Ullr packed up his gear and spun up into the cosmos mid-last week, leaving my snowboarding crew nothing but warm slabs of ice to snowboard on when we arrived in Jackson Hole. So we packed up and headed home. I returned to Mothership around 10pmt EST Saturday night and spent this morning applying my refreshed mind to all things stock market. Now I intend to update you, the good reader of this here Humble Raul Blog (HRB) with everything you need to know heading into the first week of March.

Thank you to everyone who followed along with my adventure on Instragram (@vincalim). Your comments and music advice helped bridge the cold nights and long drives.

Okay back to work.

The President’s Day peak (and my love affair with numbers)

A couple of us around here have a suspicion that major market swings tend to occur around holidays. Something like President’s Day, where we celebrate a renowned hemp grower and wooden-toothed brawler by the name of George Warshington [sic] serves as a near-perfect platform to form a swing high. The day reminded us that we are currently being ruled by a reality teevee host and even worse, we are headed into another wretched election cycle. That’s enough to make even your most hardened speculator want to take some risk off the table. Super Tuesday is likely to be a noisy distraction, and you can bet your bippy there will be no shortage of talking heads, tweeters and attention lovers standing atop whatever soapbox they can, saying the political events of this week are responsible for stock market movement.

This is, of course, all bullshit.

Ignore the noise however you can best. My allies in times like these are numbers and data. There was a numeric oddity right before the top, much more interesting than President’s day, 02/20/2020. Isn’t that a beautiful string of numbers? Just look at it.

Regarding actionable data

Numeric mysticism aside, numbers are cold and dead and factual, and wielded properly they cut through all the nonsense and provide clarity. Charts are simply numbers plugged into a graph. Most charts have time on the x-axis and price on the y. When used properly, they can tell a story. As I have posited for at least two years, semiconductors are the primary driver of our current secular bull market. Therefore, we can draw conclusions on how these entire stock market is likely to behave from one simple chart—the PHLX Semiconductor index. OBSERVE:

Just as I told my main squeeze, I am sorry I wasn’t around on Valentine’s Day. She received a very goth bouquet of flowers in my absence. Unfortunately, all you received were tweets of me jumping my snowboard off mountains. I am not sorry for myself for missing the big sell-off, for I was making much better use of my time, taking a long sip of ambrosia from the chalice of the gods.

As of today, heading into March, we have two simple action points for understanding the entire stock market. We have a bunch of supply trapped overhead. If (when) we revisit that shaded zone, it will likely behave as resistance, at least for a while. How the market treats those levels will tell a story. More relevant however to the upcoming week is the green line—old resistance. One the the market’s favorite pastimes is converting old resistance into support (and vice versa). Even if we slash down through this level some time next week, it is likely to assert a bid in the market.

As always, to be determined. We ought to remain flexible to the idea that the higher time frame participants will continue to liquidate their equity holdings, causing a deeper gulch to form, but I will be in the betting markets positioning for this level to hold.

Full disclosure: I have been wrong before.

System data generated by Exodus (shameless plug alert)

I am so thoroughly impressed with Exodus. I cannot offer The Fly enough praise. Bear in mind, I receive zero compensation for your paid memberships to this platform. My payment is free access, and I earn my money trading the signals generated by its mother algo. To be honest, I prefer it this way. It keeps my motives pure.

Before the top, we had a buy signal (10-day hybrid overbought bullish cycle) running from February 5th thru the 19th. I am pretty sure about 2% of our entire community took advantage of it (about the same percentage of people who can trade for a living). Its timing was sublime, allowing me to pick up the proverbial nickles in front of the steamroller. While earning +7% on a TQQQ swing trade may seem silly to most of you, had I been inside Mothership, trading opening bells on the /NQ_F, I would have been on the right side of the tape the whole time. Check out the final performance of the popular NASDAQ 100 ETF QQQ over the ten-day period:

S.H.O.M.P.

And we have another signal live now. I normally wouldn’t discuss live signals on the public blog out of respect for Exodus members, but since the cat is already out of the bag, and also since nobody seems to have the huevos to take this trade, I feel okay discussing the hybrid oversold signal in play. I bought TQQQ on Friday morning and will be holding it for nine more trading days, right up into the Thursday before OPEX—a likely brutal quad witching, where the stock market will seek to zero out as many options trading accounts as possible in one fell swoop. Since I am back in action, be sure to drop by this blog after about 9am eastern for my morning trading reports. We are going to take the action one day at a time using Gaussian curves, a data lover’s best friend.

