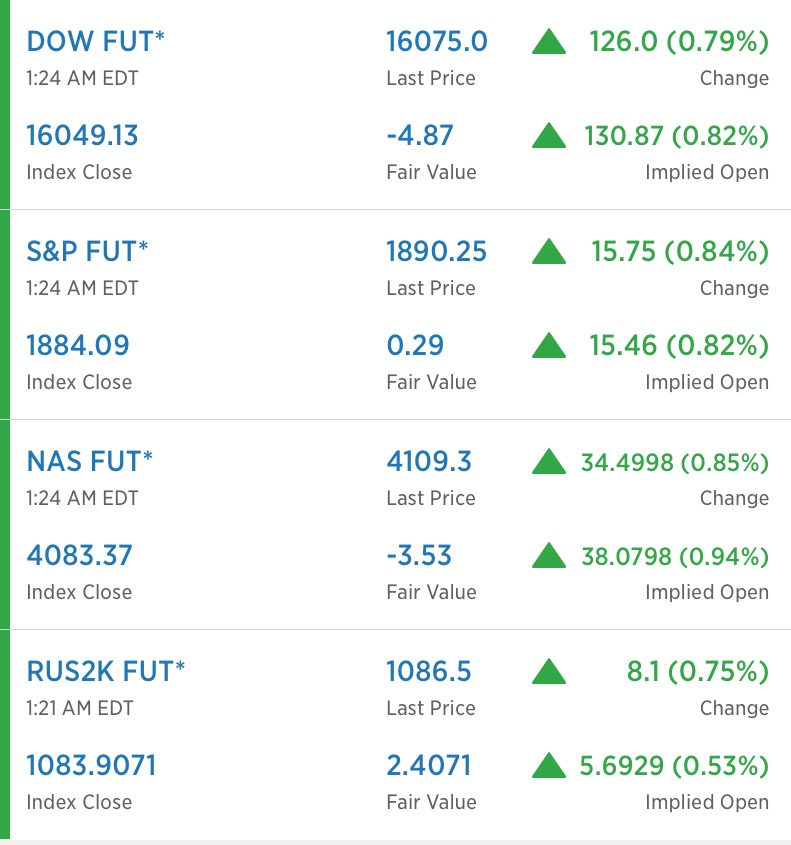

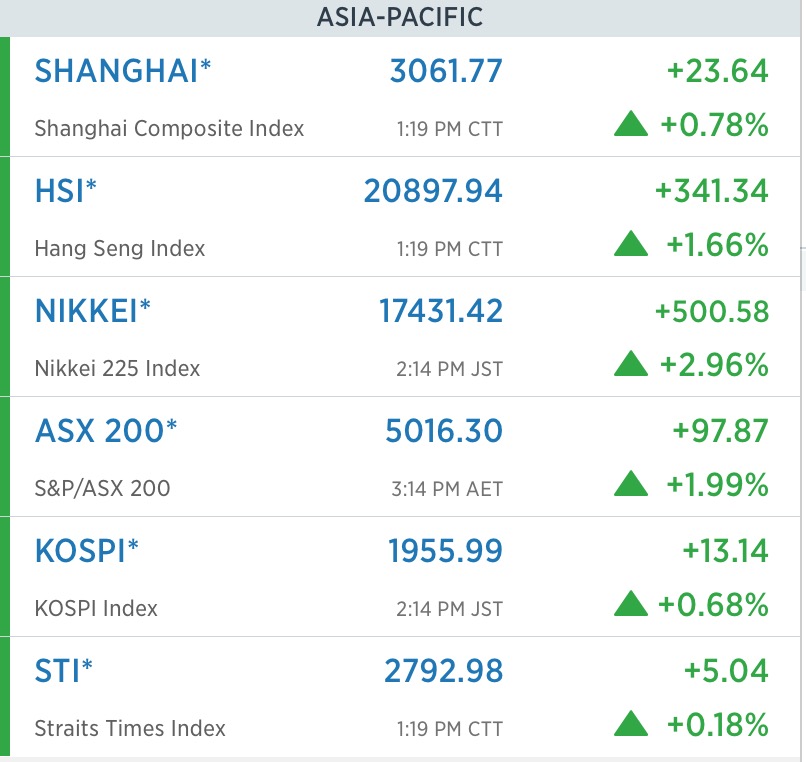

Asian markets are enjoying respite this evening and S&P futs are trading at session highs. If you’re short stocks, I hope you toss and turn this fine evening–and wake up to Janet Yellen vomiting into your fucking faces.

