Here is an anecdote about Gamestop that may not have any value, but I want to air it out regardless.

Nephew Raul is 13 now, but two years ago I asked him what he wanted for his birthday. He said, “an Ironman helmet.” I was like, “Where do I even buy something like that?” And he said, without hesitation, “Gamestop.”

I was stunned. Here I thought Gamestop was just like some kind of video game store but apparently my young nephew was buying durable goods there.

Anyhow stuff like that always makes a nerve tingle in the speculator quadrant of my mortal flesh. And usually I do some research then act upon it. But that time I didn’t. I just went to Gamestop and bought him the helmet and moved on with my life. Good uncle, shitty speculator. Selah.

The lesson? When the yoots [sic] speak confidently about publicly traded companies, hunker down and make a serious decision about allocating capital.

Now I would have been two years early to the party. Would I have continued to hold into last week’s feeding frenzy?

We don’t know.

I don’t dwell in those sort of ‘what ifs’ however, because I am too busy working hardt on the next big thing.

Do I have a next big thing right now? Sort of. But my highest conviction investment going into 2021 is heckin’ Del Taco. Not exactly earth rattling stuff. I am working on a big land deal, and boy is it taking forever, but let’s stick to the matter of extracting fiat american from the world of speculative public markets, shall we?

Most of us had big Januarys. Making lots of moneys. Either ‘on paper’ or IRL. Now what? January will be done after this week. Is it our intention to continue pressing into these markets, milking them like coked up robots? Or can we be grateful for our early gains and just like go live a little?

I think you know my answer. I shall be taking my gains and heading to the mountains to spend them on fancy airBNBs, big meals and mountain nature fun. I am going to be off the grid for a while, so this entry will serve as a final logging of my thoughts for a bit. Feel free to leave a comment about your favorite way to spend fiat american. In the meantime, wish me luck as I head into the great snowy peaks of the west.

Raul Santos, January 24th, 2021

And here is my final research report for now. The 322nd edition. Enjoy:

Stocklabs Strategy Session: 01/25/21 – 01/29/21

I. Executive Summary

Raul’s bias score 3.55, medium bull. Equity markets hold the highs, trading sideways, perhaps with a slight upward bias. Then look for price to pivot Wednesday afternoon after the Powell conference.

Be aware of major tech earnings: Microsoft Tuesday after market close, Apple, Tesla and Facebook Wednesday after market close.

II. RECAP OF THE ACTION

Gap and go higher Tuesday into the holiday shortened week. Pro gap up Wednesday is bid higher. Tech heavy NASDSAQ leading while the Russell lagged.

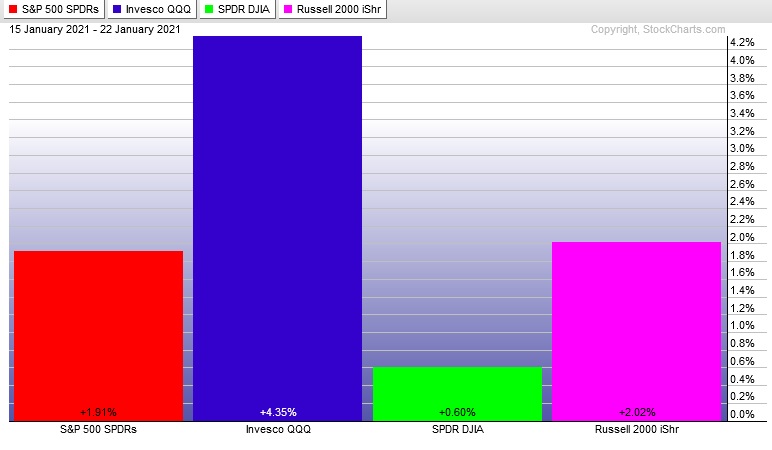

The last week performance of each major index is shown below:

Rotational Report:

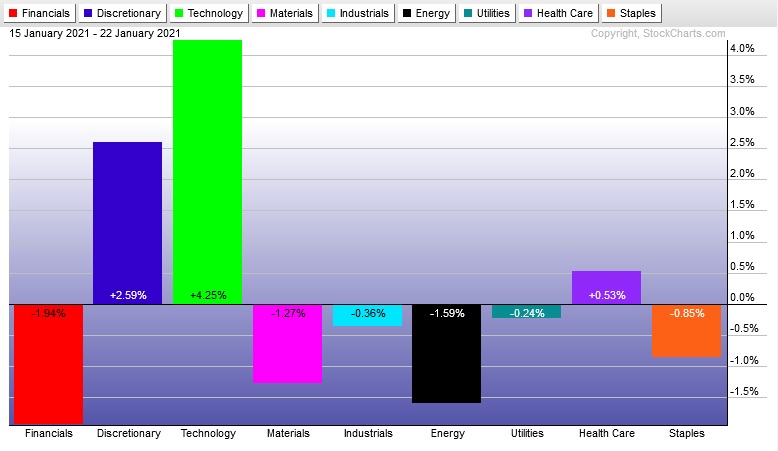

After two weeks of lagging behind, Tech makes a big move out in front, leading the market higher. Flanked by the quality Discretionary sector. Everything else sort of lower.

bullish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

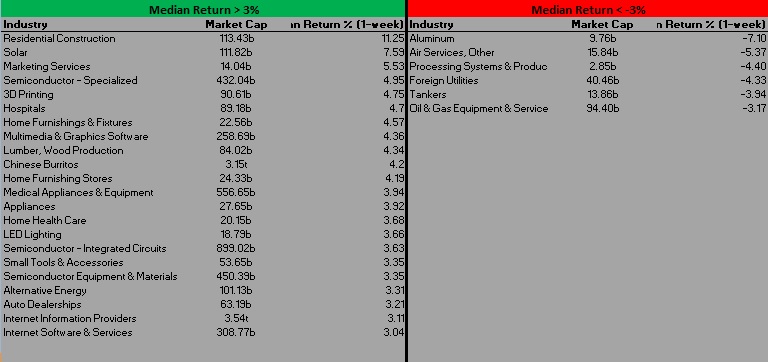

Industry flows skewed a bit to the positive side of the ledger.

slightly bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Customized screens

Inside Stocklabs every screen has the ability to be customized. Look for the blue plus symbol (+) any time you see a list of stocks, industries, or anything else. Clicking this symbol opens a window that allows for customization of the page.

For example, I modify the Industry page to show me the one week return instead of the default daily return, and add in breadth readings along with volume delta.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Equity markets hold the highs, trading sideways, perhaps with a slight upward bias. Then look for price to pivot Wednesday afternoon after the Powell conference.

Bias Book:

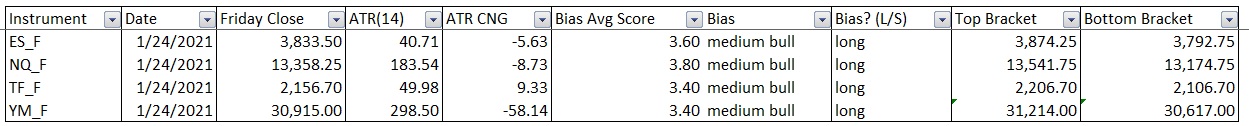

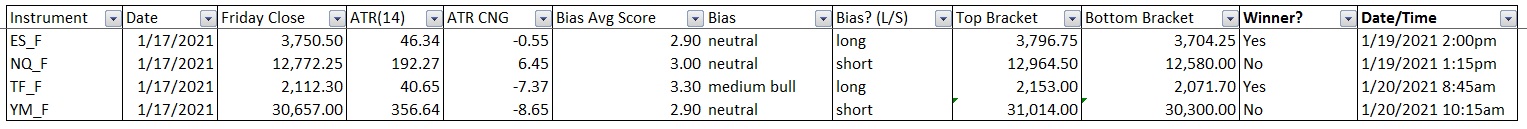

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

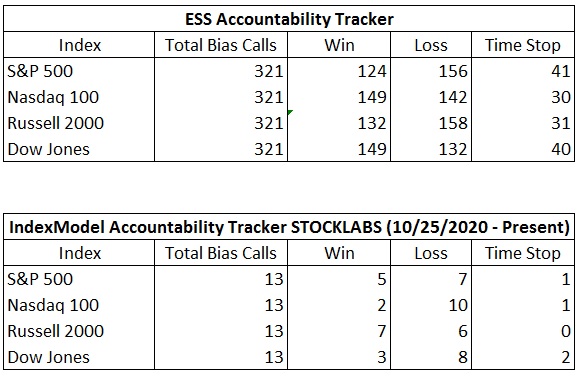

Bias Book Performance [11/17/2014-Present]:

Transports attempt a favorite market pastime

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports appear to be converting old resistance into support. This level is likely to hold and lead to a new high. If not, a quick trip back into the old balance zone could catch the markets by surprise.

bullish

See below:

Semiconductors continue to discover higher prices.

bullish

See below:

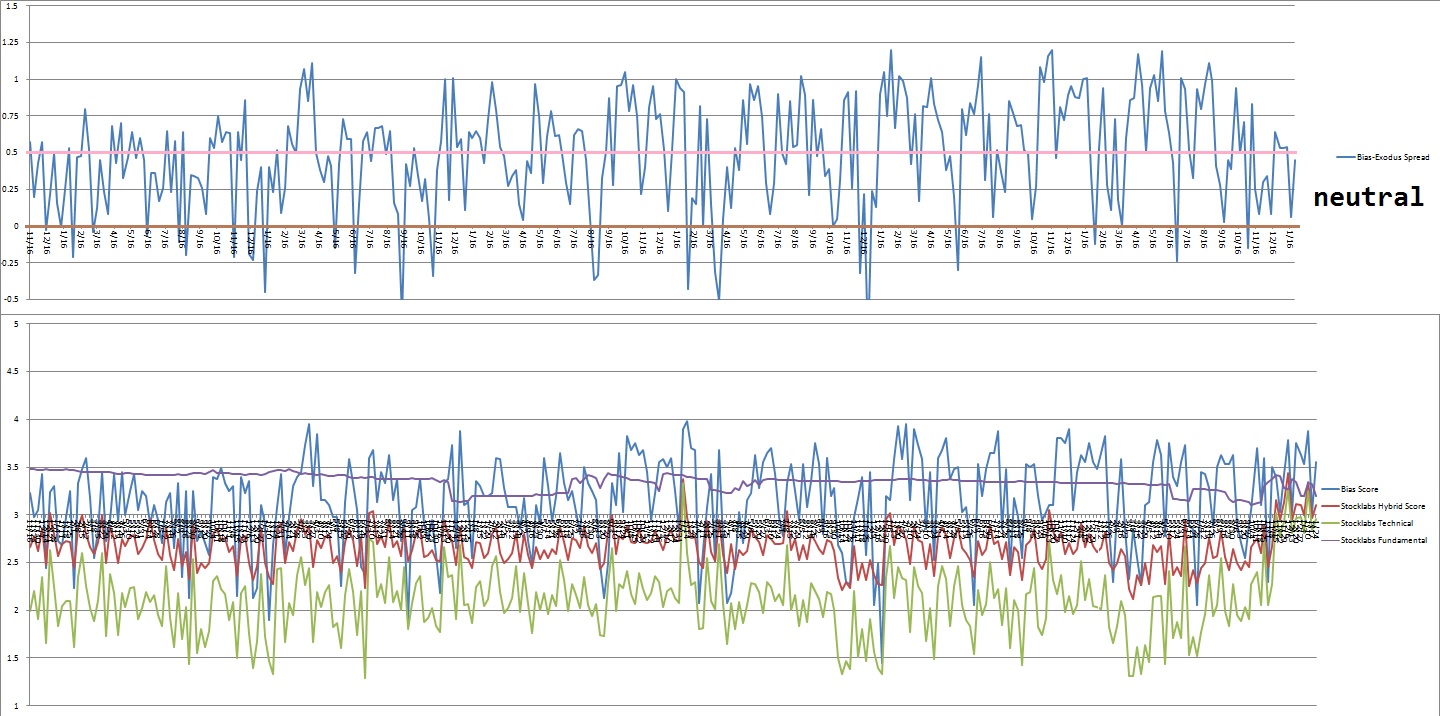

V. INDEX MODEL

Bias model is neutral for a ninth consecutive week. No bias.

VI. Stocklabs Hybrid Overbought.

On Thursday, January 7th Stocklabs flagged hybrid overbought on the 12-month algo. This bullish cycle ran through Thursday, January 21st end-of-day. Here is the final performance of each major index:

VII. QUOTE OF THE WEEK:

“Chance favors the prepared mind.” – Louis Pasteur

If you enjoy the content at iBankCoin, please follow us on Twitter