The only thing that makes me a halfway successful investor is a technique I refer to as ‘faith-based investing’. What it boils down to is investing in individual stocks of companies that I believe down to my core will exist long after I return to the ethereal plane. To me these titans of capitalism are manifestations of the gods of history. They possess omnipotence and immortality — like ze gods. Alls I do is layer on a bit of cyclical understanding and stick to my guns. The risk cycle has played out about five or six times in my short existence and in this time I have formed a basic competence. And from the competence I present to you today, the rag tag folks of iBankCoin (many of whom are some of the lowest swine on the internet), my belief that the risk cycle has indeed reset.

Early in a risk cycle investors start to ease into safe bets. Look at Walmart, for instance. Nearly trading at all-time highs, offering one of the finest dividends one can access. Selling groceries and hundreds of thousands of other consumer goods for a modest 25% profit. Walstreet is rewarding this behemoth for its size (largest employer in 39 american states) and durability. Early risk cycle winner.

Mega big tech has fared well as of recent. Tickers like GOOGL are sharply off the lows printed around Halloween.

Can I saw with certainty that the S&P 500 or the NASDAQ have bottomed? No. But I am gaining a ton of confidence that the overall risk cycle has been reset.

So we leg into these mega caps, then maybe early next year we can start to dabble in higher risk stuff like Rivian and crypto. And eventually, way down the line, we can run those cute penguin pictures again. But not yet.

Listen, the bearshitters have had their run of the joint pretty much all year long. They’re getting so loud. Almost as loud as I was this time last year, but of course for different reasons.

The perma-bull is a different kind of plauge. A perpetual optimist, who stares at reality with some kind of distorted lense that shows progress, the end of religion and state, giant glass buildings, autonomous low cost transportation for all, universal basic income that covers shelter, healthcare and foodt.

A bunch of folks simply existing — wandering around, writing stories and enjoying life.

These bearshitters…I dunno man, they’re fucked up. They want death. They become giddy over the potential of world war. They throw shade on anyone building.

If I must be diagnosed with a terminal illness, let it be permabullishness.

Raul Santos, November 20th, 2022

And now the 411th Strategy Session. Happy Thanksgiving!

Stocklabs Strategy Session: 11/21/22 – 11/25/22

I. Executive Summary

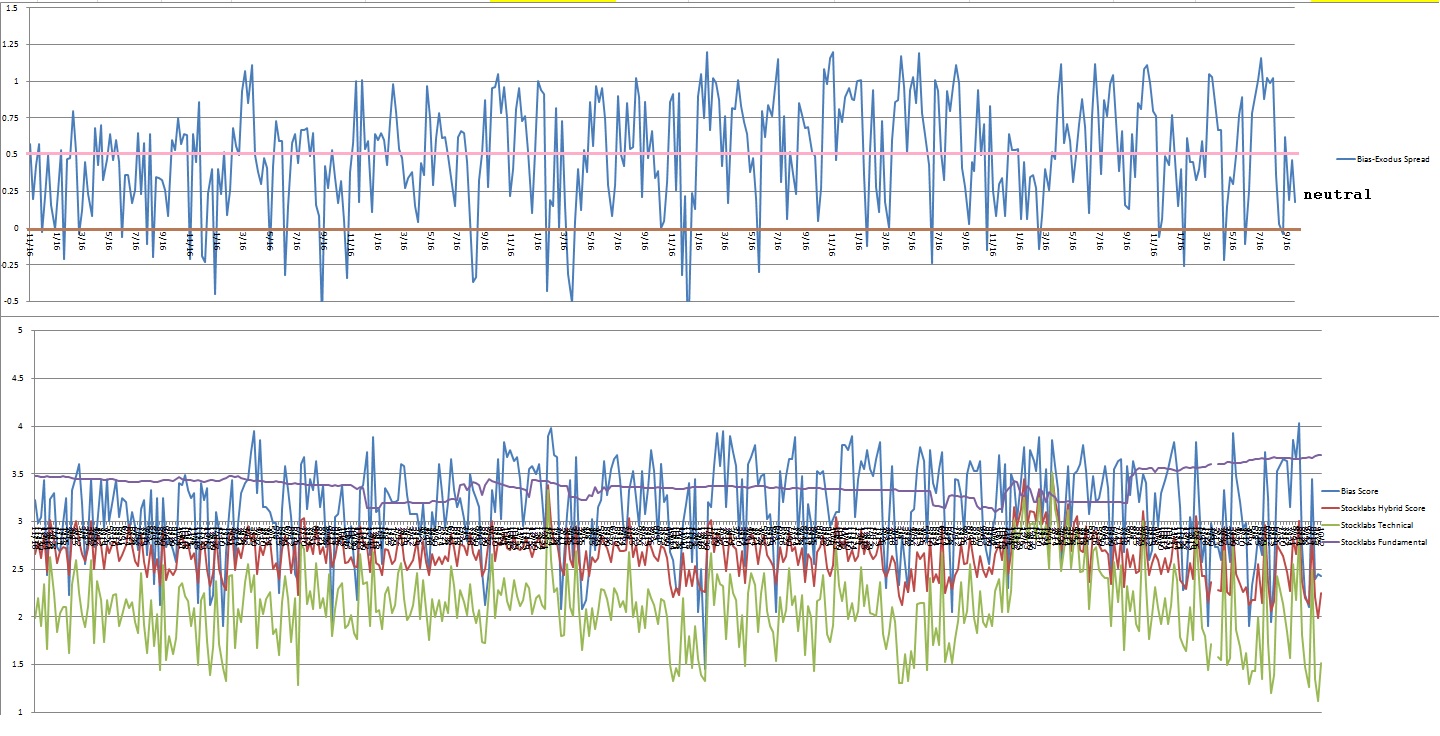

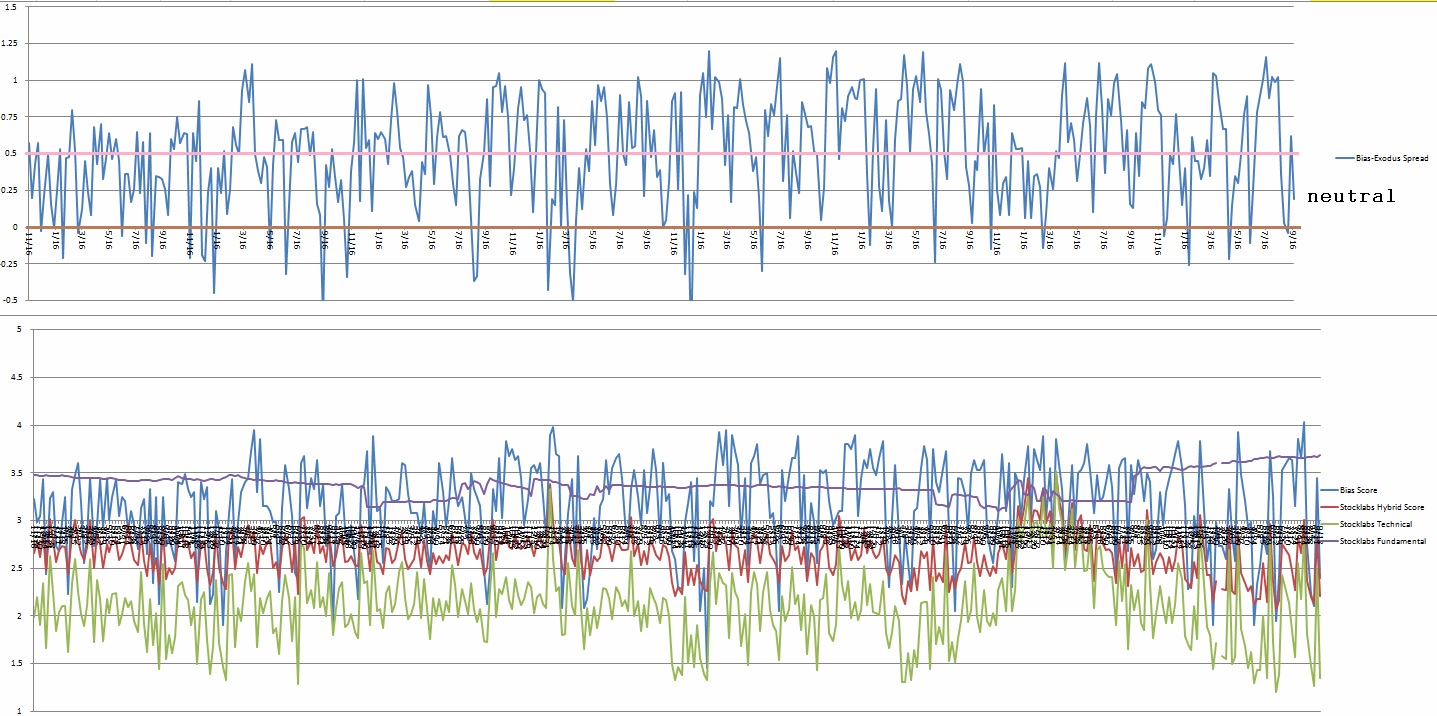

Raul’s bias score 3.00*, neutral. Markets drift through the beginning of the week. Then look for lots of economic data due out Wednesday (durable goods, jobless claims 8:30am ET, PMI 9:45am and Fed minutes 2pm) to put some direction into the tape ahead of the holiday.

*Rose Colored Sunglasses bearish bias triggered, see Section V.

U.S. markets will be closed Thursday, November 24th in observation of Thanksgiving and will resume trading for a half day Friday the 25th.

II. RECAP OF THE ACTION

Chopped higher through early Tuesday, lower through mid-day Thursday, then back to the middle heading into the weekend.

