I guess this is where I thank everyone at iBankCoin for the opportunity to have my work featured here on the main part of the site for 2 months.

I have to say, the experience has been most enjoyable and I am grateful for all of you out there who have taken time out of your busy days to entertain my thoughts on a daily basis.

Initially this started out as a popularity contest, one in which I felt like I was strung out and basically publicly humiliated in front of all of the readers of this site. Some random person emerges days before the “election”, someone who had contributed a handful of posts (none of which had anything to do with the stock market, mind you) in the months leading up to the election, and all of the sudden this person vaults two ensconced members of the blogger network, thus pitting us against one another in a special “run-off” election.

As you probably know, I lost.

To suggest that I was EXTREMELY bitter would be one of the great understatements of our time, but I kept my trap shut and accepted my fate as nothing more than a pawn in this game. Thus, yes, I had reservations when Jeremy asked if I would like to contribute, but decided that I would give it a shot anyway. I sucked it up and buried any hard feelings that I had and was determined to give it my best shot.

Rhino, Raul and I were provided a traffic monitoring site to determine if we were meeting the 3% threshold. Throughout the month of January, I was hitting refresh repeatedly on that screen, banging out a total of 100 posts in the month. Those stats suggested that I was well above the 3% threshold.

Then on January 31, we received an email from Jeremy suggesting that, according to some new stats, in fact, we were well below the required 3% threshold. Very discouraging news to say the least.

It was at that point that I came to the conclusion that there was just not enough time in my day for me to do the necessary work required to attain (let alone maintain) 3% of the readership. The writing was on the wall, I knew that this day would come eventually…so I have braced for this moment for a while and have come to peace with it.

I am grateful that “The Fly” decided to make it a swift execution and not drag this out through more elections or other suchness. I appreciate that.

So the question of where do I go from here is up in the air. A return to the blogger network is in the cards, but I also ask myself: “what purpose will that serve?” Yes, I have built a small, but (seemingly) loyal audience here. I have had my chance in the “big leagues” and I was not able to meet the required numbers, so it’s not like I will be able to perform at a substantially higher level in the future with my life in this current configuration.

I enjoy writing more than anything, and I feel like this experience, whether or not it has reflected in my P/L thusfar, has been hugely beneficial to my trading. Thus I do not want to lose the momentum I have built over these last two months. I guess all I can say is: stay tuned.

Thanks again to the crew here for the opportunity, I really appreciate it.

