NASDAQ futures are coming into Friday gap up +50 after an overnight session featuring extreme range and volume. Price continued lower Thursday evening after an afternoon bout of selling continued into Globex. Said selling saw price briefly trade below the Wednesday low before responsive buyers stepped in. Said buyers reversed the evening selling and more, reclaiming Thursday’s range. At 8:30am durable goods orders came out weaker than expected. As we approach cash open, price is hovering below Thursday’s midpoint.

Intel reported stronger than expected earnings after the bell Thursday but investors received the guidance poorly. Shares of the chip maker are about -5% lower in pre market trade.

Also on the economic calendar today we have U. of Michigan’s final April reading of sentiment at 10am.

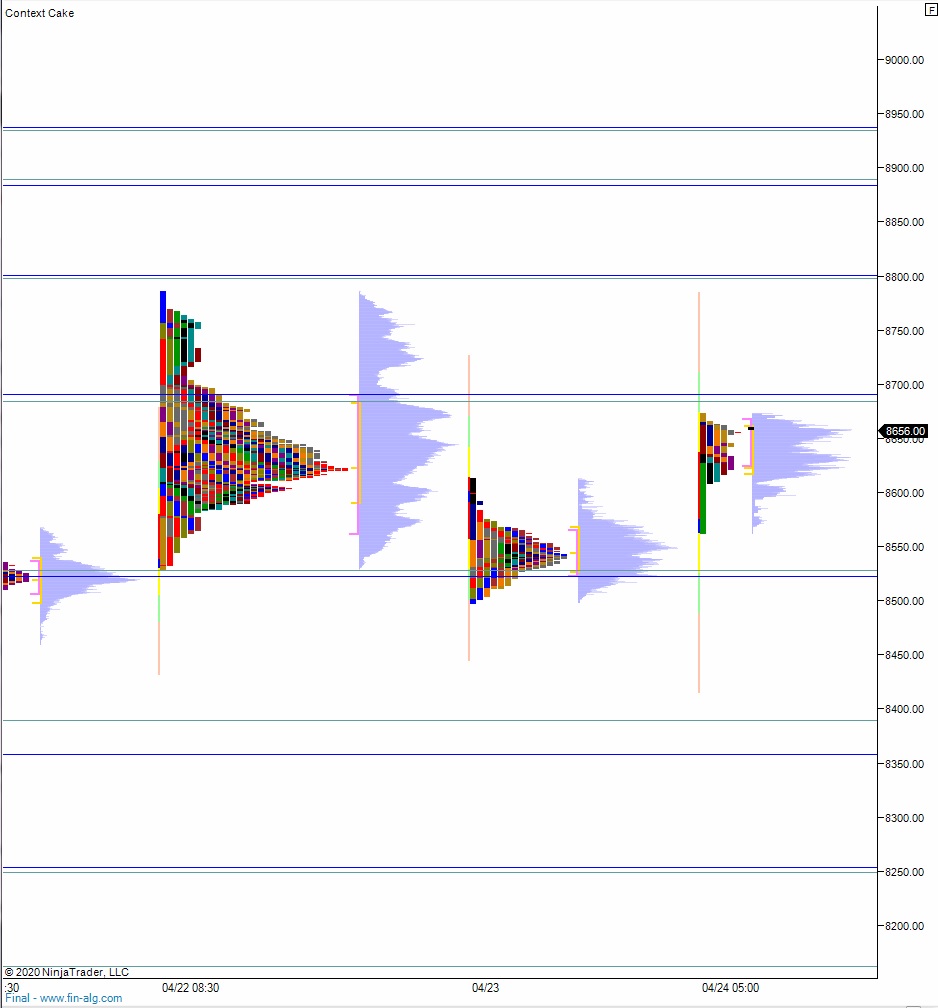

Yesterday we printed a neutral extreme down. The day began with a gap up and drive higher, with price tagging the NVPOC at 8743.25 before pausing a bit then continuing higher. The auction stalled out around Monday’s midpoint. Then sellers stepped in and reversed the entire morning move. After a few chops along the bottom side of the daily midpoint, sellers drove lower into the close, closing near session low.

Neutral extreme down.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 8684 before two way trade ensues.

Hypo 2 stronger buyers trade up to 8796.75 and potentially tag the naked VPOC at 8820 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 8600.50. From here they continue lower, down through overnight low 8498.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: