NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme volume on elevated range. Price worked higher overnight, taking out the Tuesday high before rotating down. As we approach cash open, price is hovering inside the upper quadrant of Tueday’s range.

On the economic calendar today we have housing starts/building permits at 8:30am, crude oil inventories at 10:30am, and FOMC minutes at 2pm.

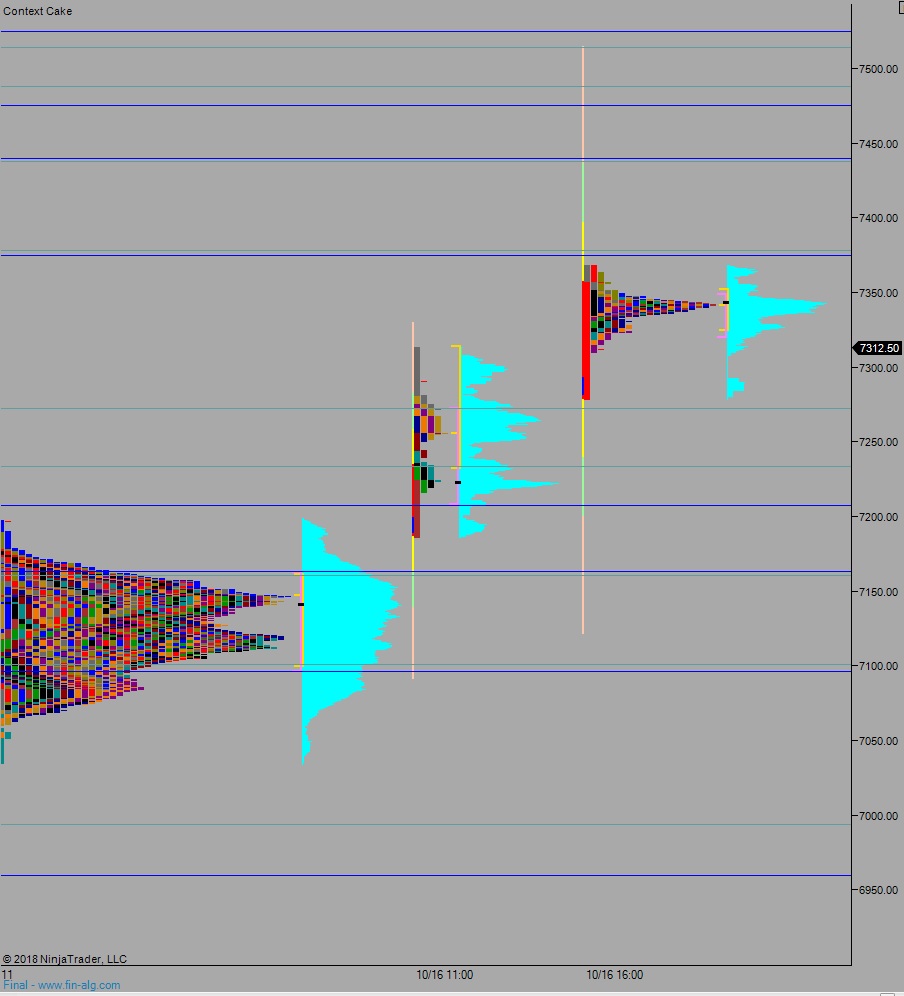

Yesterday we printed a trend up. The day began with a gap up and drive higher as buyer rejected an early attempt to trade back into Monday’s range. Then, late into the first hour of trade sellers made a second attempt into Monday range which very briefly pressed the market range extension down. However, this second rejection by the buyers triggered a trend up which continued all the way into closing bell. The action was accented by a squeeze higher during settlement.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7357.50. From here we continue higher, up through overnight high 7368.50. Look for sellers up at 7374.25 and two way trade to ensue. Then look for the third reaction after the 2pm FOMC minutes to dictate direction into end-of-day.

Hypo 2 stronger buyers sustain trade above 7375 setting up a move to target 7400 before two way trade ensues. Then look for the third reaction after the 2pm FOMC minutes to dictate direction into end-of-day.

Hypo 3 sellers gap-and-go lower, sustain trade below 7300, setting up a move to target 7271.75 before two way trade ensues. Then look for the third reaction after the 2pm FOMC minutes to dictate direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: