…nothing has changed…

My apologies for the lack of content of late…but really, what is there to comment on? We have essentially gone nowhere since my last post almost three weeks ago.

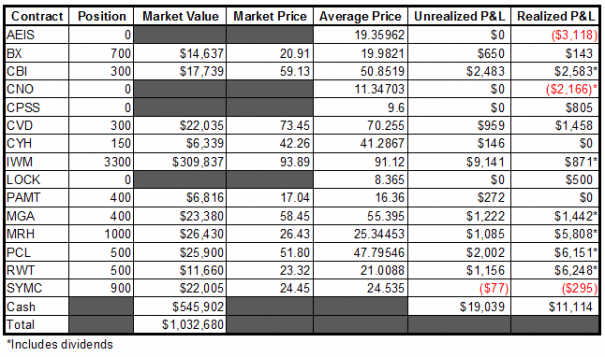

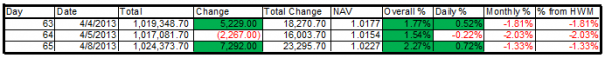

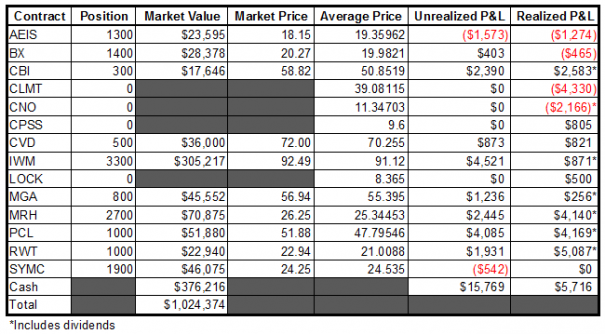

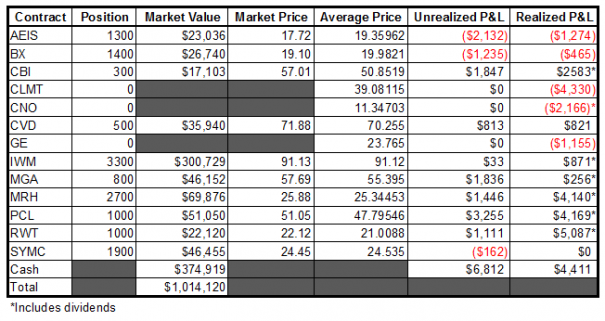

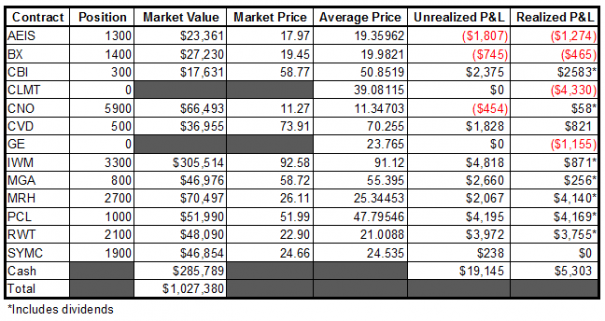

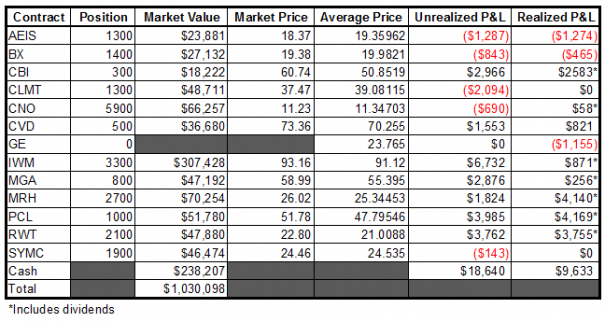

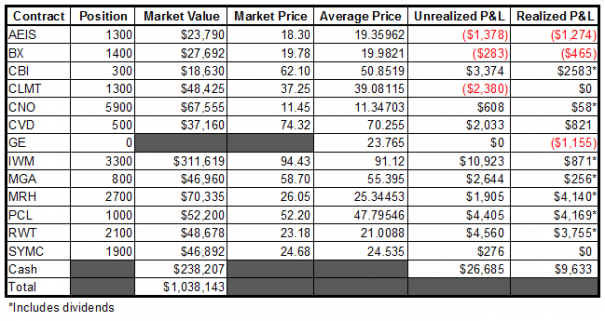

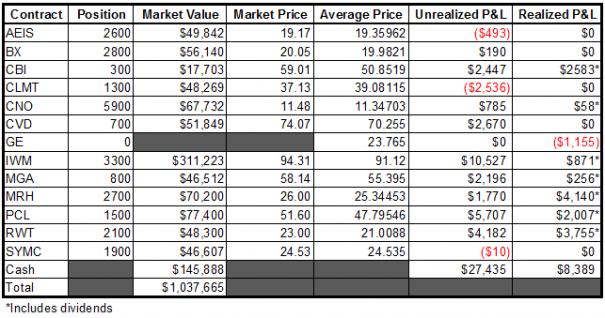

Additionally, I have not made any (as in ZERO) adjustments to the core holdings of my portfolio, letting the ebb and flow of the market take these positions where it wants to. (which, coincidentally, was briefly into the red for the year and is now bumping back against all-time highs).

Now that we have made the roundtrip into the depths of hell (aka a 4% SPY “correction”), I am back to provide some thoughts on where I believe this market is headed.

The money to be made on this latest surge was discovered by growing a pair and buying when things looked worst. Just think, two weeks ago, we had a pair of retarded Chechen brothers setting off explosives in crowded streets in order to kill/maim hundreds of innocent civilians, fertilizer plants blowing up, and the aforementioned Chechen asshats on the loose and shutting down a major northeast city.

The market had all the makings of a sinister and swift more lower.

Please…don’t be naïve, this shit is never that easy.

As mentioned, we are now back to having our mugs filled with the finest ambrosia, gleefully bidding up the price of any and everything we can get our hands on. Just wait until those stops in the high 159’s are run on $SPY, this market is going to 1700 in short order.

Do I really think that will happen?

Answer: no, I do not.

I think we are likely going to take out the all-time high on the S&P, but I have little doubt that we will run out of gas soon afterward.

Then the selling will begin.

The selling will continue for a few days, ripping to shreds anyone who was bold (read: stupid) enough to go long at the very top, thus leading to everyone getting all crazy and scared and the doomsday theorists will all crawl (back) out of the woodwork and proclaim about how THIS is the real one, the big one, and we had better make preparations for DOW 9,000. Then things will look extremely bleak, like, if one more bad news item hits the wires, the market will be headed to a -1,000 day…oh wait, we have already covered this scenario earlier in the post.

Basically what I am getting at is this: I believe the upward momentum in the market has reached a peak for the time being and we have entered a range-bound trade. Right now, the upside is known…I think the downside will expand in the coming weeks.

I will continue to tread VERY lightly here with my cash levels hovering around 55%. #Knifecatcher continues to make system based trades (currently long only WHX), but those are completely unaffected by my opinion and other useless subjective measures.

Until next time.

-EM