We have some early strength in the NASDAQ index futures. The question on everyone’s mind this morning is whether we will see the early weakness get faded by strong sell flow or whether the higher advertised prices encourage buyers to enter the marketplace. The former has been more prevalent for the last two to three weeks.

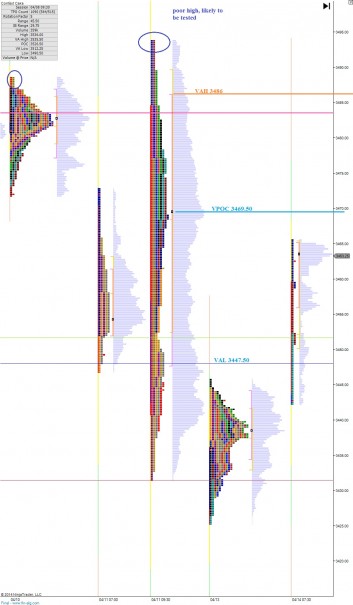

For today’s presentation of the intermediate timeframe, I chose to build out the volume profile based upon the 72 trading sessions completed thus far this year. From the volume profile emerges some unique clues into whether the intermediate term is balanced or readying to explore lower for value. The pattern of lower highs and lows gives sellers a clear momentum edge on the intermediate timeframe, but what is volume suggesting about value? We do show some consensus of value around 3550 which you will notice is below the midpoint of our annual profile. This suggests value has built lower and adds support to the idea of a continued migration lower. However we do show a semblance of the bell curve too which makes the mean revision trade still a viable thought, although one which needs to engage sooner than later. Also, any bounce which materializes much be carefully observed verses the very low volume node at 3580. If price cannot gain acceptance above this level we would further expect price to continue lower. I have highlighted these observations and a few others on the following annual volume profile distribution:

The short term auction suggests buyers have an edge this morning. We had a rather thorough auction during our globex session which built an excess low which can be seen as a thin tail below the profile. This suggests responsive buying and sellers drying up. As the USA comes online we are seeing the large value area from Friday gain acceptance via volume building higher on our current profile. This creates the expectation for trade through Friday’s value. I have highlighted Friday’s value area and the key levels inside of it on the following market profile chart:

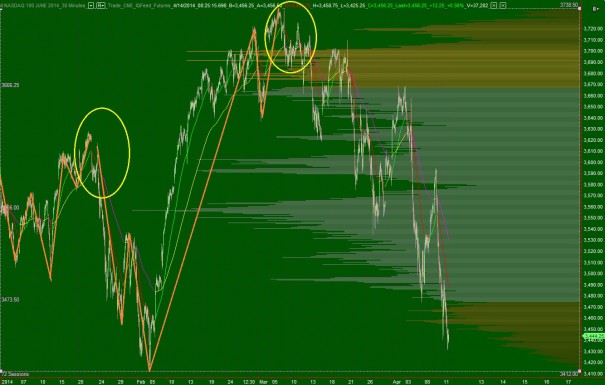

Taking our attention out to the long term we can see the buyers no longer clearly in control of the long term auction according to the daily chart. We are trading below our moving averages which are flat at best and some moving lower. We are still above February lows and we may see a balanced, bracketed trading range form. Overall the long term auction is in balance until we take out the February lows.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great analysis Raul3. BTW, reading some of your older posts, what does your acronym of LIFO stand for?

Last in, first out….as in the last price I paid for a stock