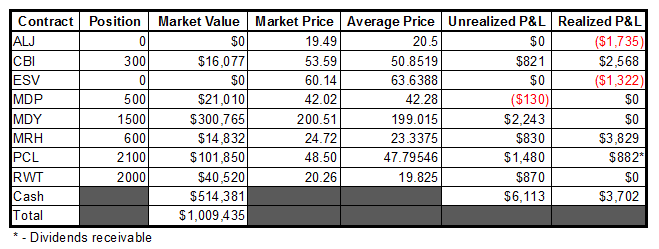

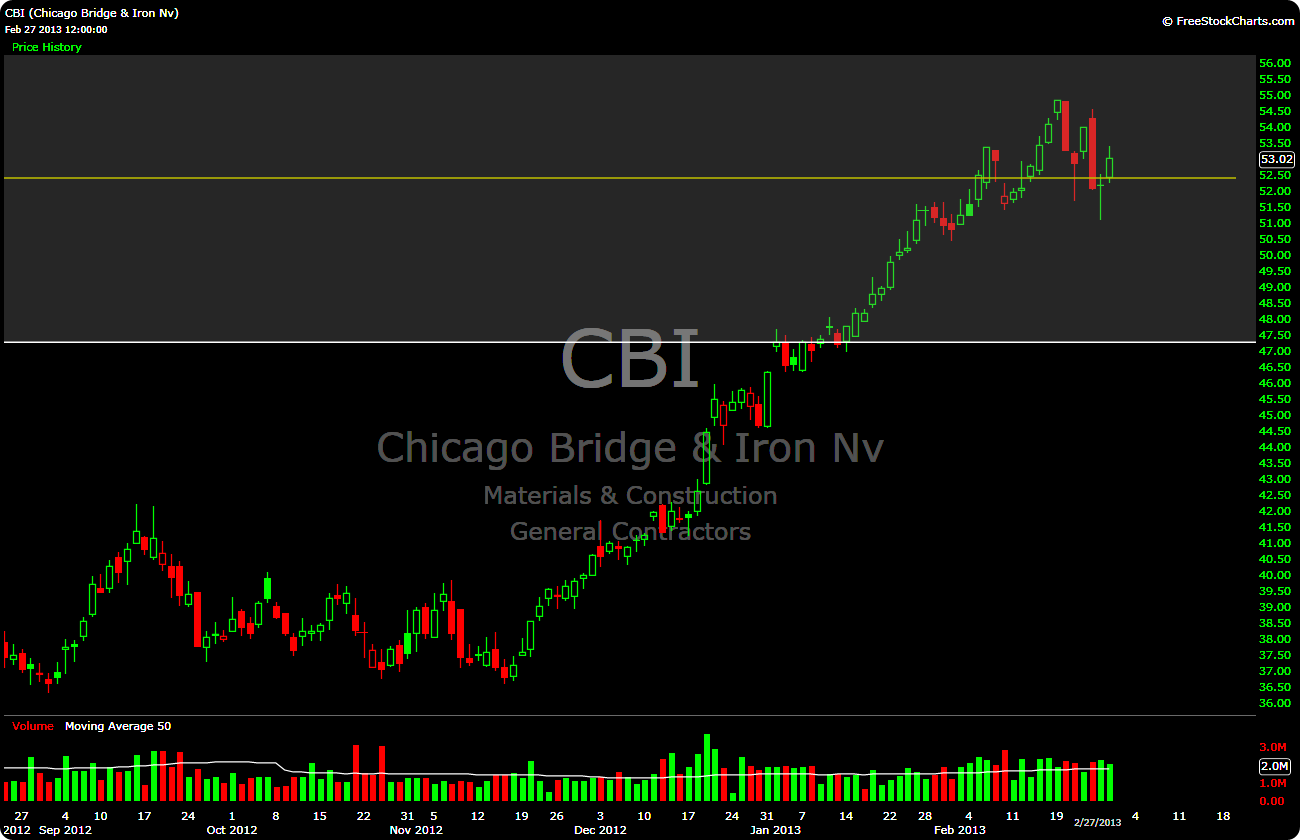

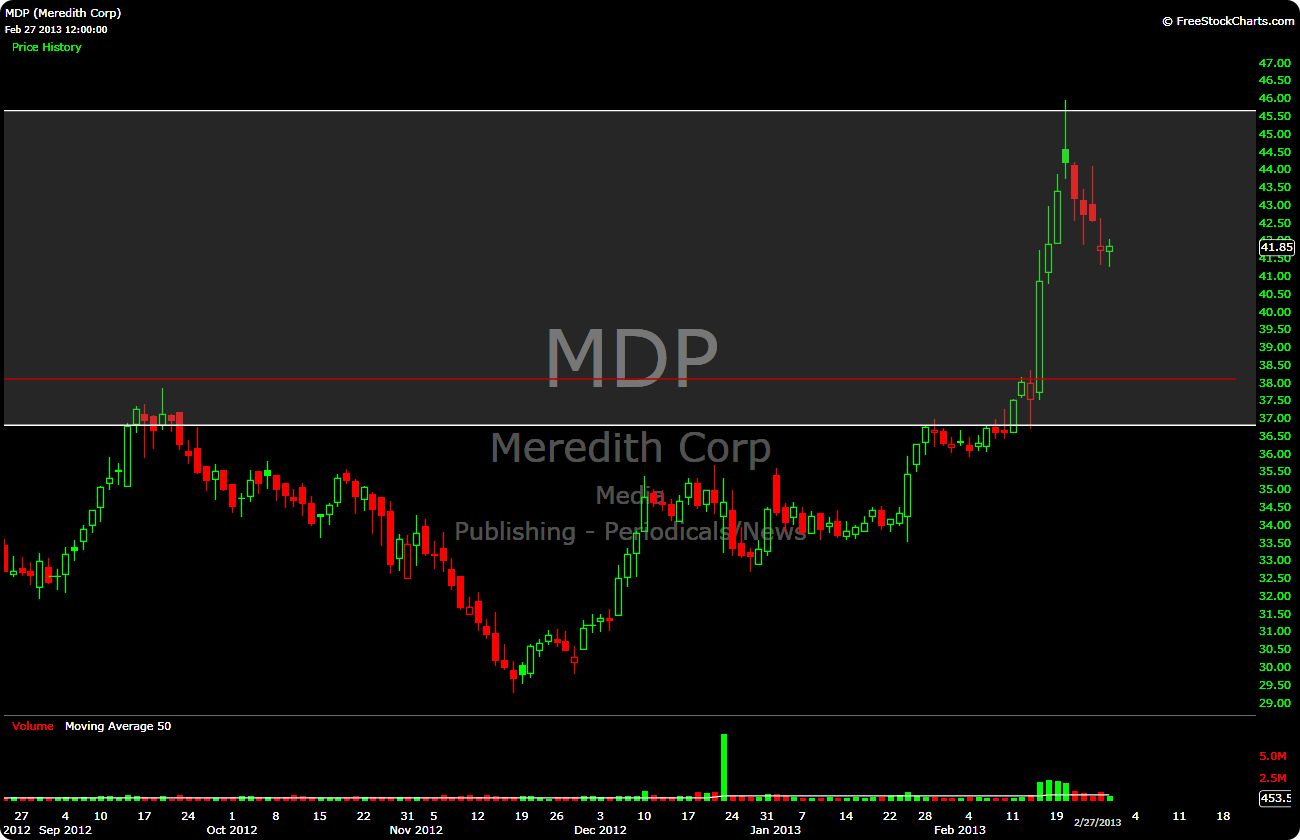

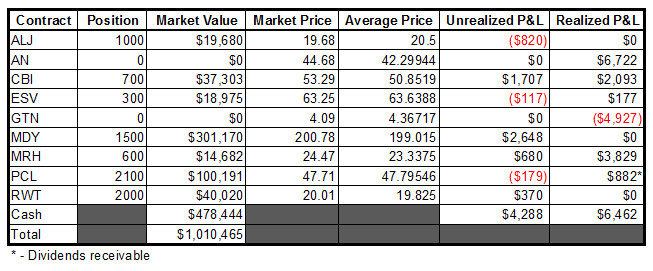

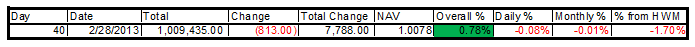

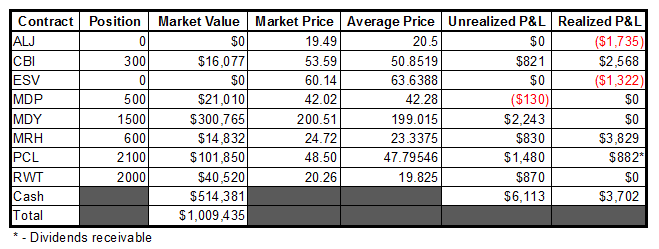

Here is how my portfolio looks at the end of February:

-EM