We all should have been aware that this brief “retreat” on the stock exchanges was a perfect opportunity to buy more shares of all of our favourite (sic) stocks and ETFs at reduced prices. Looking at the futures this morning, I am seeing lots of green…big surprise.

The country was obviously starting to crumble at its very foundation upon the thought of three consecutive days of stock market losses.

Rumor has it that normally clean shaven men (and women…though I can’t speak to that) have been seen roaming the halls of the Federal Reserve, faces adorned with the first signs of stubble. Evidently a mandate has been passed down from on high that, for the love of man and country, beards will be required for the foreseeable future as a sign of “solidarity” in the face of this latest economic calamity. Members of the 1982 New York Islanders have been hired as consultants to help guide them through this transition.

As an aside, I would love to join in the cause, but Mrs. ElizaMae (an oxymoron, no?) has passed her own anti-beard mandate following the 2011 Super Bowl, stating that “growing a beard out of superstition is stupid idea” (forgive me, I’m paraphrasing a bit here).

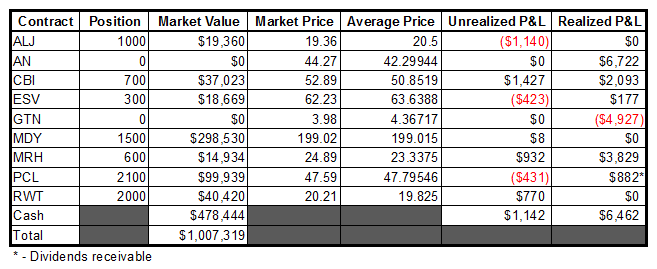

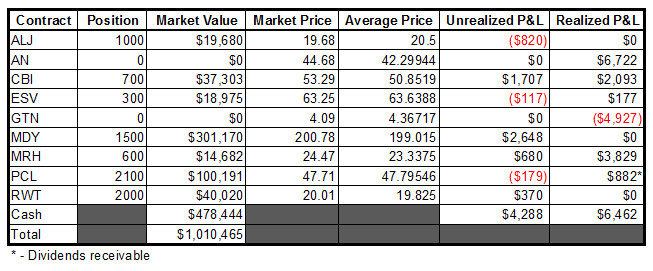

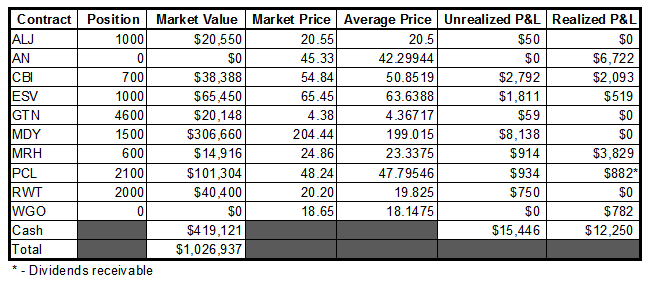

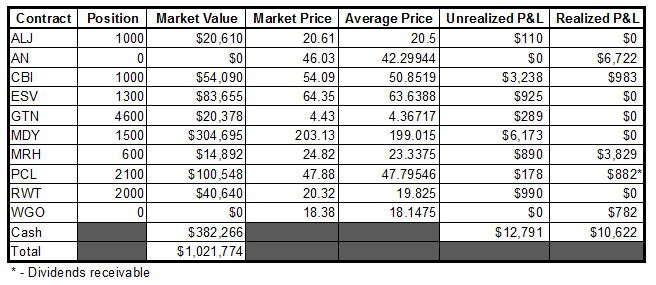

My portfolio continued to receive clawhammers to the skull in quaint early-day trading yesterday, though things stabilized later in the day, but I still finished the day off by a decent margin. Aside from my idiotic mistake of holding a full GTN position through earnings, an oversized position in MDY has been a significant contributor in the violent fluctuation in portfolio performance since Wednesday morning. Here are some brief notes regarding my positions:

- If my cost basis on ALJ wasn’t in the mid 20’s, I would be much more enthused by this pullback as a buying opportunity. As it stands, I’m not all that eager to average down on an already underwater position, so I am more likely to wait this out than I am to buy more shares…probably to my detriment.

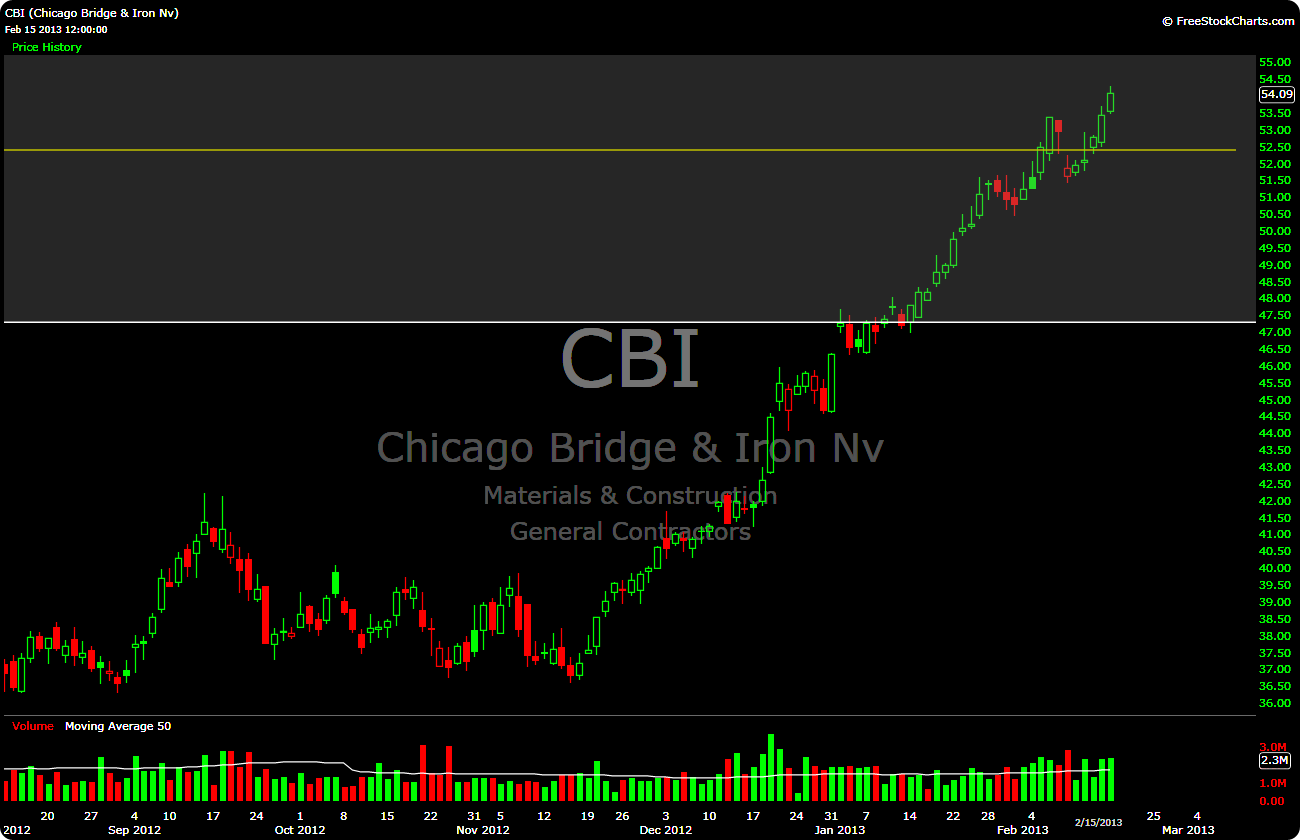

- I really should be buying more shares of CBI, but earnings are next week and I’m more content to just hang on with what I currently own versus buying more, only to have to sell by next Wednesday. Unless we are looking at an extended pullback here (and I don’t think that we are), data from The PPT suggests that this would be a good place to add.

- There was some interesting post-earnings action yesterday in ESV. Now that is out of the way, this could be a buyable dip, though I would like to see the range of prices lessen significantly before feeling better about adding shares. My cost basis could be lowered nicely here, but I’m still feeling a little nervous following Wednesday’s bloodbath.

- I am content with my positions in MRH, PCL and RWT and will just let the market do what it wants with them for the time being. The patterns they have etched out with “markets in turmoil” are not those that I have a great amount of confidence in trading…so like I said, I’m going to sit and wait.

