Prepare to overshoot to the downside.

The fundamentals do not matter now, only emotion and forced selling by catamites who are now below maintenance. I did not buy today because I do not gamble. “The Fly” bets on sure things and partakes in ideas emanating from the stock gods, found inside and around his urinal shadows.

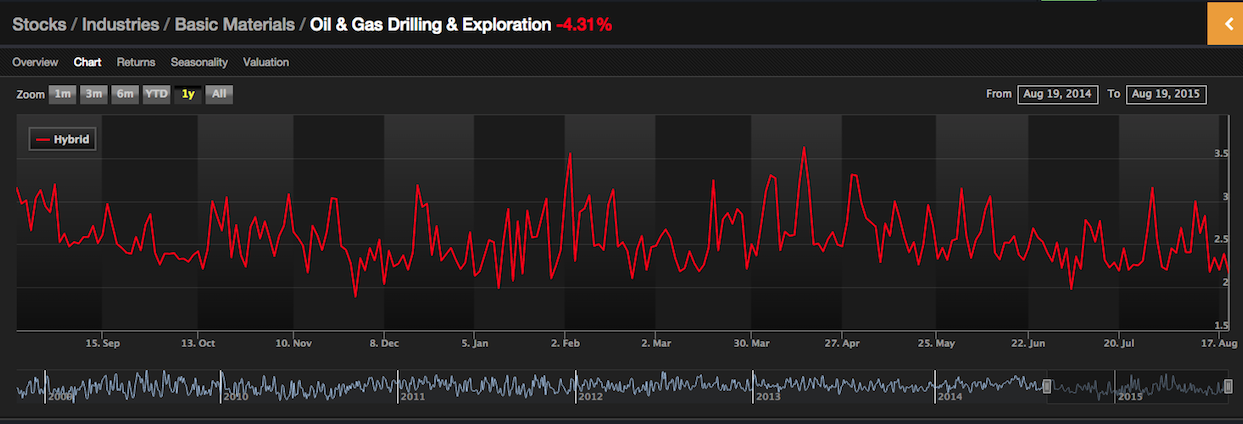

This is the worst two day drop since 2008. We are now off by more than 10%, marking an official correction, first time since 2011. More than 66% of stocks are down 10% or more and 25% are off by 20%, aka bear market territory.

The fears of China slowing are feeding upon itself and is causing people to reexamine everything. Bear in mind, this entire run higher has been based upon global growth. The civilized world has been stymied for quite some time and we’ve been relying upon savages in the far east to buy our wares.

Bottom line: we plunge lower, through the fucking floor boards, on Monday. Asian markets will get clobbered and disappear into thin air, as if they never existed. This is a very unique and special situation. I truly want you, as a novice investor, to appreciate the novela styled drama of all this. Take it in and learn from your idiotic mistakes.

As an aside, “The Fly” has been in a 50% (now 60%+) cash position for almost two weeks, having sold his largest position in GG yesterday. I stand before you a mountain amongst a field of pebbles. I endeavor to buy all of the blood and opportunistically bid for quality names, which I will outline in a special weekend blog inside Exodus this weekend, into the teeth of this monumental and memorable market calamity.

Good day and God speed.

Comments »