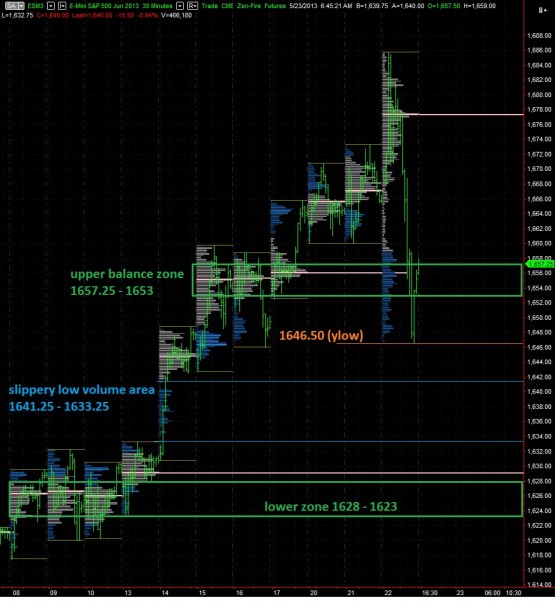

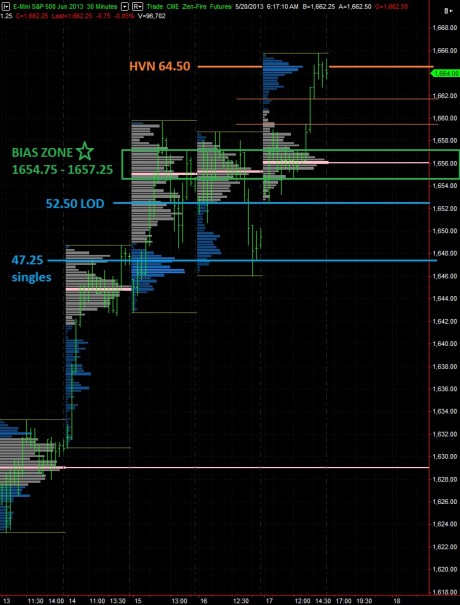

We have two major price zones to use as guideposts if this market continues to put in large ranges. The balance zone above (which coincides with a possible gap fill) from 1657.25 – 1653 is our barrier to the upside, and the lower zone, our major support, spans from 1628 – 1623. It’s best to view these areas on the volume profile charts to see their significance.

In between, we have a low volume slip zone that the overnight session had some fun sliding down and up through. I’m not going to inject much bias into this piece, I’m simply defining interesting reference points, and seeing how we behave today.

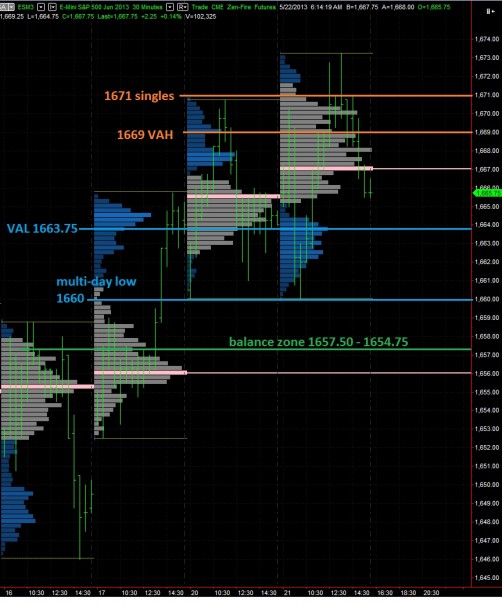

I want to see if they can form any semblance of a gap fill. How well that goes (or doesn’t) will be telling.

Comments »