The purpose of this Sunday blog entry is to inform you all of my five day stock market forecast while also making a few program notes. First the programming notes. For 305 weeks or about 5.8 years I have put out a report on Sunday somewhere here at iBankCoin—usually behind the paywall. It was a task I reluctantly took over from another anonymous twitter trader named ChessNwine. ChessNwine went full nuclear around 5.8 years ago when we started all meeting each other in real life. The thought of the veil being lifted terrified the lad, he high tailed it out of here and blocked ever one of us.

The show had to go on.

I had no desire to put out a Weekly Strategy Session like ChessNwine did. His was long as hell and peppered with dozens of tickers he deemed bullish or bearish. It was all around not suited to my style of trading. I rebuilt the report to suit my interests—day trading index futures.

Since the amount of people interested in all the work, work, bloody self discovery, work and other work needed to be a consistently profitable futures trader is extremely small, the weekly report became wildly unpopular.

Ocassionally people would ask us to do little things to it, like fix the formatting of the damn thing so it was actually readable on a mobile phone. Little things that were beyond my abilities as an internet person. I am just a humble trader and a heck of a gardener and beyond that I rest easy on the fact that I am a beautiful man. Being beautiful makes life easy. I simply show up places, looking beautiful, and enough money comes my way to supplement and hard months I have out in the futures markets. The fixes were never made.

The report is now slated for retirement. It will no longer be tasked with preparing the report once we upgrade to Stocklabs. Which is fine. Stocklabs is shaping up to be a really badass tool and I cannot wait to see it move out of beta.

That said, the heckin’ report made me. Accountability for my research elevated my trading performance in a meaningful way. I mean, be honest, anyone reading this unpopular blog even casually over the last four years or so has to be like, “damn, that fucker Raul was right again.” I have been bowling strikes for years, hitting doubles and triples with a high average and I nailed a grand slam on Tesla, Match and Square.

I steered my flock away from crack head ticker lottery and into big tech. These weren’t massive feats on their own, but collectively they made a mint. Still, my popularity on the internet has never been like real life. The old Raul charisma just doesn’t sink its hooks in the reader. If I wasn’t so sure of my ability to trade well, the whole thing might be depressing.

The way my equity grows and my mind develops makes the whole thing worthwhile. And I know that if I were to give up my Sunday research now, I risk taking a big step backward—back to being an impulsive dullard, taking positions in the stock market for no damn good reason beyond some base reaction to a jolt in price or some other nonsense like a recommendation from some boob on teevee.

The show must go on lads. Therefore starting today and going forward, I will write a brief odd Sunday blurb as always, then it will be followed by the Sunday Strategy Session. Free of charge.

The models are neutral. Exodus is neutral. There is one tiny whisper of data that give a slight edge to the bears. I am personally bearish as hell and remain cashed up and hedged into quarter end. This position is based merely on prevailing sentiment as it appears through my crusty, jaded, hardened and otherwise indifferent perspective and not anything concrete like data. Maybe once October comes the data will support my perspective. Otherwise I will be forced to cut anchor, drop the SQQQ and chase my favorite names higher.

As always, TBD.

Raul Santos, September 27th 2020

And now the Sunday Strategy Session. Enjoy:

Exodus Strategy Session: 09/28/20 – 10/02/20

I. Executive Summary

Raul’s bias score 2.9, neutral. Volatility remains high as market struggles to find direction into quarter end.

II. RECAP OF THE ACTION

Big down gap to start the week. Choppy. Chopped higher through Tuesday then lower through Friday morning. Then a big Friday rally.

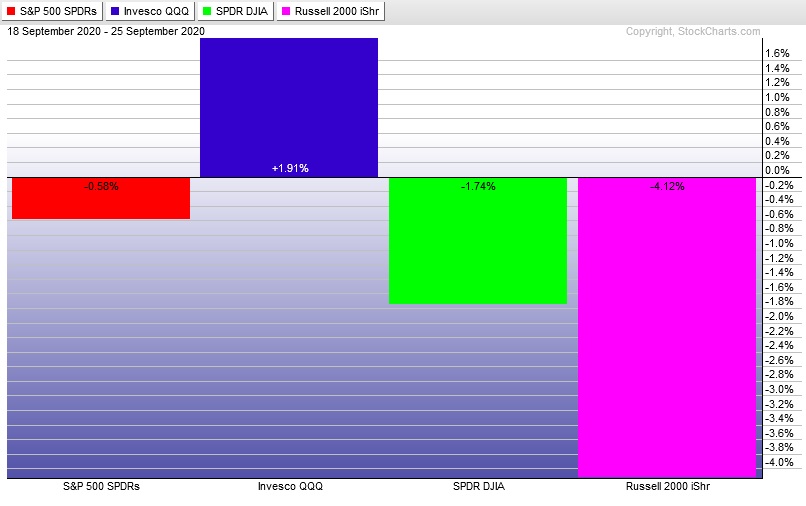

The last week performance of each major index is shown below:

Rotational Report:

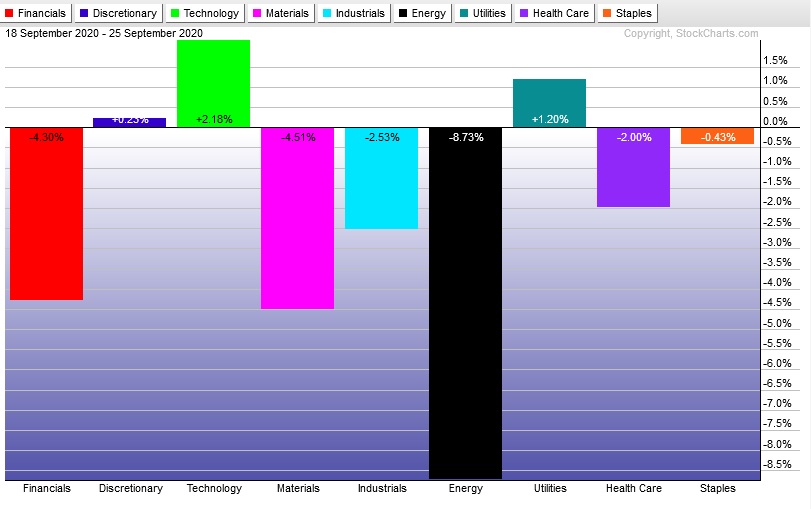

Sector rotations skewed bearish, with the key Tech sector diverging and remaining strong. Alongside the strong Tech performance however was the risk averse Utilities sector.

bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

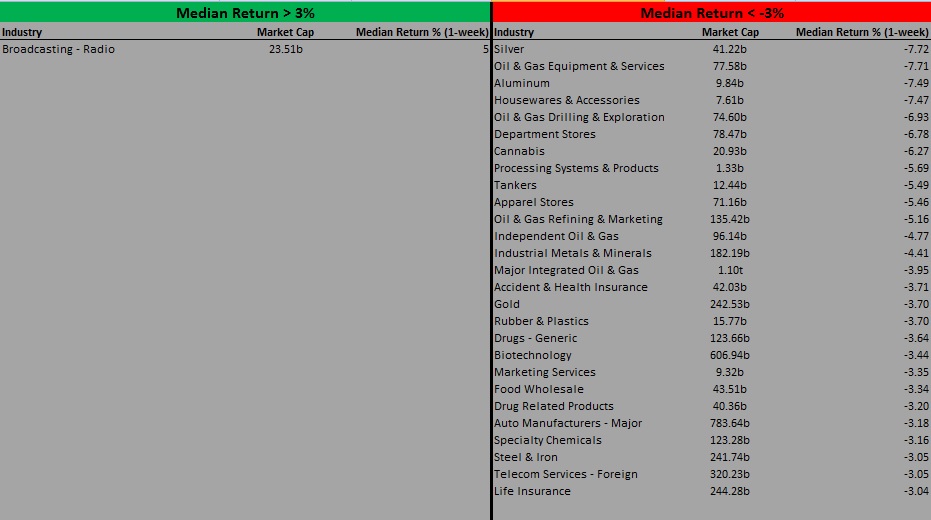

Exodus [PPT 2.0] streamlines how we can research the individual behavior of each industry and how it pertains to overall market sentiment.

Using the Industries screen, we can filter for the Median Return [1 week] of each industry. I have established an arbitrary -/+ 3% cutoff for qualifying industries of interest.

Money flows skewed bearish. Nothing extreme yet but certainly not bullish.

slightly bearish

Here are this week’s results:

III. Exodus ACADEMY

Same call as last THREE weeks: Neutral means very minimal trading

I have very low conviction without some kind of directional bias from either IndexModel or Exodus. I’ll trade open gaps in range, especially a gap up that I can fade lower. But that is about the only risk I am willing to be exposed to.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

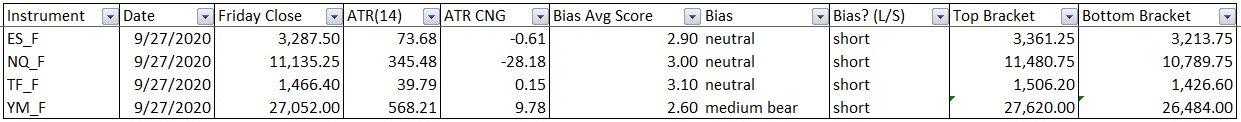

Bias Book:

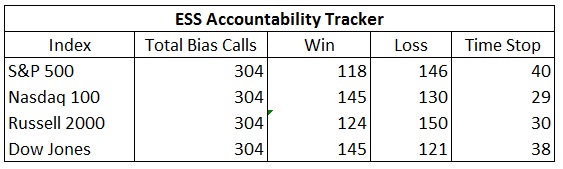

The following biases were formed using basic price action and volume profile analysis. By objectively observing these actual attributes of the market we gain a sense of the overall market context. To quantify the effectiveness of this approach, each of the 4 equity indexes (/ES, /NQ, /YM, and /TF) has been assigned a fixed long/short target using a standard 14-period ATR. Each week there will be an outcome of win, loss, or timed stop on all four indexes. The first bracket level hit is deemed the winner in the event that both sides are tagged. This will be tracked and included in the Exodus Strategy Session.