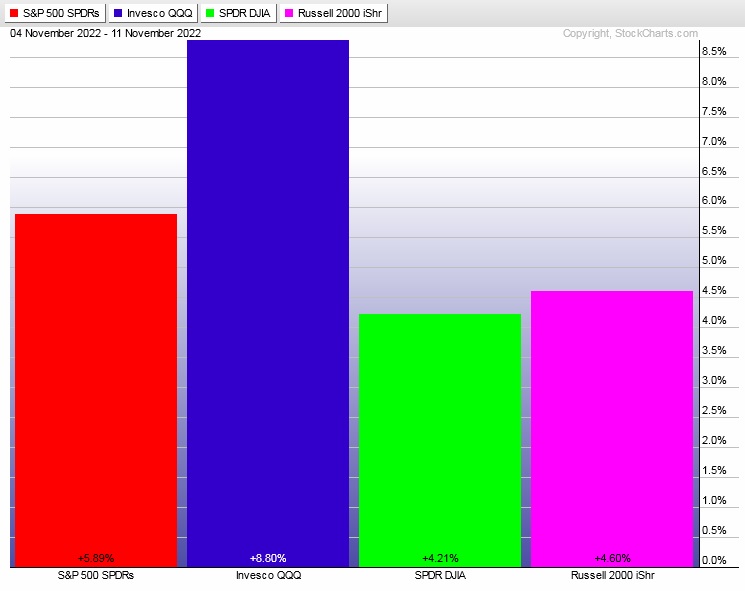

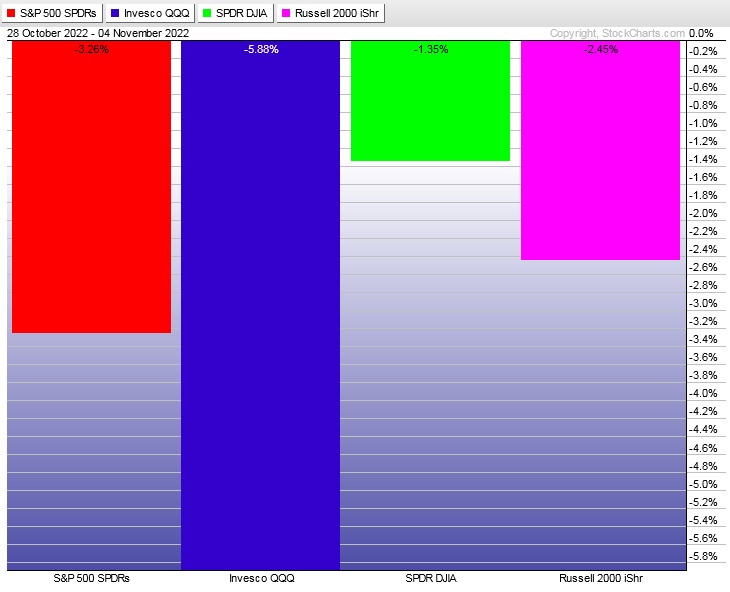

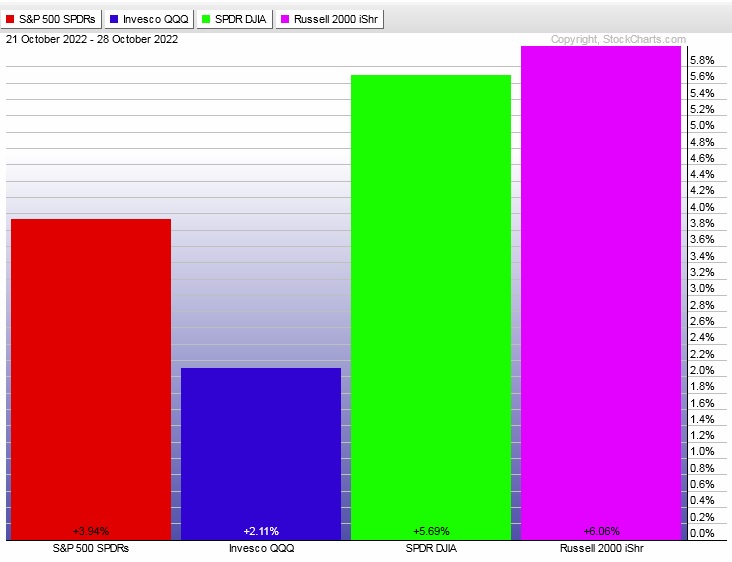

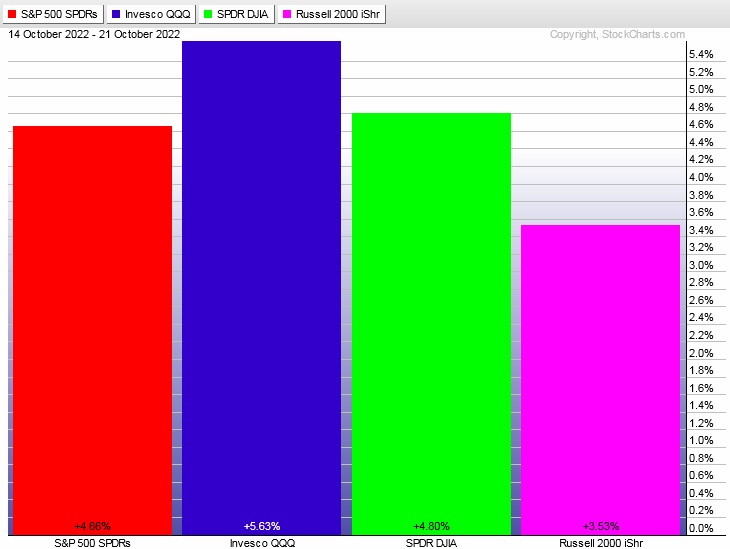

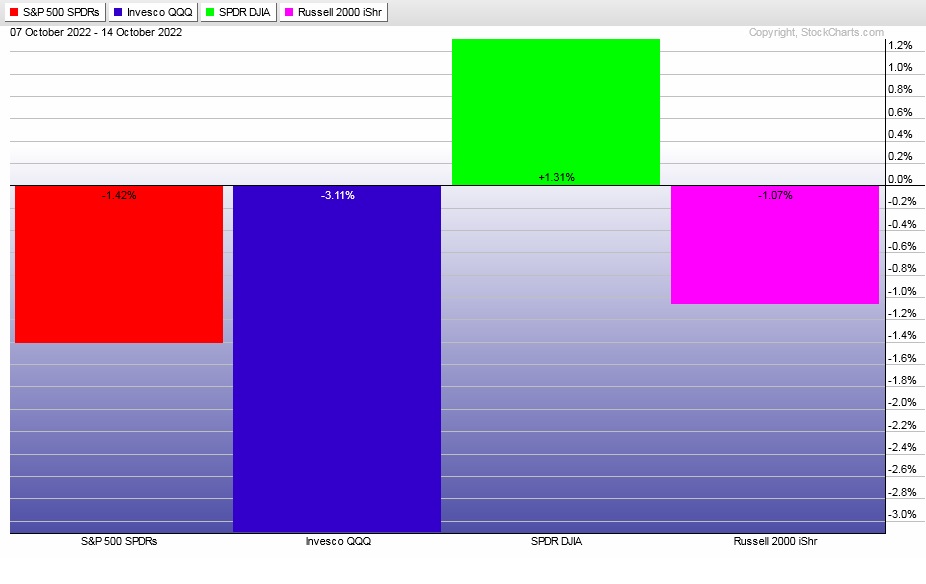

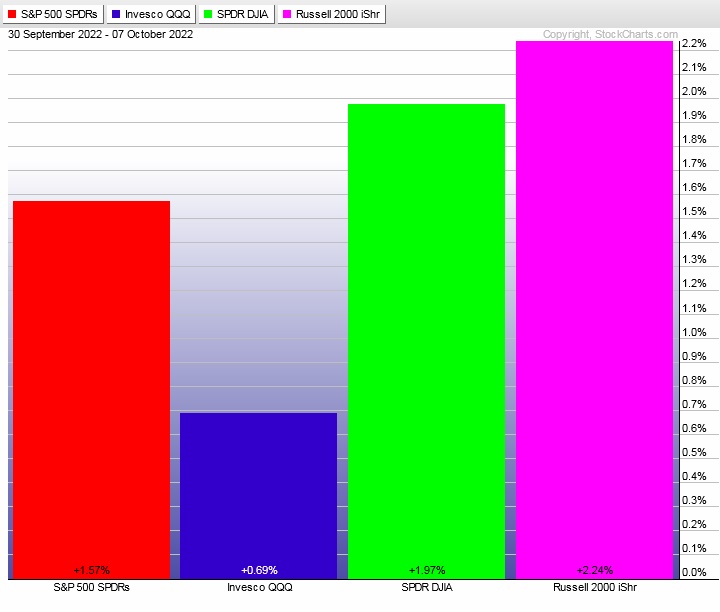

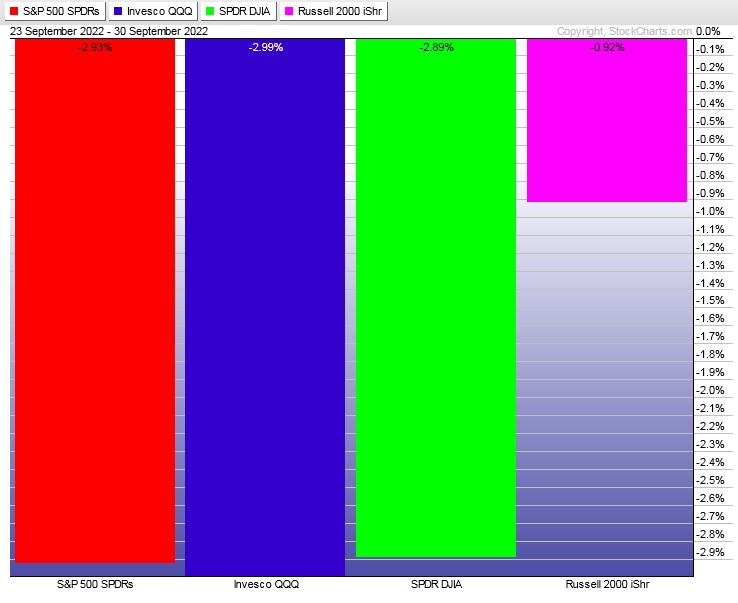

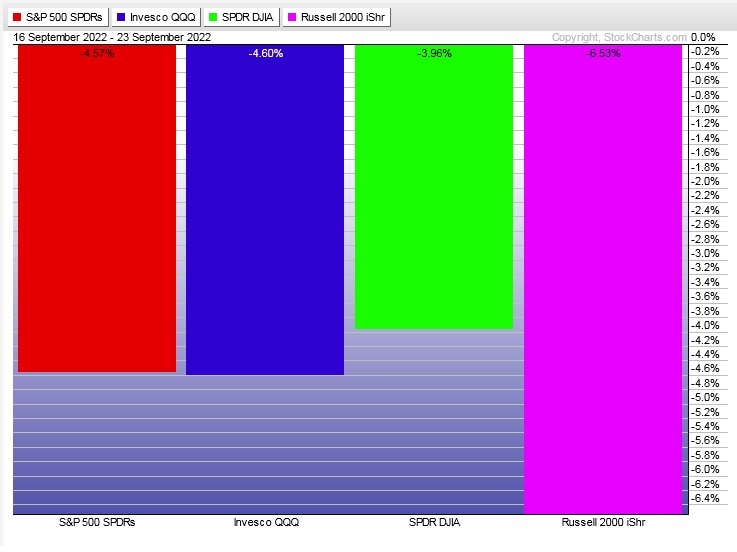

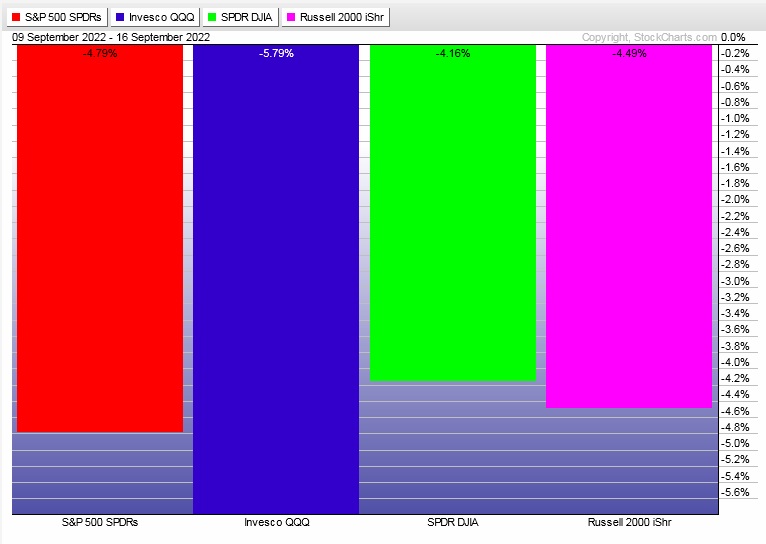

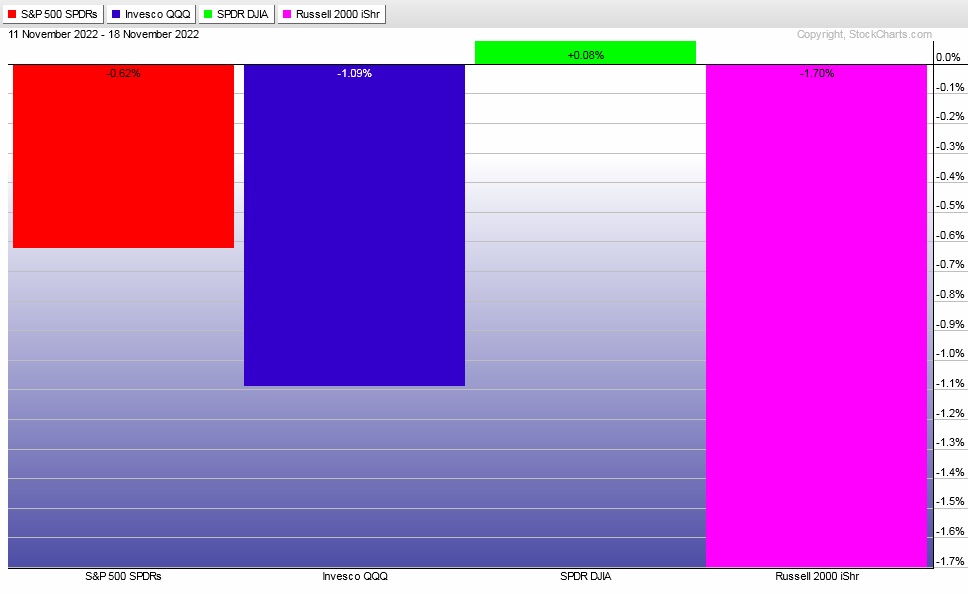

The last week performance of each major index is shown below:

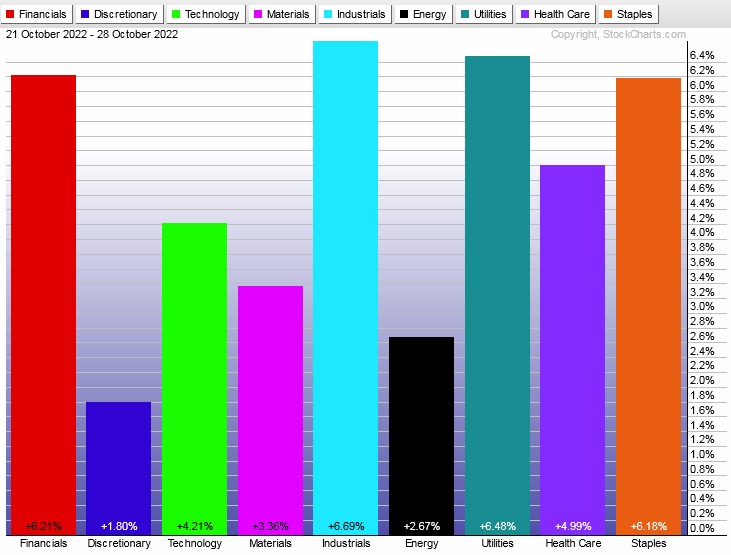

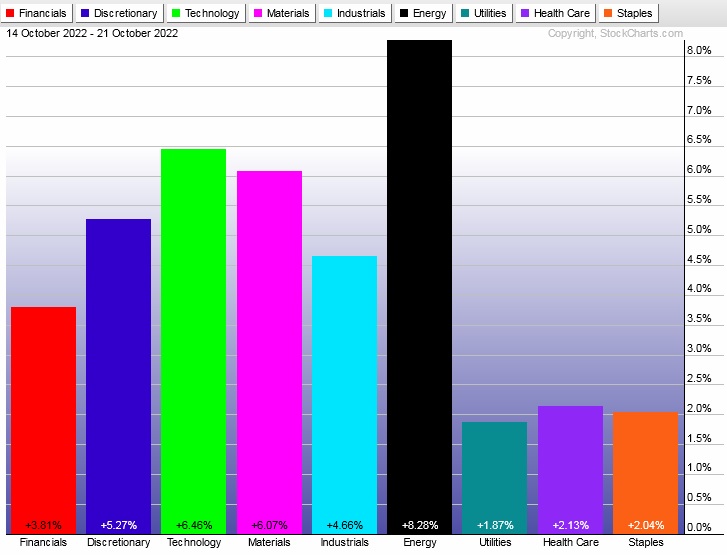

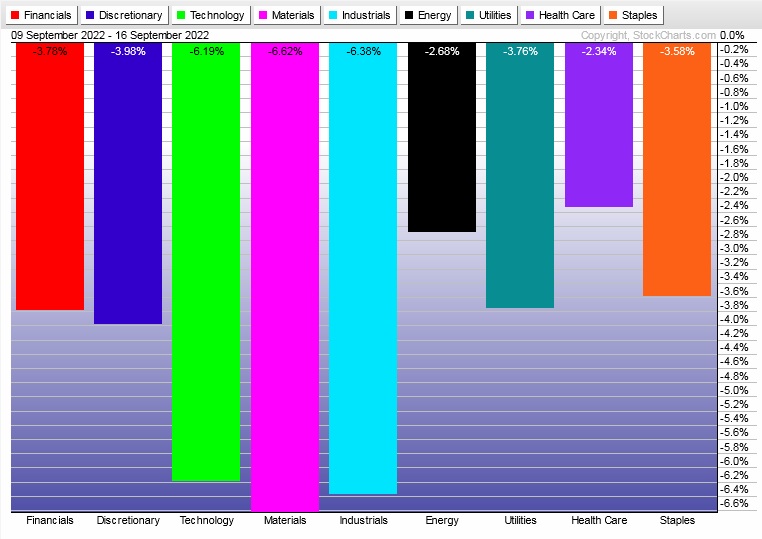

Rotational Report:

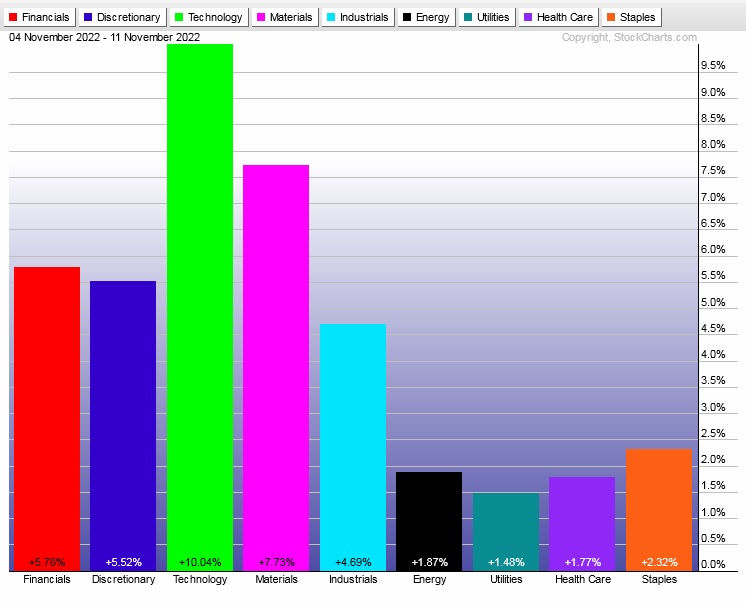

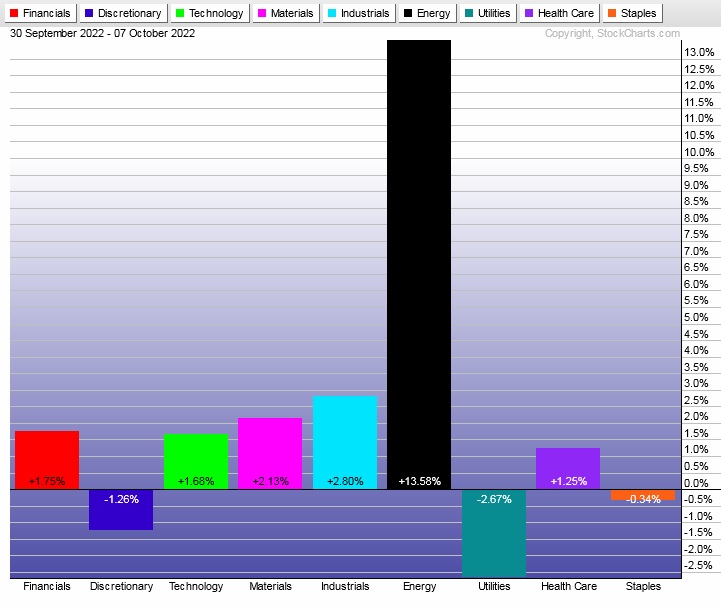

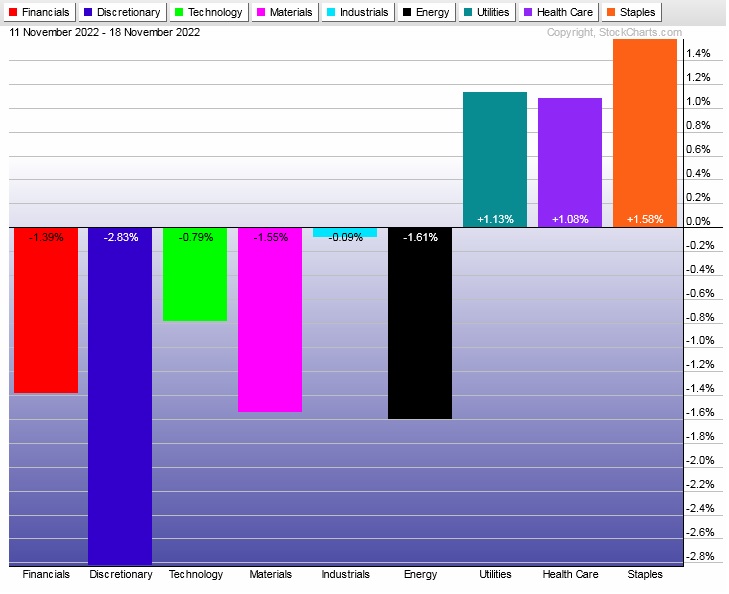

Rotations flipped back to risk aversion last week after flipping bullish two weeks back.

neutral

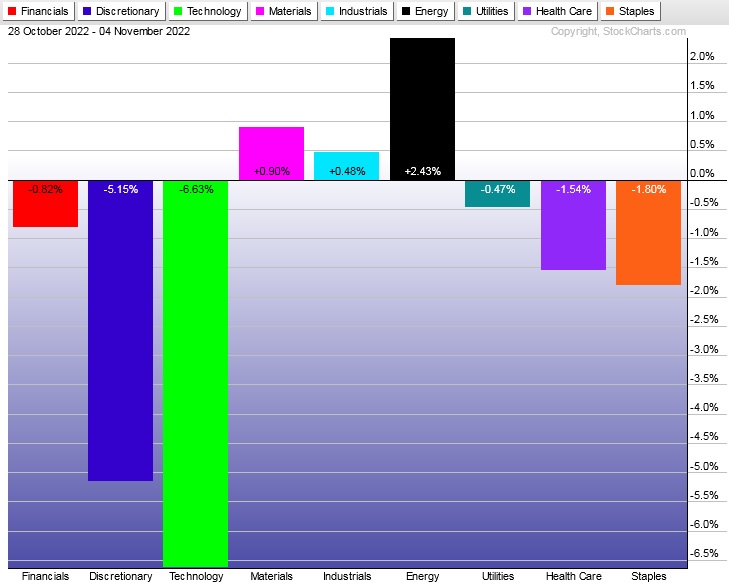

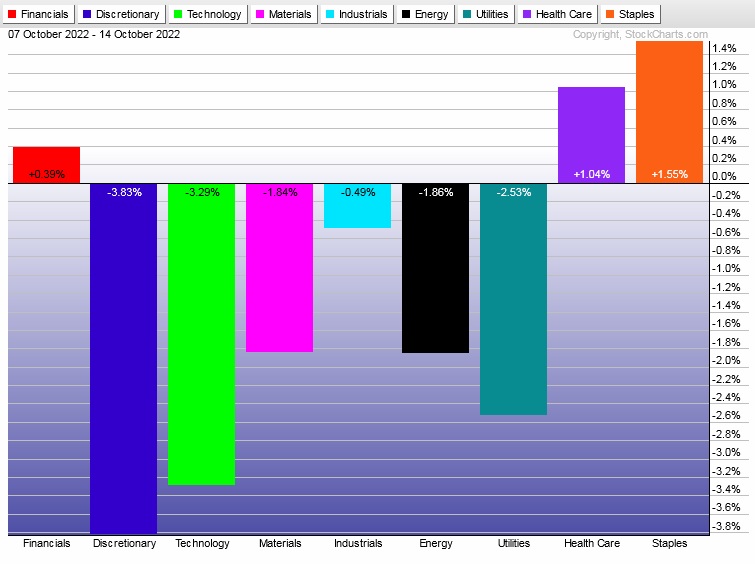

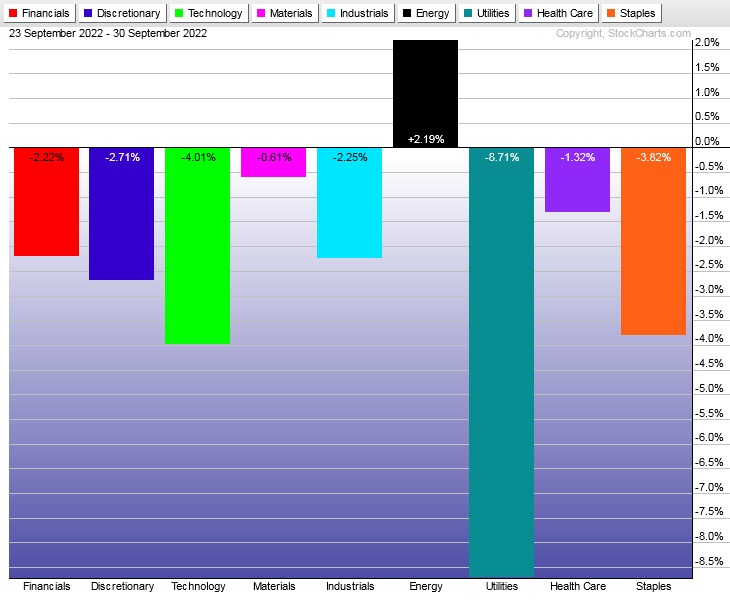

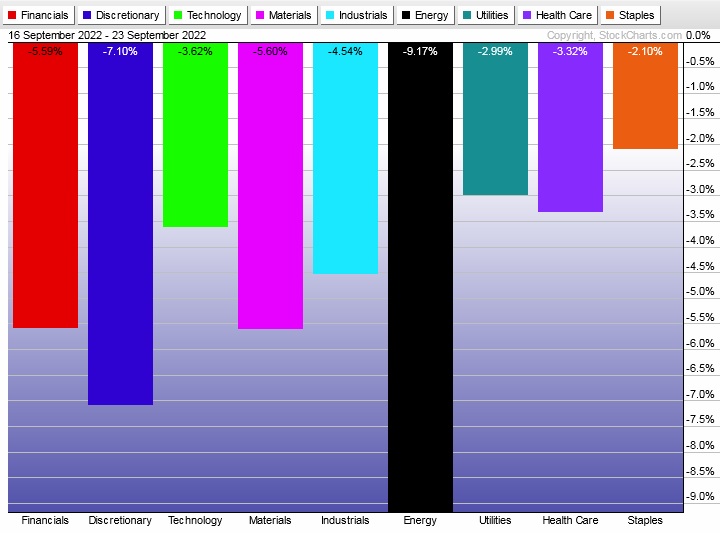

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows went back into balance after breaking balance to the buy side two weeks back.

slightly bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Sticking to the stats

If you look at the 10-year backtest of the 6-month overbought signal, Stocklabs returns 62 samples. After day five is when the signal becomes most bullish. These next five trading days, historically, according to Stocklabs have had a higher probability of positive returns.

