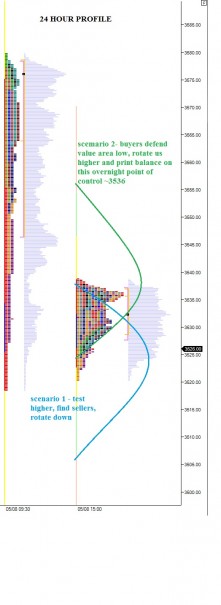

Nasdaq futures are down a bit overnight but trading off the overnight lows as the US comes online to start the week. The overnight session shows a balanced trade with a bulge of activity (volume) near the bottom of our profile. Overall the globex session auctioned the price zone left behind by the fast afternoon move. We are currently priced to open inside the thin and fast range which may lead to a choppy open.

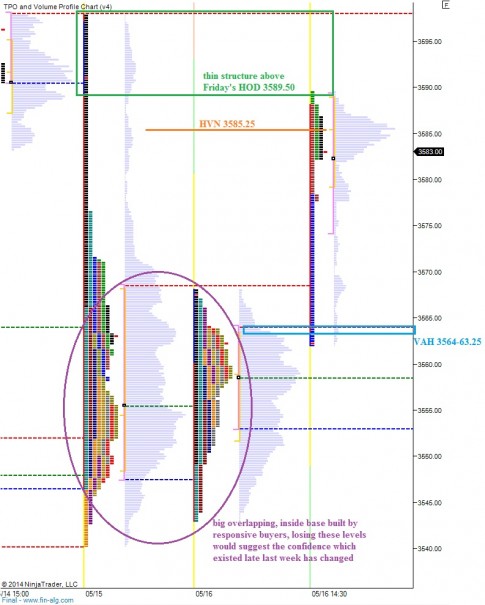

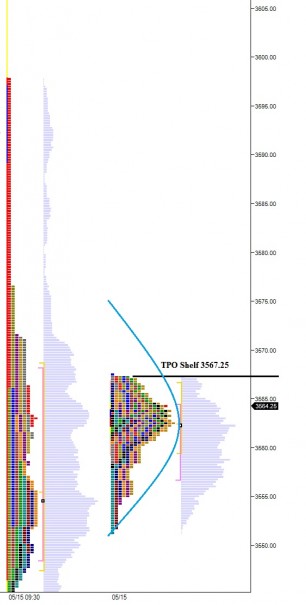

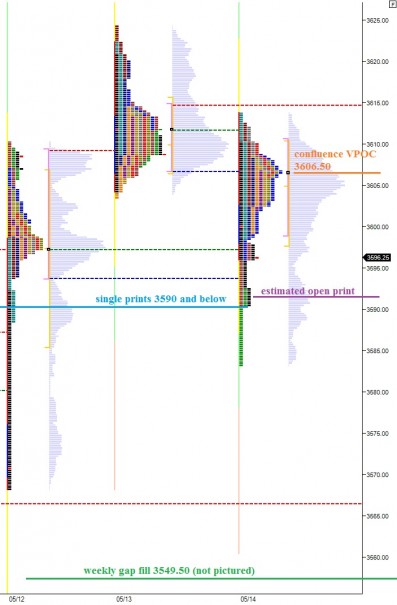

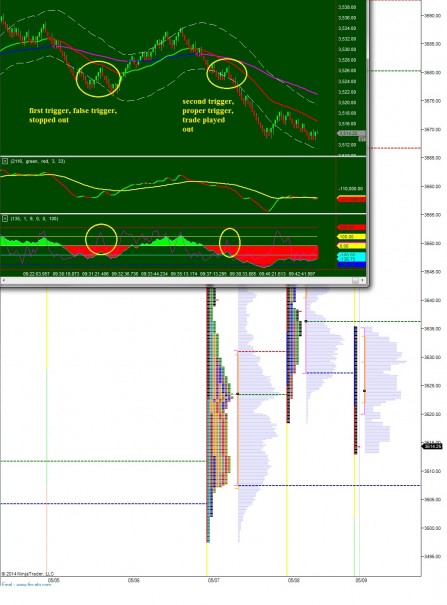

On the short term, I am looking for support from 3564 – 3563.25 which marks the value area high of Friday’s primary distribution. If buyers are not found at these levels we are likely to traverse the entire value region. Up above our current prices I will be watching the high volume node which formed at 3585.25. The burst of activity rushing into the market Friday was most transacted at this level. If sellers are not active around this region then we are likely to continue rotating higher as there is little resistance above Friday’s high of the session 3589.50. I have highlighted these short term observations on the following market profile:

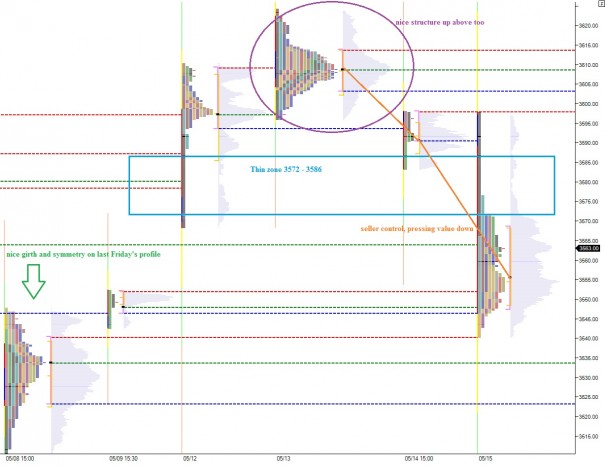

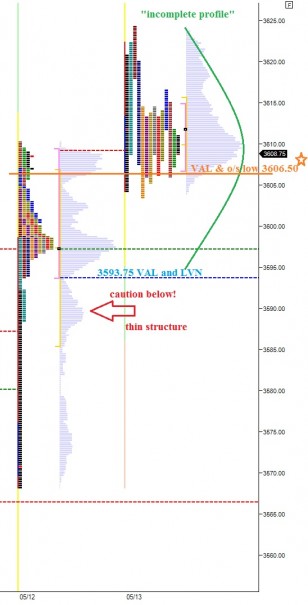

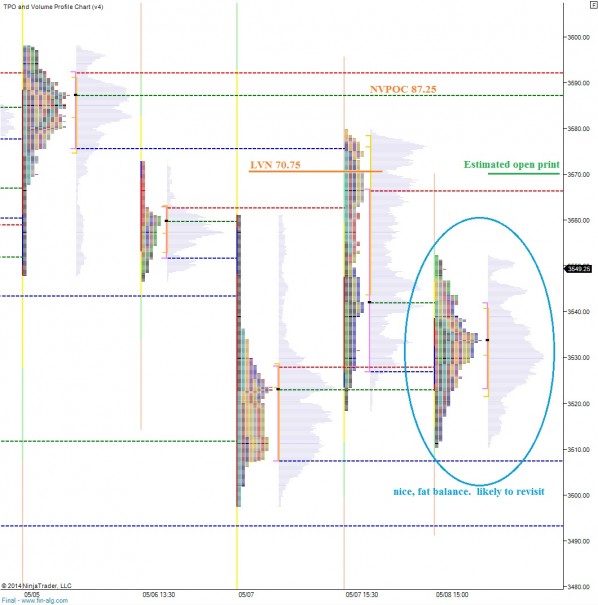

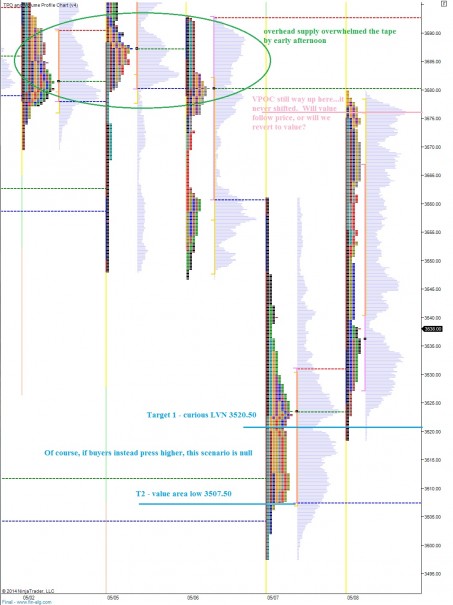

On the intermediate term timeframe we can see what had me hesitant to buy Thursday’s close. My authentic swing was setting up, the proverbial thrust-pullback-thrust. However, buyers showed up right when they needed to and printed a double bottom right on the base of our tightening consolidation/balance region. This level is important for the week, 3543, because below it we open the door to break balance on the downside. Prior to last week we were consolidating along very orderly. However the big gap up into last Monday made the picture a bit sloppier. Overall the intermediate term continues to remain in balance, although the fast nature of the balancing would inherently favor the sellers. There is a large overhang of supply left above 3600 after we flushed through the level last week. I suspect we will struggle to press through this level as we attempt to work off that supply. See below:

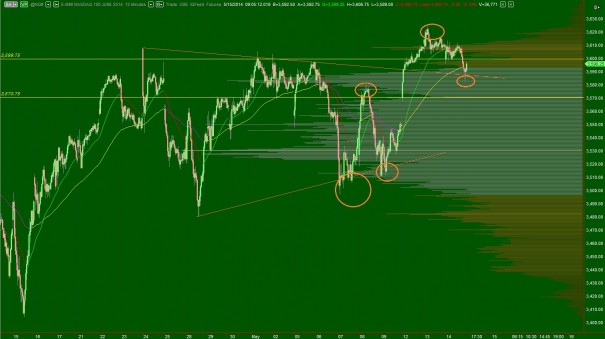

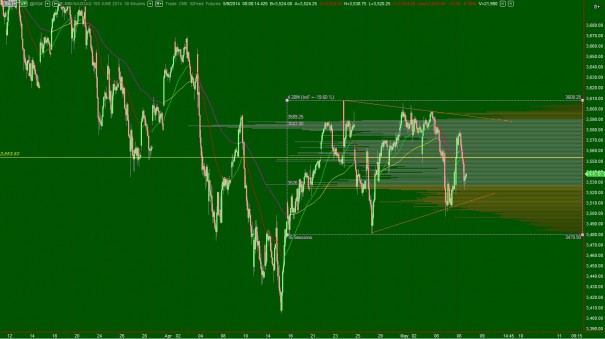

Zooming way out to the forest view, high above in a hot air balloon if you will, you can see the level of indecision in the marketplace. This environment may seem volatile but in actuality we are balanced after a bout of selling. The next move is yet to occur. Until we see a definitive break away from this zone there are likely to be plenty of head fakes and stalled momentum attempts on swing trades:

Comments »