Forget About 2013

“For the third year in a row, I am up huge (+15%) in the first two months of the year. Unlike the past when hubris controlled my compass, I endeavor to keep these gains by steadily moving up the market cap ladder, ignoring my inner Henry Fool–discarding him to the trash heap of society, melting his face off with a flame thrower.”

Smooth Sailing

“CCL is a broken company, not just a chart. They sell a luxury item that has been killing their customers or forcing them to defecate on themselves. I cannot think of a worse brand in America right now. Wait until the lawsuits hit and the crap swings around and hits them in the face.”

A Few Side Notes and Well Wishes

“May 10,000 bolts of lightening evaporate your well being into ashes and rapacious hurricane winds disperse them quickly–to steal away a proper burial for your family and loved ones.”

WHAT ARE YOU WAITING FOR?

“My play is Japan, asset managers and home construction. Your play might be marijuana, solar and chinese burrito stocks–THAT’S BECAUSE YOU’RE A GOD DAMNED VAGABOND without a home or purpose in life”

The Apple Trump Card

“One thing for you to acknowledge is this market is at new highs, despite AAPL being down 25% from its highs. This would’ve been unthinkable last year. Since 2009, every single crisis set bears up for a massive short squeeze. I see no reason to believe the crisis in AAPL won’t resolve itself, trapping all of the people who are shorting it now, as well as derivative plays CY, CRUS and ZAGG.”

“THE FLY” HAS BEEN STRUCK BY LIGHTNING

“NEW YORK (AP) — Early this morning witnesses said a man, who is known as “The Fly” on internet blog iBankCoin, was struck by lightning–after cursing the stock gods for bestowing him with “reckless investments.” This all happened around 10:30 am near The Four Seasons Hotel, where “The Fly” has been known to loiter.”

A Proper Execution

“If this is the first of many down days, at 140% leverage, I will be cut to ribbons within days. I could sell off some up positions, bulk up on my short CCL and mitigate risk. Or, I can buy this dip, like a true master of the suicide arts, and play handball with a grenade in my backyard.”

This Afternoon I Was Corrected

“It’s the stupidest lesson never learned. Each and every time I float about the office in ancient Roman costume, burning sage in fire pits, slapping people with my leather sandals, I get corrected. I get corrected when I focus more on spending my money than earning it.

I get corrected when I push the limits of reason to the extreme, begging for something bad to happen, daring it to happen.”

“Like I said yesterday, only the Fed can bring the market down, and that’s exactly what happened today. Some of the beardless members at the Fed are calling into question QE-infiitum. They don’t have the balls or the facial hair to challenge Mr. Bernanke and shall be vanquished, dispatched, in short order.”

Rely On Your Government

“Rely on your government to meddle in your lives, wrecking your investment prospects. Compromises will not be made, because we are led by a pack of wolves whose ideologies are financed by people who want to destroy America, rather than see it thrive for another 237 years.”

No Bottom in Sight

“We’re in free-fall mode, as high beta/return stocks get beat down like a homeless man taking a piss on a police car.”

YOU CANNOT STOP THE COCAINE TRAIN

“The losses are painful and we all want to kill ourselves now. I get it.

But don’t do it! Before you know it, great whores will suckle from your anatomy and the stock market will soar to new heights, giving license to move around freely–spending money like a addicted heroin fiend in an afghan poppy field.”

Partaking in Parlour Tricks into the Bell

“I added to several positions today, in large testicle’d manner, ignoring the minimum basics of risk management. It says “when markets start to drop, take a step back pal, chill out, and eat a sandwich. If you even think about buying stocks, I’m gonna call the SEC on you.”

The Official 2013 Review of Select Blogs from Around the Web-o-Sphere

“Yahoo Finance: I love Marissa Mayer and would leave my wife and 3 kids to make sex to her, if I was some sort of base, primal, creature– whose sole focus was to procreate and do drugs. Grade: A”

Kill the Leprechaun

“I thought we’d board the cocaine train to hedonism this morning, celebrating all day long–partaking in a great many frivolities. Instead, it looks like cowards are selling into strength, scared to pieces over sequestration. This is all very disconcerting, as the market needs to truck higher to support the revenue base of the United Steaks of America.”

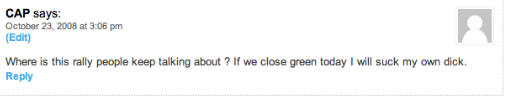

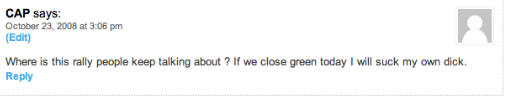

FLASHBACK of a FLASHBACK: The Fellatio Bottom Revisited

CHOO, CHOO!

“On an unbelievable side note, my good friend, “The Devil”, saw Ben “the beard” Bernanke at an airport recently and had a chance to introduce himself and have a small chat. The Devil asked Ben about gold and he retorted “there is no inflation and there will be no inflation.” Now the story will start to sound slightly unbelievable. He said Bernanke furthered by saying “I’m going to keep my foot on the pedal.”