No joke, this is a big part of my job.

Basically, when a developer wants to build on a parcel of land, my job as a Traffic Engineer is to go out and study the ‘intersections of impact’. A significant part of this process is obtaining turning movement counts at each intersection of interest to determine existing conditions during the AM (7-9), PM (4-6) and Saturday (11-2) “Peak Hours”.

Yes, it is more advanced than sitting there making tally marks on a piece of paper, but the “count boards” that we use are still pretty antiquated devices. Basically, there are 4 approaches (N-S-E-W) with buttons for three movements in each direction (left, through, right) and one for pedestrians. Every car that performs a certain action I push the button that denotes that action.

Sometimes there isn’t much traffic at all and I even have time to read a book. Other times, shit gets hectic. The closest thing I can relate it to is playing “Rock Band” or “Guitar Hero”. The cars just keep on coming and I have to do my best to try and pay attention and document everything. Today was/will be one of those days.

Anyway, we use this data to project (based on growth rates) how the traffic will grow when the development is complete and (usually) 5 years after that. Then we add in the traffic that the land use typically generates and can (somewhat reliably) predict how the development will impact the traffic in the area.

Fascinating stuff, I know (well, it actually is to me…but I’m a dork, so…).

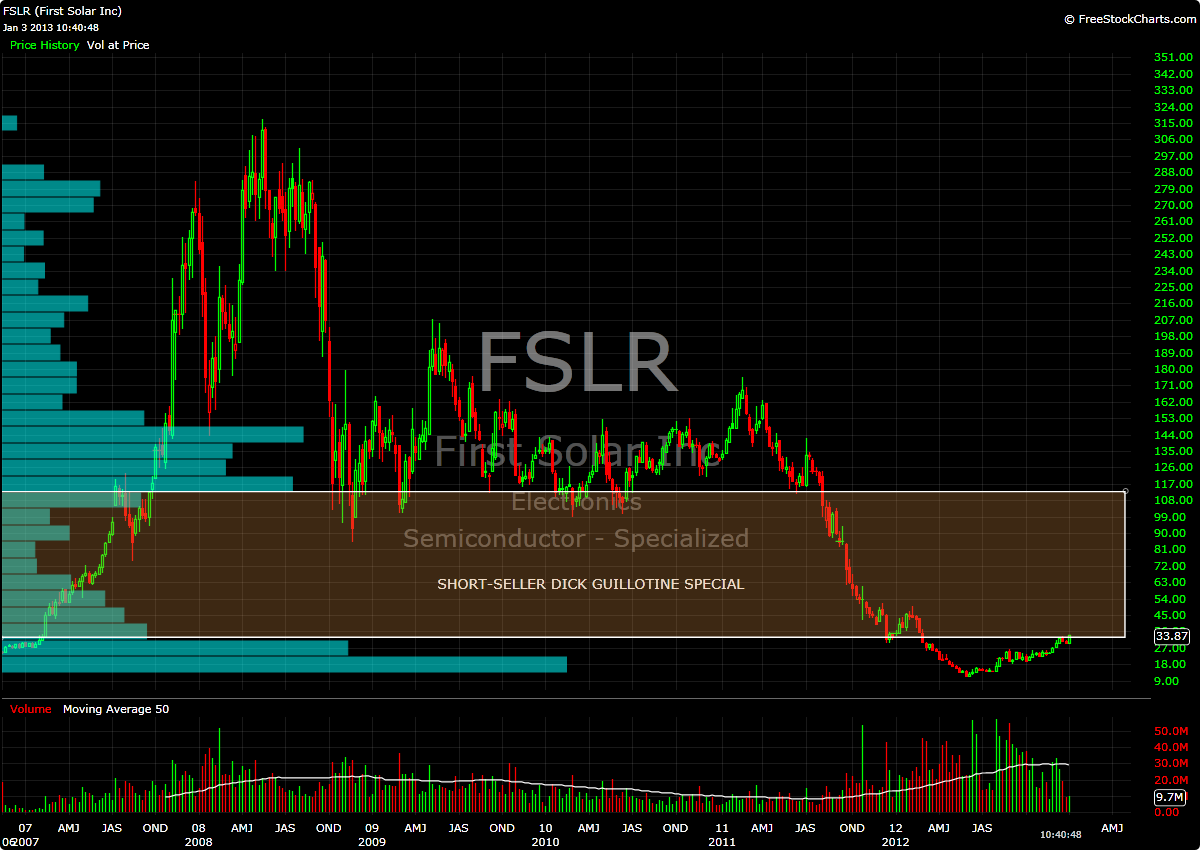

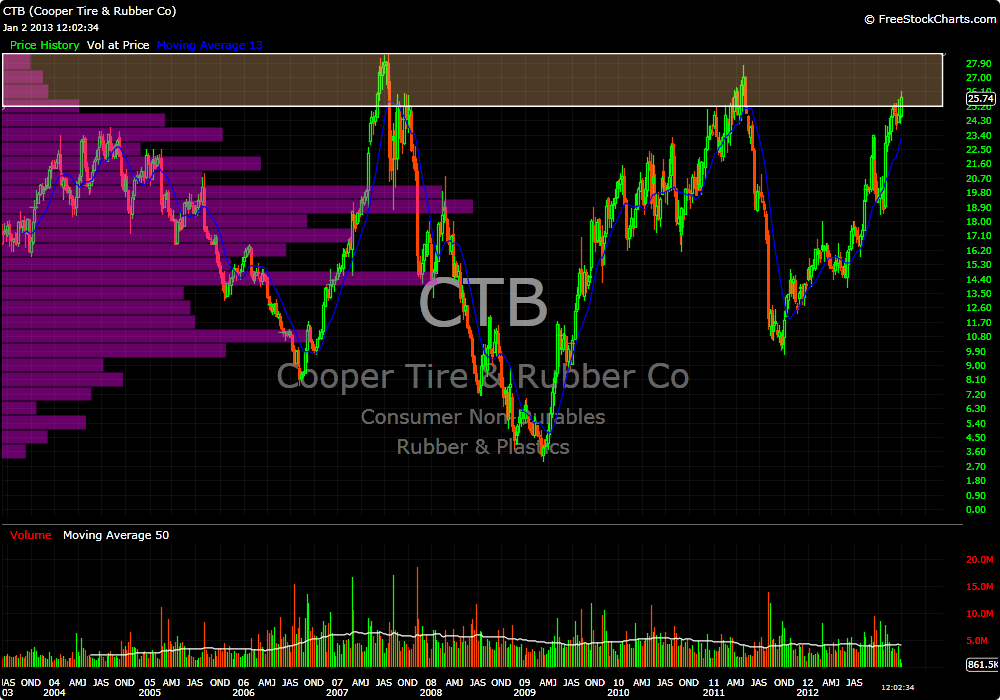

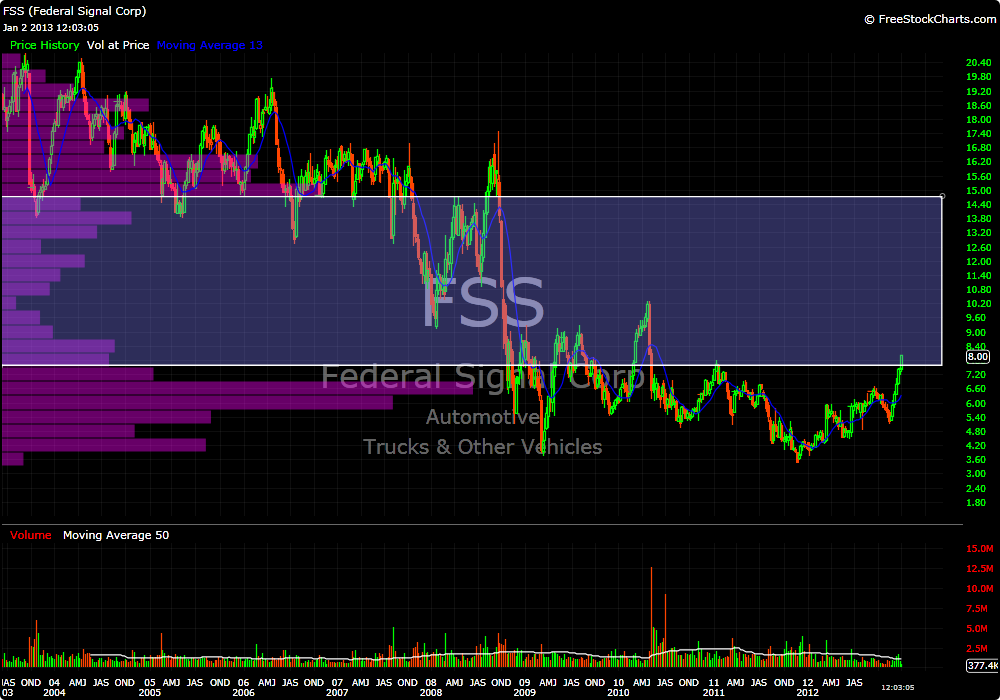

Unfortunately, the downside is this keeps me away from my computer for most of the day; therefore my ability to blog and monitor the market is limited. In the meantime, it doesn’t appear that I am missing much anyway…other than the market continuing to rest and potentially giving me some opportunities to buy.

Until we meet again.

-EM