Keep it simple.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Markets drift through the beginning of the week. Then look for lots of economic data due out Wednesday (durable goods, jobless claims 8:30am ET, PMI 9:45am and Fed minutes 2pm) to put some direction into the tape ahead of the holiday.

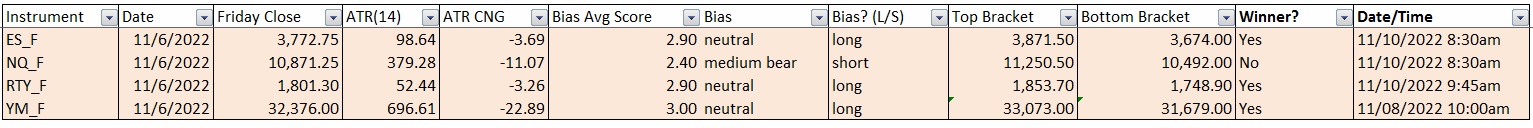

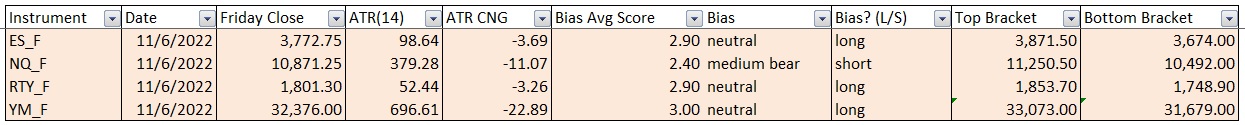

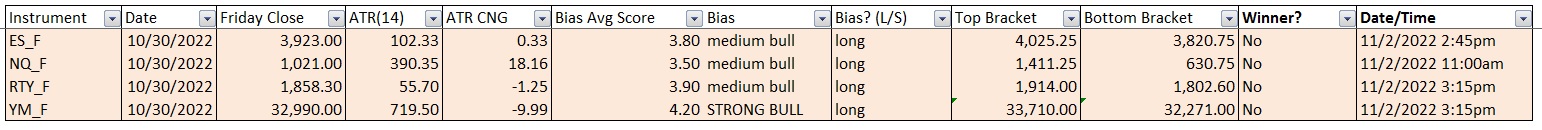

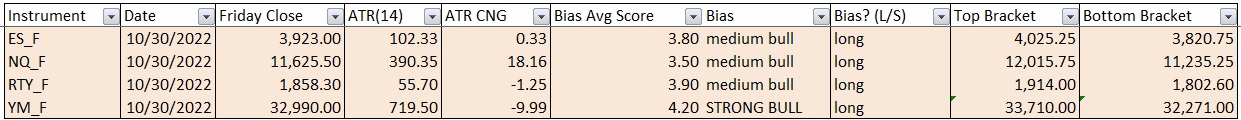

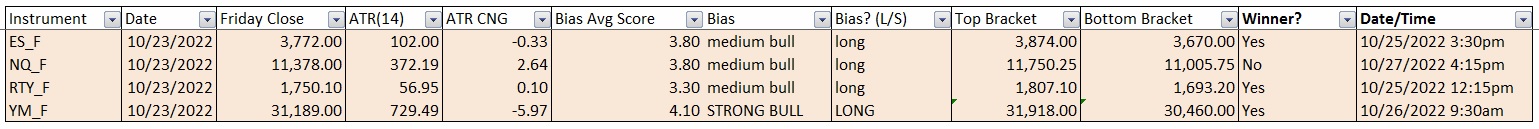

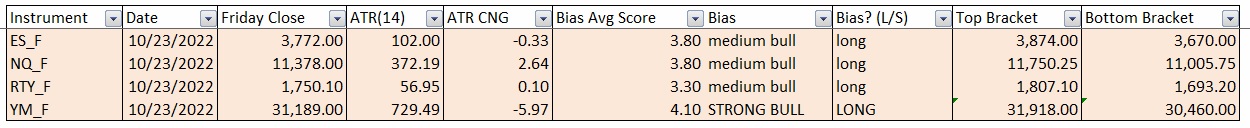

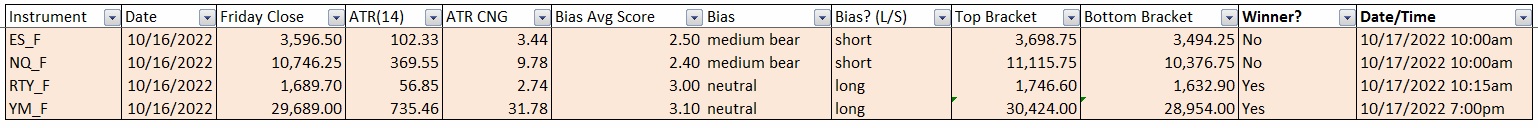

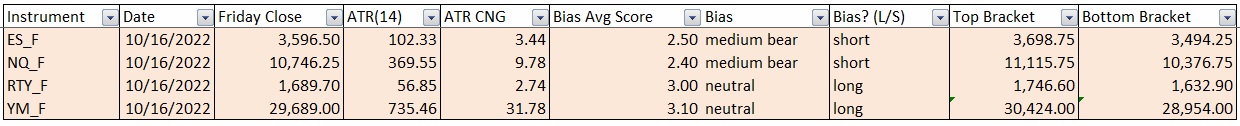

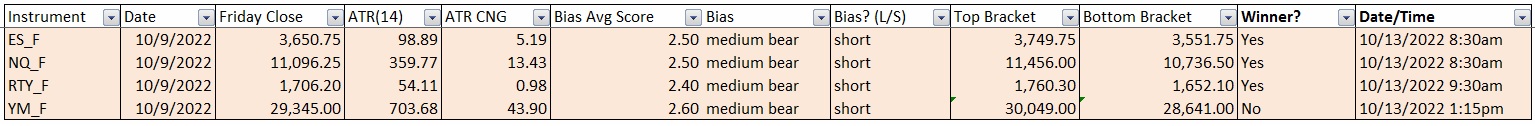

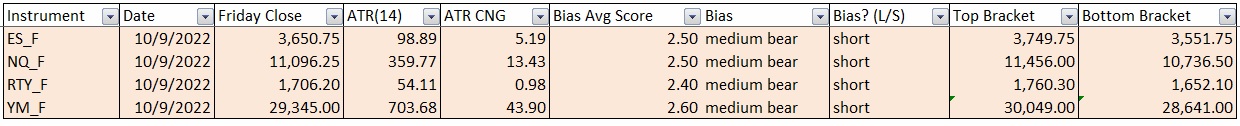

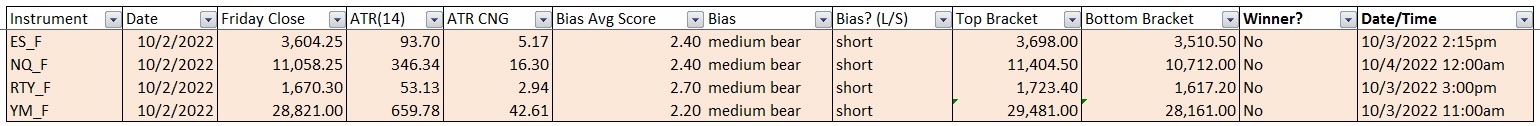

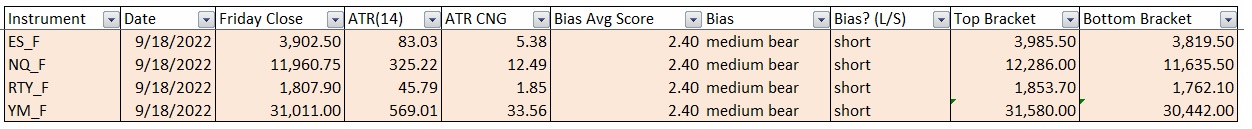

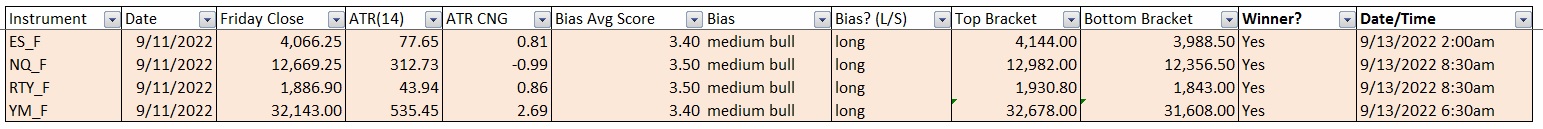

Bias Book:

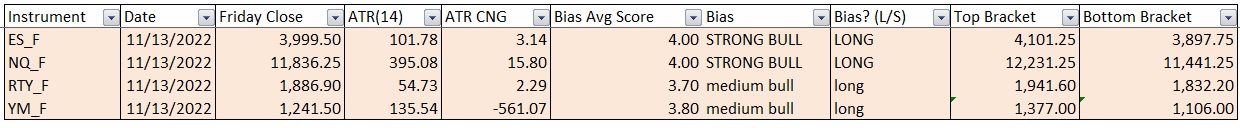

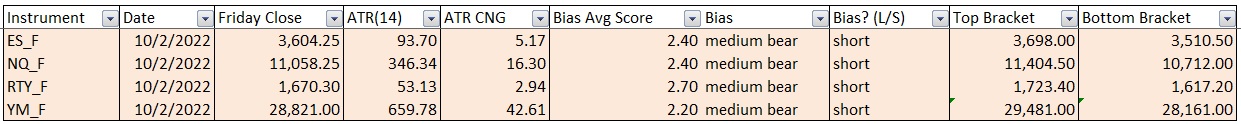

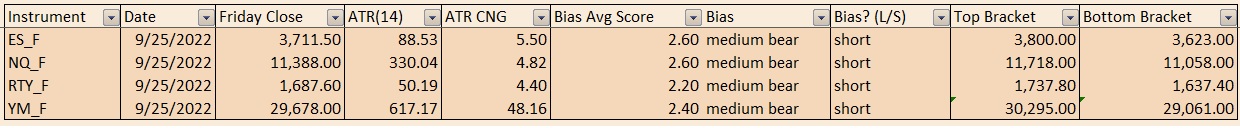

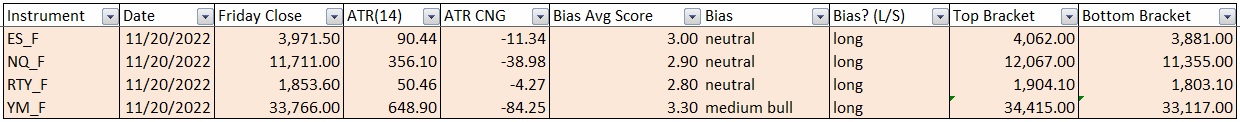

Here are the bias trades and price levels for this week:

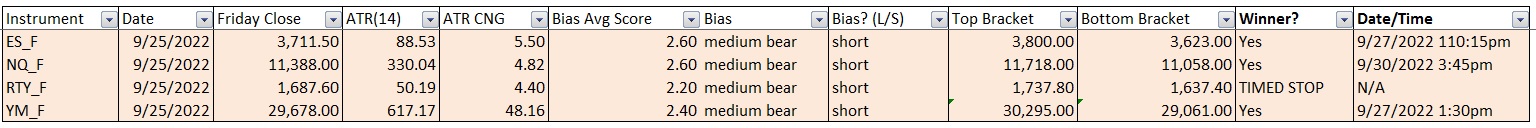

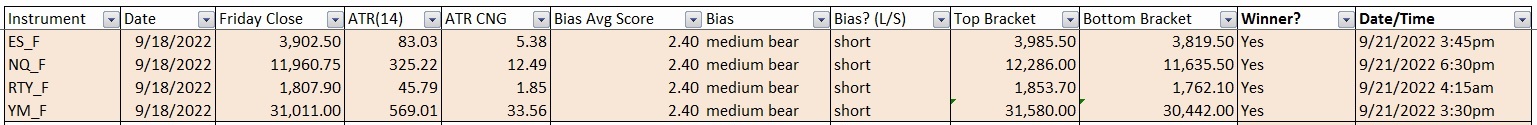

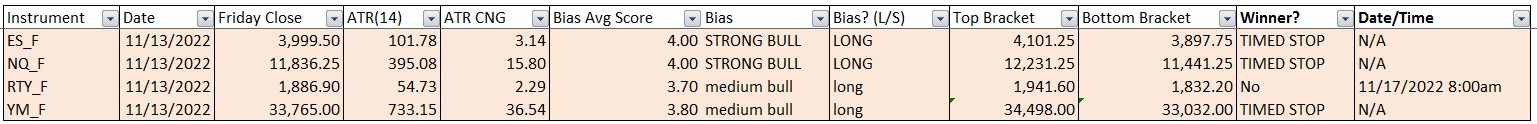

Here are last week’s bias trade results:

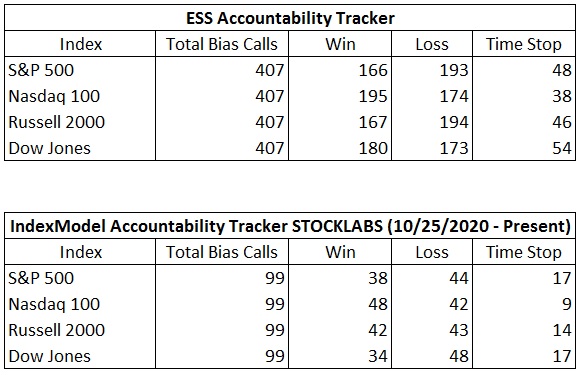

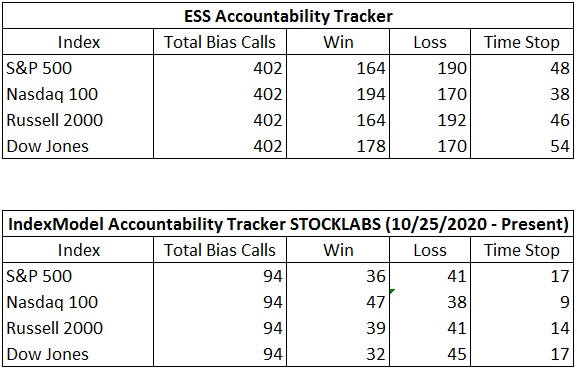

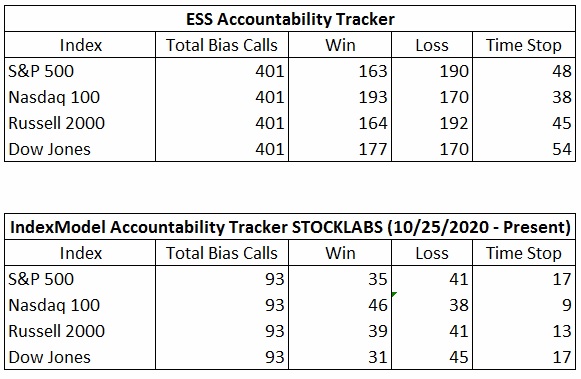

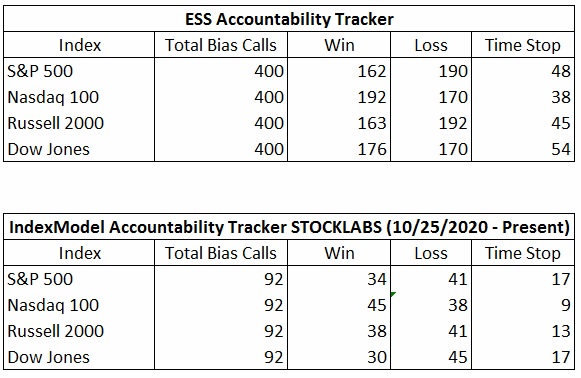

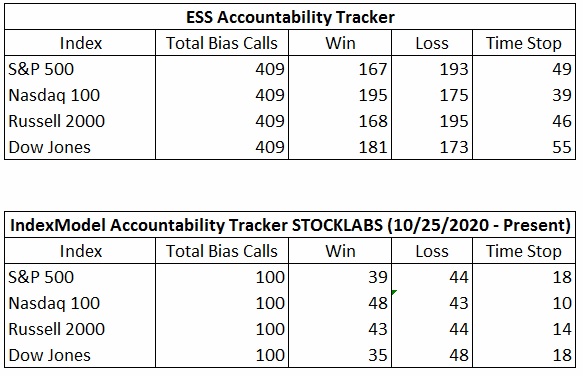

Bias Book Performance [11/17/2014-Present]:

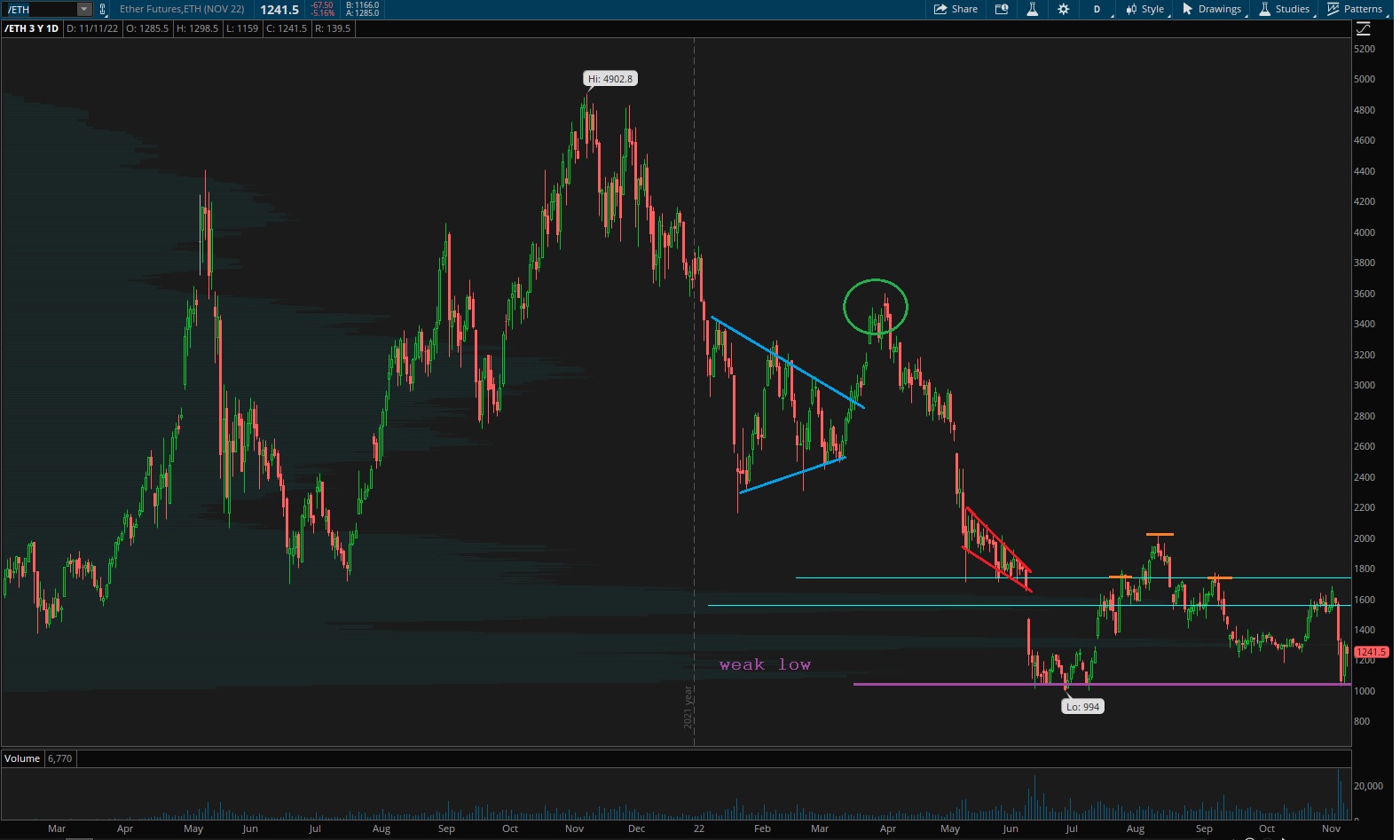

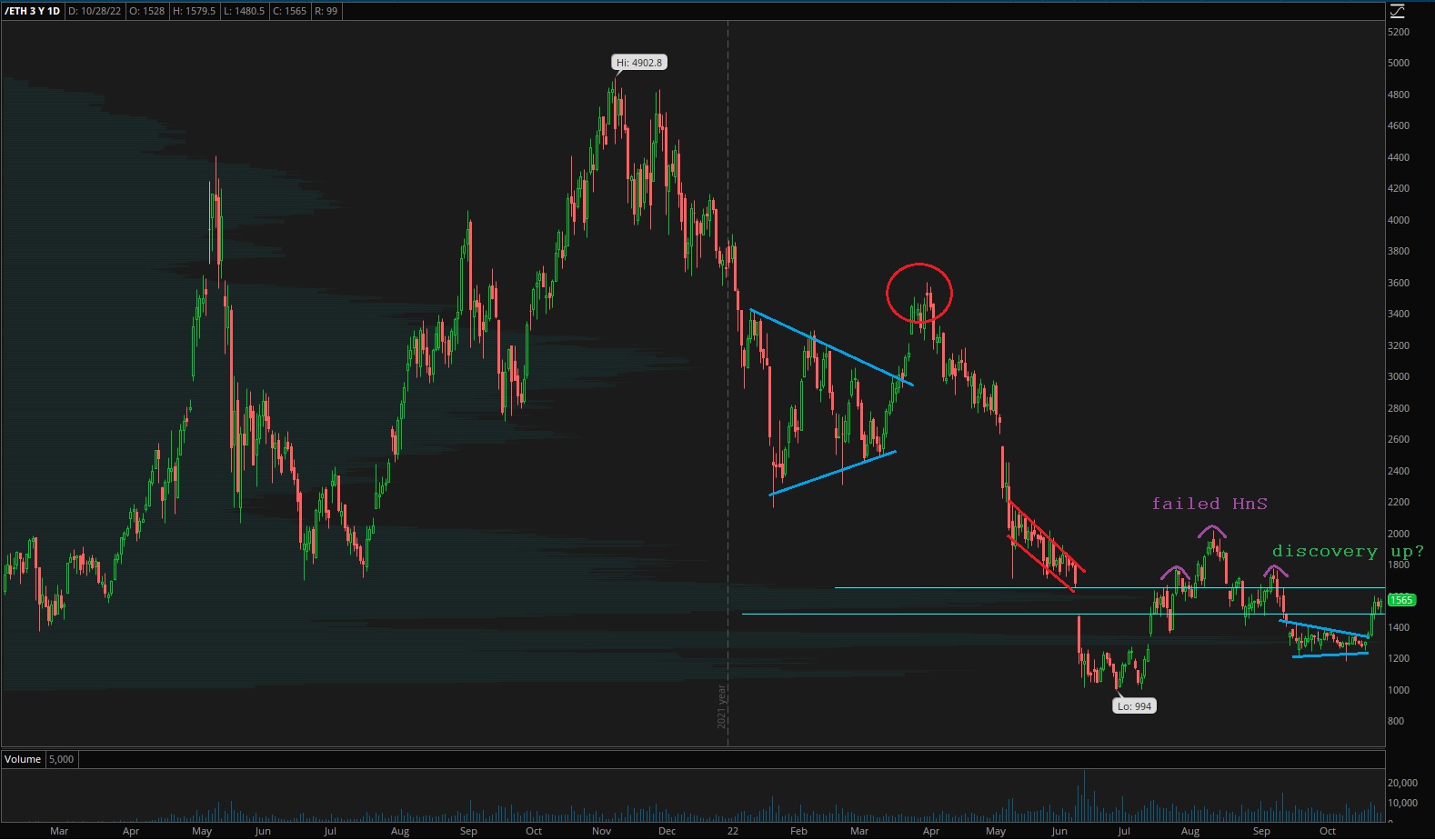

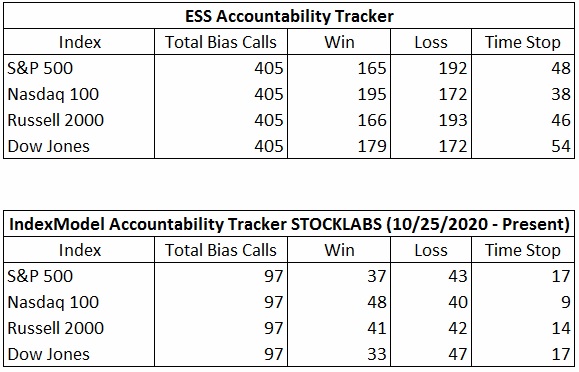

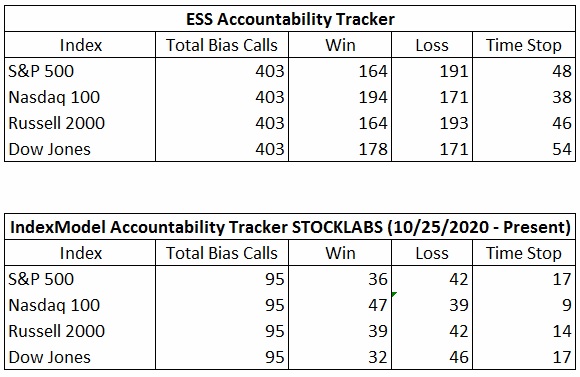

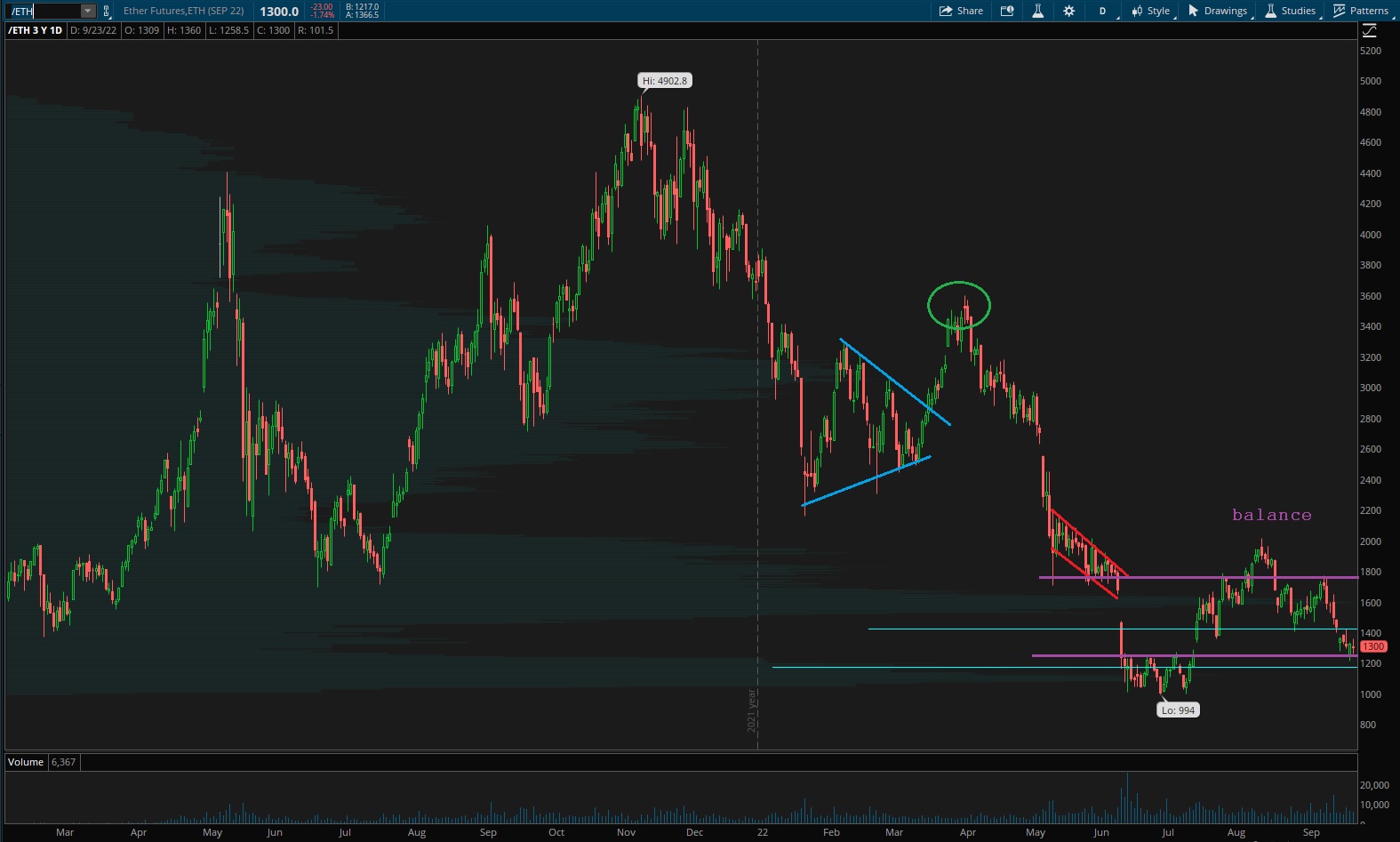

Weak ether, balance elsewhere

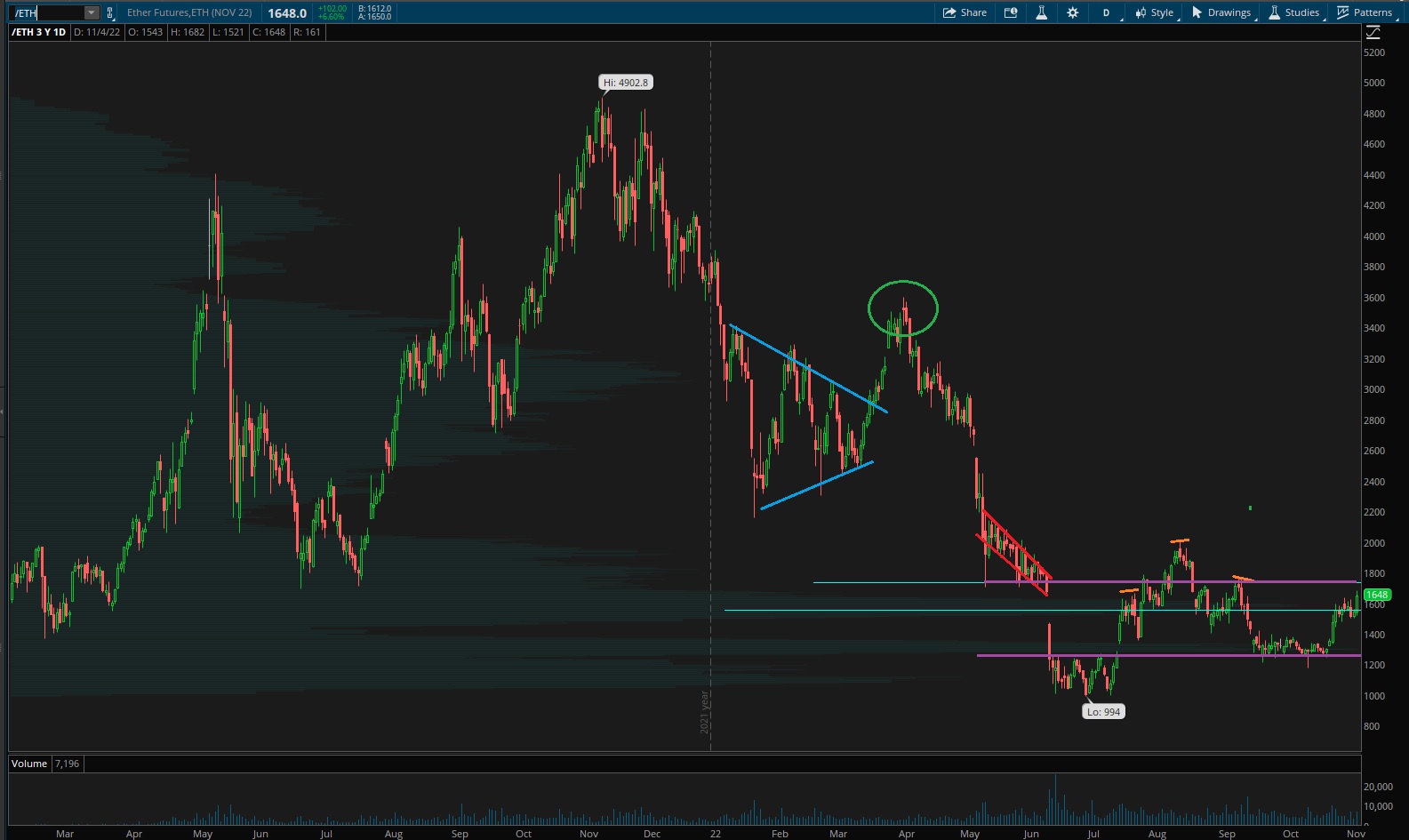

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

