First off, I suppose it was a matter of time before RVLT would lurch its dull dagger into my gut once CREE hit the bricks. Today the Grim Reaper paid me a visit and took a swipe at my groin region. This is classic, no-news-but-the-past-setting-in sell flow. I have made my money on this stock, and I have made money on this ugly chart, oddly enough, because I have conviction in the industry as a whole.

As promising as the market for LED lighting is my temptation is increasing to bootstrap the entire idea and do it myself because I am afraid these companies may have a different vision than I do. This is a digression I am completely unequipped to pen on Friday at 4:40pm.

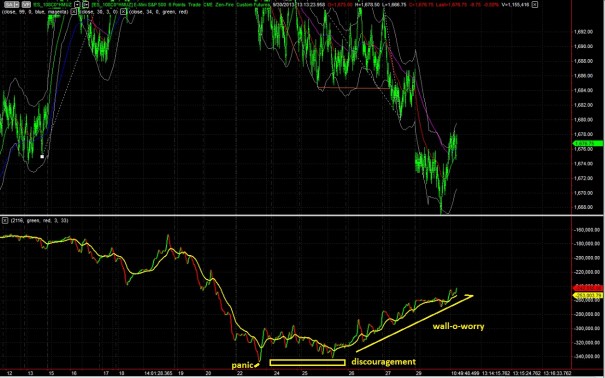

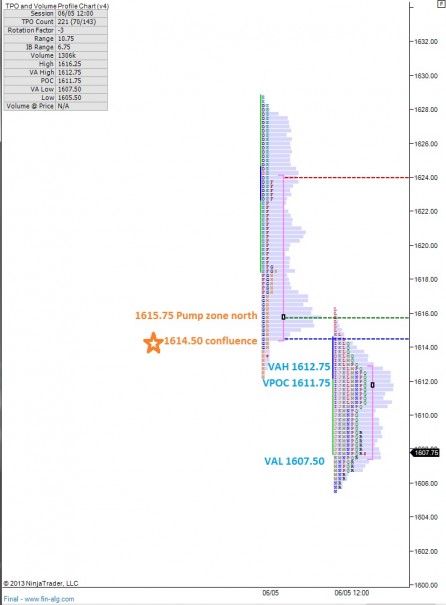

The important matter which had me making the hard decision of cutting longs was the massive absorption of orders I saw taking place throughout most of the day. Absorption on a larger scale than I have seen in quite a while. And it occurred in a curious place—just above a consolidation formation. Tons of buy flow pressed on the market, and the seller only relented slightly into the bell. I captured the following screenshot with cumulative volume delta on the lower pane and price on the upper:

It looks like a massive and patient seller which, once you see that type of absorbtion the next thing we look for is aggressive bid hitting with price dropping swiftly. By selling WDAY and ADHD I am attempting to get out in front of that occurrence.

And to be quite honest, I should have “done sold” ADHD days ago at about these same prices. That trade got away from me and I had to sit through way too much risk to get a more reasonable exit point. It could have kept tanking taking Raul aka Pesce Piccolo down the toilet with it.

WDAY could still win, I really can’t say with any certainty it won’t but I was respecting the whale currents I see. I almost cut WLT too but I will give it a little more of a chance. If that spinning top candle confirms lower, I am out.

CREE is going to be the soxhlet for a while because momentum has left the building. Let everyone forget about this name then consider accumulating. Good news is Chuck Swoboda made his monthly DC payment to keep the LED revolution’s gears greased. Here he can be seen presenting the ceremonial briefcase of cash (the real money gets wired) to our Commander in Chief:

I still have some Ford stock and I like where this company is headed but I never imagined it trading so poorly. It needs to come to life soon or I may take my interests elsewhere.

I bought more GOGO today and I did so too soon and with plenty of vigor. Sometimes when you have a ton of conviction in a name you just want more. But this action has been benign for quite some time and it may offer some real horrorshow brutality for longs next week. I can just feel it.

PPC is my largest position now, hehehe. Earnings next week and I like where price sits currently. I suppose I’m feeling lucky with this one as I sit minus ten percent. May the chicken gods award my complacency with chicken rain.

USO needs to appreciate from here or it is toast.

LO can do no wrong.

ONVO made me and plenty other fine folks on iBankCoin good money this week. That was a lot of fun.

I perked cash up to 15% after one day of being 95% long. Have a great weekend.

Comments »