Comments »Is the Market Cheap?

Let’s have a look at some of the key players.

AAPL is trading 12x earnings, a 26% discount to its 10 year historical median. They are also trading at a 22% discount on a price to sales basis too. Their FPE is 11x. Based on the high estimates, it’s trading at 9x.

GOOGL is trading 29x earnings, a 6% discount to its 10 year historical median. They are also trading at a 5% discount on a price to sales basis too. Their FPE is 21x. Based on the high estimates, it’s trading at 18x.

MSFT is trading 29x earnings, a 74% premium to its 10 year historical median. But I think that number is screwy. On a price to sales basis, it’s trading at a 7% discount. Their FPE is 16x. Based on the high estimates, it’s trading at 11x. The 10 year historical median PE is 17.

WFC is trading 12x earnings, a 9% discount to its 10 year historical median. Because it’s a bank, we’ll be looking at its p/b ratio, which is 1.53, a discount of 4%. FPE is 12, based on high estimates 11.

AMZN isn’t interested in making money. Therefore, its PE is negligible. On a p/s basis, it is trading at 2.46, in line with its 10 year historical median. I haven’t the slightest idea how to value AMZN.

DIS is trading at 20x earnings, a 12% premium to 10 year historical median. On a price to sales basis, it’s retardo expensive, more than a 70% premium based on a 10 year median. It is, however, in line with the new valuation that Wall Street assigned it the past 3 years. FPE is 17, a slight discount to the 10 year median.

I can do this all day, using the Exodus platform. I’ll end it with WMT, which is trading at 13x earnings, a 13% discount to its 10 year historical average. Based on p/s, it is trading at a 16% discount. And, finally, they have a FPE of around 13x.

The overall market is trading at 18x earnings, the lowest since 2012. On a price to sales basis, stocks are cheap at 1.78x, the cheapest since 2012. The p/b is at 1.87, again the lowest since 2012.

In short, stocks are only cheap if the earnings aspect of the PE remains constant. If earnings are to be drastically cut back, stocks might have a rough ride over the next 6 months. By all measures, stocks are moderately priced, not even remotely close to the excessive valuations of 2000.

Comments »100% HORSESHIT

Human beings don’t trade like this.

Fuck the robots. Next time I step into a Brookstone store, I am going to bash every single robot to pieces.

Not to get all emotional and shit here, but I really wish every single bear out there falls victim to electrocution or arson…TONIGHT.

Comments »IT LOOKED LIKE…THIS

This is the worst market I’ve ever seen. I do not mean today, or the past 2 months. I am talking about the past two years. No other market, in all of my years in Wall Street, have behaved in such an erratic, unpredictable manner. Sure, there are opportunities to buy and sell; but the moves are too violent to go to sleep at night with confidence.

At least back in 2008-2009, it was literally end of days trading. I was accepting of the declines, and shorted it for most of the way down, because it was a fat pitch. This decline is methodical, done one sector at a time, one small cut after the next until the patient bleeds out. Being a student of the market, I know this is typical behavior of a bear market and I shouldn’t make a big deal about it. Stocks go up and then they come down. If you’re able to withstand the barrage, you will most likely come out the other end intact–providing you have the faintest idea how to structure a portfolio.

Over the past month, 587 stocks are down over 20%. Think about that for a moment.

The problem with downward spiraling markets is the debt. Once the stock market is impaired and companies who need cash are unable to price secondaries, bankruptcies happen fast. I suspect we are about to see a lot of tumult in the oil sector soon. But there are others who will be hurt in the process. So many of our lauded tech names are running deficits in a good economy. If this economy is about to turn lower, those clowns will be pounded into dust, their share prices stripped of all value, and their investors tossed off the cliff of Moher–into the rocks for the birds to pick at.

Comments »MARGIN CALL TIME

This is a very sick market. There are lots of courageous bears out there with spears, trying to harpoon a few weak bulls. Be careful out there lads, for the woods are dark and dangerous.

Perusing over the market, I am intrigued over big biotech. Stocks like BIIB, GILD, VRX and AMGN are trading at very low levels. And let’s face it, the price of their drugs aren’t going lower either, no matter what Clinton says.

In the case of CELG, it is now trading at a 17% discount to its historical median PE ratio.

