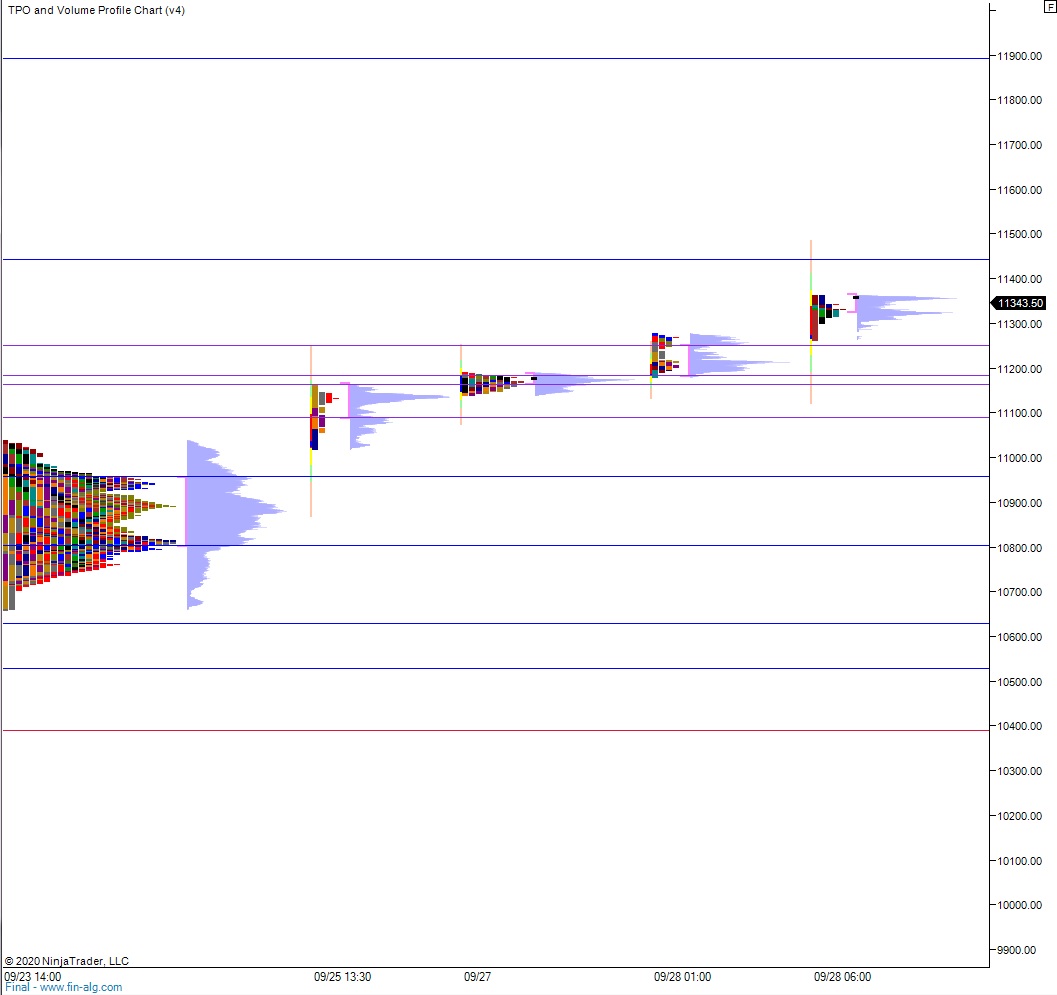

NASDAQ futures are coming into Monday pro gap up after an overnight session featuring extreme range and volume. After a two way auction from Globex open until about 10pm a steady campaign higher took hold. Price has rallied unidirectional up since, and as we approach cash open price is hovering inside the upper quadrant of the 09/17 range (two Thursday’s back).

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

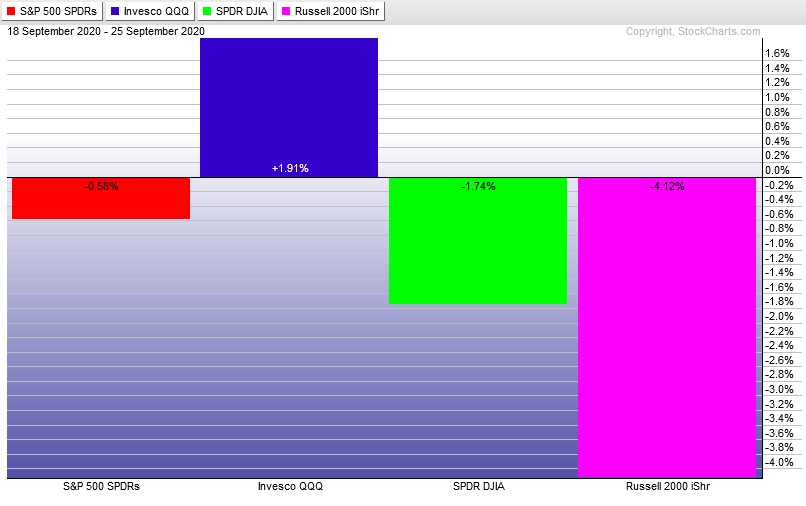

Recall last week started with a big down gap then lots of chop. Price chopped higher through Tuesday then lower until Friday morning. Then a big trend up Friday and into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend up. The day began with a pretty wide and choppy two-way auction, chopping all over the midpoint several times before around 10:20am when buyers took control of the tape. From then on we were trend up, ending the week just below the weekly high and near session high.

Heading into today my primary expectation is for a short squeeze on the open, squeezing up to 11,442.75 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 11,135.25. Sellers continue lower, down through overnight low 11,125. Look for buyers down at 11,100 and for two way trade to ensue.

Hypo 3 stronger sellers liquidate down to 10,960 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

Hey Raul, could this be driving things?

https://www.zerohedge.com/markets/unprecedented-reversal-nasdaq-shorts-hit-second-highest-ever

If so, how long?

Absolutely it could drive things. For how long…we don’t know.

I meant this particular interpretation of the phenomenon:

“Nasdaq non-commercial futures positioning is now the shortest since 2008, the index has rapidly blown through the March lows. We are definitely not bullish Nasdaq, but this certainly gives us pause. It is quite possible that this is just momentum players hedging their FANG gains etc, but still quite a move. Keep in mind, that was out a week ago. We’d imagine most dealers and former dealers are bearish risk and are short futures because every piled into puts very quickly (i.e dealers had to hedge themselves on the other side of the trade). ****Setting up for a squeeze to short into.. ****.”