Good day

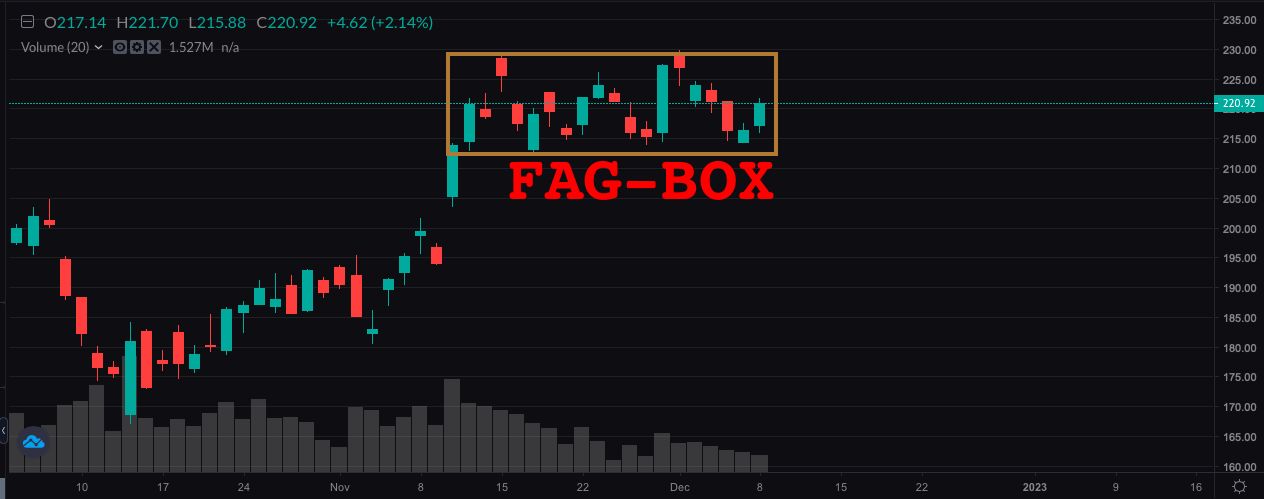

The last time I discussed the semiconductors I was prescient in the sense that November was going to hoist upon us a terrific rally of sorts, gleeful turkey loving market trades piled in and piled the fuck out for a magnanimous trade of +20%. Since then the index has been stuck, TRAPPED EVEN, inside the fag-box. Observe.

My analysis is as follows:

If you’re looking for the SMH break out of this prison it finds itself in, let me remind you that it is not going to happen. The keys have been tossed out and the locks are very strong. Overall, the facility in inescapable — surrounded by a moat filled with deadly sharks and outside the perimeter there are bears.

You feel good today due to recency bias. This is a mental disorder that greatly afflicts mostly low IQ market participants, who regularly soil themselves when markets trade down. As soon as it trades up, these submentals jump up and practically smash their heads against the ceiling — so excited by the markets resolve. Truth is, the market’s true resolve is to go lower. Any brief period of time that elapses with actual gains should be considered something of a gift that should be taken, POST HASTE.

I am higher by 1.7% today, not because I am particularly fond of the market but because I am fully invested based upon the advice provided to me by my computer brain inside Stocklabs. I discussed this in great length before. But if you’re just tuning in now, I am using the algos for weekly picks that I will hold no matter what — supplemented by trades that I might do intra-day and overnight, which are mainly hedges.

Comments »