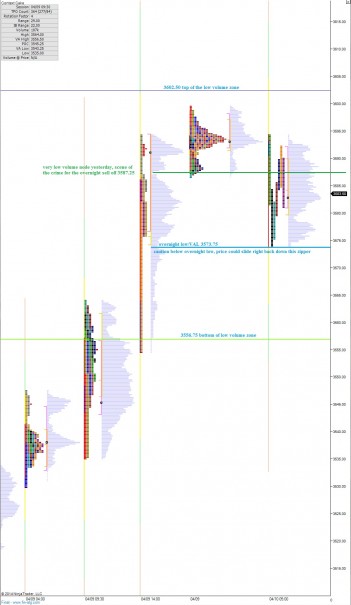

In summary, I plan to tighten up my book into 2-3 intermediate term trades lasting anywhere from 1-12 days, and 3-5 multi-quarter investments. That way I can give proper focus to order flow trading in the futures market and my other enterprises—which I will not be expanding upon.

Sometimes I get lucky and I can trade around an investment like I am doing to Twitter right now. Twitter is one of my top three stock positions and I took some YOLO options for a spin this afternoon with precision. The harder I work, the luckier I get. This trade was entered minutes before news hit the wires that Twitter headhunted some big time Google Maps fella. I already have taken scales because I couldn’t care less about making a huge win on this trade. Instead I am managing risk and putting a winner in the book. Blood moon knows I need it after this string of April losers:

YELP, KNDI, WUBA, GOGO

I suppose one of those goof balls may still toss a hail marry to my egregious strike prices, but I am not expending too much hopium on that happening in the next two days.

Other action today was stopping out IMGN at nearly a -30% and ENPH for about a -15% if I recall correctly.

Less, more succinct trades and going easy after a win is how I am going to improve from here. This applies to all timeframes of trade.

+1.3% on the day, -13% on the year, Elroi the algo still in testing (grr)

http://youtu.be/6AIdXisPqHc

Comments »