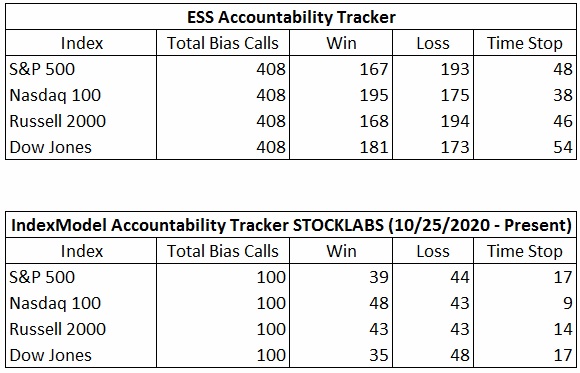

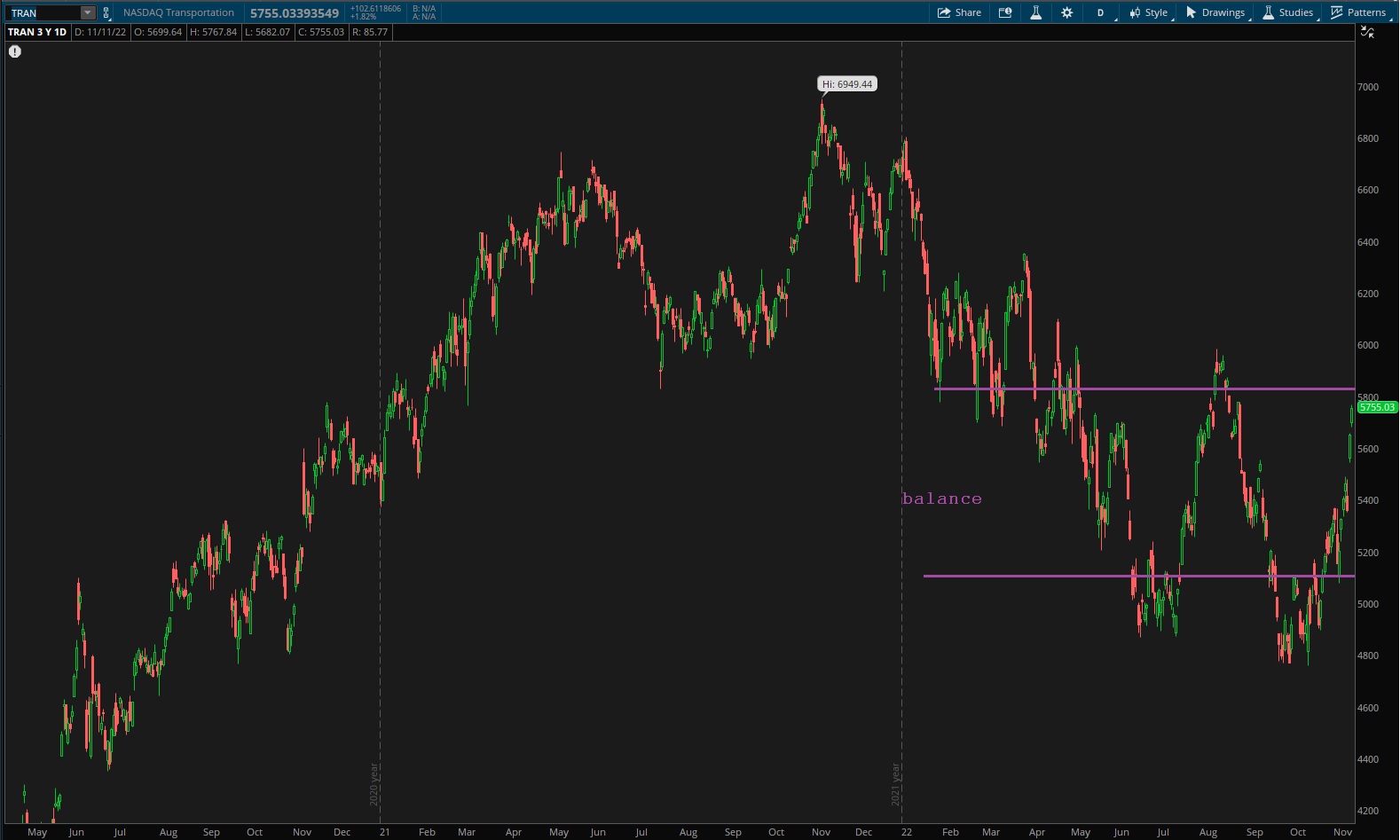

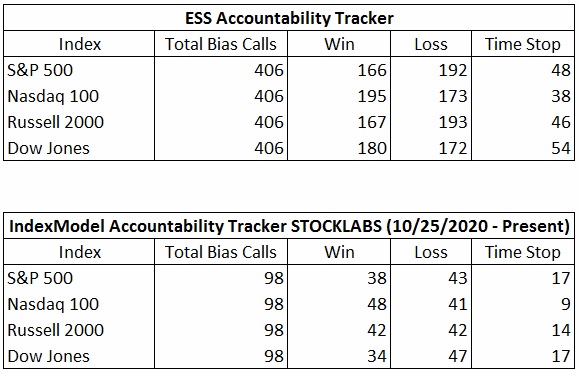

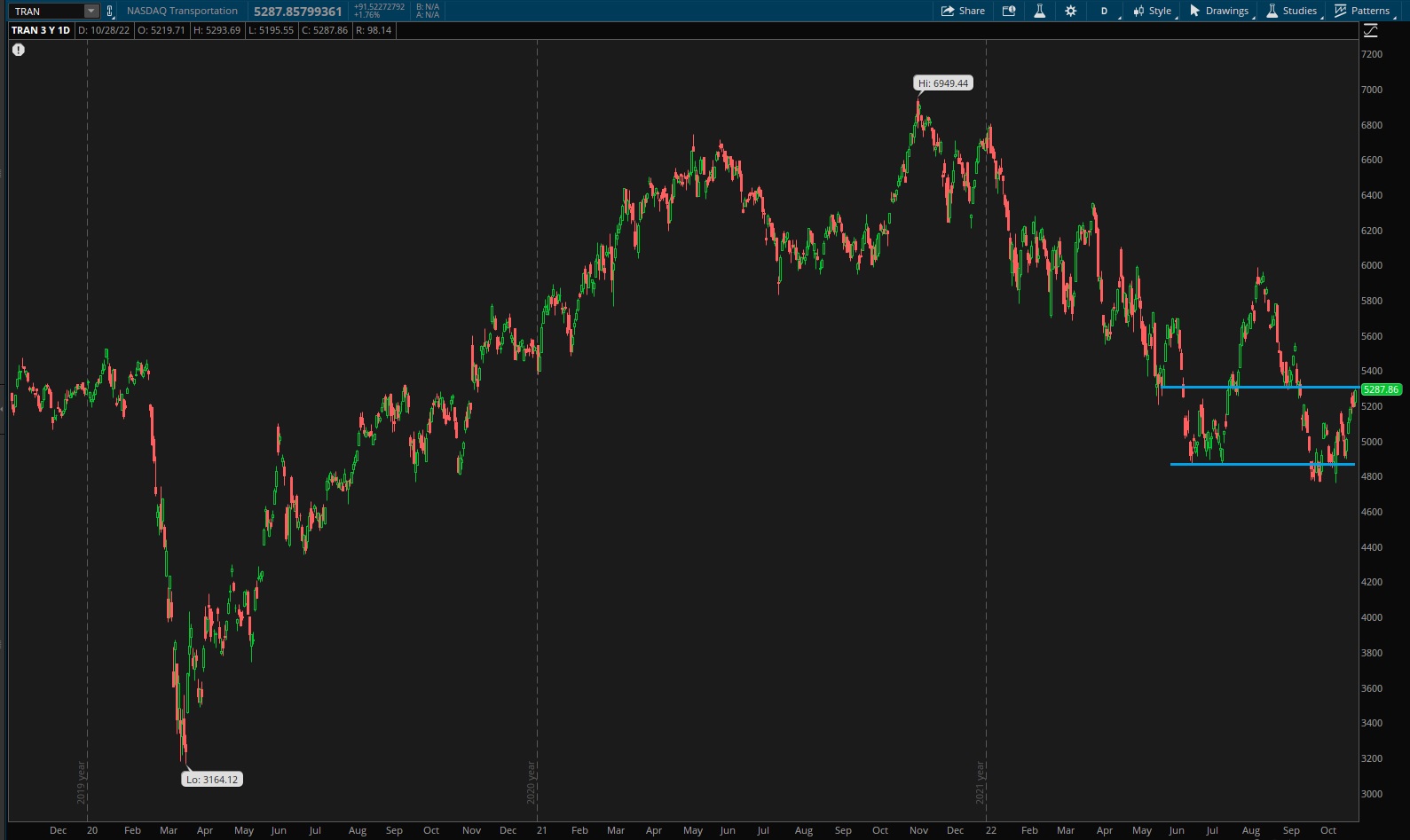

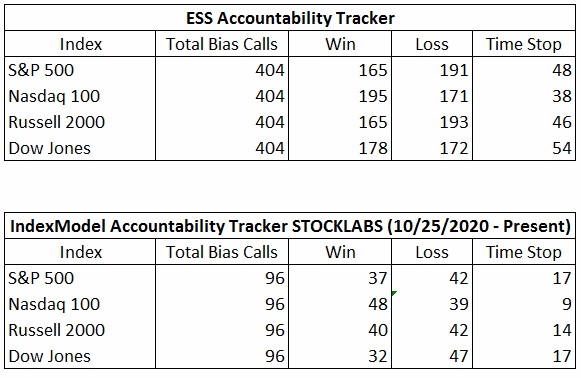

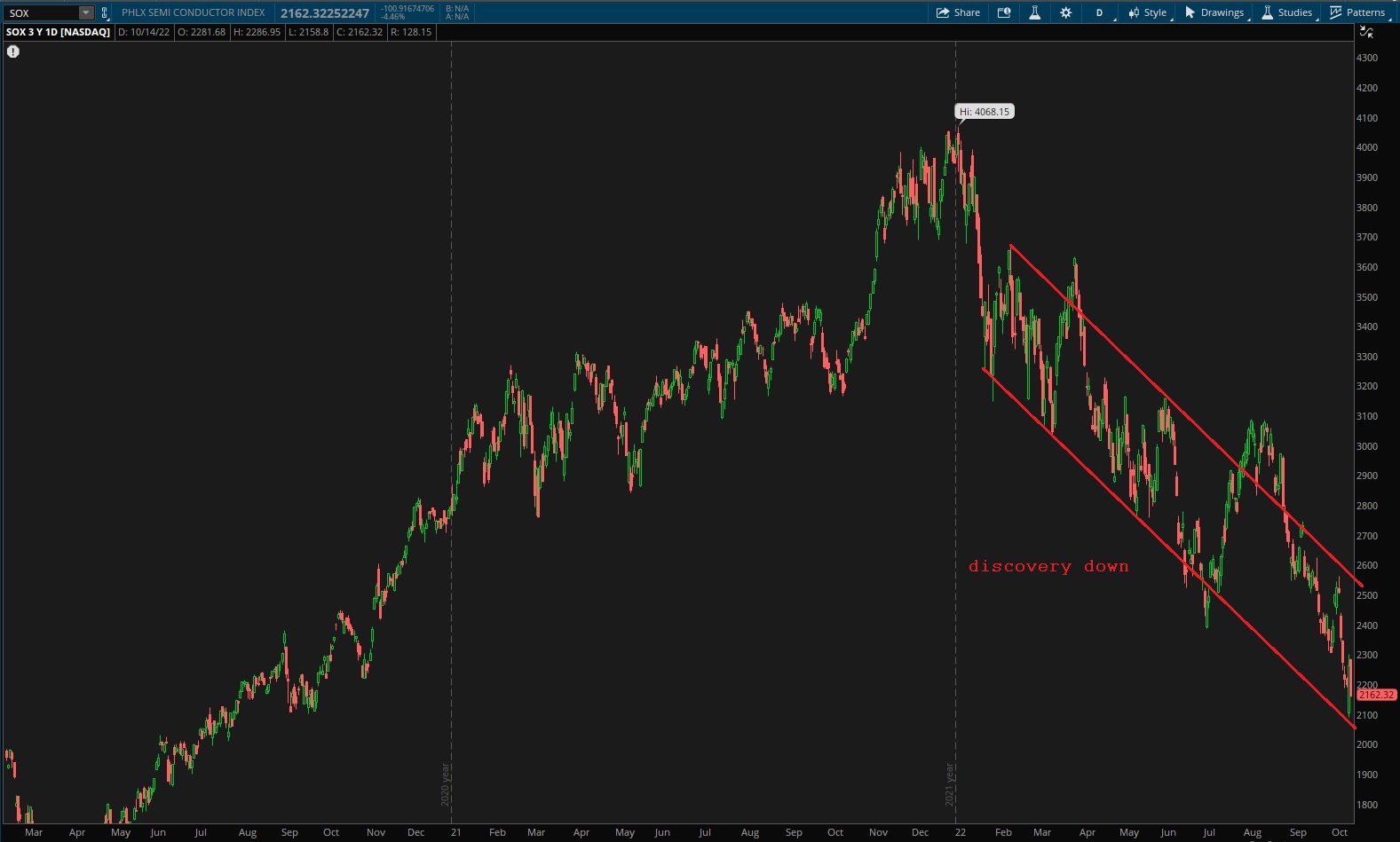

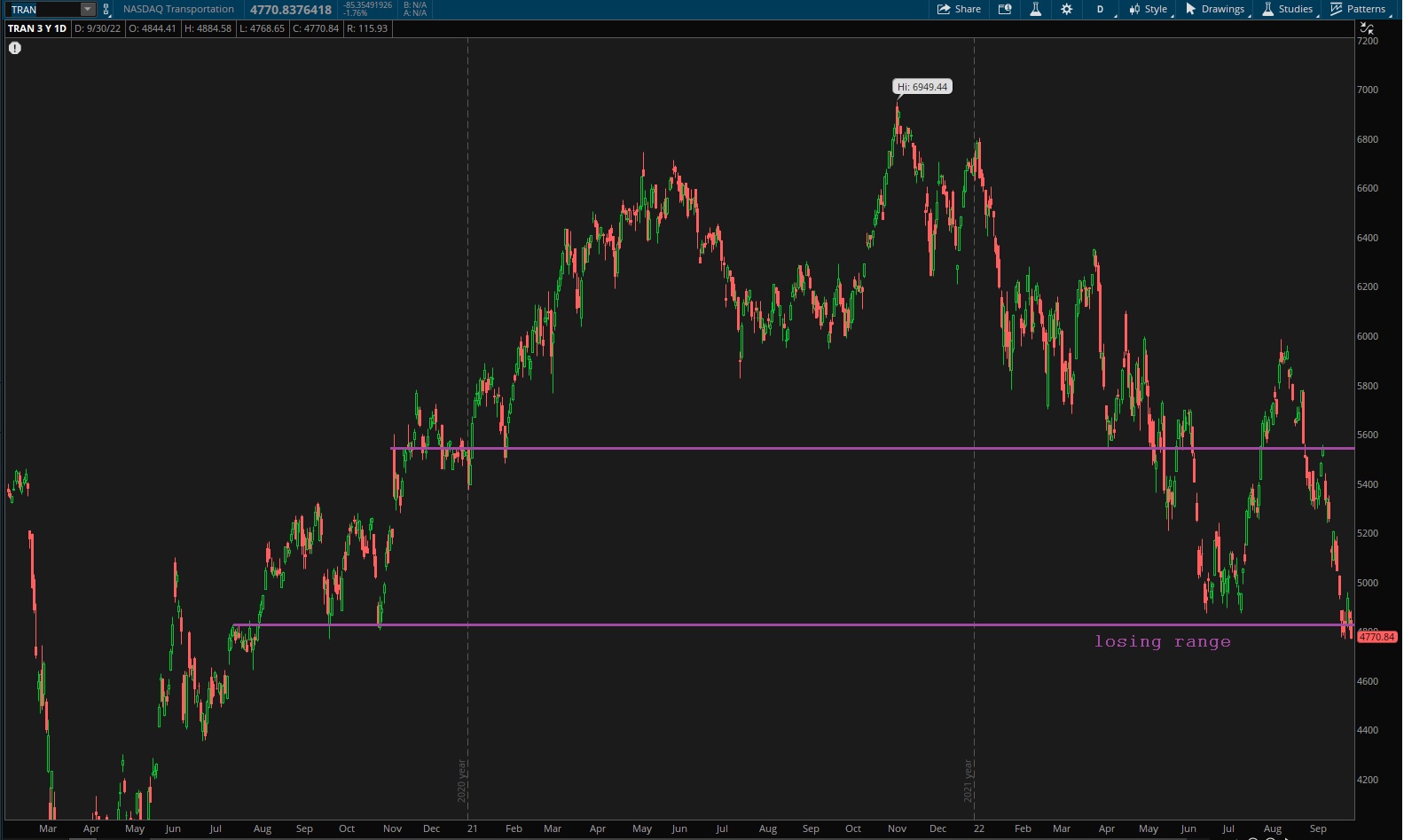

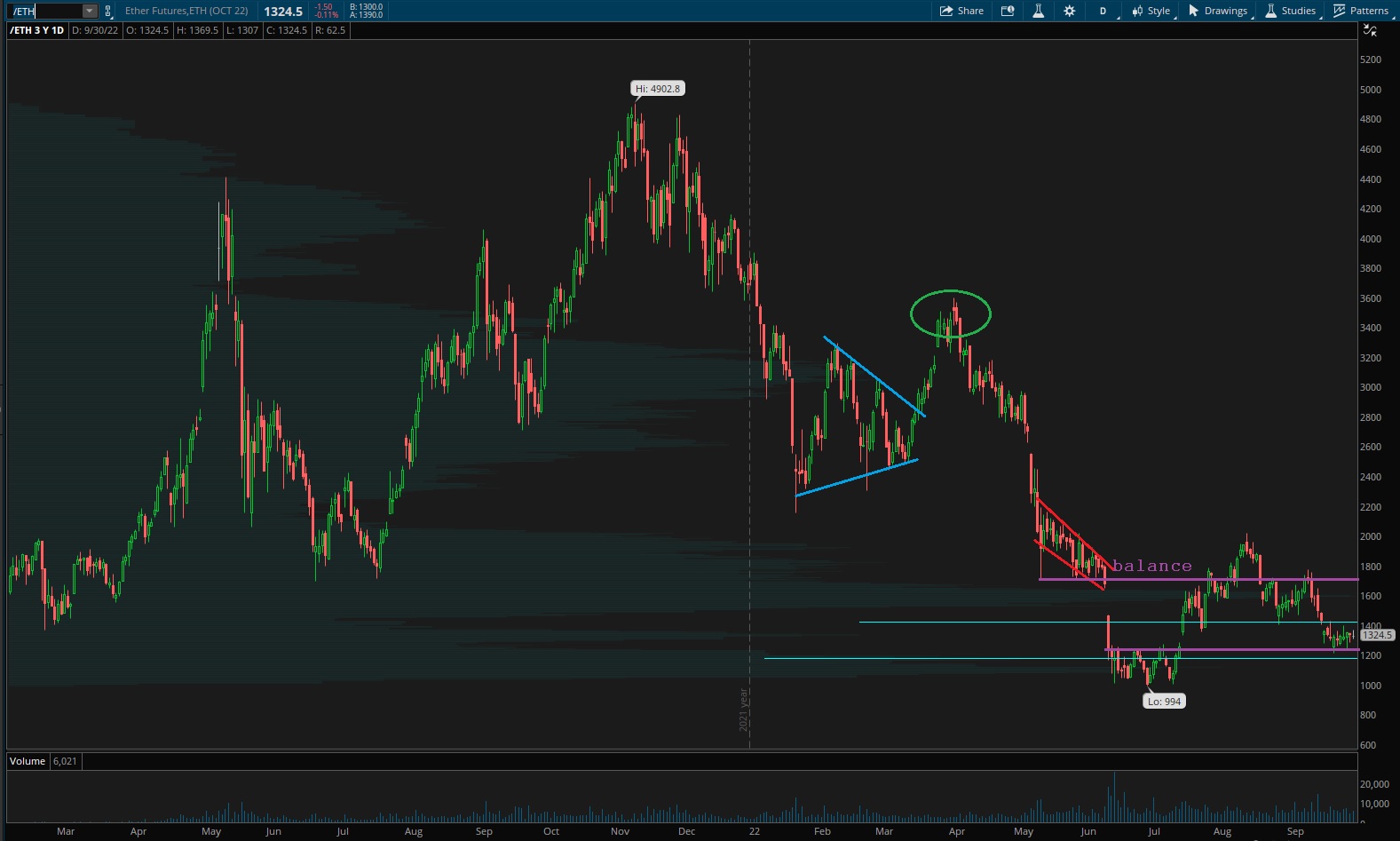

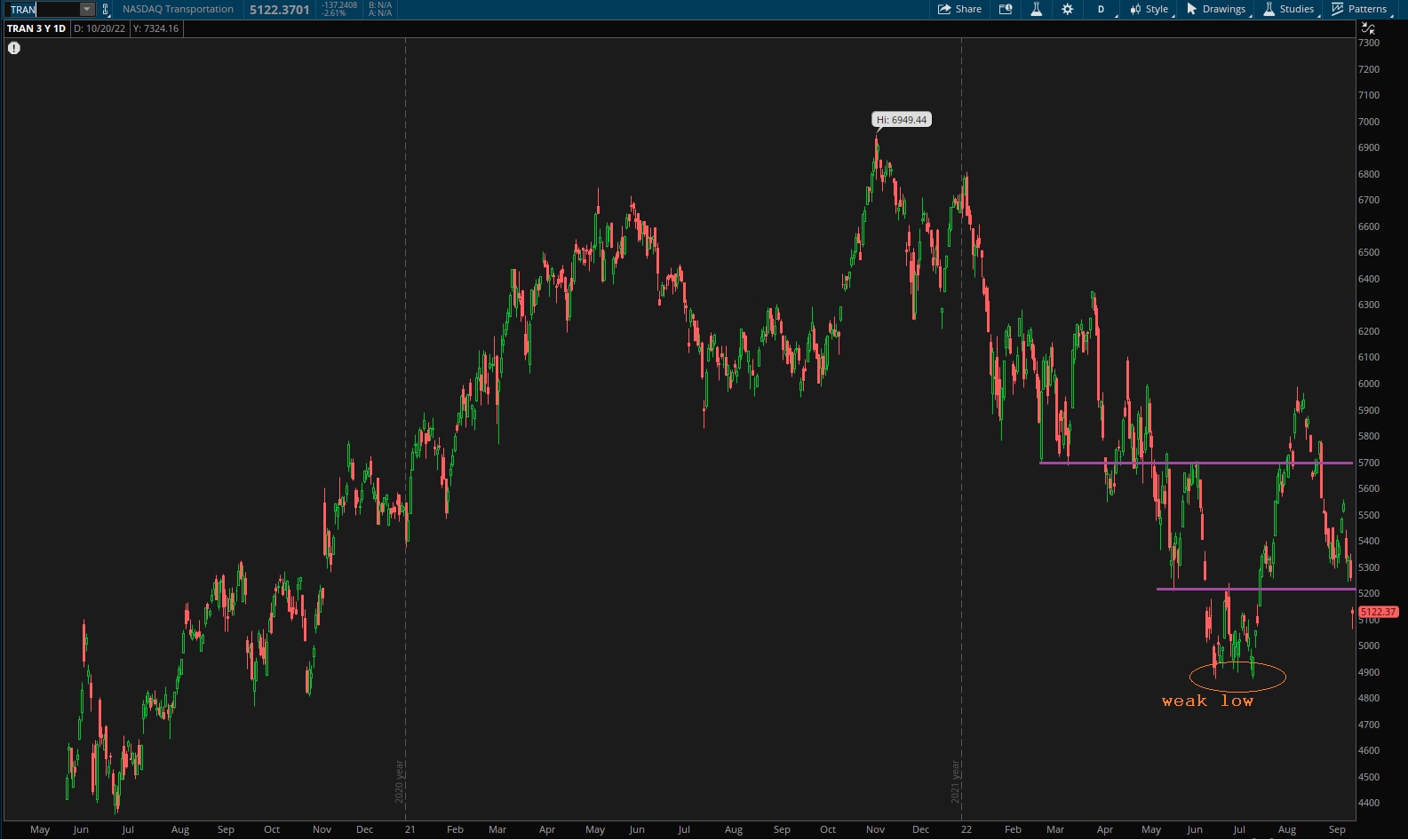

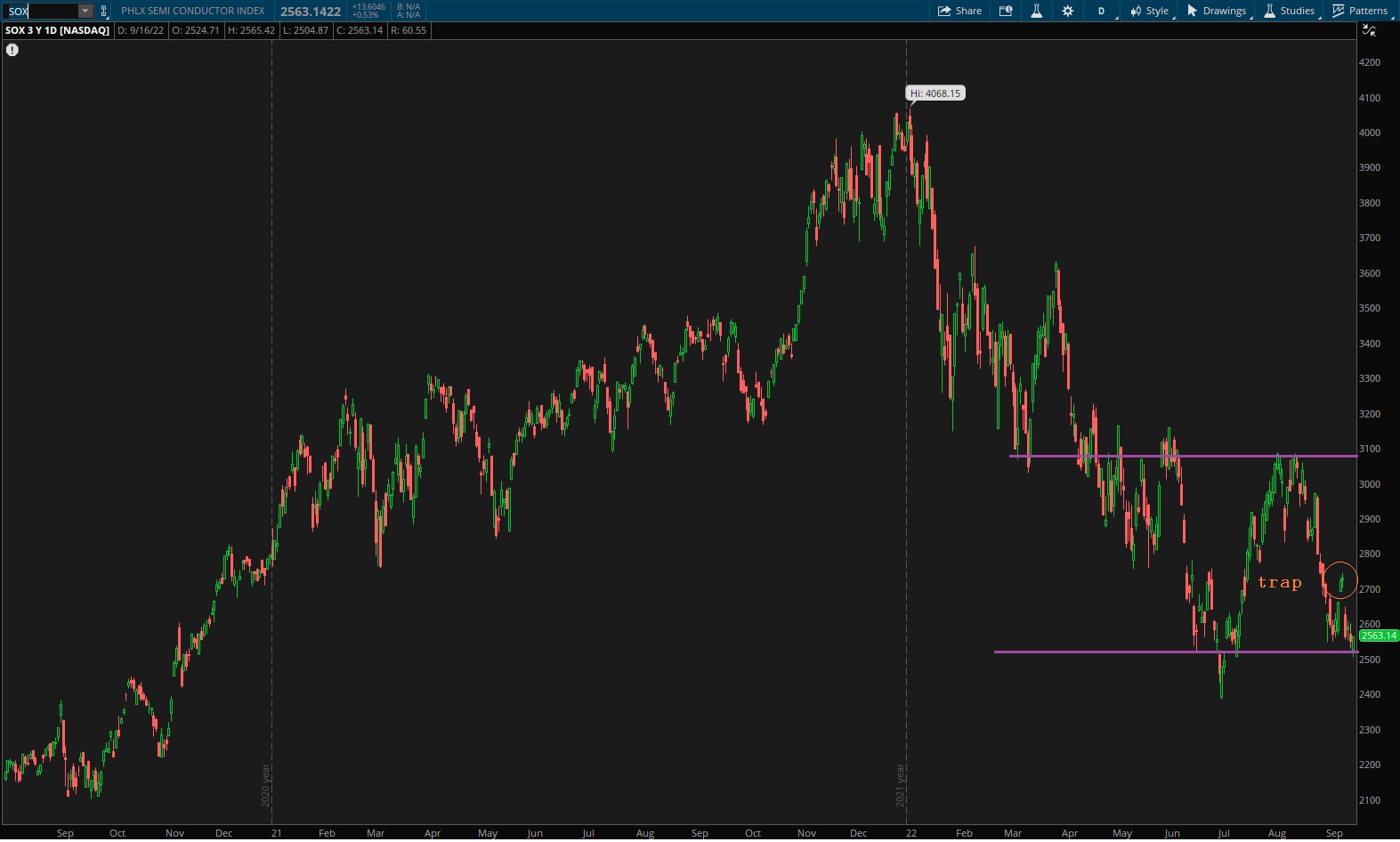

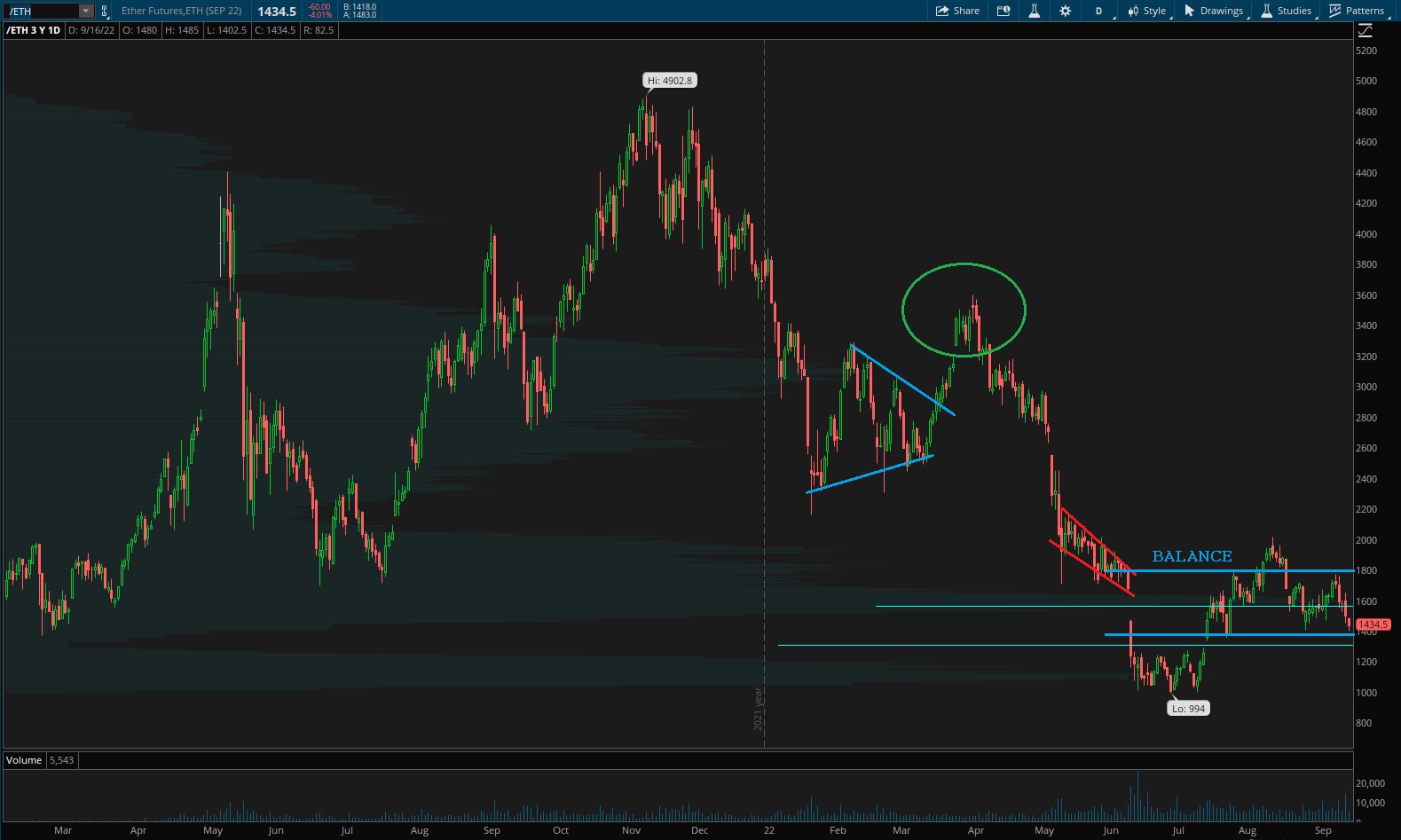

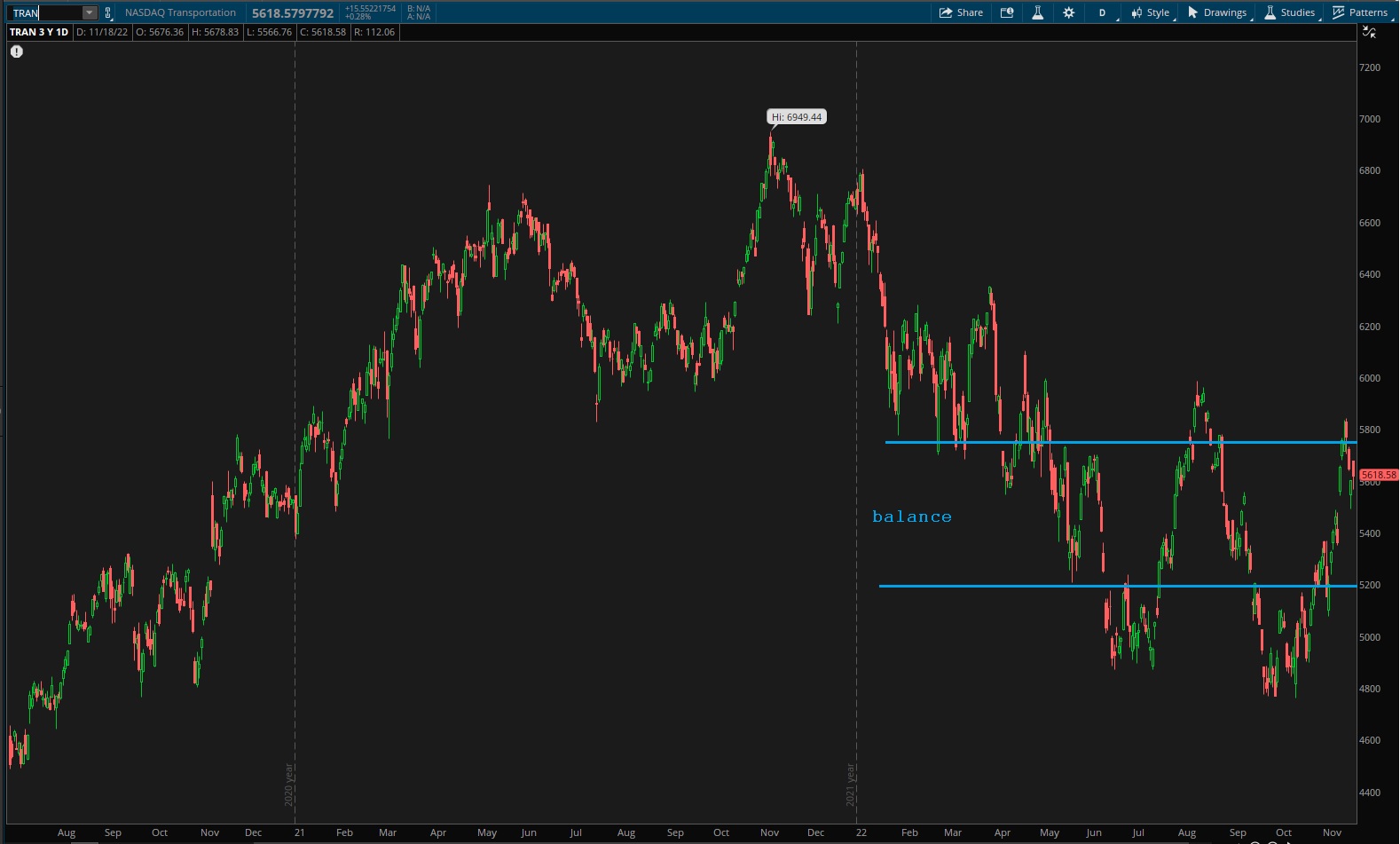

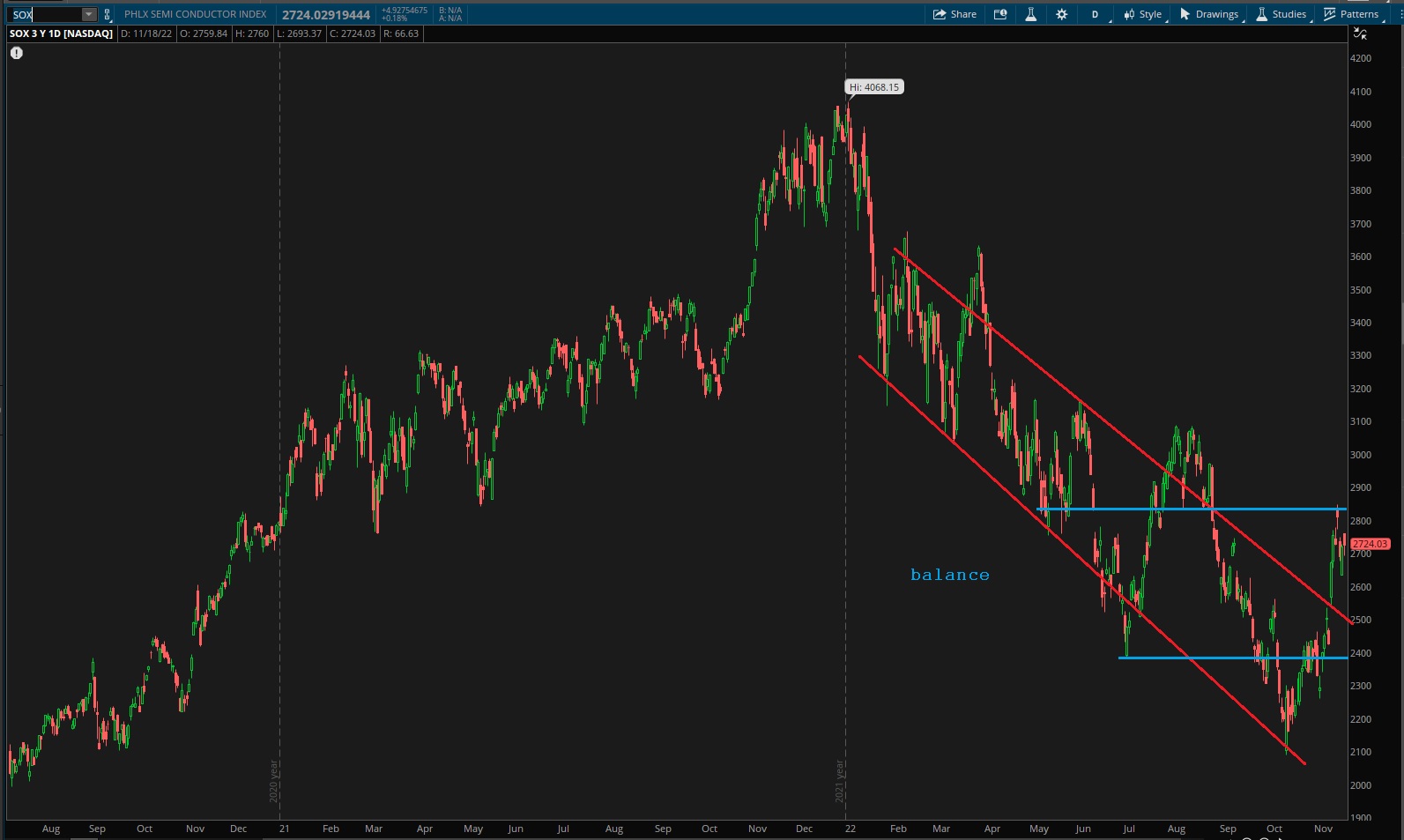

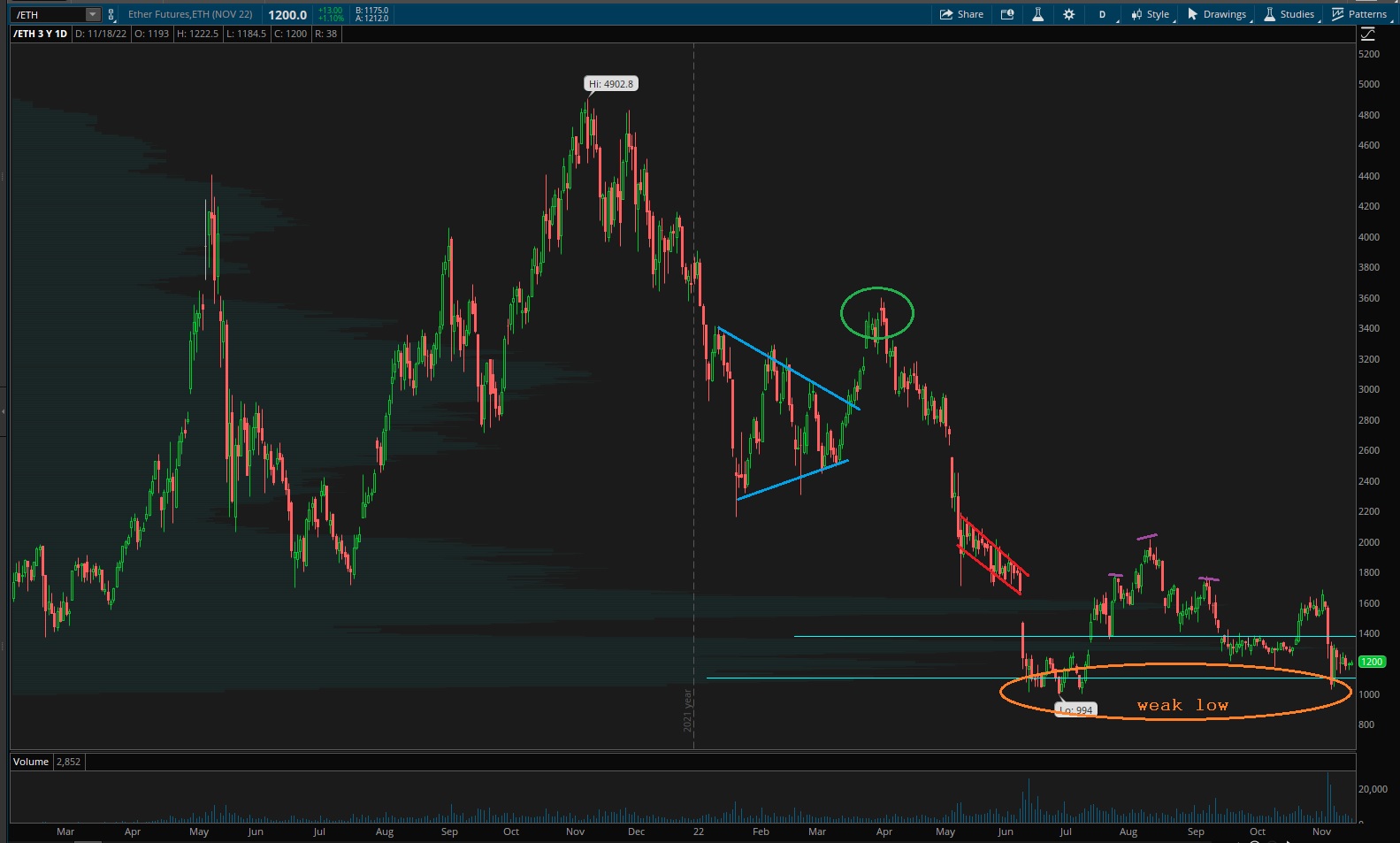

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Transports sort of lingering on the upper-end of balance.

See below:

Semiconductors have found resistance at old support levels so far, and appear to be settled into balance.

The swing lows on ether are looking increasingly weak. A test below 1k seems more likely with each day we linger down here.

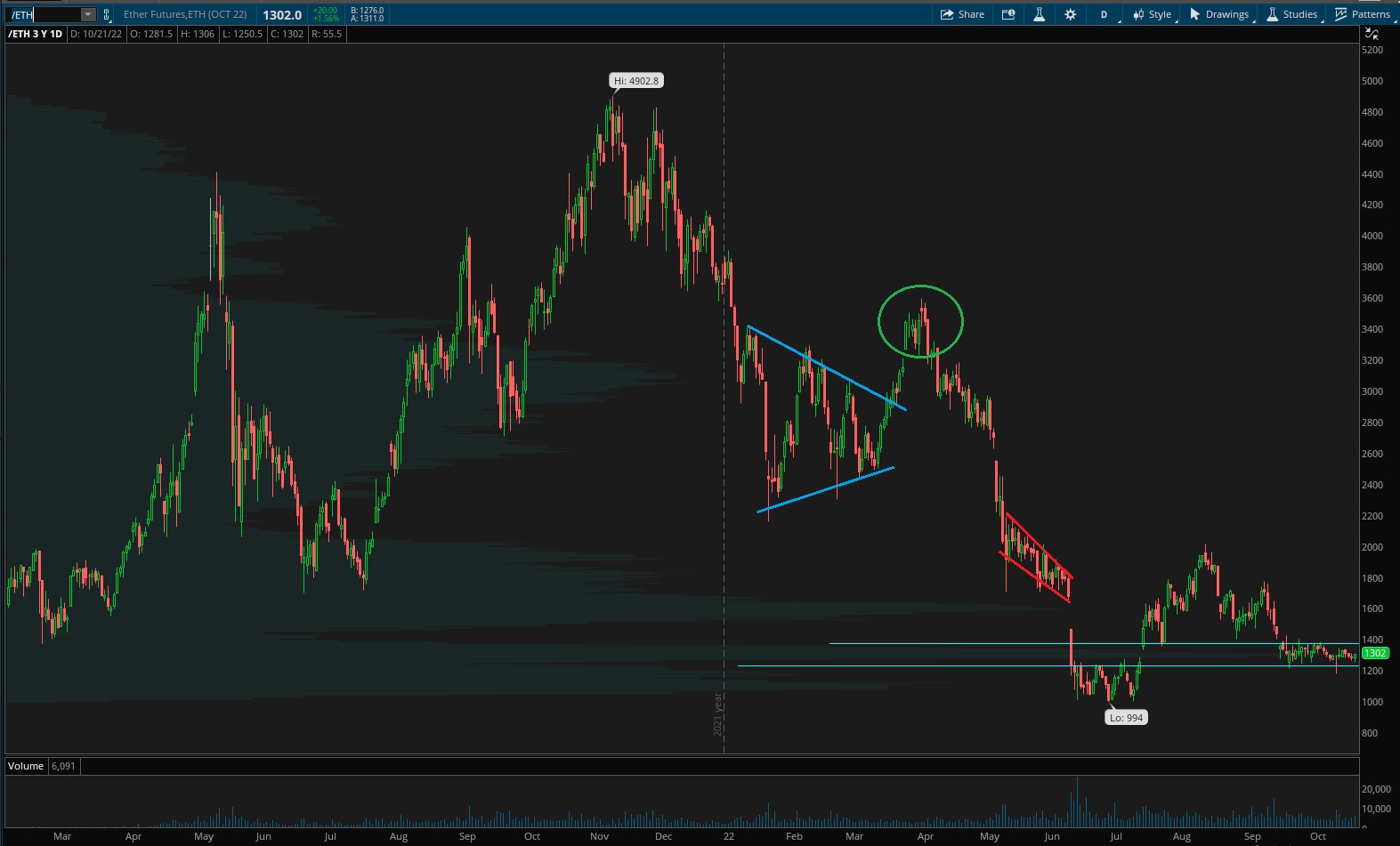

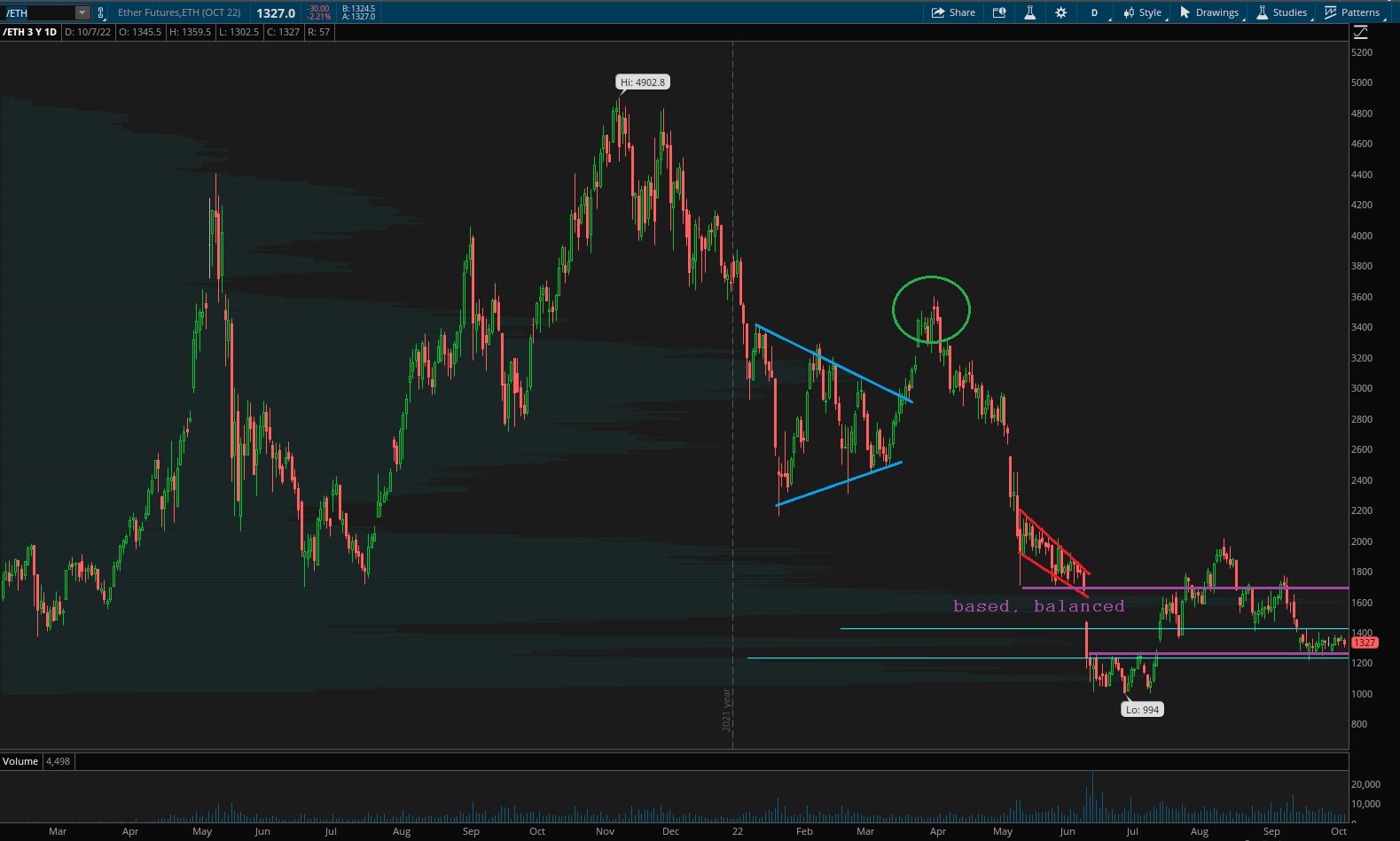

V. INDEX MODEL

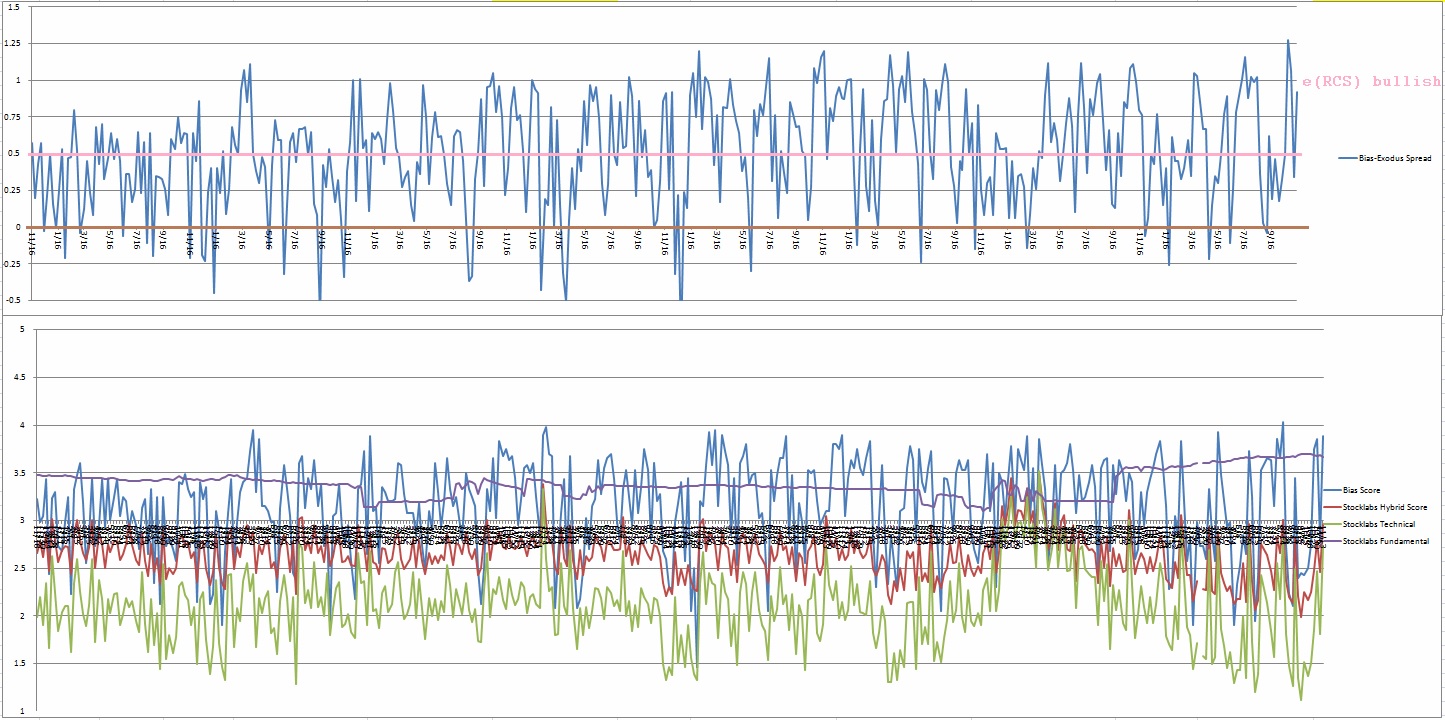

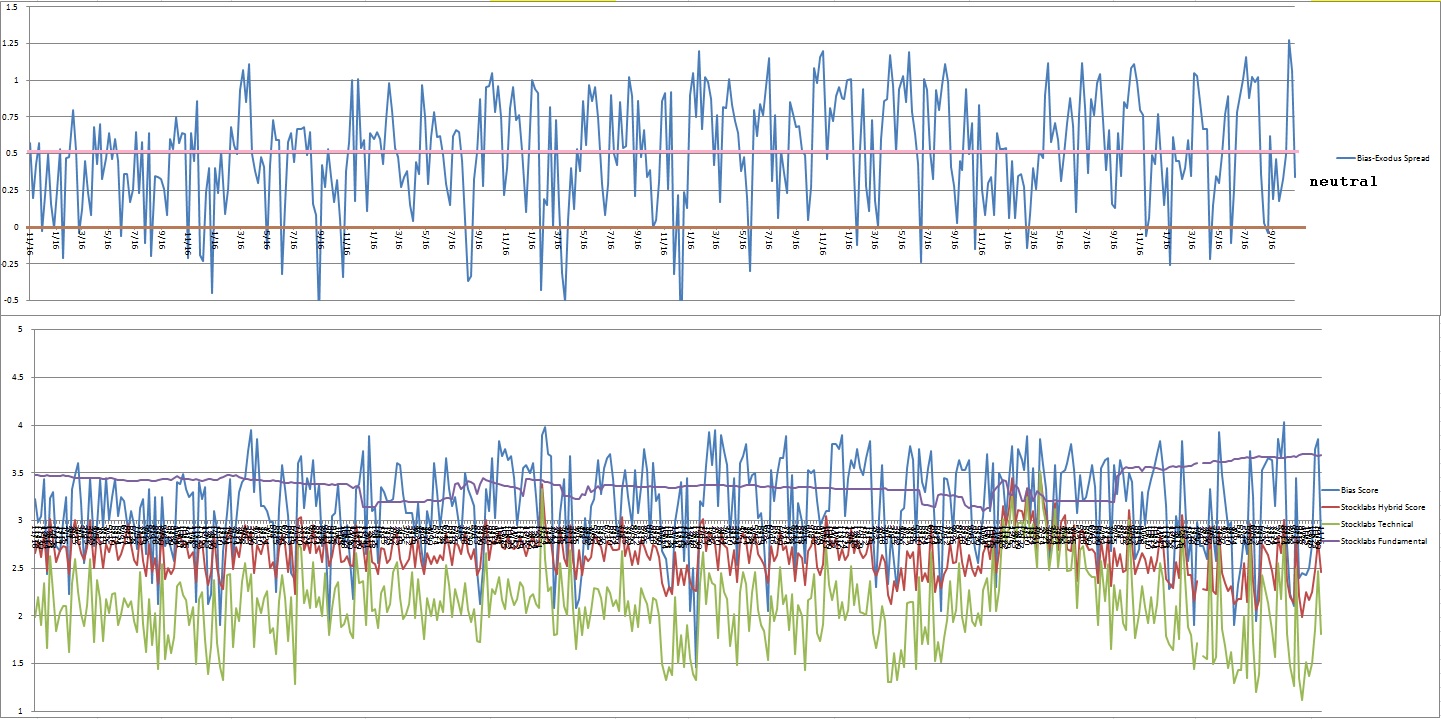

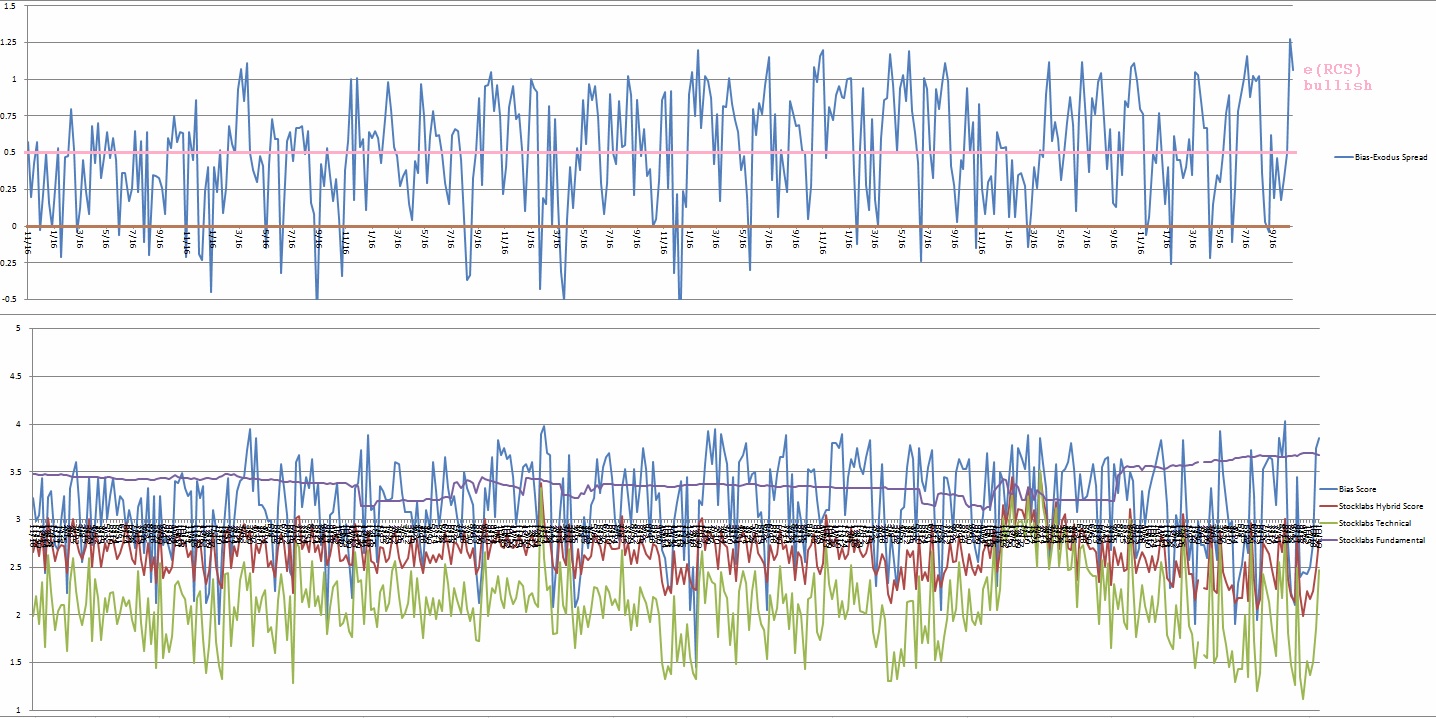

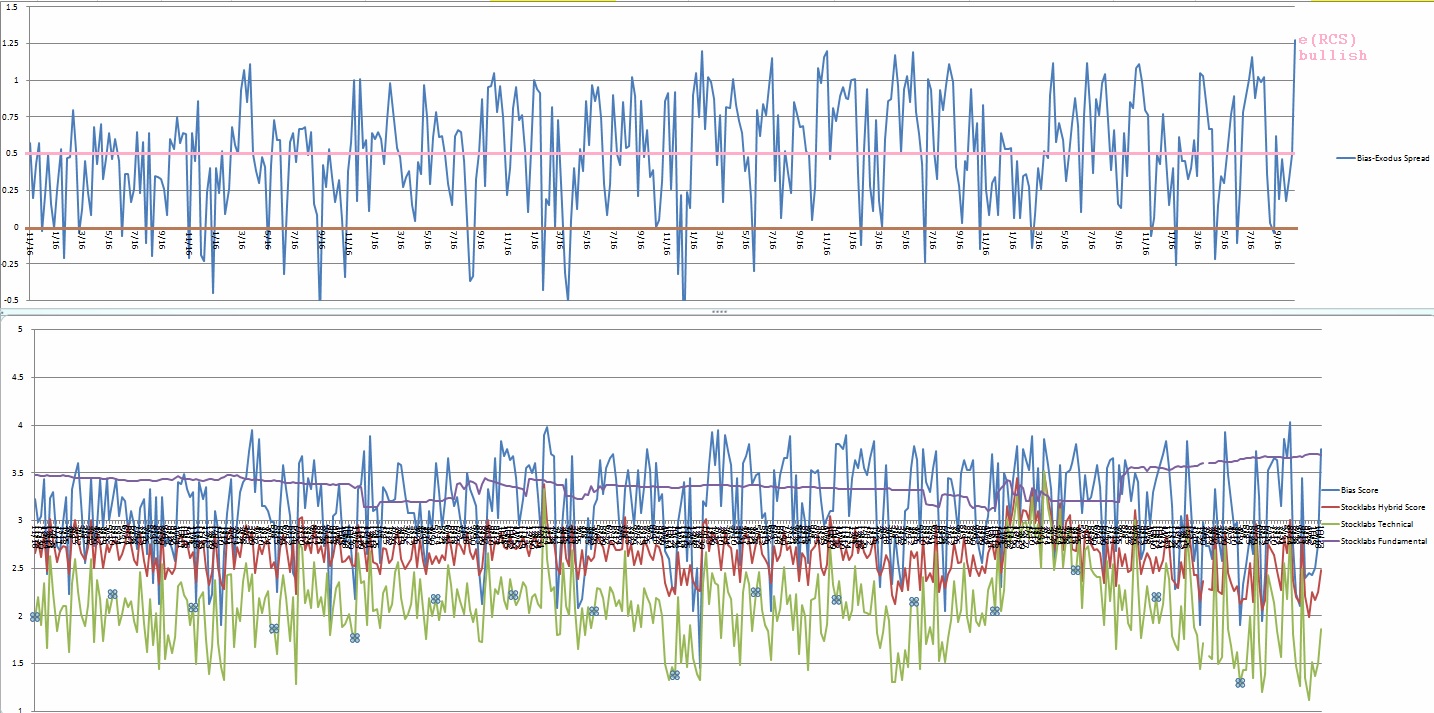

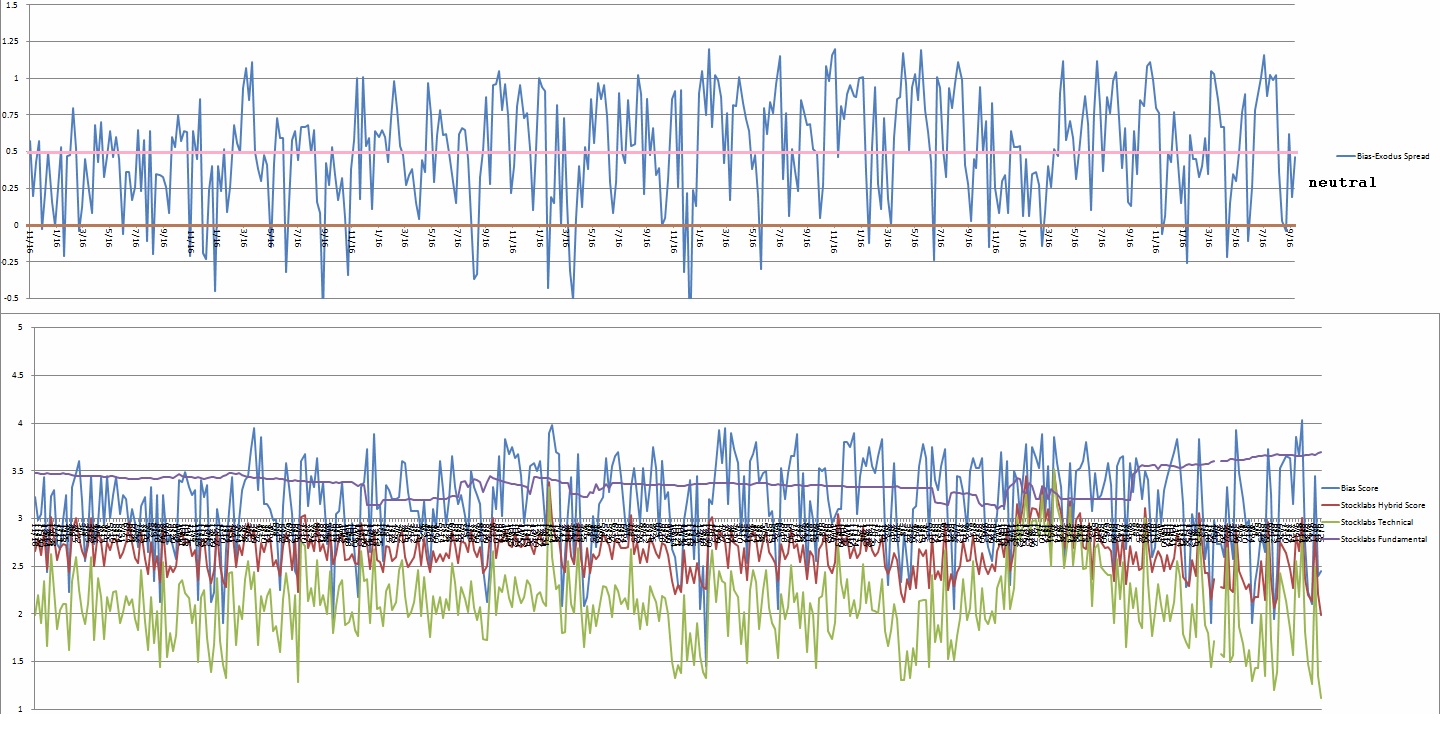

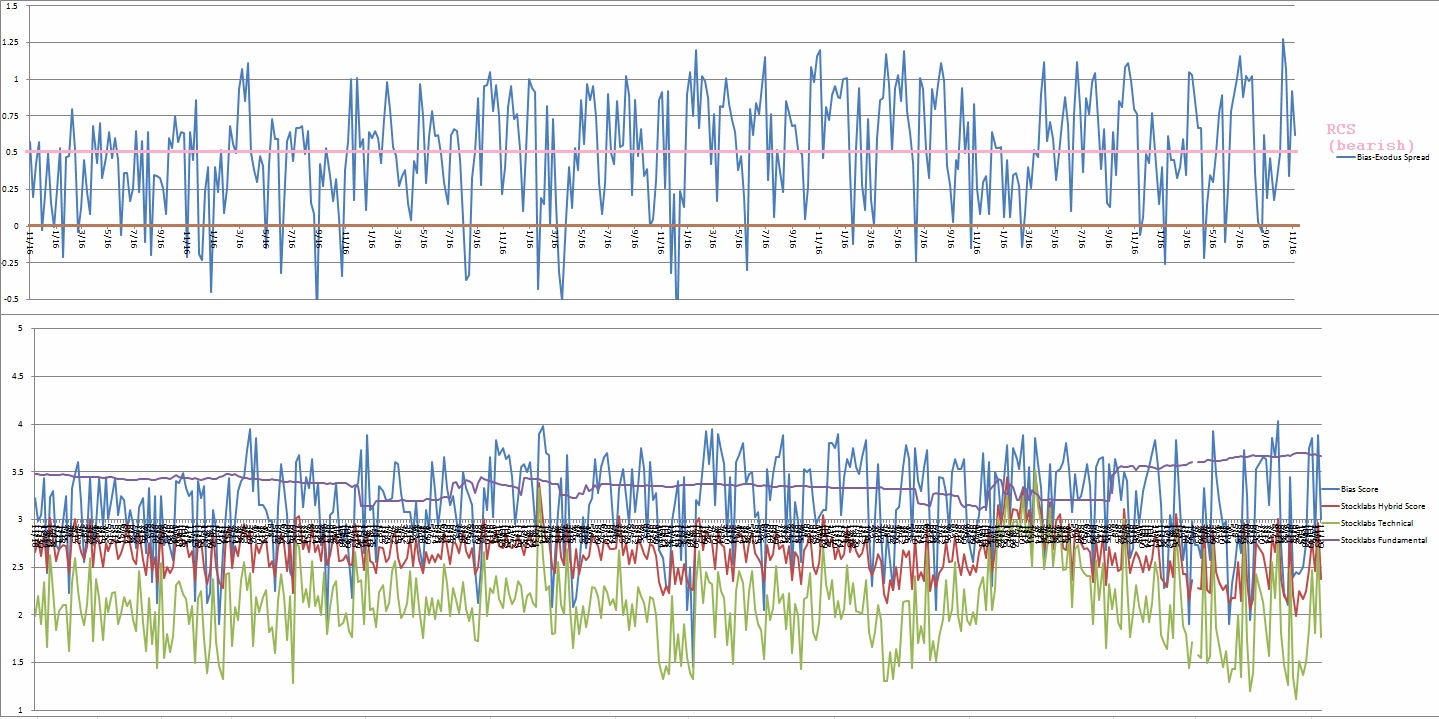

Bias model is RCS bearish after being e[RCS] bullish last week following two neutral weeks. Before all this we had two consecutive weeks of extreme Rose Colored Sunglasses (e[RCS]) bullishness.

So the count is at three e[RCS] in recent history.

There were five Bunker Busters in recent history — eleven weeks ago, twenty weeks back, twenty-seven weeks ago, fourty reports back and forty-two reports back.

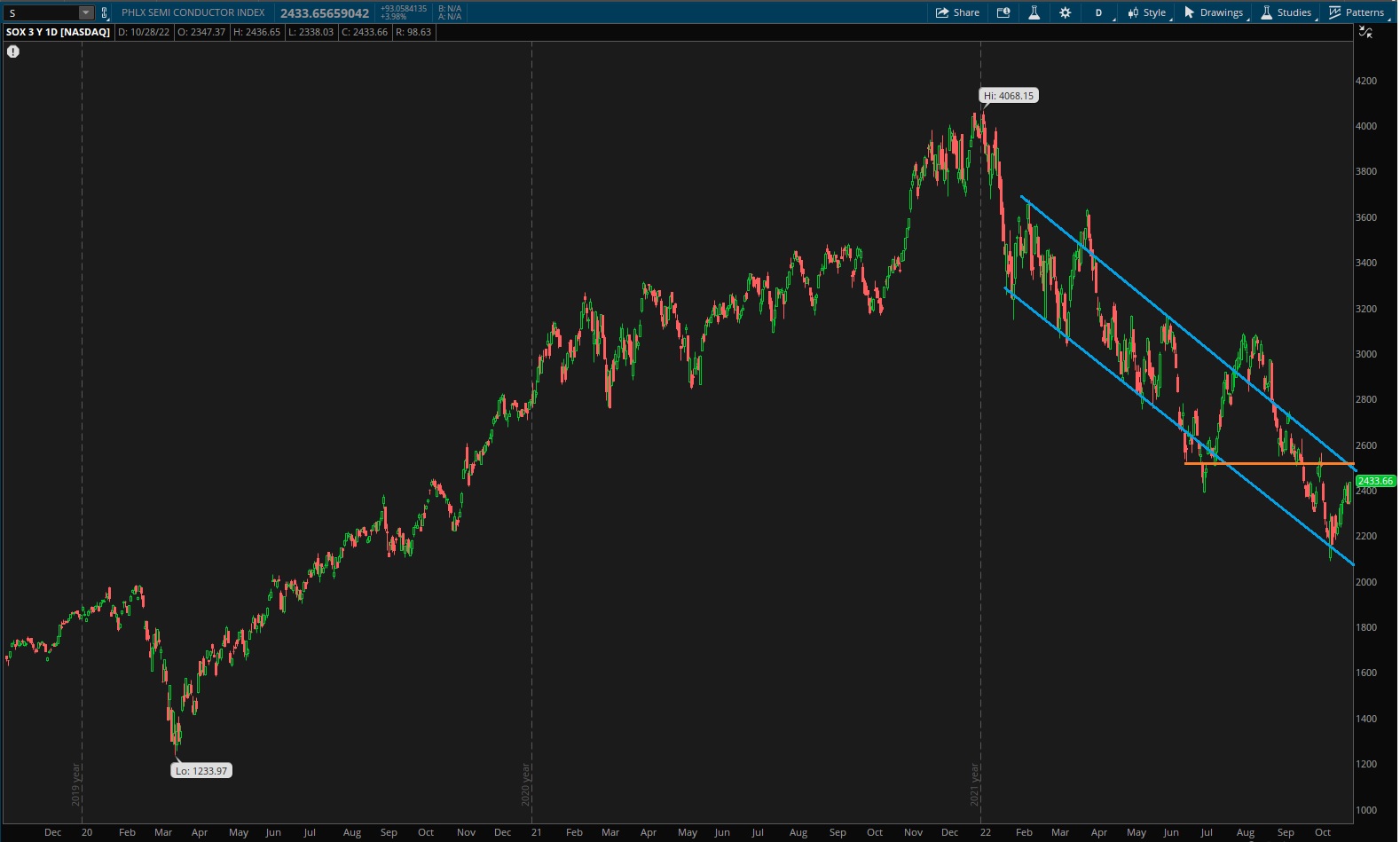

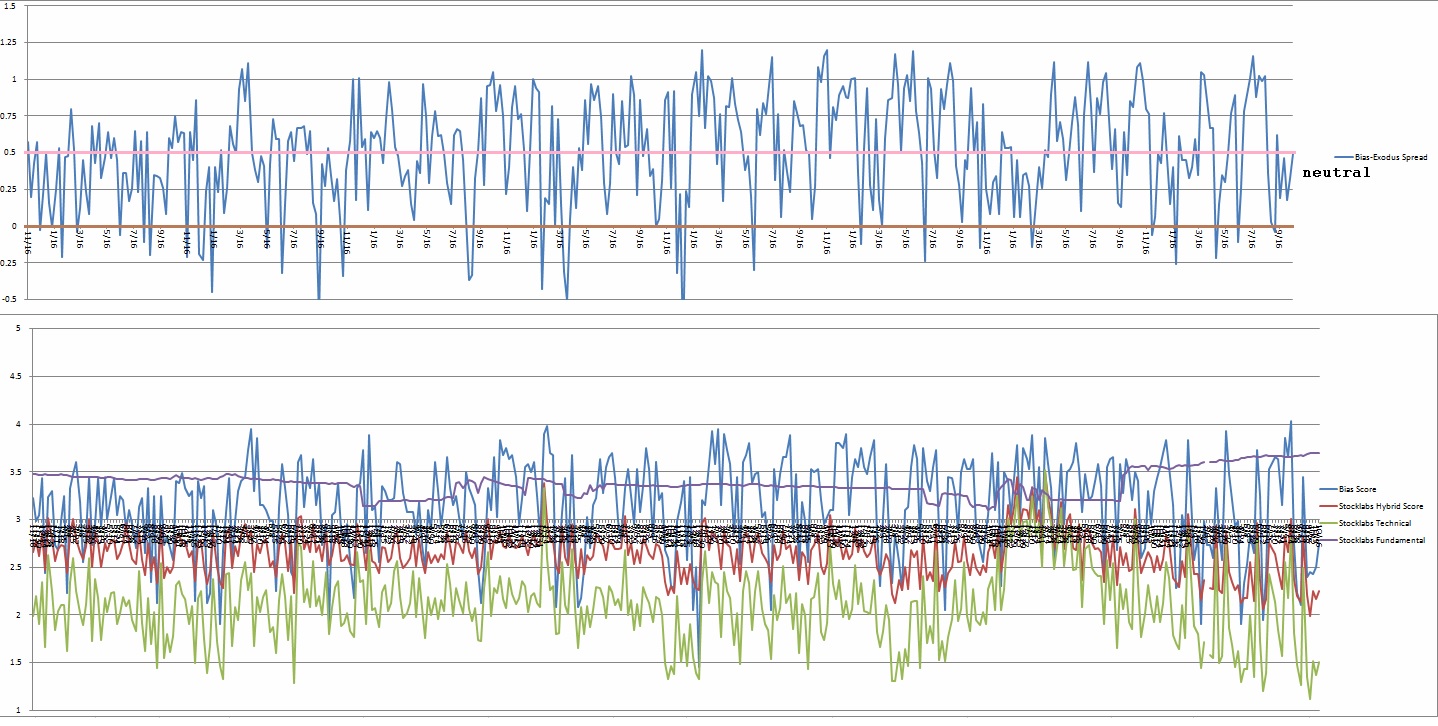

Here is the current spread:

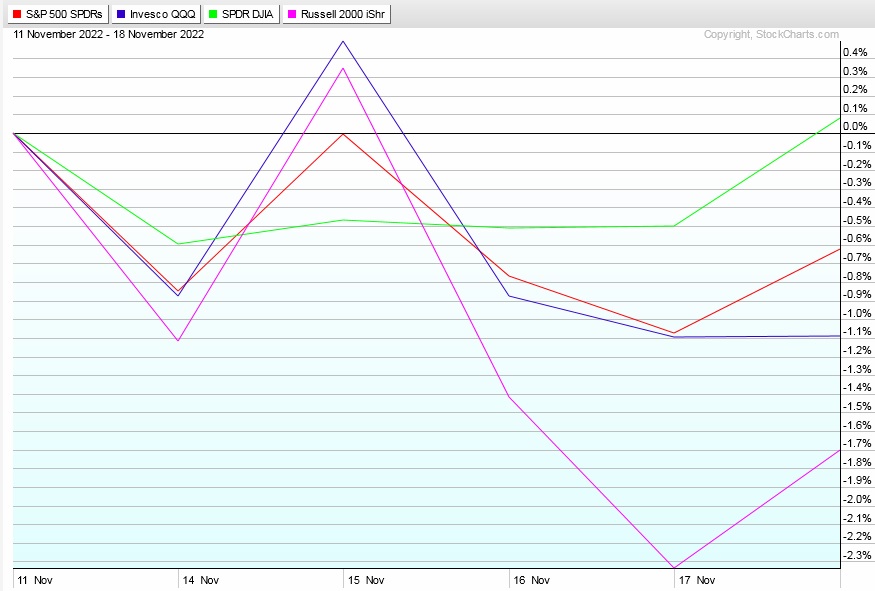

VI. Six month hybrid overbought

On Friday, November 11th Stocklabs went technical and hybrid overbought on the six month algo. This is a bullish cycle that runs through Monday, November 28th . It runs a bit longer due to a trading holiday for Thanksgiving.

Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“I saw an angel in the block of marble and I just chiseled until I set him free.” – Michelangelo

Trade simple, extract the edge

Comments »