If you bought the morning rip, you got absolutely fucked. The NASDAQ is -400 from the open and there is nothing you can do about it. The idea of a Fed pivot is all the more meaningless when you come to think about the specter of debilitating DEFLATION.

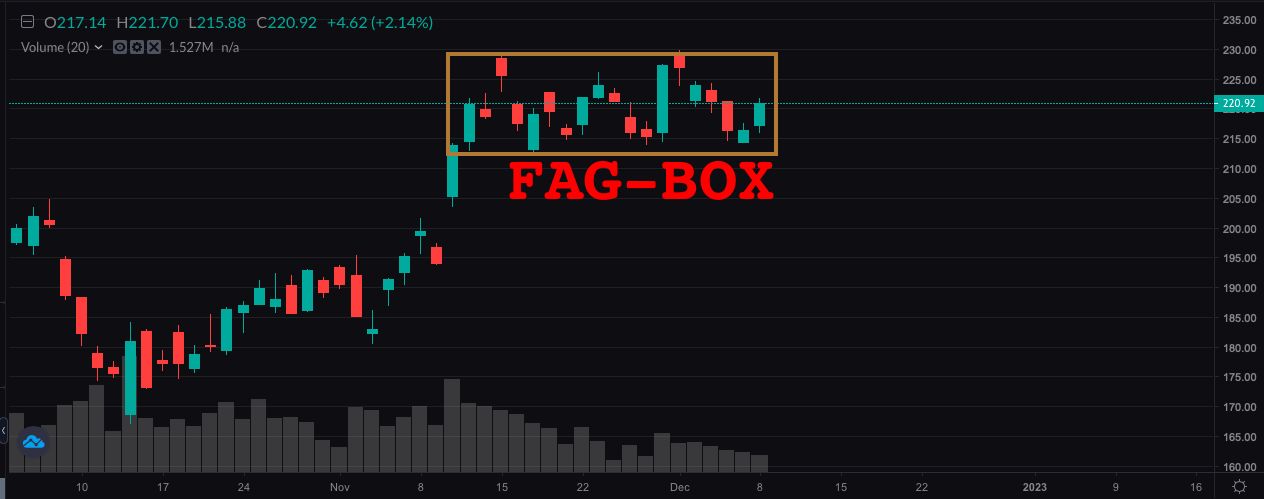

But before we get into that, I’d like to share with you a chart I made of the NASDAQ intraday. I made sure the lines fit my world view, in order to assuage my sensitivities. When I do this, bear in mind, I feel in charge.

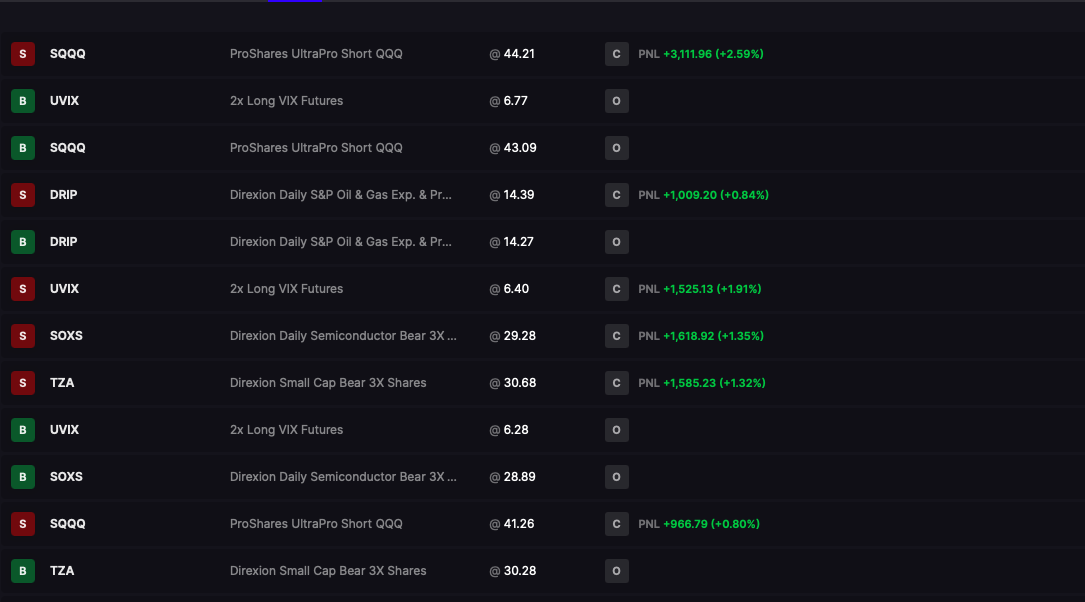

I’ve been hedging all morning, taking outsized 15% positions at a clip in SQQQ, SOXS, UVIX etc. The fucking works. Had I not done this, I’d now stand before you DOWN for the session instead of +125bps.

At the present, I have no hedges and instead opted for LEVERAGED LONG with an LABU trade on the barbie. The thing is, and I alluded to this earlier, I really don’t give a fuck. I mean, I do and I don’t. I care about doing smart things. The idea of wasting a life or money is hateful to me. But, in the end, I am indifferent to outcomes, providing I made smart choices based on data.

Most bears will tell you the market is going to Mcplunge into the close. I can see the opposite occurring, especially since we are already DOWN 400 from the open. I really do believe the NASDAQ will not move much from here till year end.

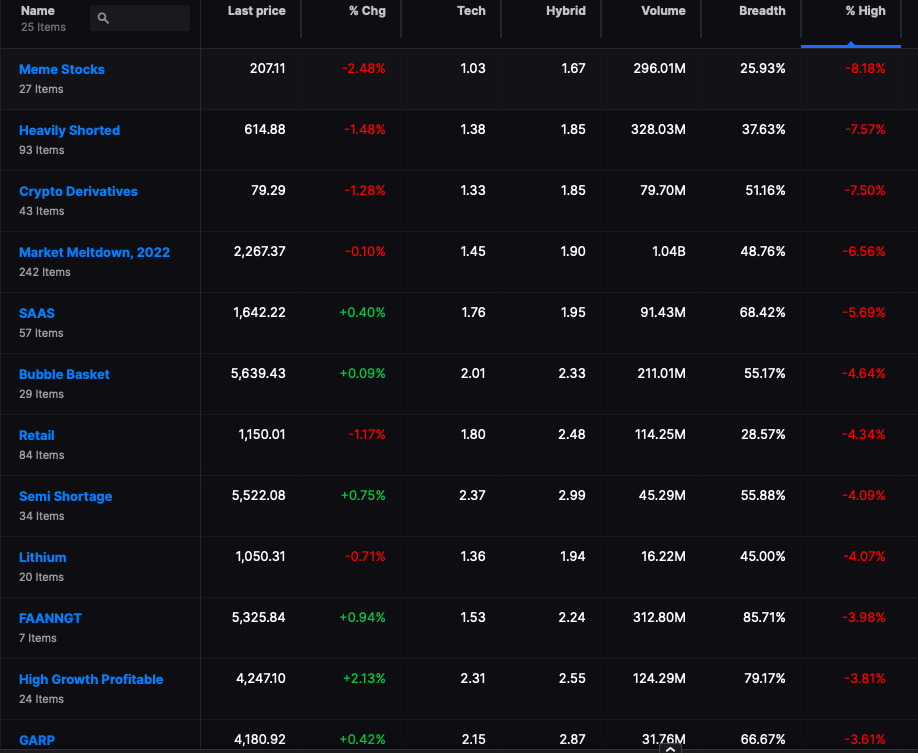

Look at these intraday declines from session highs, in Stocklabs.

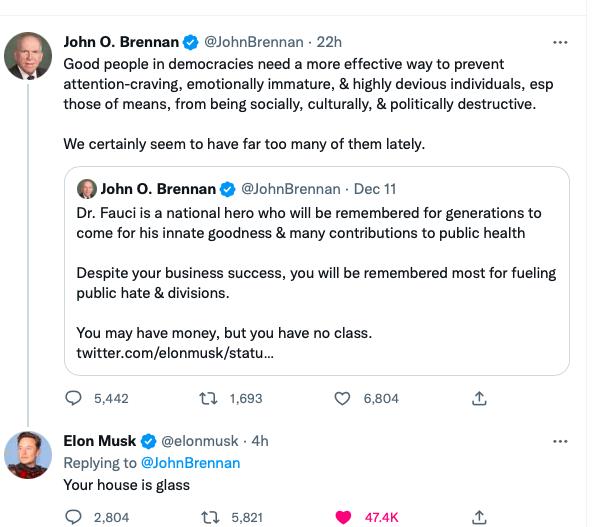

You want assured advice — but I’ve got nothing for you. We are all in this alone traveling together, attempting to act confident enough to warrant our dicks getting sucked. In the end, markets will explode higher, eventually. But it appears the inflation boogeyman is dead and in comes Mr. HORATIO CLAWHAMMER, who is far worse by the way.

Comments »