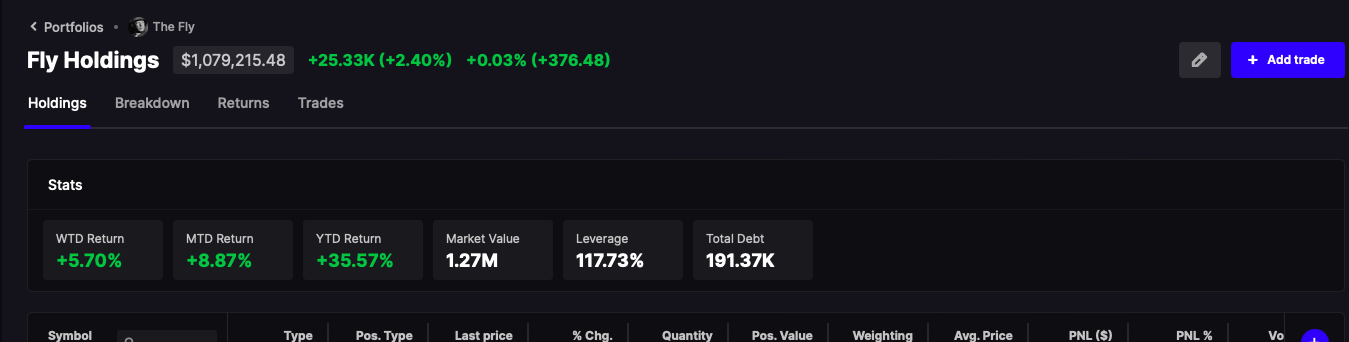

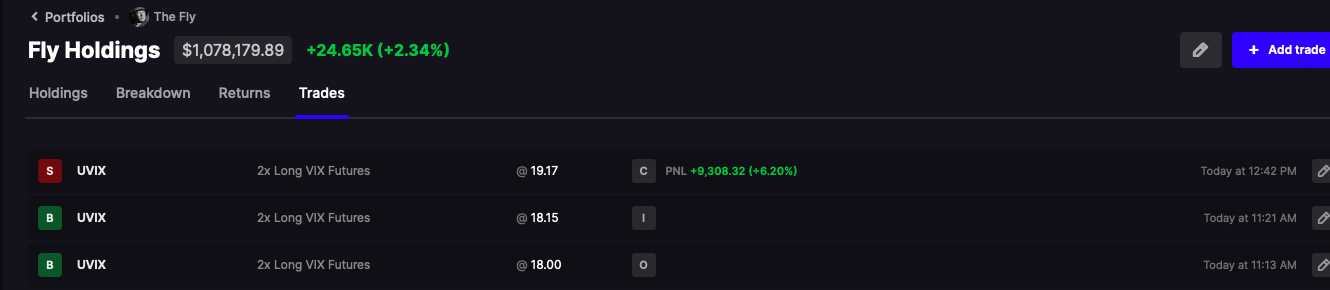

I’d like you to think about what I am about to ask you over the weekend and then formulate a plan in the event it happens.

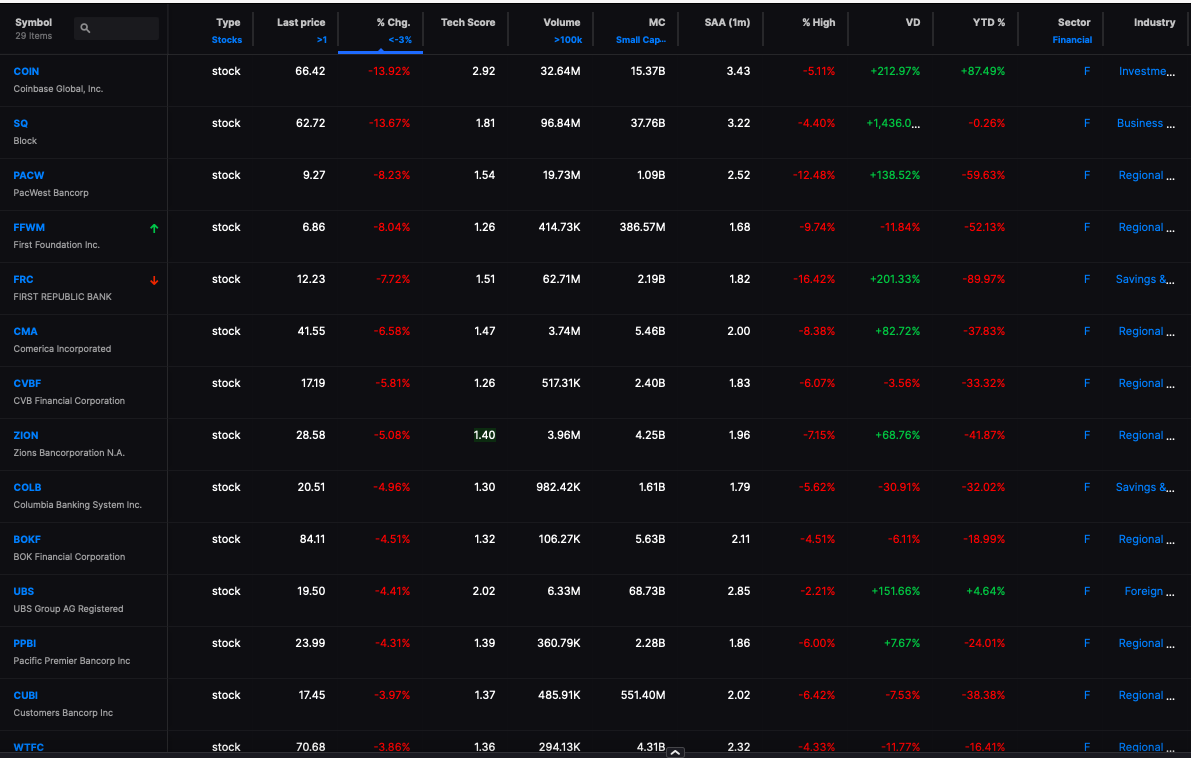

As you know the banks are under pressure now, not because the underlying assets of their govt backed bond have gone sour — but because the fucking Fed has gone from 0-5.25% in a year. For those new out there, when rates go up, prices of the bonds go down. So the bonds SVB was buying at 100 are now trading in the 70s, all thanks to Powell.

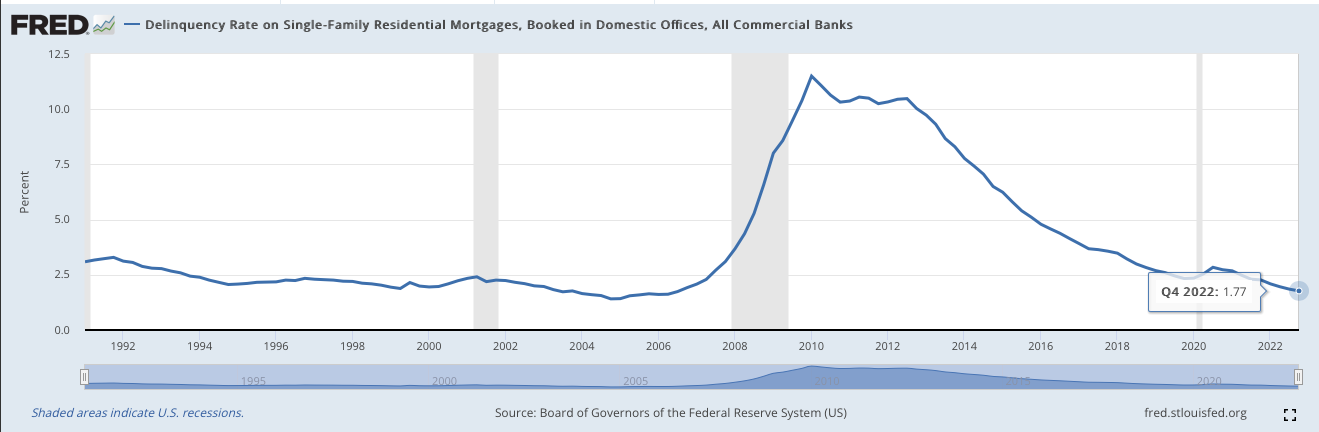

The important aspect of this entire scenario is — no one is talking about the underlying assets underneath those MBS bonds. Pray tell me, what do you think will happen to the price of those bonds if, for example, delinquencies rise to 5 or 6%? Would they sink again to $50, or maybe lower? How confident are you in the notion, if you will, the average pleb can afford a high interest rate car and home loan?

MOREOVER, and this goes without saying, what will you do when these pressures causes mass layoffs — the type of layoffs not seen since 2008?

Comments »