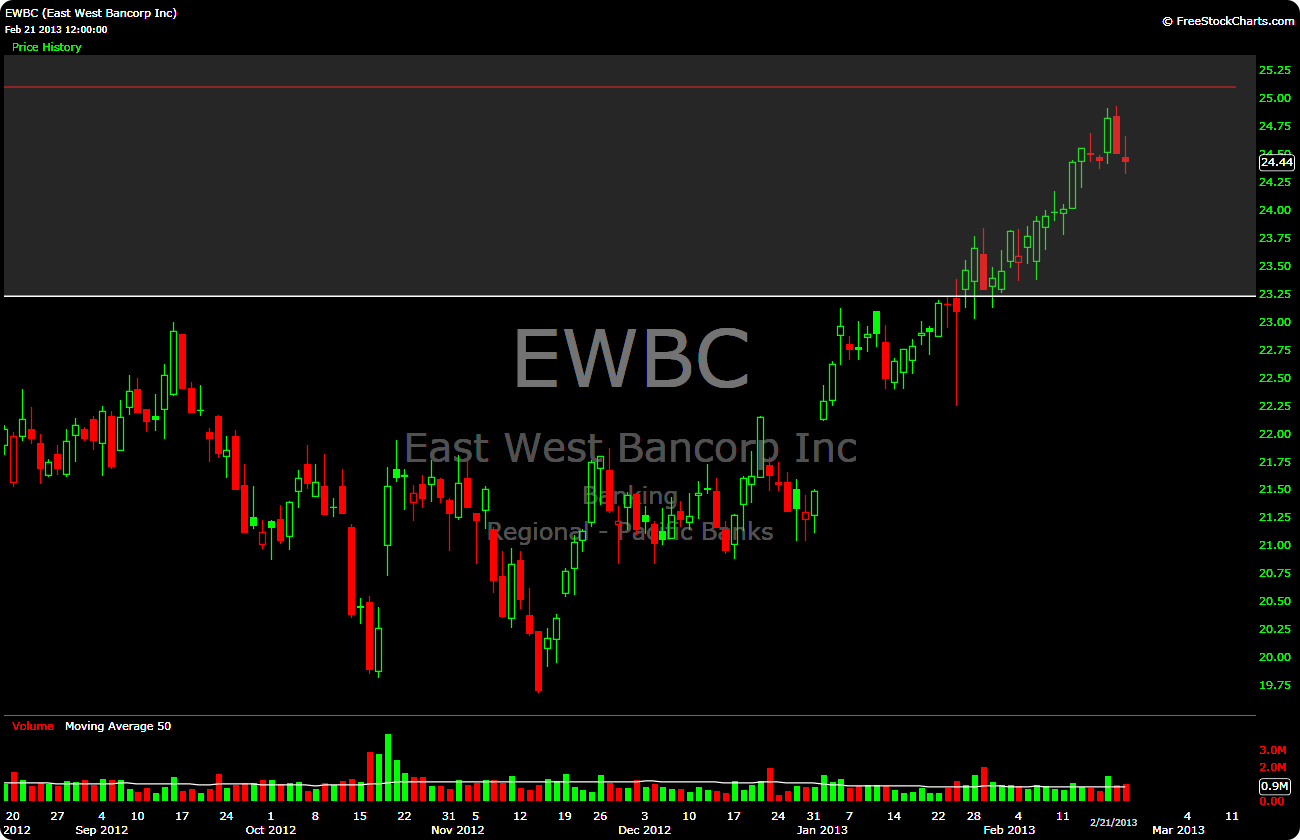

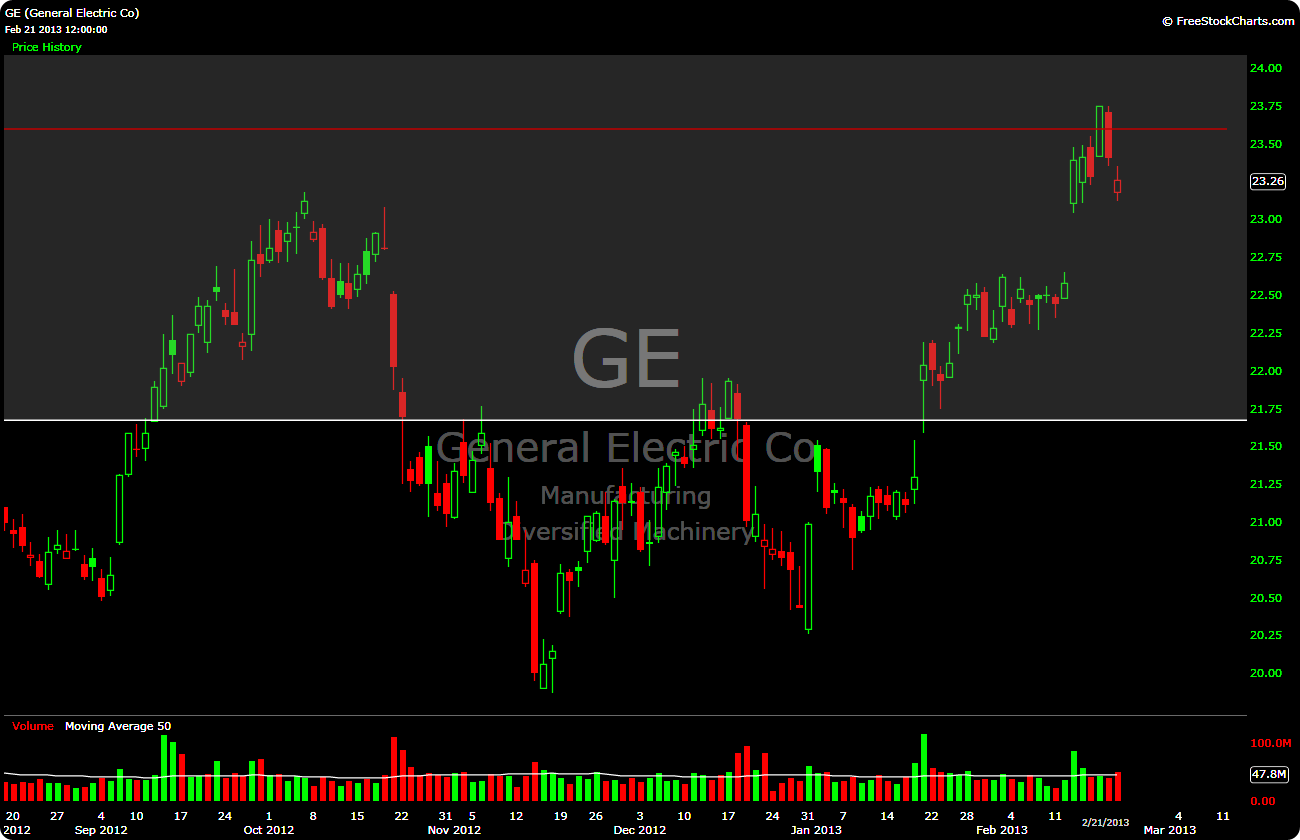

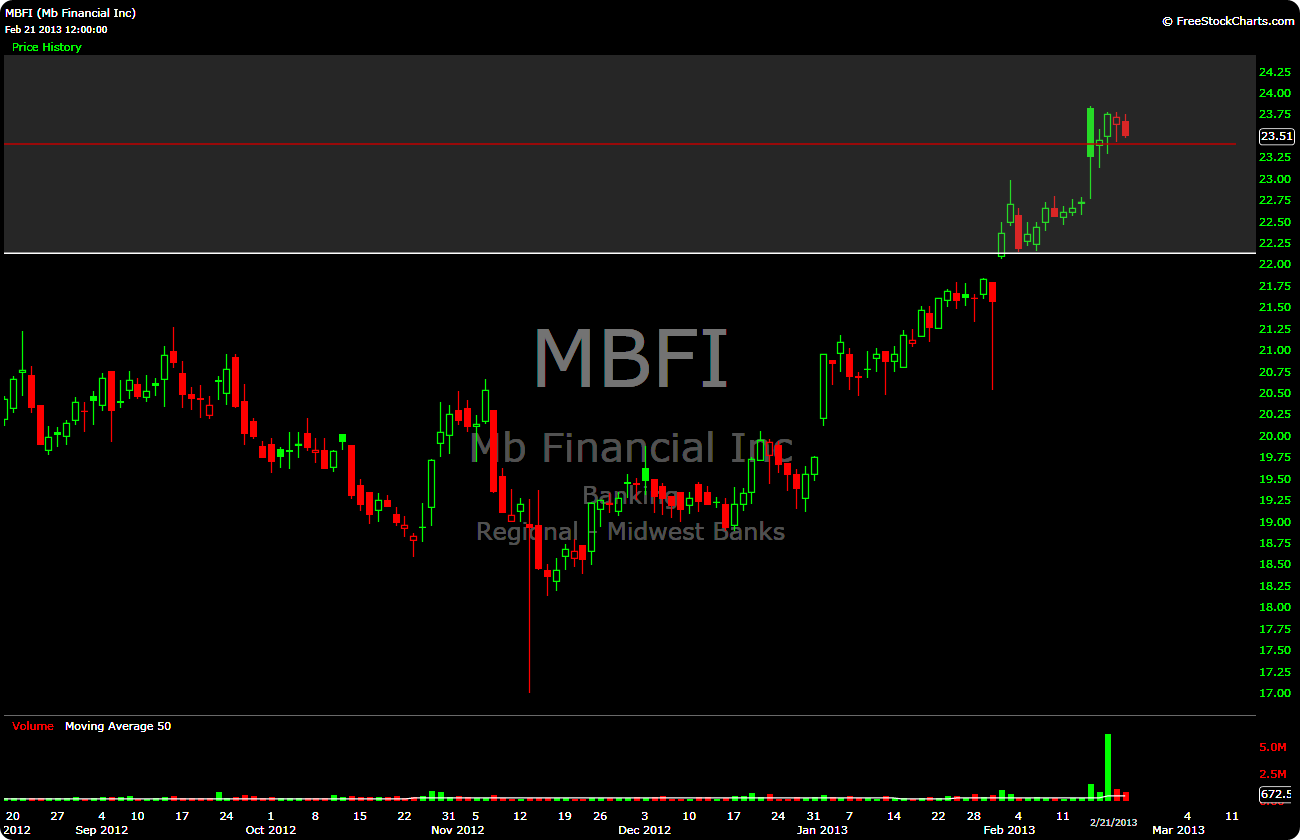

There are a number of other stocks that I am interested in buying…you will be the first to know if and when that should happen. Try to contain your excitement.

-EM