I suspect this entry will be overlooked for the most part, what with the NFL, or rather Tom Brady, putting on one of the best shows in the world today, but alas, I am back from the mountains lads. My research is caught up. I feel ready to re-engage the speculative financial markets.

And daddy we have some good signals heading into the week that’ll have me working the long side of the tape until I say otherwise.

There is nothing more empowering than a set of tools to consistently help reset the footing and mind of a hardened speculator. I spent the last twelve days or so drinking hootch and careening down rocky cliffs with a board strapped to my feet. In my downtime I’d shitpost on Twitter about doge and other internet culture that most of these fintwit dopes seem to be unable to grasp.

Let’s have an aside for a moment, shall we? And discuss why doge coin is working…

If you were around back in 2017 during the first big run in bitcoin then maybe you remember what it was like to see something mysterious and detached from the traditional financial markets skyrocket in value. However, you had to be in Miami beach during Art Basel to fully appreciate the reality of it.

I am telling you…it made the madness of the human mind visceral.

That Saturday night, the first weekend of the festival, at the Fontainebleau (no Impala) was the most absurd display of influencer wealth I have ever seen in my life. I am telling you, it was shocking. Dozens, I am not exaggerating, DOZENS, like at least thirty, of Lamborghini cars DEFACED with wretched paint jobs…made to look like Mario Cart toys, emblazoned with Bitcoin symbology. Amongst other things.

Women I’ve never heard of nor cared to know, dressed like cheetahs, followed by no less than five helpers all pointing cellphone cameras and flashlights at them.

Asian dudes, on laptops, with thousand dollar bottles of champaign next to them, rapidly trading YES TRADING LIVE, big denominations, while the thump of club music pulsed through the air.

Basketball players, b-list celebrities, money like you’ve never seen on display.

A real horror show and I loved it. I saw this little model of a dumpster—created with excruciating attention to detail, no bigger than a shoe box, sell for $5,000.

I was so tickled by it all I had to learn more. I had a tiny platform back in Detroit, a town that has a strange connection to Miami. I am the organizer of the Stocktwits meet-up group up here and I started calling meetings. Giving presentations and listening to anyone who bothered to show up. This is when I met real blockchain folks.

These were not the flashy kind from Miami. These were hunkered down discrete types, speaking about revolution, about upheval of the whole financial system. On their coattails, the most corporate, douche baggy, privacy stealing organizations on the planet.

What a shit show…

Anyhow this is right around when all these shit coins started materializing. With a few simple keystrokes, White Papers were formed and suddenly every dickhead had their own cryptocurrency.

It really tarnished bitcoin and CRYPTO WINTER ensued.

I kept faith in bitcoin. I accumulated it for the next several years. I also accumulated bitcoin cash and bitcoin gold because I had no idea what any of it meant. I accumulated ethereum as well because, and I shit you not this is how simple I keep things…it had a cool name.

Some of the local blockchain heads talked me into buying EOS also. But it was all above my head and that’s when I sort of had enough of it all.

But then there was DOGE.

Less than a single fiat penny each, this was a coin that had a lovable dog on it. I knew it was the type of thing the internet could make work.

And we’ve come full circle to me shitposting on Twitter when not snowboarding. Memes are what control the collective consciousness of earth.

This has been the case forever. Why do you think the Christians became so powerful? That fucking image of a cross. One of the most powerful memes of all time.

Dogs and cats do really well on the internet. A doge coin will do really well in today’s society.

This isn’t rocket science people.

Now I may be just a simple speculator, but I hope, that during my tenure here at iBankCoin I have demonstrated, live, more than anyone, what the ingredients are for being a strong investor. We invest in people and we invest in religions. That’s it.

The people must be sexy, like Daddy Elon or Noble Jack. The religions must be drastic, like bitcoin and now doge. Sure, there are situation where we invest in other stuff, like my call on oil back in April. When the financial markets throw the baby out with the bathwater we have to be there to eat the baby. That’s just how nature works. Then, since we knew Biden would win and how most people will fuck up and invest in solar going into a Democratic president and how the market rarely rewards common sense thinking, we stayed bullish on oil and continue to be bullish on oil. But these situational things are not the type of investments that change our life. People, sexy people change our lives. So do religions. These are the types of investments we need to constantly seek out. Then we accumulate and think. And fast. And wait.

They don’t come around often.

Anyhow, enough of that, there is a Super Bowl to watch. That handsome lad with the nice hair is attempting to do the impossible, be old and win. Beware an old tiger sensing his last fight.

Raul Santos, February 7th, 2021

And now the 324th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 02/08/21 – 02/12/21

I. Executive Summary

Raul’s bias score 3.85, medium bull. Stocks are flat-to-lower early in the week. Then look for price to rally higher into the end of the week. Watch for third reaction to Fed Chairman Powell’s Wednesday afternoon speaking to dictate the move into the second half of the week.

II. RECAP OF THE ACTION

Gap up to begin the week then a conviction buying range Monday. Pro gap up into Tuesday and move conviction buying. Some consolidation through early Thursday, then a continuation of the rally through Thursday and Friday.

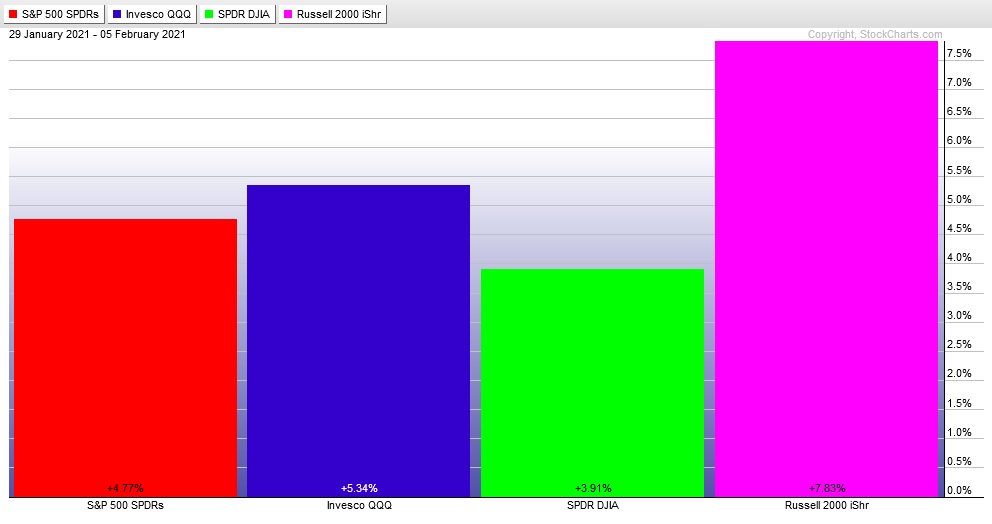

The last week performance of each major index is shown below:

Rotational Report:

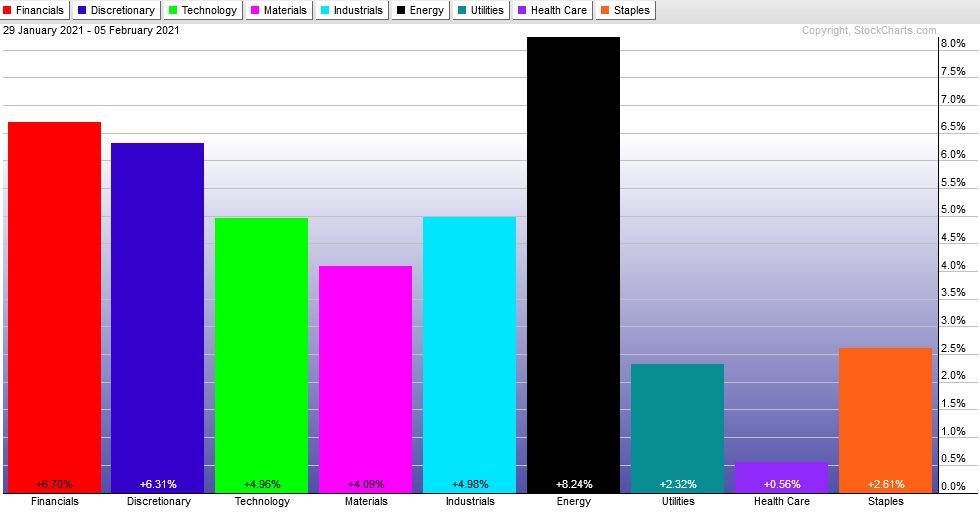

Broad rotation higher. Energy leading but as always trading independently. Utilities and Staples lagging behind, along with healthcare.

bullish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Industry flows skewed heavily to the positive side of the ledger. Median industry return on the week well over 4%.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Industry analysis

This week the way I analyze money flows between industries finally migrated away from Exodus. I figured out a way to use Stocklabs instead and I like the results. What makes Stocklabs so powerful is the ability to tailor the tools to fit different trading styles.

I trade NASDAQ futures, primarily during the opening bell. A major component of my strategy is formulating a directional bias heading into the week. I need objective means of doing this. Having a highly customizable industry analysis is a powerful way to aid this process. I can see which industries are having abnormal returns, what the market caps of these industries are. This gives me a sense of the “quality” of what is moving higher and lower.

I then codify this information on a sliding scale: bearish, slightly bearish, neutral, slightly bullish, bullish.

As I do this, over time, I gain even more objective information about my process and the results it produces.

Armed with these types of tools I build confidence in my independent analysis of the speculative financial markets. Even if I have losses on a week, I know there is information to gain and a continued path forward.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Stocks are flat-to-lower early in the week. Then look for price to rally higher into the end of the week. Watch for third reaction to Fed Chairman Powell’s Wednesday afternoon speaking to dictate the move into the second half of the week.

Bias Book:

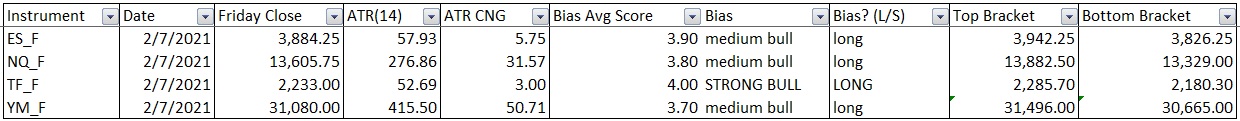

Here are the bias trades and price levels for this week:

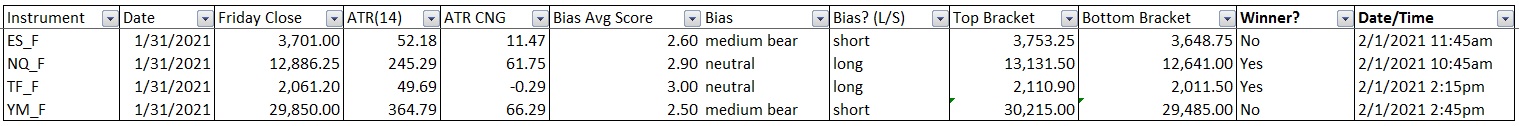

Here are last week’s bias trade results:

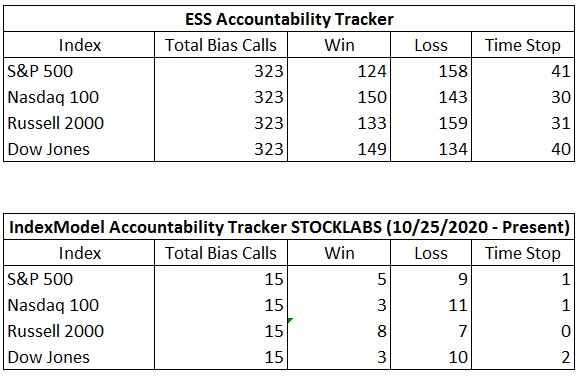

Bias Book Performance [11/17/2014-Present]:

Transports in the driver seat

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports rallied hard last week after giving up a price zone we expected to behave as support two weeks prior. When I last reported two weeks back, we expected the recent breached resistance (12/9ish highs) to be converted into support. Instead sellers cut a bit deeper, working back down to the old range high that held as resistance for years.

That level was strong support however, and the reflexive rally off of us reveals a ton of information. UPS earnings also helped the case. The package delivery company posted record profits last week and rallied more than +4% on the week.

All these things considered, while we may be forming an early range/balance, what is more likely is that Transports are in a discovery up phase.

bullish

See below:

Semiconductors behaving quite methodically. This is an extremely extended index, yet it found support at the logical Fibonacci retracement level around 2875. Keep an eye on that level as price consolidated up here along the highs The longer price can work sideways, the better the case for bulls. However, a reversal off the highs could likely start with capturing the 2875 level and holding price below it.

A move lower like that could set off selling across the broad market.

For now…balance.

slightly bullish

See below:

V. INDEX MODEL

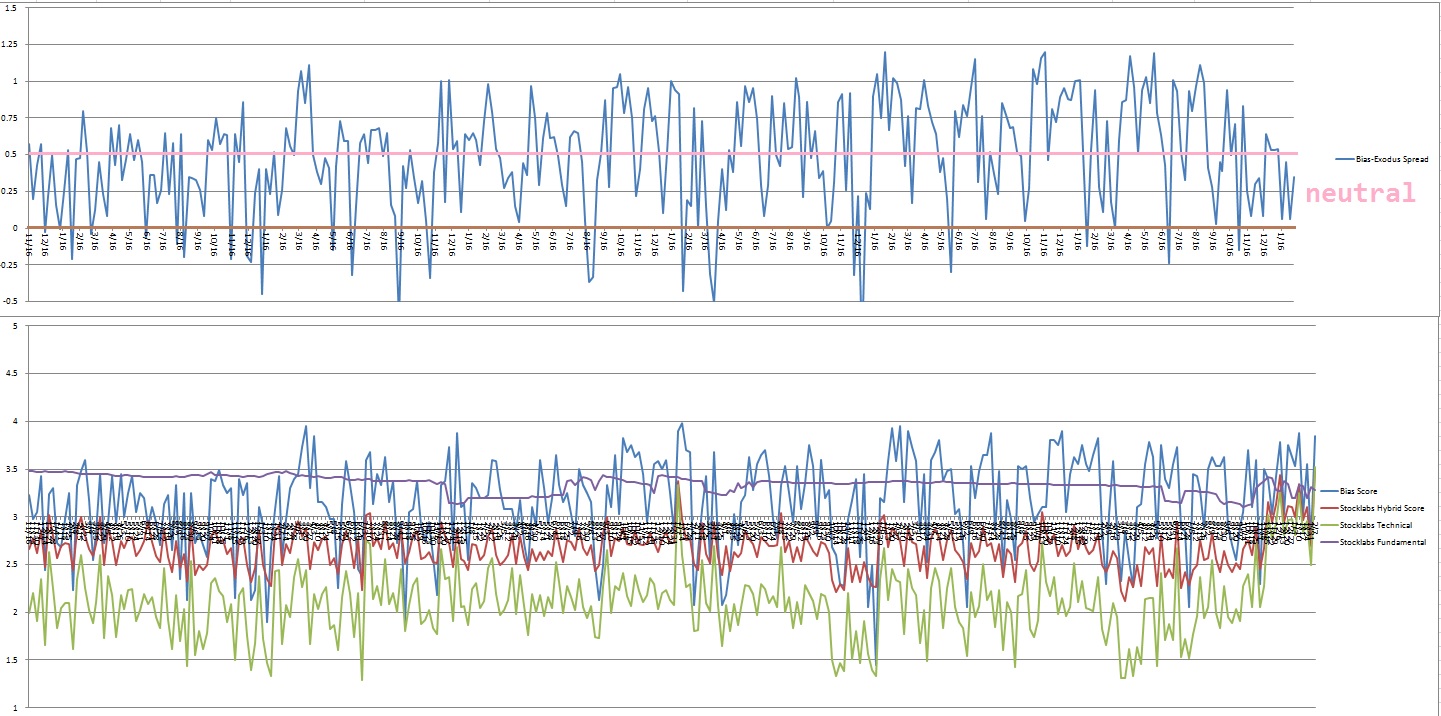

Bias model is neutral for an eleventh consecutive week. No bias.

VI. Stocklabs Hybrid Overbought.

On Friday, February 5th Exodus flagged hybrid (and technical) overbought on the 12-month algo. This is a bullish cycle that runs through Friday, February 19th end-of-day.

VII. QUOTE OF THE WEEK:

“The most difficult thing is the decision to act, the rest is merely tenacity.” – Amelia Earhart

Trade simple, trade the plan

If you enjoy the content at iBankCoin, please follow us on Twitter

Welcome back

thank you, good to be back

Sounds complicated.

I’m working hard to simplify it.