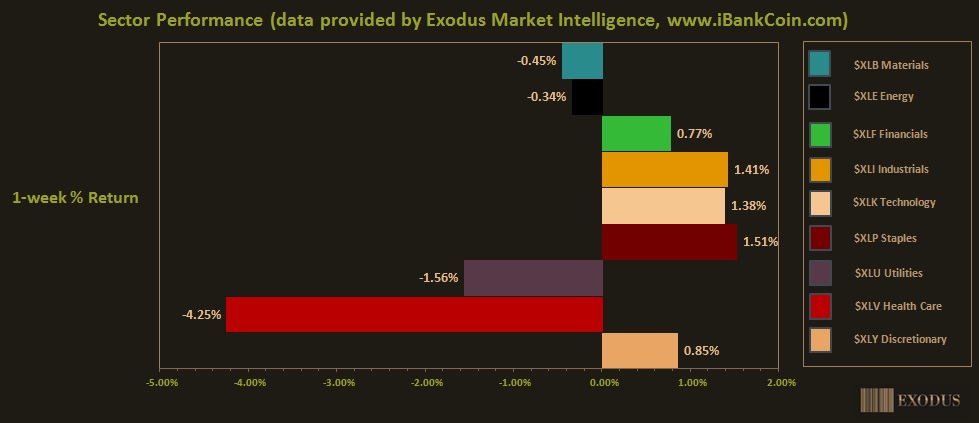

Earnings season has been kind to the stock market thus far. The only companies that matter are big tech, and big tech is stronger than ever. Can you believe it’s the year 2019 and people are still investing in oil? Investing in a commodity is not intelligent. Especially a commodity that is losing its natural demand to cleaner alternatives.

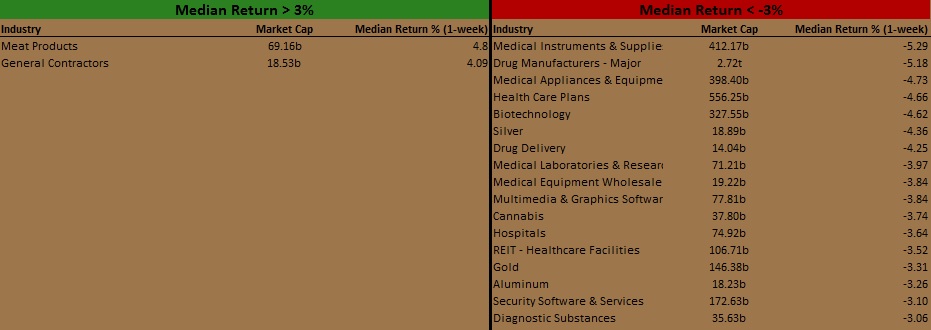

If you must invest in a commodity or its ancillary businesses, let it be cannabis. Be aware that commodity businesses are still a patriarchal stronghold, and that the same families who’ve ridden other commodity booms are shifting their fortunes over to cannabis. They know commodity-based businesses require large capital investments, that the growth is slow but incremental, and they’re dealing in basic materials. And the only reason cannabis is even remotely interesting to invest in is because the industry was artificially stifled by policy. Had hemp and weed been legal all along, it would already be another blown out commodity industry with huge, stodgy, leaders cemented in place. Boring. We’d be back to investing in oil.

That said, I have zero interest in cannabis stocks. Go talk about investing into that degenerate industry with your Uber driver.

Have you ever played Monopoly? There’s only one winner, that’s the whole point of the game. I only invest in companies that have a chance to win the proverbial ‘Monopoly’ table of our current simulation. Names that could win Monopoly: Microsoft, Amazon, Tesla, Salesforce, Goldman Sachs, GOOGLE.

I am aware that several, smaller Monopoly matches are taking place, and some 0f these themes are worth investing in. There is a big one that will always satiate the desires of the hyper-wealthy: immortality. The philosophers stone. If a company is promising to keep humans from dying, that’s investable a space I want to invest in. Conversely, I wouldn’t touch drug makers. Drugs are fucking trash. People are finally realizing that they can medicate themselves 2-3 times per day with food. This trend is not going away. The trend in medicating problems away has matured and all that new age fluffy guff the flower generation latched onto is now mainstream, hallelujah. But using viriuses to alter DNA, or building synthetic babies, that is something I will invest in. Cyborg/regenerative stuff is investable.

AI and robotics must be invested into. Robots will liberate the human spirit from its current miserable state of factory labor and driving and being accountants. Mankind will be freed to focus on what truly matters: wisdom, self-control, justice, and courage—the art of living.

These are facts. The arrow of progress is cutting through the air and there’s not much we can do to change its trajectory. Humans don’t want to die. Robots are growing in intelligence. Capitalism is the chosen ethos and in the end of every capitalist simulation there’s only one winner.

Accepting these facts, and forming an investment approach around them requires holding positions for a very long time. These changes happen slowely, then all at once! The approach is strongly inspired by the book Sapiens and if you’re an investor that book is required reading.

Now I warmly welcome bear markets and corrections. I don’t churn my fucking portfolio to bits chasing momentum or go to cash at the lows. I just keep buying companies I think will win given the facts of life.

Listen, I know most of you want to go around flipping stocks for quick gains like some kind of nuance speculator, going back to cash as you wish. I’ve found that behavior to decay both the body and mind. Why not just make highly concentrated bets on long-term winners, with a plan to dollar-cost-average for years-and-years, and patience? That’s the formula for wealth.

That’s all I have to say on this final Sunday in April. Now I am off to chop some wood before attending an elaborate vegan dinner.

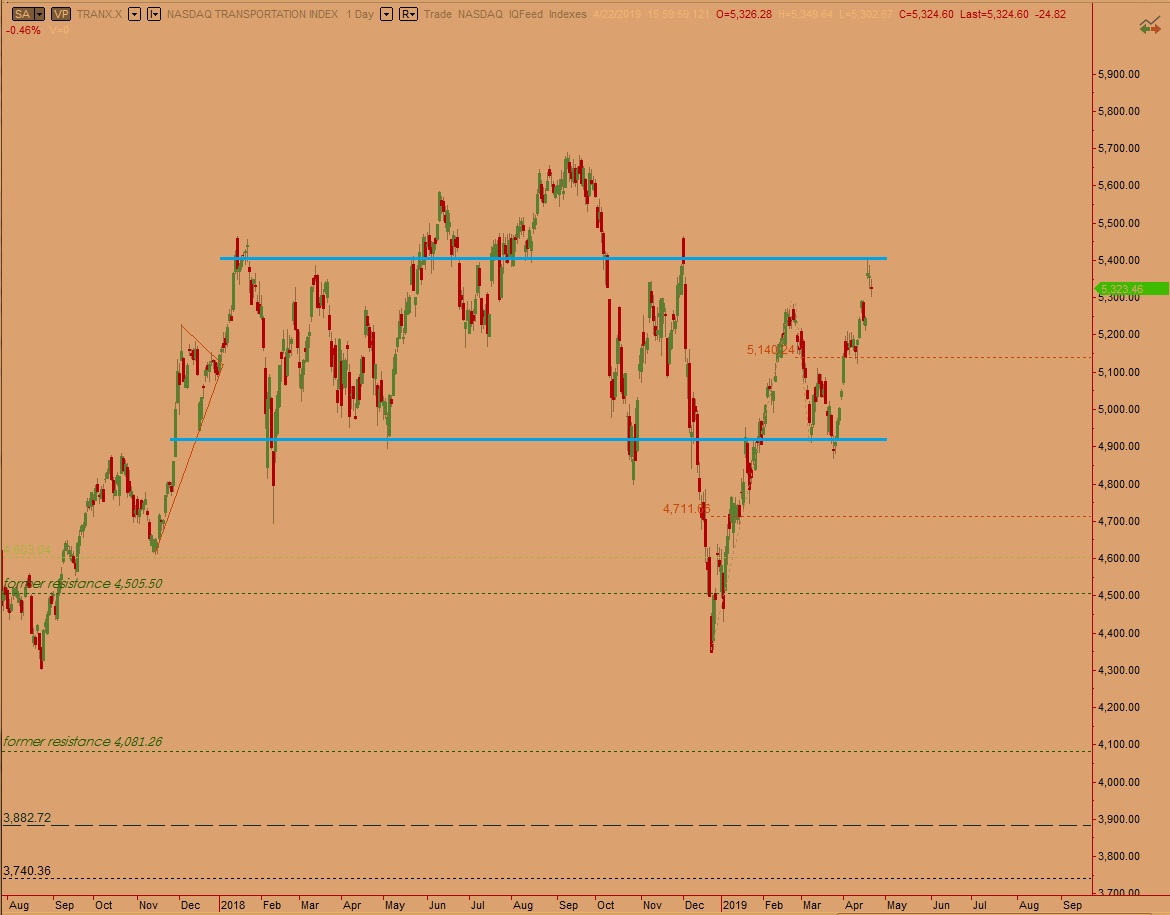

Exodus members, the 232nd edition of Strategy Session is live. Check out the notes regarding the NASDAQ transportation index.

Comments »