Nasdaq futures are set to gap a bit higher into the new week after spending most of the globex session working higher. There were no major news developments over the weekend and the economic calendar is rather quiet this week with the most notable event being Wednesday’s release of the FOMC minutes and also a speech from former Fed chair Ben Bernanke. Also Thursday we will here the BOE Rate Decision and Asset Purchase Target as well as US Continuing and Initial Jobless Claims.

Last week we saw a spike in volatility on the Nasdaq index where ranges increased. This could be re-balancing activity as the quarter transitioned. Solidifying this idea was the general lack of geopolitical activity occurring amidst the move. The only real catalyst in the news was Ebola. What we do know is a larger timeframe was at work most of last week and might continue to be active this week. Overall the long term timeframe is bullish-to-indecisive.

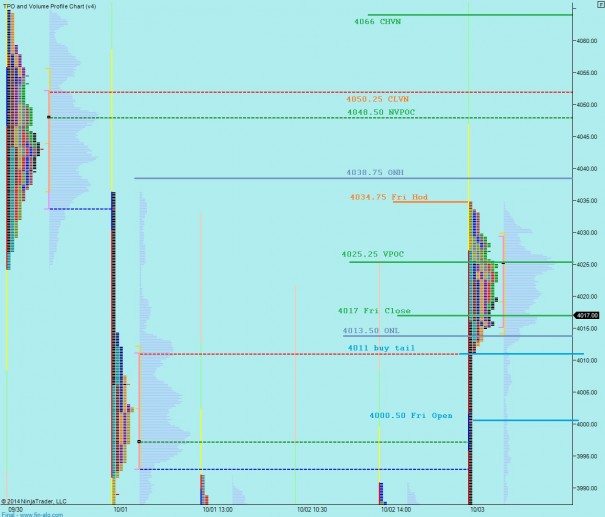

The intermediate term auction is printing a series of lower highs and lows which suggests seller control. However, we had a strong bounce Thursday which carried over into Friday and this morning which has this timeframe back inside its larger balance. Beneath current prices is an air pocket from when prices quickly moved. I have noted the key price levels I will be observing below:

Short term we are rallying after finding a strong buyer Thursday afternoon. The P-shape of Friday’s profile suggests participants were not rushing to initiate fresh risk into the weekend. Instead the early rally only modestly extended and then came into balance. I have highlighted the short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – sellers on the open press into overnight inventory, test lower to 4025.25 VPOC where we find buyers who attempt Friday HOD 4034.75 but stall and open door for proper gap fill down to 4017 and perhaps overshoot to take out overnight low 4013.50 and test 4011 buy tail where buyers emerge and take us back up to Fri HOD 4034.75

Hypo 2 – open rejection reversal sell flow, takes out overnight low 4013.50 and presses to target Friday open and millennium mark 4000.50 where we find responsive buyers who attempt back into Friday’s value

Hypo 3 – buyers drive out from the open, rejecting Friday’s range and setting up for a move to 4048.50 NVPOC and test of 4050.25 CLVN. Look for responsive sellers here otherwise continue testing higher to 4066 CHVN

There is no damn way this Ebola shit is not going to impact the economy. If they don’t start showing they have a plan to combat this spreading……

have you not been paying attention for the last 6 years? There’s no plan for anything..

been working hypo 1

looking for the gap fill to 4017