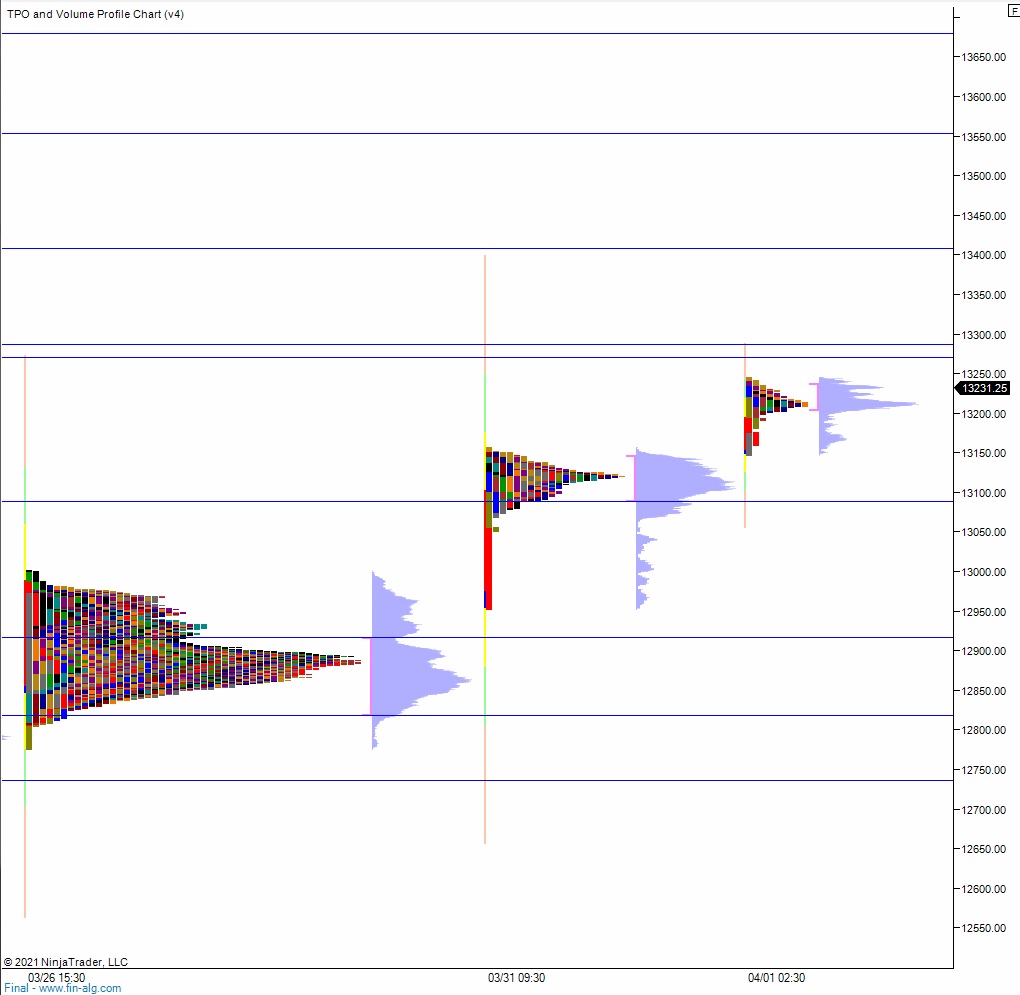

NASDSAQ futures are coming into the final trading day of the week, the first trading day of Q2 (sloppy alignment) up a quick +140 after an overnight session featuring extreme range on elevated volume. Price steadily rallied overnight, unidrectionally rotating up through the Wednesday high and up beyond the gap left behind back on Wednesday March 17th. At 8:30am jobless claims data came out worse than expected. As we approach cash open price is hovering up near those 03/17 highs.

Also on the economic calendar today we have ISM manufacturing and construction spending at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

Yesterday we printed a double distribution trend up. The day began with a gap up beyond the Tuesday high, up near the Monday high. Buyers drove into the open, rapidly sending price up to the 13,100 century mark before a brief pause. Then price continued a bit higher but near took out last week’s high. Instead we spent the rest of the session chopping along the upper quadrant of the daily range.

Heading into today my primary expectation is for buyers to gap and go a touch higher, tagging 13,255 before two way trade ensues.

Hypo 2 stronger buyers tag 13,300 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 13,085.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: