The market knows all, at least when it comes to valuing high growth/profitable companies. Hedge funds employ the smartest men in the world, utilizing the best tools, in order to find these companies worth investing in. For the layman, like yourselves, it’s very hard to find “the next apple”. Often times you are prevented from buying future big winners because of valuation concerns. Some stocks, like AMZN and NFLX, stay expensive and rarely go down. When they do go down, everyone hates them and wishes their ultimate demise.

The true bosses will step in when no one wants them and take a long term position.

What is the formula for the layman to find “a future big winner?” Believe it or not, the criteria is rather narrow.

1. Pre-revenue dreamers: these are concept stocks, like biotech or fucking idiot technology, that will never, ever see the light of day–bid up by morons in a never-ending race towards hedonism–fueled by substance abuse. Whether these stocks make it or not is immaterial, as long as you can get out before the hype wanes.

2. Small capped shit: these are companies too small for that fucking lunatic (choose from the litter: Ackman, S.A. Cohen, Tepper) to buy because, well, they’re too fucking small. This is a good thing for you, the disheveled homeless guy with an E-Trade account. You can mosey your way into one of these fuckers and make a billion dollars, or not. Odds are, you’ll blow the fuck up in fantastically gay fashion. But maybe you won’t. But you probably will.

3. Pre-IPO/Private Equity, Venture Capital pyramid schemes: Maybe you have a contact at Union Square Ventures or fashion yourself to be an expert in social media, segueing your person into the inner-circles of Silicon Valley in a serious effort to rip off fucked faces from Morgan Stanley’s IPO whore department? Yes, indeed. This entails investing in cool tech/shit before regular people and enjoying the ride as Union Square and friends jack up the fucking valuation of your investment to 10,000x sales, and then getting liquid on stupid ass stock brokers at Morgan Stanley, gutting them in a widely acclaimed IPO, promoted by catamites at CNBC. If you don’t know Fred Wilson, odds are you will never, ever get to rip off brokers at Morgan Stanley.

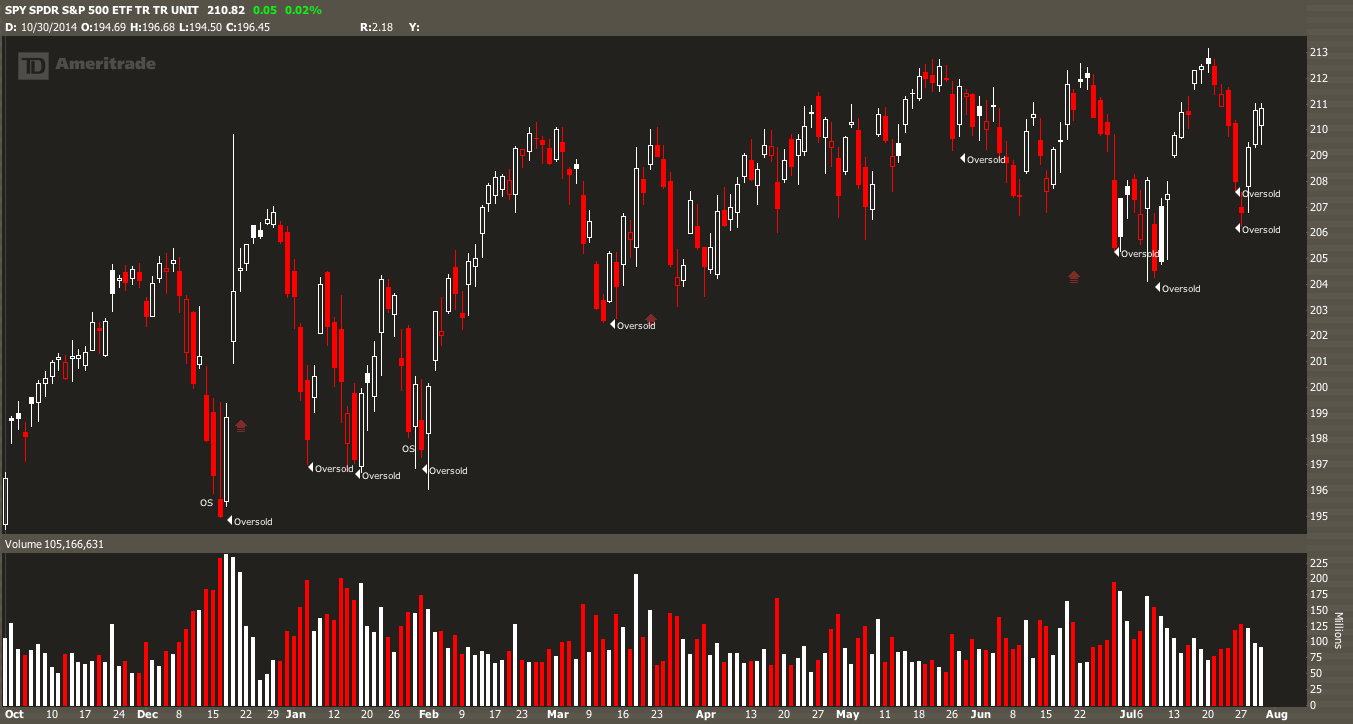

4. Distressed shit: Did you buy NFLX at $60, perhaps? I know that I did. This is one of the few ways the smart layman can brain power his kick-ass self into riches. Find shit to invest in that no one else wants and then watch sentiment turn from sour to sweet, as you kick short sellers in the nuts, all the way to the fucking bank…jank.

5. Traditional investment in free cash flow/ high valuation crap shoots: What the fuck is the difference between PANW and FEYE? I have no fucking idea, other than the fact that I bought one at $80 and rode it down to $45 and another at $80 and rode it up to $200. Growth appears to be the same and the industry appears to be doing well. I’ve resigned myself to the wanton idea that these high valuation winners are merely powerball plays of Wall Street, random careening stocks that intermittently cascade on occasion, in order to fuck the layman from the spoils of capitalism. This is, by far, the hardest way to get a big winner–because of the whack-a-mole nature of investing in high valuation, fashionable, plays.

I will be dedicating my research towards finding potential big winners. Unfortunately, I am not colleagues with Fred Wilson, so I will need to resort to olde fashioned luck and intellect to mark my path of glory.

Stay tuned.

Comments »