NASDAQ futures are coming into the final day of the first quarter up about +80 after an overnight session featuring extreme range and volume. Price was balanced overnight until about 6am when aggressive buyers stepped in and began working price higher. Said buyers rallied price up beyond the Tuesday range. At 8:15am ADP employment payroll data came out in-line with expectations and as we approach cash open price is hovering in the upper quadrant of Monday’s range.

Also on the economic calendar today we have pending home sales at 10am followed by crude oil inventories at 10:30am.

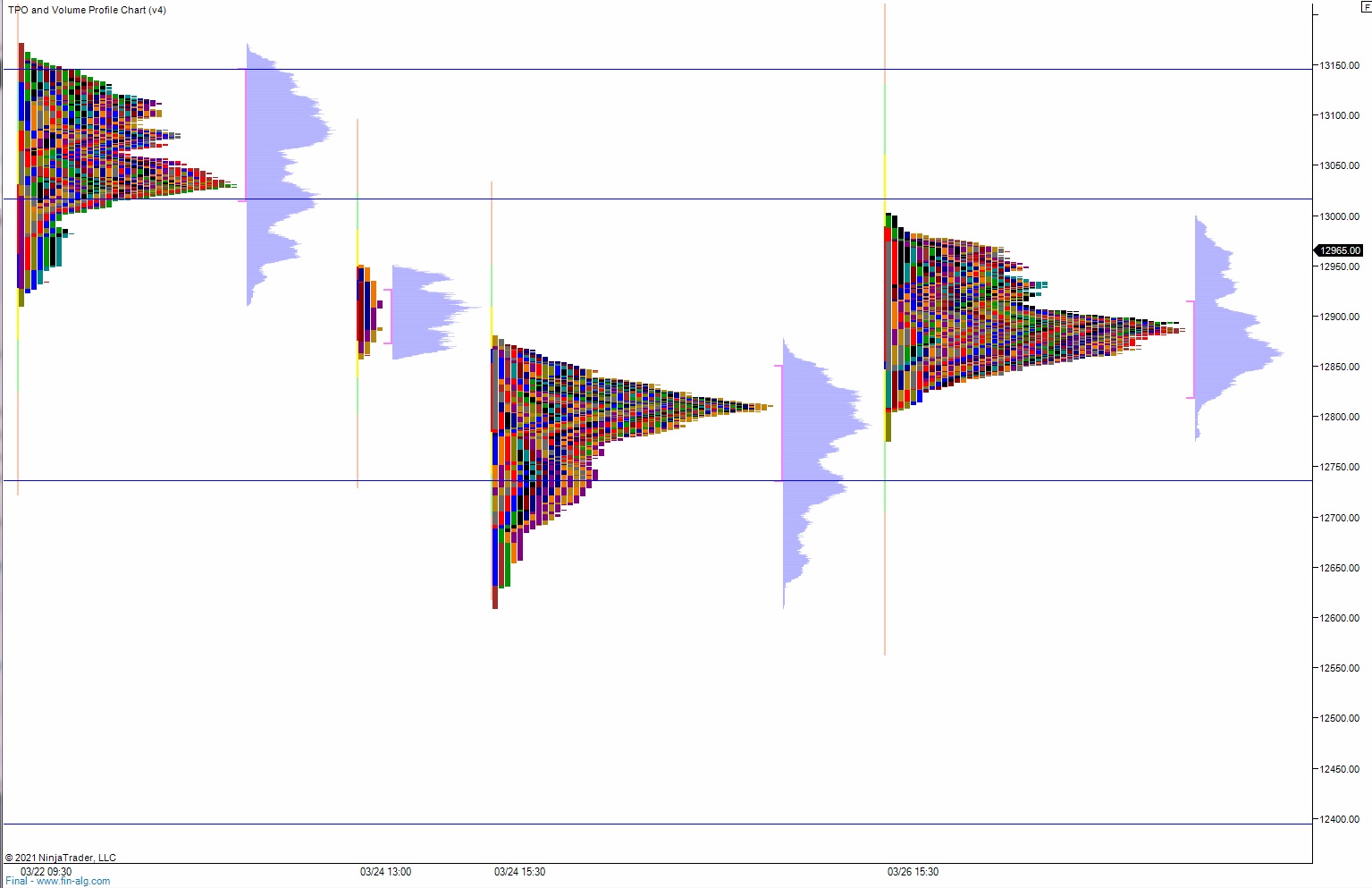

Yesterday we printed a normal variation up. The day began with gap down in range that sellers drove down into, stopping just before taking out the Monday low. Instead there was a small rotation higher before sellers did probe the Monday low. This selling action ended abruptly before the market could go range extension down. Instead buyers formed an excess low before reclaiming the midpoint. And after flagging along the morning high for about an hour price went range extension up. Then price fell back to the midpoint and chopped along the top side of it for many hours before a late-day ramp higher saw price end on the highs.

Heading into today my primary expectation is for sellers to attempt to reclaim Tuesday high 12,916.25 but buyers reject a move back into range setting up a rally to 13,016.50 before two way trade ensues.

Hypo 2 buyers gap-and-go higher, sustaining trade above 13,016.50 early on to set up a run to 13,100.

Hypo 3 sellers work a full gap fill down to 12,893 before continuing lower, down through overnight low 12,858.25. Look for buyers just below at 12,850 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: