Quick note on what I am seeing.

First, last Friday we printed a normal day. Normal days are anything but ‘normal’ …they only occur 6.36% of the time, according to my last study. A normal day sets a large initial balance then never breaks it. They tend to show up at-or-near inflection points.

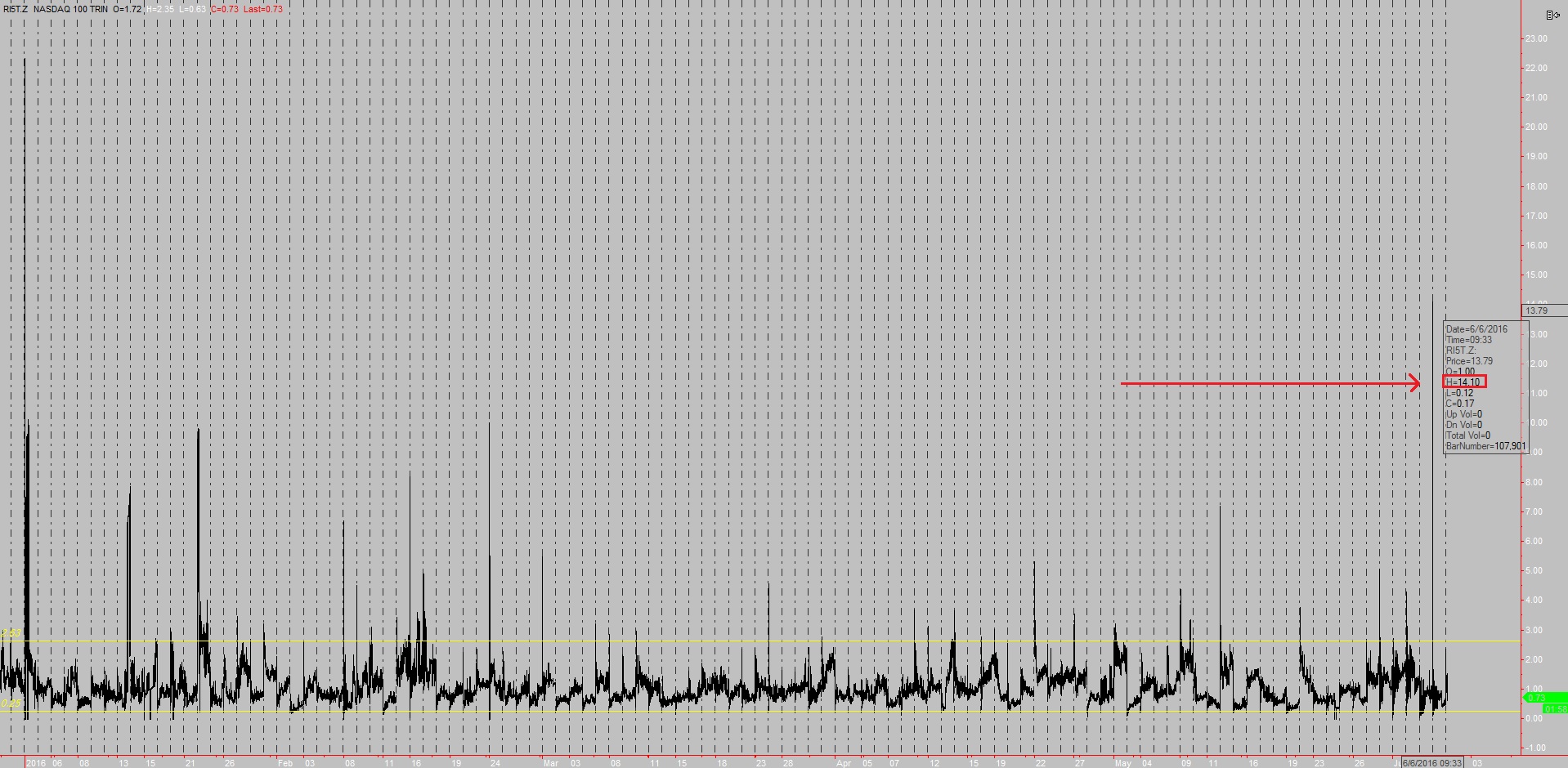

Next, we had an extreme spike on the NAS100 TRIN Monday morning–a spike higher than any level seen since 12/31/2015:

We also printed a neutral day yesterday. Another low probability day type, though not quite as rare–occurring 23.32% of the time according to past stats.

I am looking for slightly higher prices before I book a few longs and initiate shorts. I may be playing it too slow, but I will begin working the short side up around 4538.50 /NQ_F

If you enjoy the content at iBankCoin, please follow us on Twitter

next zone to work if sellers cannot defend 4538.50 is 4555. This is all a bit sketchy, shorting, especially with the tape moving slow and the Dow above 17,950 [YM_F]

how important are these TRIN prints?

Usually, it’s the least important stat I keep on the /NQ, but when it gives an extreme reading I start looking for inflection points. I would put it somewhere below failed moves (failed auctions) and above 3rd reaction analysis on the ‘range of importance’ grid.

good call. Thx.