Here are the bias trades and price levels for this week:

[Note: All levels are as quoted on the front month future contract (currently December 2020) by the IQFeed Data Servers. Prices may differ slightly from your data provider. If you do not have a platform which provides real-time futures quotes, please click here for a free (but limited) alternative.]

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

Semiconductors found balance, Transports blew their energy and came into balance

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports did exactly what we expected last week, testing lower after failing higher out of the coil. Now the key sub index appears to be in some kind of a mini discovery down. There was a potential excess low Thursday when price worked down into a cluster of support below.

There is still some more room to the downside but not much before we tag the low-end of our multi-year range.

See below:

Semiconductors are holding range, slightly off all-time highs. Consolidation remains the call until we see this range break.

See below:

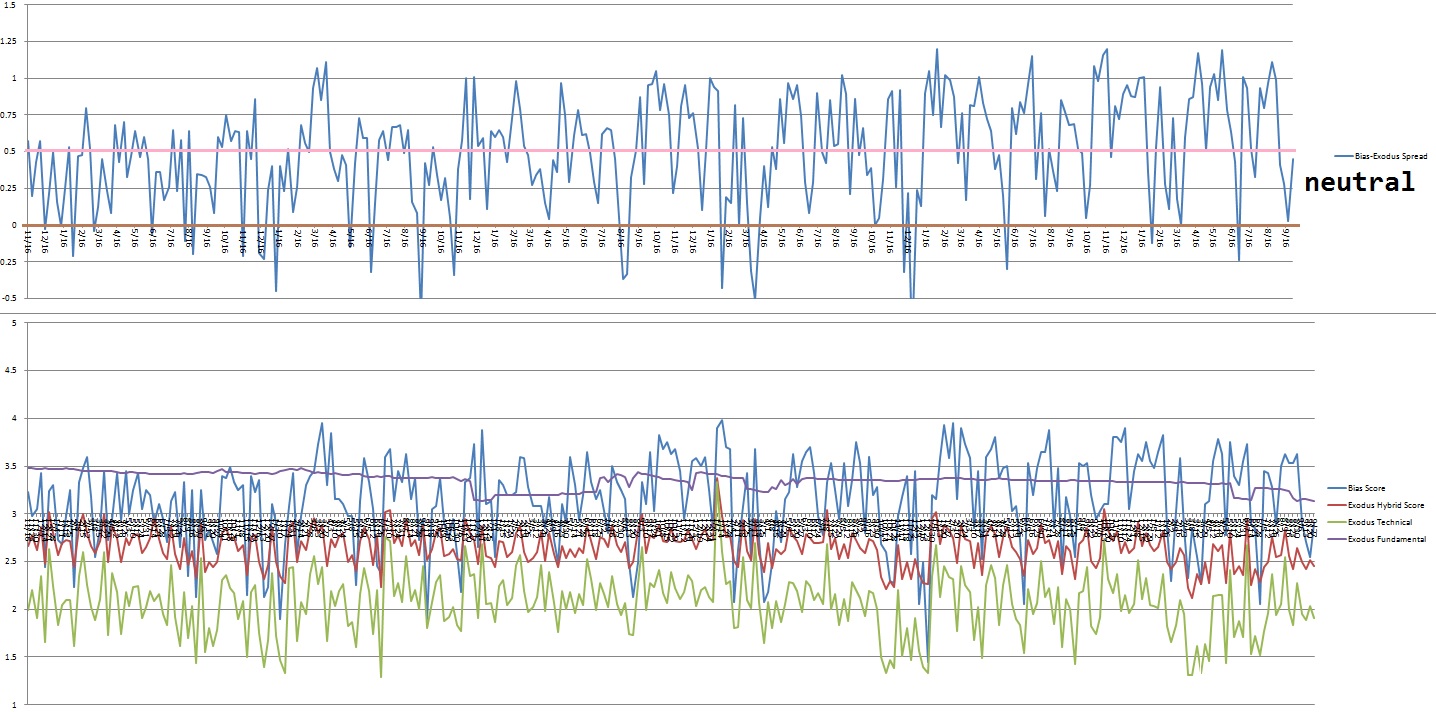

V. INDEX MODEL

Bias model is neutral for a fourth week after three prior consecutive bullish readings.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“To be prepared against surprise is to be trained. To be prepared for surprise is to be educated.” – James P. Carse

Trade simple, prepare your trades before you enter the market

If you enjoy the content at iBankCoin, please follow us on Twitter

So glad you are going to continue to share the weekly research. Very helpful. Looking forward to Stocklabs in 2026!

yeah Chessnwine is a bitch. Called him a memer when he posted an actual meme (the one where the dude is checking out some other girls ass) trying to pump gold miners right before crypto doubled in late 2017.

and he blocked me