Instead of regaling you with tales from the House of “ElizaMae” aka: The Infirmary, lets speak for a moment about the current state of affairs on the stock exchange and how it relates to my portfolio.

Last winter I missed out on the incredible move in AAPL…errrr the stock exchange, from October – March.

In 2013, I was not to make the same mistake. After “solving” the fiscal cliff, the only trade was to go long. To my detriment (in performance only), I have remained relatively cash heavy throughout this perpetual melt up. Not out of being defensive mind you, rather because I was implementing a new strategy and am waiting for the setups to come to me.

As an aside, I think “paper trading” is a bunch of baloney (aka “jumbo”, for those of you familiar with the Western PA colloquialism). You can never experience the pain of losing through paper losses. If you have ideas, start with small positions to test your theories. Make sure that you can scale them into larger positions should they prove to be successful.

Leading back into commentary about my portfolio, this is the essence of why my cash has been “heavy” and my positions “light”. Granted, it is not difficult to gain confidence when EVERYTHING goes up every day.

I am 100% sure there are new geniuses anointed amongst the pikers on Twitter each and every day with their epic “calls” of market winship.

Nevertheless, we have been in the sweet spot for a while, my only hope is that my fellow compatriots here have benefited from this incredibly easy market and can realize some gains. It won’t last forever, so “get it while the gettin’s good”.

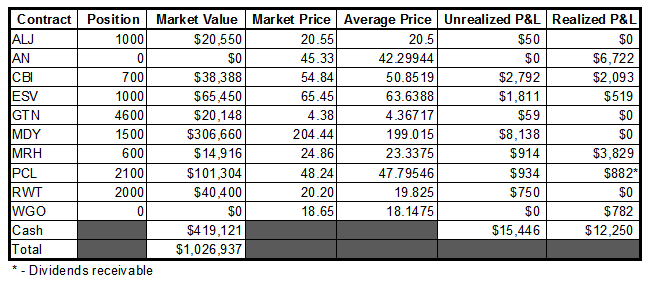

Some notes regarding my positions:

- Since breaking through 20, ALJ has used that level as support on two occasions now. If you have read my blog with any frequency, you know that I respect the power of round numbers. I think this is meaningful in either direction (support, or if it breaks below 20 with emphasis on a closing basis).

- CBI continues to “sashay” higher, and I continue to sell off parts of my position to lock in profits. I am comfortable letting the remaining shares that I have run for now and will look to buy this stock back on dips. If you follow these updates and/or are a subscriber to The PPT, you will know when a good time to buy/add to this name. Earnings are next Wednesday (2/27).

- I wasn’t able to have my limit sell order filled in ESV last Thursday and then had to sit by and watch the stock retreat on Friday. Yesterday provided me another opportunity to realize some gains (at an even better price than I had originally tried to sell at), and I did just that. This afternoon I will continue to reduce my position as ESV reports earnings before the bell tomorrow (2/21).

- From the looks of the daily chart, I was a day early on my GTN add. I really like this stock here. UPDATE: DAMN YOU TO HELL YAHOO FINANCE FOR INITIALLY TELLING ME THAT EARNINGS WERE ON 2/25. My apologies for the tenor.

- MDY is doing exactly what it is supposed to be doing, namely, giving me significant exposure to a segment of the general market. This is the anti-EEM this month.

- I may look to add to my boring MRH position on this consolidation. Having locked in a nice profit prior to earnings and being nicely in “the void”, I feel good about adding some exposure here.

- PCL finally perked up yesterday, but I’m not going to read much into it until it breaks higher (>49) or lower (<47).

- RWT is overdue for a pause and I will look to add should that opportunity present itself.

-EM

3 Responses to “Portfolio 02/19/13”

Aaron Ashcraft

Like you, I am presently 40% cash, having laddered out of several stocks, sold losers. Biggest position remains $BAC. Up 7.8% YTD including realized/unrealized gains.

elizamae

It sucks being left in the dust by many, but if/when things “correct”, I/we’ll be in a good position to minimize damage and buy the blood.

Thanks for reading.

redman59

Completely agree with you on paper trading, its for trading platform familiarization if anything. Especially in options as the fills aren’t realistic.

In my opinion its better to save up enough money, trade with about half of that not touching the other half.