That guy Murphy and his stupid law. Last evening I decided that since my daughter had been sleeping through the night, every night for an entire week (granted we, well, I am “sleep training” her), I would treat myself to a “late night”, pushing sleep off until after midnight.

Lo and BEHOLD, a few minutes after 2AM I hear the sounds that only one with young children could/would recognize. The good news: I was able to squeeze in a solid 60-70 minutes of sound sleep prior to this event. Around 3:15 she finally settled and I had the privilege to sleep for another couple hours prior to work.

I can plow through my real work here without much deliberation or need to be completely alert. Blogging (and writing in general), however, takes a heightened mental capacity that is often left clouded and confused when I don’t get enough “shut eye”. I apologize in advance if I repeat similar phrases a few times…my brain is not currently firing on all cylinders.

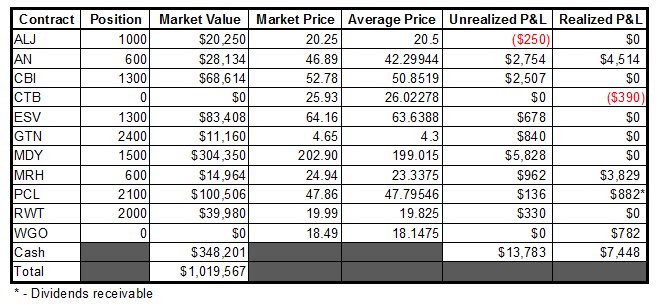

The portfolio crept ahead to gain all-time highs again yesterday, for that I am happy.

Some individual notes:

- I’m unsure of what to make of what is happening in ALJ. Prior to the 5% selloff on Tuesday, this stock looked great: scooping out a nice shallow consolidation, looking poised to move higher in a most gentlemanly fashion. I like to use moving averages for reference only, so where we are now I suppose the simple 20 day is in play as support. That level also coincides with the bottom side of a few days from that consolidation I spoke of earlier. If those levels cannot hold on a closing basis, usually that’s a pretty good sign that there are going to be better opportunities somewhere else, and for me to liquidate some, if not all of my position.

- Yesterday I said that I was going to sell AN on a close below 47. Well that happened yesterday, but I decided not to pull the trigger. I am willing to give it a little more rope to try and figure out what it wants to do here. This stock was trading so far above the 20 day for so long, that a bout of selling reel it back in was long overdue. Now, I’d rather see it continue to meander sideways in the post earnings range and let the moving averages catch up to price (as opposed to the stock knifing lower). I wouldn’t say that I have a hair trigger with this, but it is certainly “on watch” for possible liquidation.

- CBI continues to impress me. The moves are not huge, but it just keeps making higher lows. As long as this pattern persists, I will continue to remain bullish on this stock. Earnings are on February 27, so it still has plenty of time to ‘do some things’ prior to my forced liquidation. With a cost basis of 50.85, if the recent low (51.42) breaks, I will likely sell at least some of my shares to lock in a (small) profit.

- Speaking of using the simple 20 day moving average as support, I present you with ESV. As I analyze the weekly chart and “volume pocket”, I notice that the best parts of the void are above 65. I was probably too early on this purchase, so that makes me a little nervous. Then again, I am holding a decent size position and this stock could really run on a break of the most recent highs.

- The action in GTN yesterday seemed like one of exhaustion. This stock has come a LONG way in a short amount of time. These things can’t go up every day, so I wouldn’t be at all surprised to see some sort of correction here. I am fine with that, as my position was basically “taking a flier” on this stock to get some “skin in the game” and catch some momentum. If it behaves in calm and suitable manner, I will look to start building a position in earnest in the coming days/weeks.

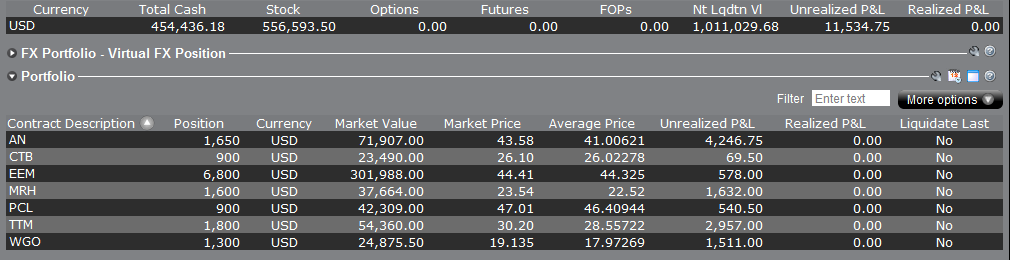

- I am just along for the ride in MRH at the moment. The volume void is very enticing, so I’m once again going to look to start adding shares at logical points. The stock typically pays a dividend at the end of March…currently paying 0.12/share.

- If you notice, the dividend payout in PCL (from yesterday) is reflected in the “realized gain” column in the table below. I would say that this stock is becoming “coiled”, but since REIT’s don’t typically trade like high beta momentum stocks, I’m not sure how excited to get about the prospects of a sharp break higher (or worried about it knifing lower). Otherwise, I suppose this recent behavior could be considered “correcting through time”.

- It seems like the overall market is the only thing holding RWT back. The stock is at prices unseen to shareholders since October 2008. I’m a big believer in the power of round numbers affecting the price of a stock. RWT is hanging out right around 20. WGO did the same for almost a month before I jettisoned that stock, so I’m hoping that this stock does embark on a similar fate. It certainly looks like it wants to go higher, now only the market needs to oblige.

As mentioned, new highs:

-EM