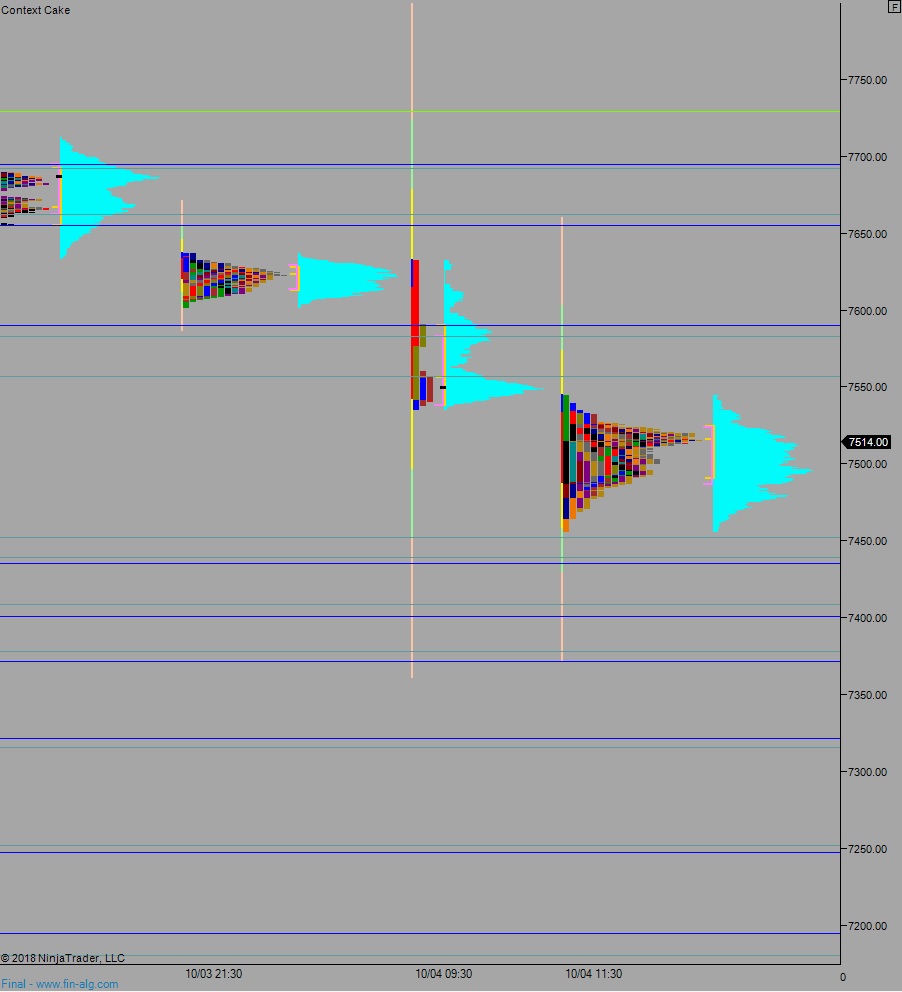

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price balanced overnight, chopping along the lower quadrant of Thursday’s trend down. As we approach cash open, price is hovering in the lower quadrant still and yet to breach the Thursday low. At 8:30am Non-farm payroll data came out mixed, with change in non-farm134k vs 185k payrolls coming in well below expectations [134k vs 185k est].

Also on the economic calendar today we have consumer credit at 3pm.

Yesterday we printed a trend down. The day began with a gap down and drive lower. Price opened just below weekly low and drove down, uncontested, until discovering a responsive bid at the 09/13 open gap. Price managed to ramp a bit into the closing bell.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7513. Then sellers step in and work price down through overnight low 7469.75. Look for buyers down at 7450 and two way trade to ensue.

Hypo 2 gap-and-go lower, sustain trade below 7450 setting up a move to target 7408.50 before two way trade ensues.

Hypo 3 stronger buyers close overnight gap 7513 then work up through overnight high 7540 setting up a move to target 7556 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: