Nasdaq futures are down just a touch premarket on an orderly session of price balance with a slightly below normal amount of volume transacting during the session. We are set to hear Consumer Credit at 3pm today but have an otherwise quiet economic docket for the week. UK GPD comes out Tuesday morning, China CPI late Wednesday, a Monthly Budget Statement at 2pm Thursday, and Retail sales and U. of M. Confidence numbers on Friday.

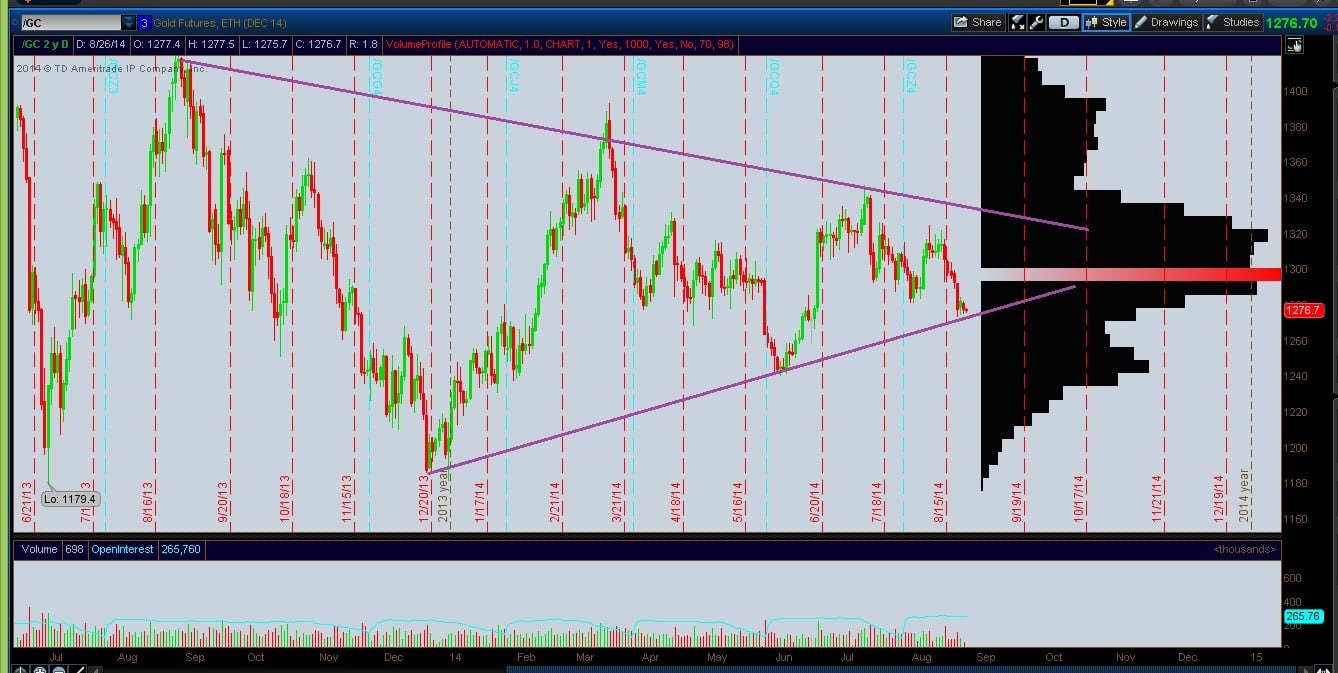

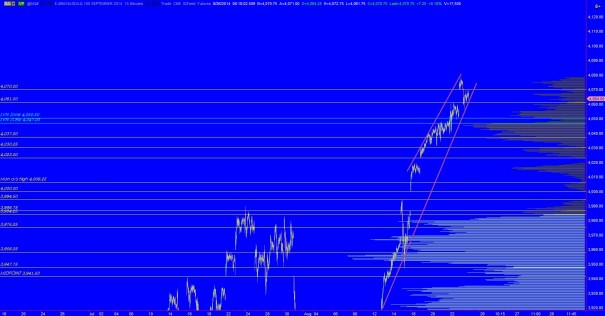

Long term, the Nasdaq continues to be bullish after printing an outside candle on the weekly chart. The outside candle is often referred to as an “outside reversal” and in this case a “bearish engulfing” pattern. The quirk to last week’s candle is the long wicks on both sides, especially the bottom. This suggests a strong response to lower prices was able to press us well off the weekly lows. The gap zone left behind 14 years ago is living up to the expectations of gap zones by providing fast trading action. Overall, the market continues to sustain trade above the gap and we have to bear in mind how much energy was expended by the dip buyers and whether we see buyers initiating more risk this week:

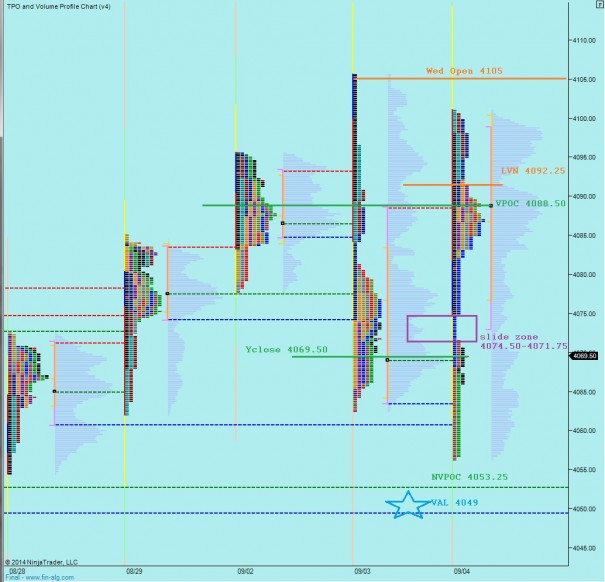

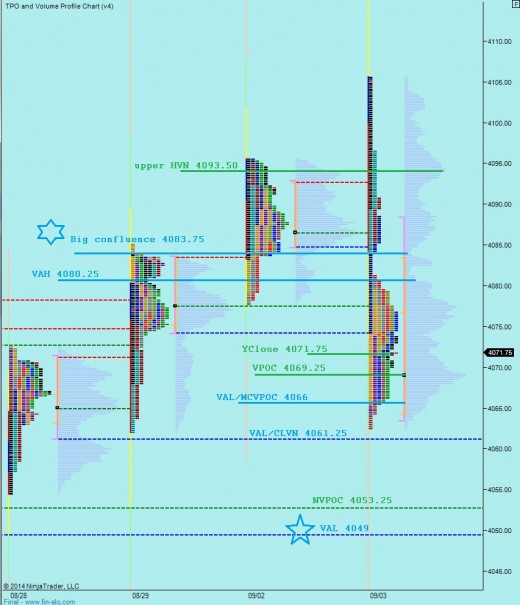

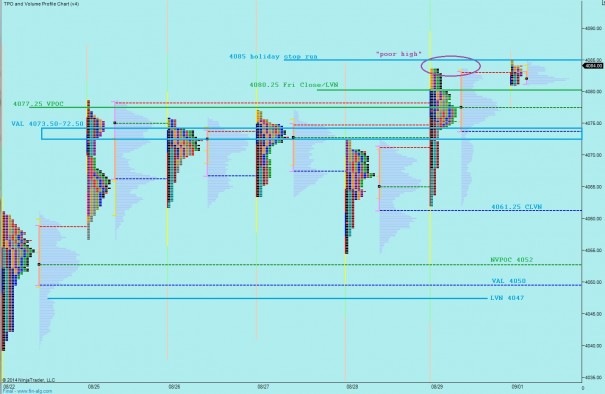

Intermediate term we are fairly neutral at the moment. This can be seen best on the following volume profile which encompasses eleven session of trade:

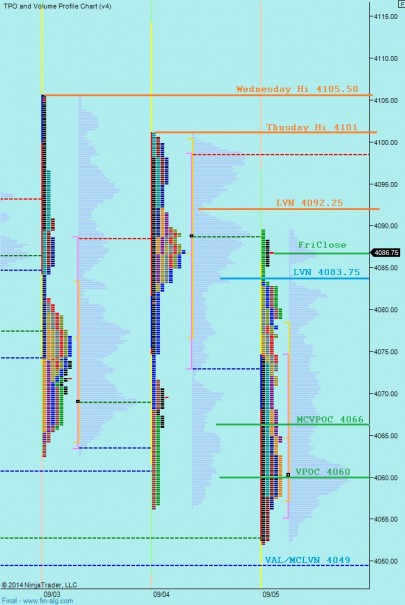

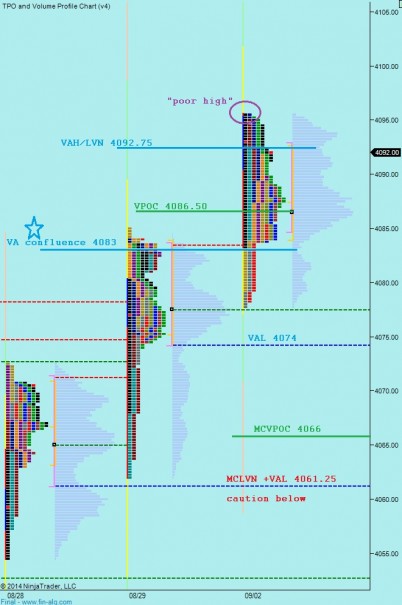

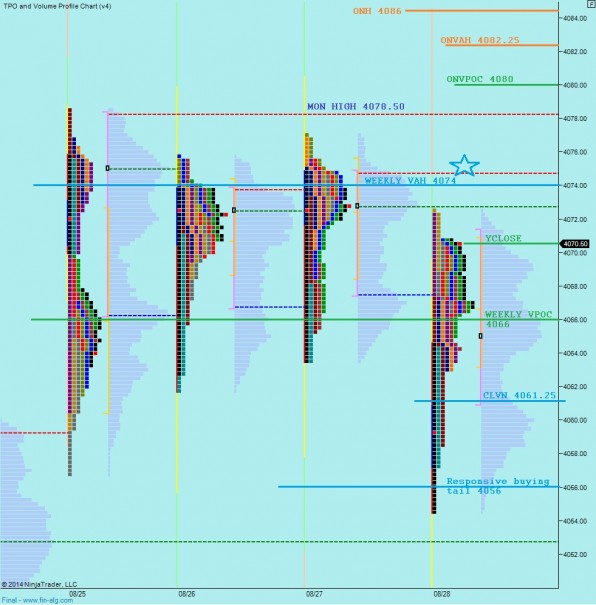

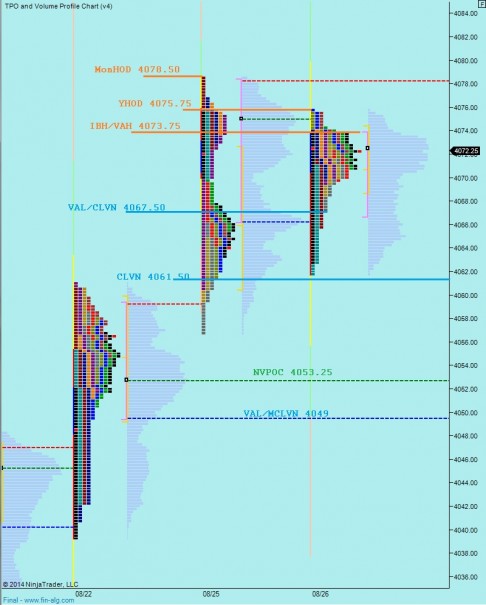

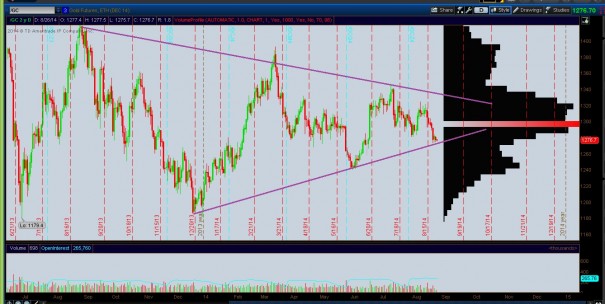

I have noted the short term price levels I will be observing using the market profile chart below:

Comments »