Without a doubt, the tone of this market is one of a bear market. It ropes you in, hoping for a bounce, almost praying for it. Ultimately, considering there is over $100 billion in distressed oil and gas debt out there, we go lower. The slippery slope of that debt is insidious–because the lower oil and gas stocks go, the more distressed the debt becomes. Reminds you of the 2008 credit crisis, no?

Having said that, even if there is 30% downside in the tape, we will bounce first, furiously, luring a fresh set of investors into a long trade.

For me, risk, or lack thereof, is being measured in real time in the shares of GILD and PANW. I really would like to tell you “you’re all fucked” and how the planet is cosmically fucked like nothing you’ve ever seen before.

But I think we bounce first. Shit, I might just say this every day for the rest of my life, the way this non-sense is shaping up.

Comments »BIOTECH STOCKS ARE BEING RAIDED AGAIN

The sector is now a source of funds for clown raping short sellers. An entire industry has been pounded into dust, in little more than one week since Hillary Clinton cried foul over expensive drugs. This of course was all initiated after that bozo from Turing Pharmaceuticals decided it was his God given right to kill poor people.

Data provided by Exodus

THE DENNIS GARTMAN COMMODITY BOTTOM?

Once every thousand years, the immortal gargoyle known to you as Dennis Gartman makes a great market call.

Just yesterday he told you to not be short of commodities, for he felt the money has already been made there. Instead, he’d greatly appreciate it if you were long of commodities, preferably in yen terms, so that he might execute his one great call per millennia, as transcribed in the New Testament.

Gold stocks are up 2.2%

Oil stocks are up more than 2%

Hell, silver is up 2%

Even steel stocks are up 1.2%

Even still, I don’t trust anything about this market. The margin clerks haven’t made their rounds yet and breadth stands at a paltry 58%.

Make no mistake, this is a very tenuous rally that could easily unravel and get ugly fast. If we are to bounce, there is a solid 500 points of upside left, so there’s no reason to rush in now.

Comments »Markets Visited Depths of Hell, Then Reversed

Look, I’m in this thing on the long side, one way or another. I will not sell out here, at extreme oversold levels. I’d rather fucking die, literally. In my last post I laid out a scenario that might be playing out now.

We entered the opening tick with hope; futures had been up around 70. Immediately, biotech stocks, a leadership group to the upside and downside, underwent severe selling action. Then the whole market followed it down into the pits of hell, plunging the NASDAQS down 22ish.

I published my post, went to go get a swig of cyanide (I am building an immunity to it) and voila, the fucking NASDAQ is up 22!

Now this is a text book key reversal, one that might mark a near term bottom. Or, this could be a god damned trap, one that ropes us into a false sense of hope, then drops the dick guillotine on us like a motherfucker.

Either way, it makes for interesting conversation (awkward smile).

NOTE: GILD and PANW are your risk barometers.

Comments »Three Guys in Pajamas Led Us Astray

Where is that grandiose 100 point snap back the futures market promised us? Right now we’re about flat; but the under current is negative. Those 3 guys in pajamas that Cramer has talked about, always playing with our futures markets, have done it again.

Biotechs are being hit, once again. It feels as if nothing can pull the market out from its doldrums. Then again, every single downturn that I could remember felt the exact same way. Eventually, you give up hope and quit calling for bottoms. At that point of indifference, the market will rise, catch everyone flat footed, then proceed to bash in the fucking skulls of all of you who were so mean to it, selling it short and casting aspersions, releasing midnight bearshitter movies on the internet (extra Icahn) and the like.

This is a depressing time to be a bull, or anyone who manages money on a professional level. Bear markets and recessions are man-made creations of abject idiocy, formed from paranoid thoughts and projected depression. They’re almost self fulfilling prophecies, so don’t discount the offal you see and hear on the teevee, for eventually the fantasy will become reality and all of your money will be gone. Poof, right into Jim Chanos’ purse (extra homo).

These drawdowns are expensive lessons and thw Dow is now off 50 and the NASDAQ is off by 20. The stories might be imaginary; but this fuckery is real.

Comments »The Market Set to Bounce: What Could Go Wrong?

Dow futures are up 98 and some little piker company, ticker PNX, just got bought out for an outrageous 169% premium.

Europe is moderately higher and of course Asia got crushed. Let’s see if US markets can lead the way out of the seemingly never ending spiral of margin liquidation, or continue to circle down the toilet bowl.

Comments »