Executing signals through economic events and news

We are headed into a heavy news and event cycle. If you are like me, you spent a good part of your weekend monitoring the coronavirus as best you could, watching hand-washing tutorials and Costco mob hysteria. That is an okay use of our time, I guess, as long as it isn’t affecting our ability to do our jobs. Coronoavirus aside, here are all the events we need to at least be aware of during the upcoming week:

- Berkshire Hathaway earnings Monday after the bell

- Super Tuesday

- Federal Reserve Beige Book Wednesday afternoon

- Costco earnings Thursday after the bell

- Nonfarm payrolls Friday before the bell

When I have a system-generated signal, it is not my job to fuss my mind with thoughts of whether or not to take the trade. My job is to execute my plan and that means taking my trades—whether they signal during the opening bell, in the middle of a scheduled economic event or earnings, during a surprise or otherwise. It is my job to be aware of these events, as best as possible, and be prepared for action to accelerate or pivot.

Christian meat withdraws

Do not forget, our competitors in the stock market are primarily folks belonging to one of the many cult offshoots of Christianity that exist here in the United States. These righteous fuckers are being forced by their faith to set aside their beloved Friday hammed burgers and steaks to prove through suffering that they are worthy of mercy from their god.

Have you ever taken meat away from a carnivore? They become aggressive and confused, like rabid dogs. Be okay with the idea of standing aside and letting these animals tear each other apart. The eastern philosophy of the aesthetics is particularly valuable in times like these. Now is an excellent time to hone your ability to sit and listen and fast.

The Christians will be safe to fatten up on disgusting bacon and ham flesh after April 12th.

Good verses evil and after market deceit

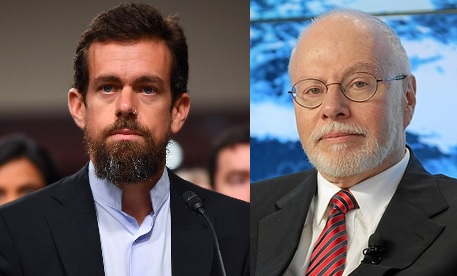

On Friday evening the Wall Street Journal reported that vulture capitalist Paul Singer’s Elliott Management Corp. has elected four of his people to Twitter’s board of directors. Claims are being made that Paul intends to remove CEO Jack Dorsey from his position.

I have not mixed my words when it comes to Jack Dorsey. I consider him my second most significant role model behind only Elon Musk. His ability to sit in silence for months on end, his brave move to ban all political advertising from Twitter, his nose ring in Congress and simple manner of dress—the world needs more @Jack and way way waaaaay less Paul.

Twitter is my second largest investment. Shares of TWTR were allegedly higher after the bell Friday on this news. I do not put much faith in after market moves, in this instance or otherwise. I never do. Regardless, this situation demands close attention. If Twitter goes the way of Elliott Management, it puts the safety of the entire internet at risk. Jack keeps Twitter safe, and in doing so he keeps Twitter the only social media platform left for people to safely be heard.

He banned Zerohedge, and I share Joe Weisenthal’s sentiment on this matter. Mixed feelings, but in general life is too short to follow dumb dumb accounts like ZH or QTR:

You know I've got mixed feelings about zerohedge being banned. But it's important to remember how much of their stuff was complete garbage, including this, whose headline is contradicted in the first sentence pic.twitter.com/DWy7UqZ5Q0

— Joe Weisenthal (@TheStalwart) February 29, 2020

Even tonight, Sunday, there will be temptation to pull up quotes on the futures markets. To see if prices continue to collapse. I urge you to avoid such activity. Are you going to be taking trades tonight? Does that information need to be consumed? There will be plenty of time to work these markets come Monday.

Have a good meal. Hug your family. Make love to your wife. Watch a movie or read a book. Light a fire. Exercise if you are restless. Set up your weekly to-do list. All better uses of your time.

Recent Comment

Finally I would like to address comments left on my last blog entry because I appreciate anyone who suffers their way though the Humble Raul Blog. We are a rare breed, not tethered to some company that requires us to filter our voice. Straight up speculators whose sole intent is to extract as many fiat american dollars from the global financial complex as possible, while being as kind as possible to our fellow earth inhabitants.

Juice, you asked me what good my free will is if my fate is predetermined by the gods.

I sat at a table with the gods twice on my trip, half frozen to the side of a rock, in silent contemplation with the celestial plane. By loving my fate and accepting whatever it brings, I am blessed with clarity. What good is free will if I allow life the ability to cause me suffering? Letting go of control and going with the flow allows me to have an optimal grip on reality. That way when I make my way though the world, no one’s master and no one’s slave, as Marcus Aurelius so eloquently stated, I am on the right path.

Cheers and thank you for the comment

Exodus members, while most of my convictions are outlined above, be sure to check out the 275th edition of Strategy Session, which is live now. The concentrated money flows section, in particular, is important.

Comments »

The cat is out of the bag. In 2016, a reality TV host became President of the free world. A ruthless capitalist usurped career politicans to take the White House. In 2018, Bitcoin and other digital currencies established themselves as players inside the financial ecosystem.

The cat is out of the bag. In 2016, a reality TV host became President of the free world. A ruthless capitalist usurped career politicans to take the White House. In 2018, Bitcoin and other digital currencies established themselves as players inside the financial ecosystem.