I’ve been blogging since 2002, on the finance side since 2005. Pardon me if I grow tired of reader bullshit, comments designed to stir my emotions. “The Fly” is a slab of granite amongst a sea of slime. None of you clown-rapists can hold a candle to me, not even one of you.

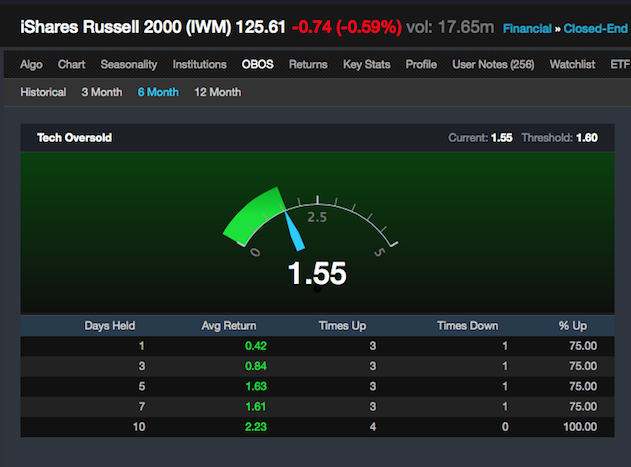

The market isn’t really down today. IBM and the misfits at UTX account for 100 of the Dow points today, so things are looking neutral. Speaking of which, if you ex out the largest capped Nasdaq stocks (AAPL, GOOG, FB, AMZN), the Nasdaq is barely up. The Russell is underperforming and the market has zero patience for companies growing fast on the top line, but offering very little on the bottom (extra Yelp).

I’m not a fan of GPRO here. I think the stock has run up a lot and has a shit load of new competition. It’s actually quite hard to stick with a name and not worry about the integrity of its earnings. I am sticking with SBNY because I have no reason to doubt their ability to crush numbers. Have you seen their revenues and EPS charts in Exodus?

Basic material stocks now make up less than 12% of the market. If that number gets down to 10%, buy with both hands. I am not a fan of oil here, or gold. However, I am a fan of gasoline. My top play for gas stations is TA. Demand is through the roof, thanks to lower prices.

I was very close to stopping out of CYBR yesterday. I was down 10% from basis and didn’t want to see it trade below $55. Lo and behold, it’s ripping higher today. The risk to CYBR, as well as all other high growth/valuation names, is its super high price to sales ratio. This company needs to demolish estimates, or it will feel the wrath of Mother Market. You should know this before investing in any stock trading north of 10x sales.

Lastly, I have some money to allocate, but find myself a little unsure as to where I might want to invest it. The market is taking on a tone of indecisive malaise. We might be setting up for a few weeks of grind, so prepare for that.

Comments »