Without sounding too bitchy about the whole ordeal, there are times when I feel, due to my seasonal allergies, I’d prefer to be on the Bakhmut front lines lobbing hand grenades into Ukrainian trenches. Then again, I very much doubt the Bakhmut front lines have my preferred foods and beverages. I often wonder if the soldiers fighting there suffer SEASONAL ALLERGIES as well.

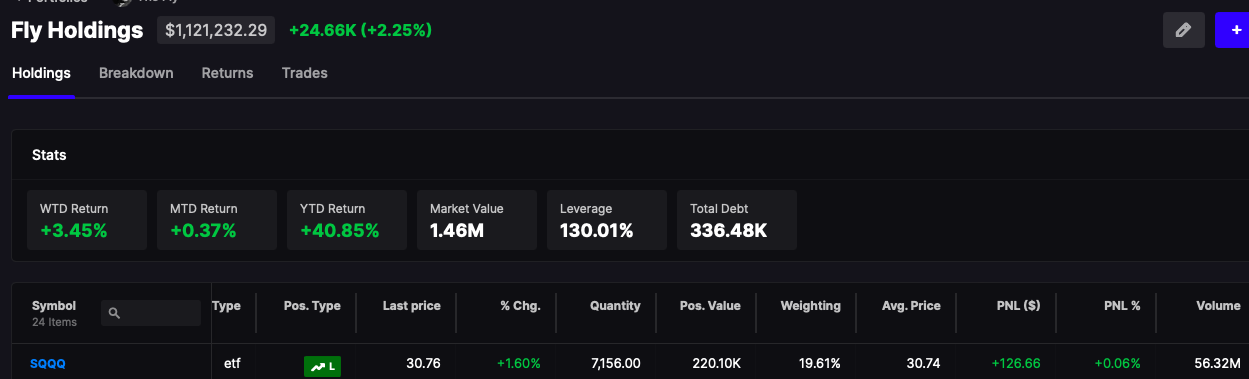

I was awoken to my own sneezing at 5am, and then again at 7am, and again when the market opened at 9:30. I didn’t bother looking at the tape. All I did was deleverage myself and go back to sleep. Because you see, when I am asleep I am not suffering. But now I am awake again, suffering in spite of Claritin 24, down 1% and looking for a way to get my money back.

I am running out of time — and the late afternoon looms. I have no opinions thus far, other than to suggest the market is rancid. I was hoping for something grandiose to shuttle me into the weekend feeling ebullient and proud. I’d venture over to my wife and say — “you see this here? This is my account balance at my brokerage firm. I’d like very much for you to thank me now for my good work and all of my efforts.” She’d glare at me in a combination of pure hatred and respect and change the subject to something like “when are you going to put your shoes away.” And I’d say “indeud, I will take that as a thank you. Next time make it snappier.” And we’d carry on in this carousel of nonsense for the next 25-30 minutes.

Comments »